Zero-knowledge (zk) rollups have rapidly transitioned from theoretical innovation to practical infrastructure, now underpinning the next wave of scalable DeFi protocols in 2025. As Ethereum’s mainnet faces persistent congestion and high transaction costs, zk rollups offer a pragmatic solution: they bundle hundreds or thousands of transactions off-chain, post a single proof on-chain, and maintain both security and data integrity. This approach has unlocked new possibilities for decentralized finance, making it accessible, efficient, and increasingly private.

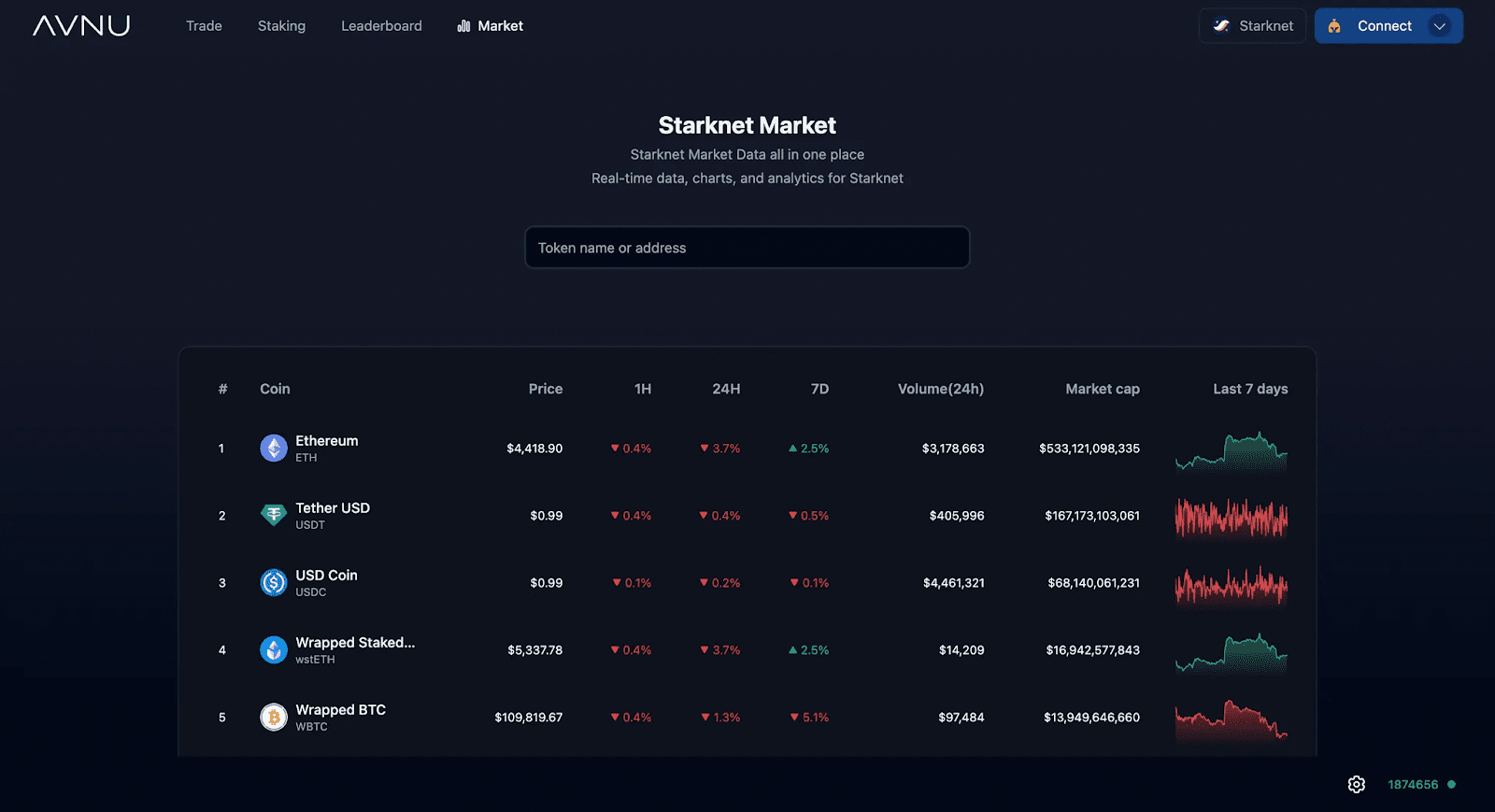

Starknet: The Backbone of High-Throughput DeFi

Starknet stands out as the leading zk rollup protocol enabling high-throughput, low-cost DeFi dApps on Ethereum. Developed by StarkWare and powered by zk-STARKs technology, Starknet removes the bottlenecks that previously limited DeFi’s scalability. In 2025, it supports complex smart contracts with minimal latency and negligible fees, critical for sophisticated applications like decentralized derivatives or automated market makers.

Unlike early Layer 2 solutions that compromised on either security or compatibility, Starknet achieves both. It processes thousands of transactions per second while inheriting Ethereum’s robust security guarantees. This reliability has attracted major DeFi projects to migrate or launch directly on Starknet, catalyzing an ecosystem where users no longer have to choose between cost efficiency and trustlessness.

Decentralized Exchanges Reimagined: Scalable Privacy-Preserving DEXs

The most immediate and visible impact of zk rollups is seen in decentralized exchanges (DEXs). Platforms like dYdX and Uniswap v4 now leverage zk rollup technology to deliver scalable, privacy-preserving trading experiences that rival centralized exchanges in speed but surpass them in transparency. Decentralized Exchanges (DEXs) with zk rollups are not just faster, they are fundamentally more secure against front-running and MEV attacks due to their cryptographic design.

This transformation is especially significant for high-frequency traders and liquidity providers who were previously deterred by prohibitive gas fees or slow confirmation times. With zk-powered DEXs, micro-transactions become economically viable, opening up new strategies such as algorithmic trading within the DeFi space. Privacy features built into these platforms also mean that sensitive trading data is shielded from public view without sacrificing auditability, a breakthrough for institutional adoption.

If you want to dive deeper into how zk rollups are revolutionizing DEX scalability and privacy, see our detailed analysis here: How ZK Rollups Improve Scalability and Privacy in DEXs.

The Future of Private DeFi: Zero-Knowledge Proofs for Compliance and Identity

The next frontier is the Future of Private DeFi, where zero-knowledge proofs extend beyond transaction compression to power regulatory compliance and on-chain identity solutions. In 2025, privacy is not just about hiding balances or trades; it’s about enabling compliant participation without compromising user sovereignty. Enhanced privacy tools allow users to prove eligibility or accreditation status without revealing their full identity, an essential feature as institutional capital flows into DeFi under stricter regulatory regimes.

This evolution paves the way for confidential lending markets, private stablecoin transfers, and even one-human-one-vote governance mechanisms, all verifiable on-chain yet shielded from public scrutiny. By integrating privacy with compliance via zero-knowledge proofs, zk rollup ecosystems are poised to make decentralized finance both more inclusive and more robust against regulatory headwinds.

As privacy and compliance become central to DeFi’s mainstream adoption, protocols are racing to integrate zero-knowledge proofs at every layer of the stack. Starknet’s flexible architecture allows developers to build natively private smart contracts, while DEXs like dYdX and Uniswap v4 now offer selective disclosure, enabling users to verify trade legitimacy or KYC status without exposing sensitive data on-chain. This paradigm shift is not theoretical: several high-profile institutional pilots in 2025 demonstrate that regulatory-compliant DeFi can be achieved without sacrificing decentralization or user privacy.

Key zk Rollup Innovations Powering DeFi in 2025

-

Starknet: Leading zk rollup protocol enabling high-throughput, low-cost DeFi dApps on Ethereum. Starknet, built by StarkWare, leverages zk-STARKs for secure, scalable computation without a trusted setup. Its support for complex smart contracts and robust throughput make it a backbone for next-generation DeFi platforms.

-

Decentralized Exchanges (DEXs) with zk rollups: Scalable, privacy-preserving trading platforms like dYdX and Uniswap v4 harness zk rollups to offer high-speed, low-fee trades while maintaining user privacy and Ethereum-level security. These DEXs enable efficient trading, micro-transactions, and new DeFi strategies.

-

Future of Private DeFi: Enhanced privacy and compliance through zero-knowledge proofs for on-chain identity and regulatory integration. In 2025, zk rollups are driving innovations like confidential lending, private transactions, and compliant DeFi protocols, paving the way for mainstream adoption and institutional participation.

The synergy between scalability and privacy is also driving new composable primitives in DeFi. For example, cross-chain liquidity pools now leverage zk proofs for both settlement finality and user verification, allowing capital to flow seamlessly between Ethereum and other major blockchains. This interoperability is a direct result of advances in zk rollup design, particularly protocols like Starknet that support complex state transitions and off-chain computation while maintaining trustless verification on Ethereum’s mainnet.

Looking ahead, the integration of advanced zero-knowledge proof systems will enable even richer applications: think confidential lending protocols where collateral ratios are proven but not disclosed, or decentralized identity frameworks where users prove uniqueness for governance without revealing personal information. The convergence of these capabilities signals a new era for DeFi, one where scalability, privacy, and compliance are no longer trade-offs but mutually reinforcing features.

Key Takeaways for Stakeholders

For developers, embracing zk rollup frameworks like Starknet means access to scalable infrastructure with built-in privacy modules, lowering barriers to innovation in everything from DEXs to lending platforms. For investors and institutions, this technology offers exposure to a rapidly growing sector with improved risk controls and clearer regulatory pathways. And for users, the promise is simple: faster transactions, lower costs, stronger security guarantees, and true sovereignty over financial data.

The metrics back up this momentum. By Q3 2025, DeFi’s Total Value Locked (TVL) reached $160 billion, a 41% year-over-year increase, with $3.5 billion attributed directly to ZK rollup platforms such as Starknet. As new primitives emerge around private compliance and cross-chain composability, these numbers are poised to accelerate further.

For those seeking deeper technical dives or frameworks for evaluating zk-powered DeFi opportunities, we recommend exploring our related resources:

- How ZK Rollups Enable Scalable and Private DeFi Applications

- How ZK Rollups Improve Scalability and Privacy in DEXs

Ultimately, zk rollups have moved beyond mere scaling solutions, they are now foundational pillars enabling the next generation of secure, compliant, and inclusive decentralized finance. As we move into 2026 and beyond, expect further breakthroughs at the intersection of cryptography and financial engineering as these technologies continue to redefine what’s possible in open finance.