Cross-chain liquidity is the holy grail of decentralized finance, but for years it’s been a patchwork of bridges, wrapped tokens, and opt-in protocols. These approaches have delivered convenience at the cost of security and composability. Now, zero-knowledge (ZK) rollups are fundamentally reshaping the landscape by enabling trustless cross-chain liquidity: without requiring users or protocols to opt in to yet another bridge or intermediary.

The Problem with Opt-In Bridges and Fragmented Liquidity

Traditional bridges force users to lock assets on one chain and mint synthetic versions elsewhere. This fragments liquidity, introduces new attack surfaces, and slows down user experience. Each bridge or wrapped asset comes with its own set of trust assumptions, often relying on multi-sig wallets or external validators. As a result, DeFi protocols struggle to offer seamless experiences across chains, while users bear the brunt of complexity and risk.

The market has seen high-profile exploits exploiting these weaknesses. The appetite for a solution that doesn’t require opt-in or additional trust layers is immense. That’s where ZK rollups come in with a fundamentally different approach to zk rollup cross-chain liquidity.

ZK Rollups: Native Trustless Interoperability

ZK rollups process transactions off-chain and submit succinct cryptographic proofs back to Layer 1 chains. This not only scales throughput but enables state verification across multiple blockchains, without exposing private data or relying on external parties.

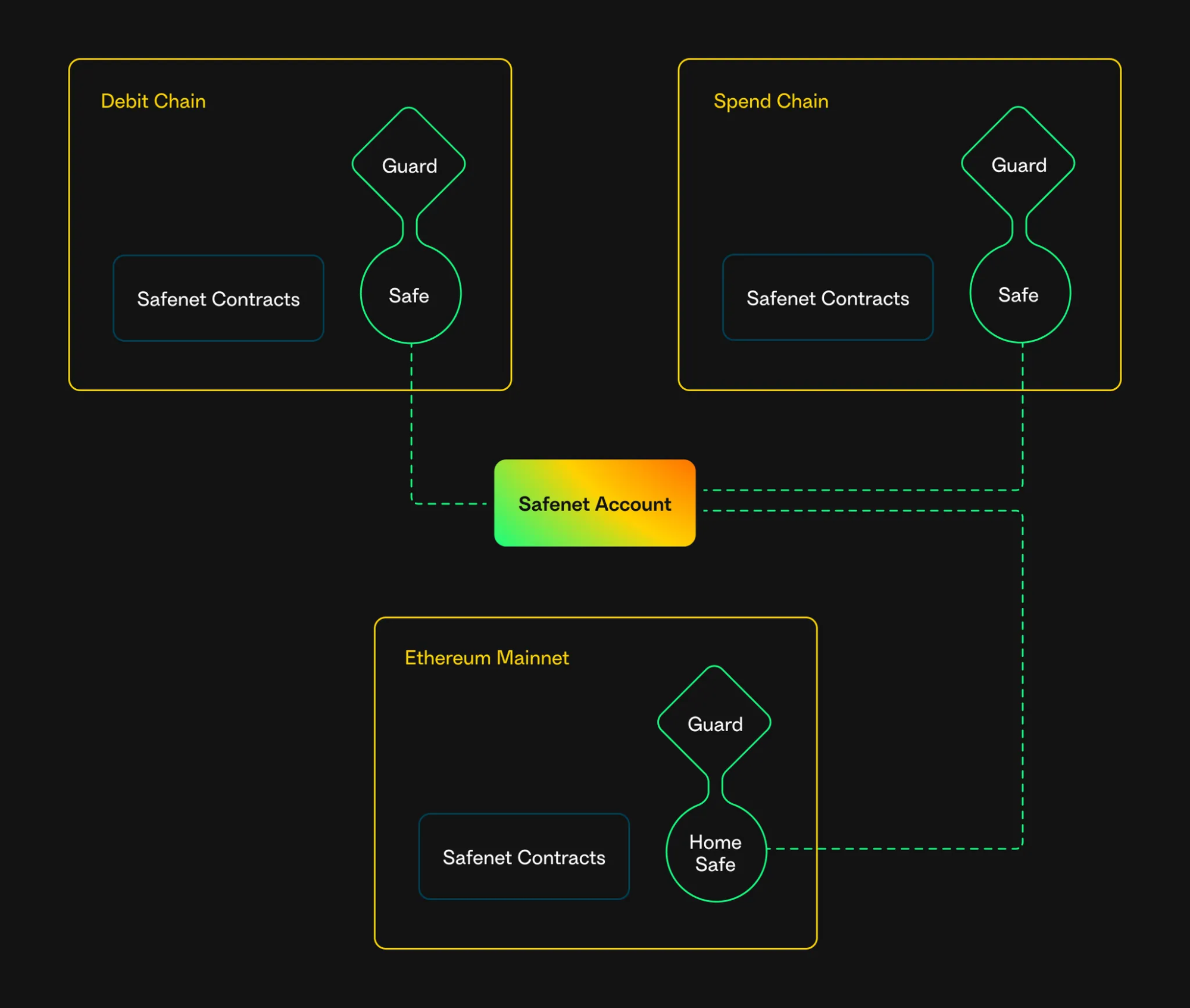

The innovation lies in designs like Entangled Rollups, which synchronize states across several blockchains using recursive ZK proofs. Here’s how it works:

Key Benefits of Entangled ZK Rollup Designs in Multichain DeFi

-

Trustless Cross-Chain Asset Transfers: Entangled ZK rollups enable seamless asset movement across blockchains without relying on bridges or intermediaries, reducing counterparty risk and eliminating the need for users to opt in to third-party protocols.

-

Superior Security Guarantees: ZK rollups inherit the security of their underlying blockchains and use cryptographic proofs to validate cross-chain transactions, removing the need for additional trust assumptions common in traditional bridges.

-

Enhanced Interoperability: Multi-chain ZK rollup designs, such as parallel or entangled rollups, foster interoperability by allowing dApps and assets to interact across different chains, paving the way for a unified DeFi ecosystem.

-

Improved User Experience: By abstracting away complex bridging processes and enabling direct cross-chain transactions, users enjoy faster settlements and a seamless DeFi experience without manual opt-ins or asset wrapping.

By deploying entangled rollups on each participating chain, transaction states are kept in sync through cryptographic guarantees alone. There’s no need for traditional bridges or opt-in mechanisms, liquidity can move natively between Layer 2s as if they were part of a single system.

“ZK Rollups enable unified execution environments across chains by making state transitions verifiable anywhere proof is submitted. “

Aggregated Rollup Infrastructures: The Rise of zkLink and Beyond

The race is on to build aggregated infrastructures that make zk rollup unified execution a reality for developers and users alike. Protocols like zkLink are pioneering this space by offering an architecture that aggregates liquidity from multiple chains into a single interface for dApps.

This multi-layered approach (with settlement, execution, sequencer, and data availability layers) allows protocols to tap into cross-chain liquidity pools without ever leaving the safety net of ZK proofs. It’s not just theory, projects like Twine are already demonstrating multi-settlement ZK rollups that work across blockchains as a unified settlement layer.

Key Features Driving Adoption

- No Opt-In Required: Users interact with assets natively; no need for bridging contracts or wrapped tokens.

- Native Security: All transfers are backed by cryptographic proofs verified on each respective chain.

- Cohesive User Experience: Developers can build dApps that span multiple chains without fragmenting their user base or liquidity pools.

- Easier State Verification: Fast settlements between L2s enable more composable DeFi primitives (see Bankless’ take: “Improved L2 Interoperability”).

The Endgame: True Cross-Chain Composability Without Compromise

This isn’t just about moving tokens from Chain A to Chain B, it’s about enabling true composability. With ZK rollups as the foundation for multichain settlement layers, DeFi protocols can finally unlock network effects previously siloed by fragmented ecosystems. As projects like zkLink and Twine mature, expect “cross-chain” to become an invisible feature rather than an explicit user action, a paradigm shift powered by zero-knowledge technology.

Developers are already leveraging these advances to create seamless omnichain DeFi platforms. Instead of spinning up isolated liquidity pools on every new chain, dApps can now access unified liquidity directly through ZK rollup-based infrastructures. This is a game changer for both capital efficiency and user experience. Protocols no longer have to bootstrap fragmented markets, while users benefit from deeper liquidity and lower slippage, without the friction of bridging or re-wrapping assets.

Consider the implications for yield aggregators, lending protocols, and DEXs: with zk rollup cross-chain liquidity, they can offer products that aggregate opportunities across multiple ecosystems natively. The composability of DeFi finally extends beyond single-chain silos, unleashing a wave of innovation limited only by developer creativity.

Security and Efficiency: No More Trade-Offs

The security model is perhaps the most compelling aspect. With traditional bridges, every hop introduces a new trust assumption or attack vector. By contrast, ZK rollups inherit their security directly from Layer 1 blockchains, each cross-chain transfer is just as secure as the underlying chains themselves. No opt-in means no additional risk surface; users interact with cryptographically verified states at every step.

This also unlocks unprecedented efficiency. Recursive proofs allow transaction batches from multiple chains to be validated in a single succinct proof submitted on mainnet. This reduces gas costs and confirmation times across all participating networks, a win-win for both developers and end users looking for faster settlements.

Top Real-World Use Cases for zk Rollup Multichain Settlement

-

Unified DeFi Liquidity Pools: zkLink enables decentralized exchanges and lending platforms to aggregate liquidity from multiple blockchains, allowing users to trade and lend assets seamlessly across chains without relying on traditional bridges or wrapped tokens.

-

Omnichain NFT Marketplaces: Platforms like zkLink and ZKM’s entangled rollups facilitate NFT minting, trading, and transfers across different blockchains, enabling creators and collectors to access broader markets without manual bridging.

-

Cross-Chain Payment Solutions: By leveraging ZK rollup-based infrastructures such as zkLink, payment providers can offer instant, low-fee settlements across multiple blockchains, improving user experience and reducing fragmentation.

-

Interoperable Game Economies: zk rollup multichain settlement allows blockchain games to unify in-game assets and currencies across ecosystems, supporting true asset ownership and transferability between games built on different chains.

-

Trustless Yield Aggregators: Yield platforms can use zk rollup architectures to aggregate and optimize returns from protocols on various blockchains, letting users deposit once and earn yield from multiple sources without managing cross-chain transfers themselves.

What’s Next? The Road Ahead for zk Rollup Interoperability

The road ahead is promising but not without challenges. Ecosystem coordination will be critical, standards must emerge to ensure compatibility between different rollup implementations and settlement layers. Still, momentum is building fast; leading teams are collaborating to define universal interfaces and shared data availability solutions.

Meanwhile, integrations with interoperability protocols like LayerZero are being actively explored to further streamline omnichain messaging and asset movement using ZK proofs (read more here). As these models mature, expect even more robust developer tooling and SDKs that abstract away complexity for builders.

“We’re approaching an era where cross-chain liquidity isn’t just possible, it’s default. “

The bottom line: zero-knowledge technology is quietly dissolving the boundaries between blockchains, making zk rollup DeFi liquidity, multichain settlement, and unified execution not just possible but practical at scale. For investors and builders alike, understanding these architectures now will pay dividends as network effects compound across interoperable ecosystems.