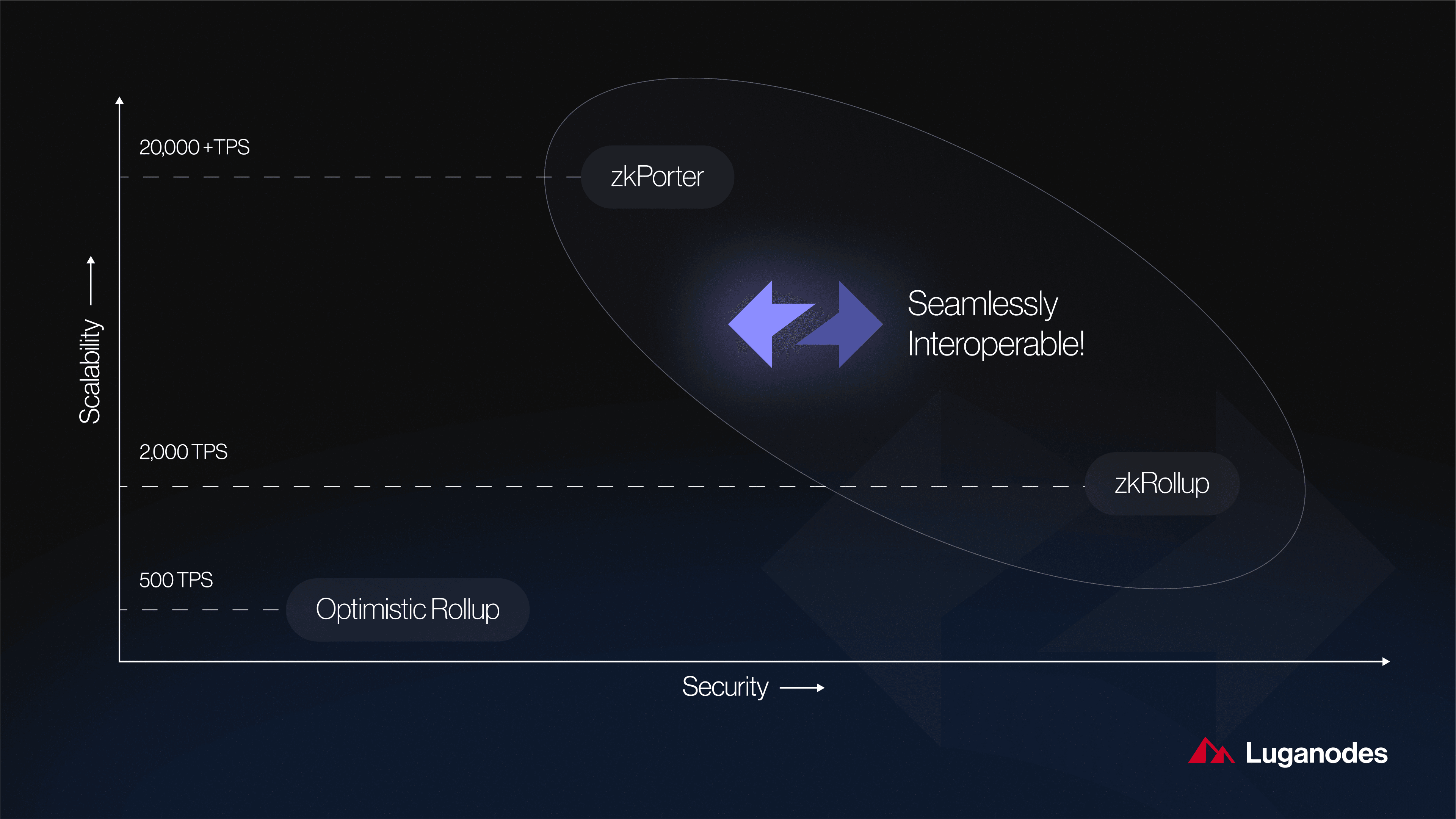

In 2024, the landscape of decentralized finance (DeFi) is being fundamentally reshaped by the rapid adoption of zk rollups, a technology that leverages zero-knowledge proofs to deliver both scalability and privacy. While Ethereum’s Layer 1 throughput remains limited to about 15 transactions per second (TPS), zk rollup solutions like zkSync 3.0 have shattered previous bottlenecks, reaching up to 10,000 TPS with finality times as low as 1-2 minutes and slashing gas fees by up to 99% compared to Layer 1. These breakthroughs are not just theoretical – they are actively powering a new generation of scalable DeFi applications, enabling high-frequency trading, lending, and complex derivatives markets without congestion or prohibitive costs.

How ZK Rollups Work: The Technical Core

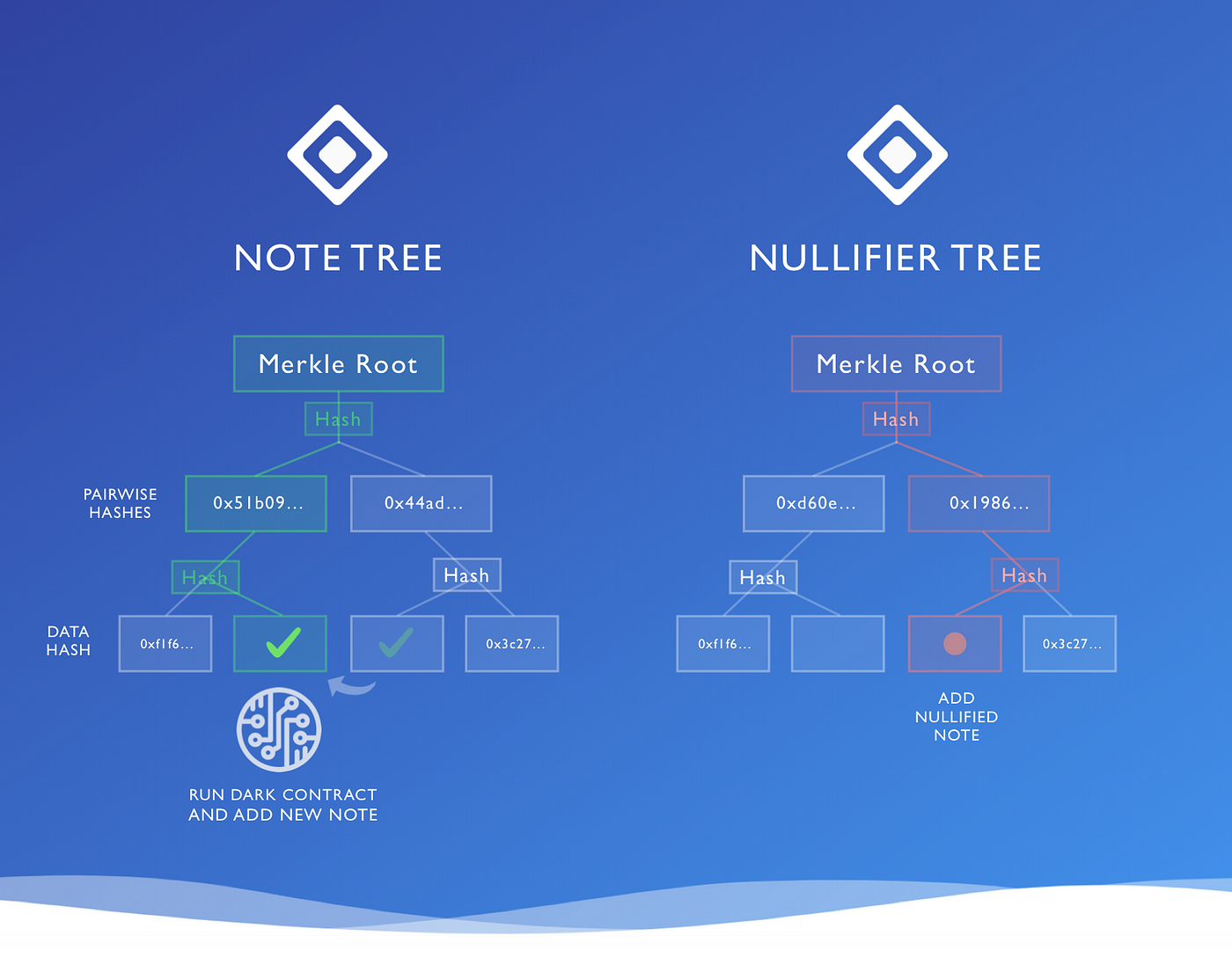

ZK rollups operate by aggregating hundreds or thousands of transactions off-chain into a single batch. Instead of posting every transaction detail on-chain, they generate a succinct cryptographic proof (such as a zk-SNARK) that verifies the validity of the entire batch. This proof is then submitted to the Ethereum mainnet, where it is checked by smart contracts. The result: users get the security and decentralization guarantees of Ethereum while enjoying vastly improved speed and cost efficiency.

This architecture also brings another critical advantage: privacy. By using zero-knowledge proofs, transaction details can be validated without exposing sensitive information on-chain. Protocols like Aztec Network and Manta Network are pioneering private DeFi transactions using zk-SNARKs, allowing for confidential transfers and even private smart contract logic – all while maintaining full compliance with Ethereum’s consensus.

Scalable DeFi Applications Powered by ZK Rollups

The impact of zk rollups on DeFi is already visible in several high-profile use cases:

Top DeFi Apps Leveraging ZK Rollups in 2024

-

zkSync: zkSync 3.0 is a leading Layer 2 platform utilizing ZK Rollups to deliver up to 10,000 transactions per second and 95-99% lower gas fees compared to Ethereum Layer 1. Its robust scalability and privacy features make it a preferred foundation for numerous DeFi protocols in 2024.

-

dYdX: As a decentralized derivatives exchange, dYdX employs ZK Rollups to enable high-frequency trading and over 1,000 trades per second with minimal transaction fees, providing traders with a scalable and efficient DeFi experience.

-

Aztec Network: Aztec Network specializes in privacy-preserving DeFi by integrating zk-SNARKs, allowing users to execute private transactions and smart contracts on Ethereum while maintaining the security of the main chain.

dYdX, for example, employs zk rollups to process over 1,000 trades per second with negligible fees – an order-of-magnitude improvement over traditional DEX models. This has enabled dYdX to compete directly with centralized exchanges in terms of speed and cost while preserving user custody over funds. Meanwhile, platforms like Manta Network focus on end-to-end privacy for swaps and lending activities through advanced zero-knowledge cryptography.

The result is a new tier of user experience: seamless trading without network congestion or exorbitant gas costs, plus robust privacy options previously unavailable on public blockchains.

Key Projects Leading the ZK Rollup Revolution in 2024

A wave of innovative projects has emerged at the forefront of this transformation:

- Manta Network: Specializes in private DeFi transactions using zk-SNARKs for confidentiality (source).

- Taiko: Implements ZK-EVM technology for full compatibility with existing Ethereum dApps, enabling seamless migration without code changes.

- Aztec Protocol: Offers hybrid public-private execution layers so developers can choose between transparency and privacy as needed (source).

This diversity demonstrates that ZK rollups are not just an incremental upgrade but a foundational shift in how blockchain infrastructure supports scalable and private financial services.

As the competitive landscape intensifies, these projects are not only pushing technical boundaries but also setting new standards for user expectations in DeFi. Aztec Protocol’s hybrid model, for instance, allows developers to finely tune the balance between transparency and privacy, an essential feature as institutional interest in DeFi grows and regulatory scrutiny increases. The flexibility to offer both public and private execution layers is likely to become a benchmark for next-generation decentralized applications.

Manta Network and Taiko further illustrate the spectrum of zk rollup innovation. Manta’s focus on privacy-first primitives, like shielded swaps and confidential lending, caters directly to users who demand financial privacy without sacrificing composability or liquidity. Meanwhile, Taiko’s ZK-EVM compatibility ensures that developers can migrate existing Ethereum-based dApps to a zk rollup environment with minimal friction, preserving network effects while inheriting scalability and cost advantages.

Challenges and Real-World Adoption in 2024

Despite these advances, several challenges remain before zk rollups can reach full mainstream adoption across DeFi:

- Complexity of Proof Generation: While zk-SNARKs and zk-STARKs have become more efficient, generating proofs for complex smart contracts still requires significant computational resources. This can limit throughput for highly intricate dApps unless further optimizations are realized.

- User Experience: Bridging assets between Layer 1 and Layer 2 remains a pain point for many users. Although protocols are working on seamless onboarding flows, wallet integrations and cross-chain interoperability continue to be areas needing refinement.

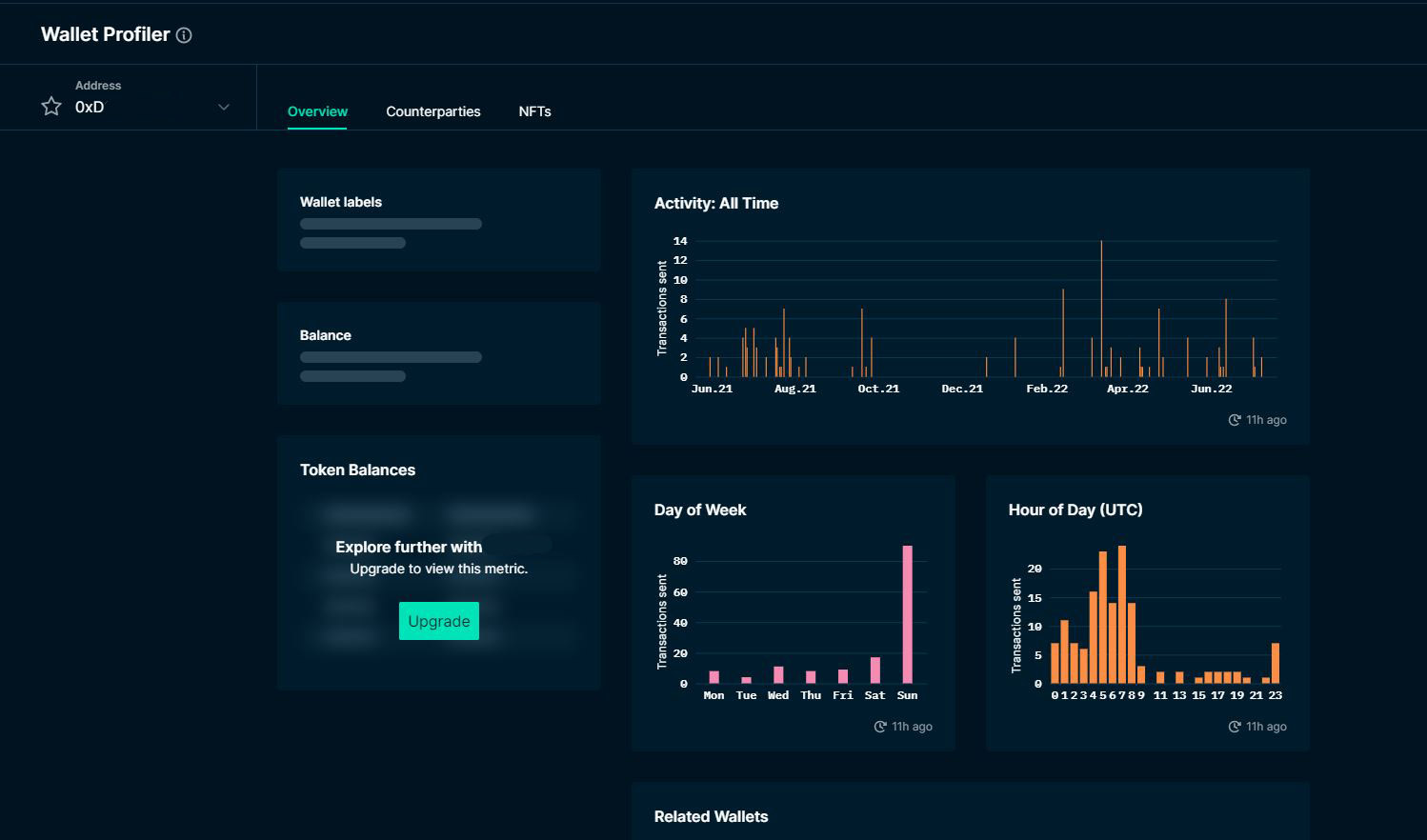

- Ecosystem Fragmentation: With multiple zk rollup solutions vying for dominance (e. g. , zkSync, Starknet, Polygon zkEVM), liquidity is fragmented across chains, which can dilute user experience until robust bridging infrastructure matures.

The market is responding with rapid iterations: wallet providers are rolling out native Layer 2 support, while cross-rollup bridges aim to unify liquidity pools. As composability improves and developer tooling matures, the barriers to entry will continue to fall.

The Road Ahead: ZK Rollups as a Foundation for Scalable and amp; Private Finance

The trajectory of zk rollups DeFi 2024 suggests that we are witnessing the emergence of a foundational layer for Web3 finance, one that marries high-throughput scalability with robust privacy guarantees. As real-world adoption accelerates in trading, lending, payments, and even on-chain identity solutions, it’s clear that zero-knowledge technology is moving from theoretical breakthrough to practical infrastructure.

Top 3 Benefits of ZK Rollups for DeFi in 2024

-

Massive Scalability and Cost Reduction: ZK Rollups like zkSync 3.0 aggregate thousands of transactions into a single batch, achieving up to 10,000 transactions per second (TPS)—a dramatic leap from Ethereum’s Layer 1 capacity of about 15 TPS. This results in gas fee reductions of 95-99% and finality times as low as 1-2 minutes, making DeFi applications faster and more affordable for users.

-

Enhanced Privacy for Transactions: Protocols such as Aztec Network and Manta Network use zk-SNARKs to validate transactions without exposing sensitive details. This allows users to interact with DeFi platforms while keeping transaction amounts, sender, and receiver information confidential—an essential feature for institutional and privacy-focused users.

-

Seamless Integration with Leading DeFi Platforms: Major DeFi projects like dYdX have adopted ZK Rollups to enable high-frequency, low-fee trading. For example, dYdX processes over 1,000 trades per second without network congestion, demonstrating how ZK Rollups support the growth of complex, high-volume DeFi services without sacrificing security or decentralization.

The coming year will likely see increased convergence between public blockchains and traditional finance as zero-knowledge proofs facilitate regulatory compliance without compromising user confidentiality. The ability of protocols like Aztec Network and Manta Network to offer both selective disclosure (for audits or compliance) and end-to-end privacy positions them at the nexus of innovation where DeFi meets mainstream finance.

For developers, investors, and users alike, staying ahead means closely tracking advancements in proof efficiency, EVM compatibility (as seen with Taiko), and cross-rollup interoperability. The research-driven conviction remains: in 2024, and beyond, zk rollups will underpin the next wave of scalable, private financial services on blockchain networks.