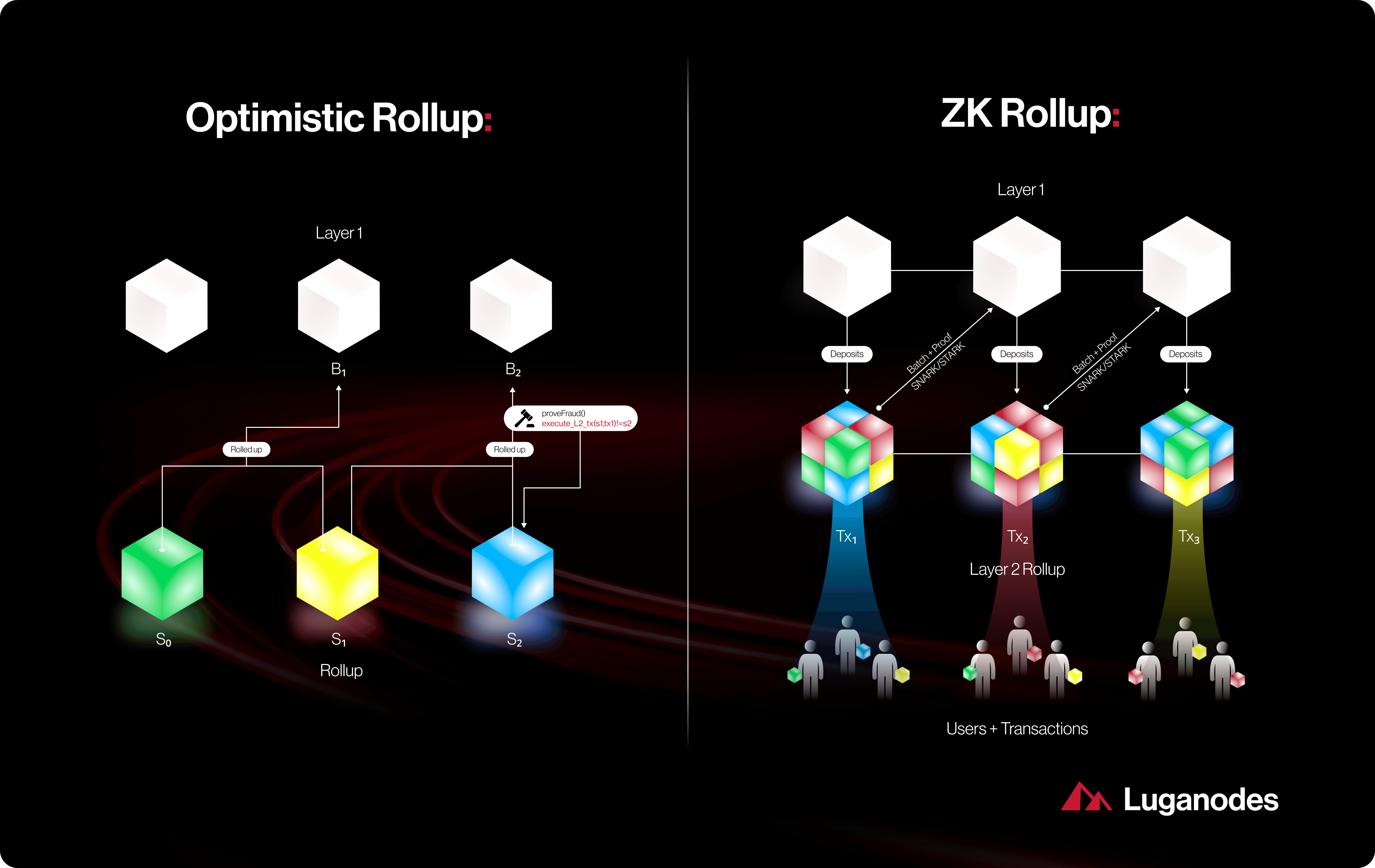

Decentralized exchanges (DEXs) have revolutionized crypto trading, but they’re often hampered by high fees and sluggish transaction speeds during network congestion. Enter zkRollups in DEXs – a game-changing layer 2 solution that’s rapidly transforming the DeFi landscape. By bundling hundreds (or thousands!) of trades off-chain and proving their validity with zero-knowledge proofs, zkRollups dramatically boost throughput while keeping costs low and privacy intact.

Why DEX Scalability Needs an Upgrade

Let’s be real: Ethereum mainnet wasn’t built for the kind of volume we see on today’s top DEXs. When demand spikes, gas fees soar, and even simple swaps can take ages to confirm. This bottleneck isn’t just inconvenient – it’s a major blocker for mass adoption. That’s why zkRollup scalability solutions are so crucial right now.

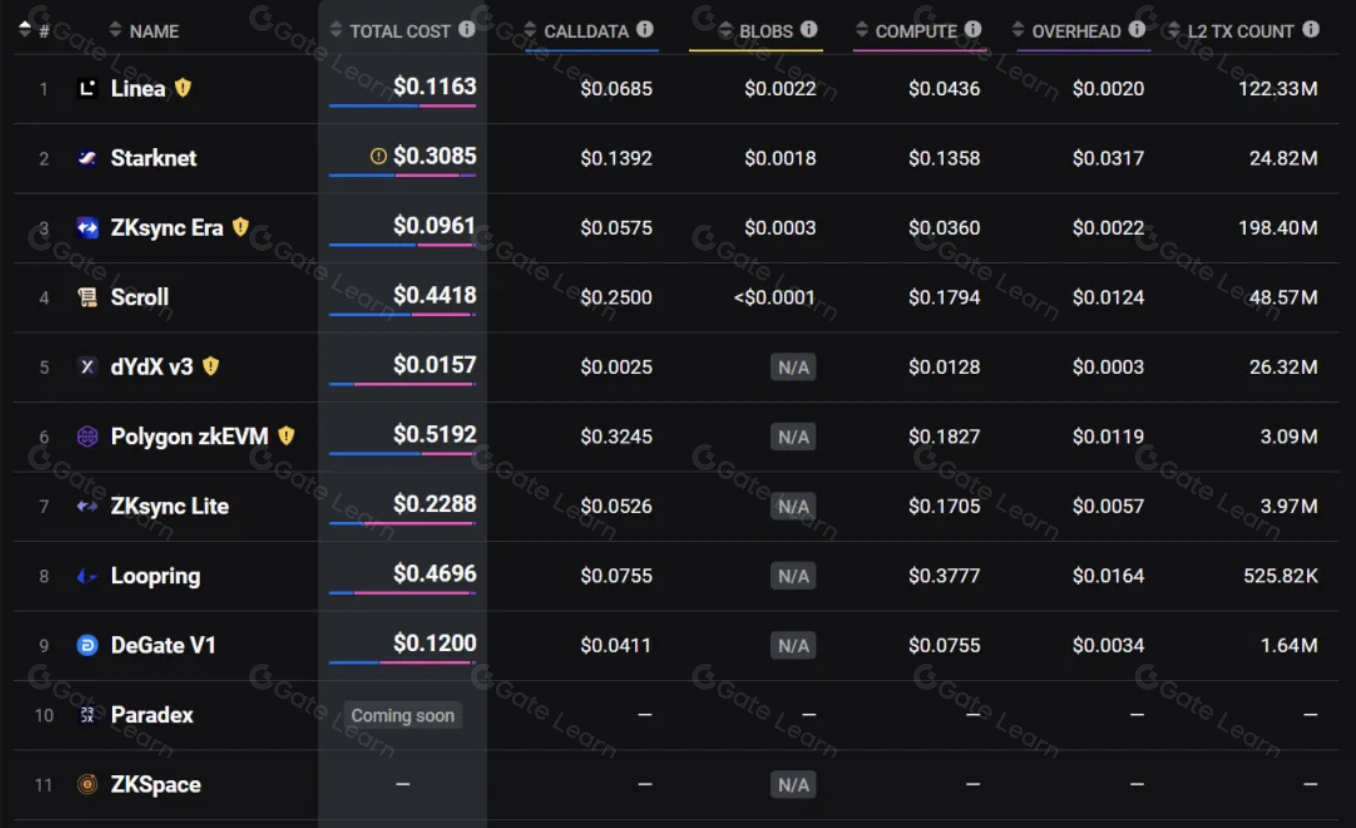

zkRollups aggregate transactions off-chain, then post a succinct cryptographic proof (a SNARK or STARK) back to the mainnet. The result? DEXs like Loopring and zkSync can process thousands of trades per second without clogging up Ethereum or compromising on security. You get lightning-fast execution at a fraction of the cost users are used to paying.

The Privacy Power-Up: Zero-Knowledge Proofs in Action

If you’ve ever worried about your DeFi activity being visible to anyone who can scan Etherscan, you’re not alone. On most blockchains, every transaction is public by default – not ideal for traders or institutions who value privacy. Here’s where zkRollup privacy benefits shine brightest.

Zero-knowledge proofs allow DEX users to prove their trades are valid without exposing sensitive details like wallet balances or trade amounts. Projects such as Aztec Network take this even further, enabling near-complete confidentiality at minimal extra cost (source). This solves one of DeFi’s biggest headaches – on-chain snooping – while still keeping everything provably secure.

Top 5 Benefits of zkRollups for DEXs

-

Massive Scalability Boost: zkRollups batch hundreds or thousands of trades off-chain, submitting only a single proof to the blockchain. This dramatically increases transaction throughput for DEXs and reduces network congestion.

-

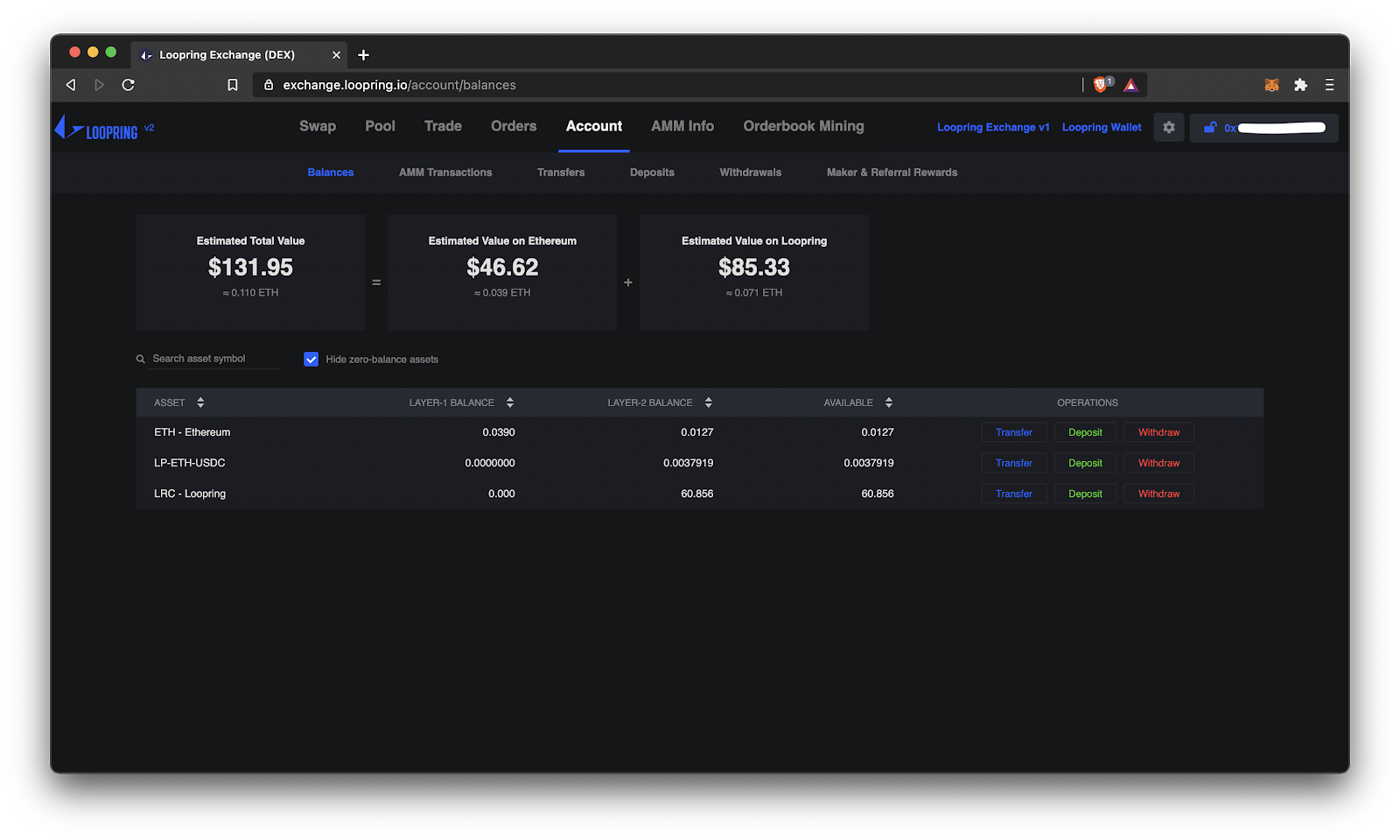

Lower Transaction Fees: By aggregating transactions, zkRollups significantly cut down on gas costs. Users on DEXs like Loopring and zkSync enjoy much cheaper trades compared to traditional on-chain swaps.

-

Enhanced Privacy: Zero-knowledge proofs validate trades without exposing sensitive details. This means users can swap tokens on DEXs like Aztec or zkSync with greater confidentiality.

-

Faster Transaction Finality: zkRollups provide near-instant confirmation times for trades, making decentralized exchanges feel as responsive as centralized ones.

-

Improved Security: All zkRollup transactions are ultimately secured by the main blockchain (like Ethereum), ensuring robust protection against fraud and hacks while benefiting from off-chain efficiency.

Real-World Examples: Loopring, zkSync and Aztec

Theory is great, but let’s talk about what’s actually live today in the world of decentralized exchange zkRollups. Loopring was one of the first protocols to roll out a fully functional zkRollup-based DEX on Ethereum. By leveraging zero-knowledge proofs, it slashed settlement costs and enabled high-frequency trading without sacrificing user custody.

zkSync, another major player, processes thousands of swaps off-chain before posting aggregated proofs back to Layer 1 for finality. This not only lightens the load on Ethereum but also ensures traders enjoy near-instant confirmation times and robust privacy features out-of-the-box.

Aztec Network takes things a step further with its focus on privacy-first DeFi. By combining zkRollup architecture with advanced zero-knowledge cryptography, Aztec enables shielded transactions that keep both sender and recipient addresses confidential. The result? Scalable trading and lending protocols where user data is protected by default, not as an afterthought. This model is already inspiring a new generation of privacy-preserving DEXs and DeFi apps.

It’s not just about speed and privacy, though. zkRollups also unlock composability across the DeFi stack. Developers can build complex protocols, think AMMs, lending markets, or even NFT platforms, on top of zkRollup rails, inheriting all the core benefits without reinventing the wheel. As more projects integrate these technologies, the network effect compounds: every new DEX or dApp makes the entire ecosystem faster, cheaper, and more private for everyone.

Key Challenges and The Road Ahead

No technology is perfect out of the gate. While zkRollups are reshaping how we think about scalability and privacy in DeFi, there are still hurdles to clear, especially around compliance and user experience. For example, privacy-preserving designs can create friction with AML/KYC requirements for institutional traders (source). Balancing regulatory needs with user confidentiality is an ongoing challenge that requires collaboration between devs, legal experts, and regulators.

Another area to watch: interoperability. As more layer 2 solutions emerge (think optimistic rollups and sidechains), seamless bridges between different scaling protocols will be critical for liquidity and composability. Teams like zkSync are already working on cross-rollup messaging standards to ensure assets can move freely across chains without compromising security or privacy.

Key Challenges Slowing zkRollup Adoption in DEXs

-

Complex Integration with Existing DEX Infrastructure: Integrating zkRollups like zkSync or Loopring into established decentralized exchanges often requires significant changes to smart contracts and backend systems, making adoption technically demanding.

-

Limited Developer Expertise in Zero-Knowledge Proofs: Building and maintaining zkRollup solutions demands advanced cryptographic knowledge, and there’s currently a shortage of developers with hands-on experience in zero-knowledge proofs.

-

Regulatory and Compliance Hurdles: Privacy-preserving features of zkRollups, such as those used by Aztec Network, can conflict with regulatory requirements like AML and KYC, creating uncertainty for DEX operators.

-

High Initial Deployment Costs: Deploying zkRollup technology on DEXs involves substantial upfront costs for research, development, and security audits, which can be a barrier for smaller projects.

-

User Experience and Wallet Compatibility: Some zkRollup-based DEXs require users to interact with new wallet interfaces or bridge assets, potentially complicating the trading experience compared to traditional DEXs.

What’s Next? zkRollups Set the Pace for DeFi’s Future

The momentum behind zero-knowledge technology is only getting stronger. With Ethereum’s roadmap prioritizing scalability upgrades, and major DEXs like Uniswap exploring layer 2 integrations, the stage is set for explosive growth in both throughput and privacy across decentralized finance.

If you’re a trader frustrated by high fees or slow settlement times on your favorite DEX, now’s the time to explore platforms powered by zkRollups. Not only will you save on costs and enjoy snappier execution, you’ll also benefit from enhanced privacy that simply isn’t possible on legacy blockchains.

As always in crypto, staying ahead means keeping your finger on the pulse of innovation, and right now, that pulse beats strongest in the world of zero-knowledge proofs DEX. Whether you’re building or trading, zkRollups are shaping up to be the backbone of scalable, private decentralized exchanges for years to come.