As Bitcoin continues to trade above $113,000, the demand for scalable and secure decentralized finance (DeFi) infrastructure on its network is reaching new heights. Hybrid ZK Rollups have emerged as a breakthrough solution, blending the robust security of Bitcoin with the advanced scalability and privacy features pioneered in Ethereum’s zero-knowledge (ZK) ecosystem. This convergence is transforming Bitcoin DeFi by delivering faster transaction finality, lower costs, and unprecedented fraud resistance.

Hybrid ZK Rollups: The Next Evolution in Bitcoin DeFi Scaling

To appreciate the innovation of hybrid zk rollup architectures, it’s essential to understand their technical lineage. Traditional rollups fall into two categories:

- Optimistic Rollups: Assume transactions are valid unless challenged within a set window (typically seven days), which can stall withdrawals and expose users to latency risks.

- ZK Rollups: Use cryptographic zero-knowledge proofs to instantly validate transaction batches, offering immediate finality but at a high computational cost.

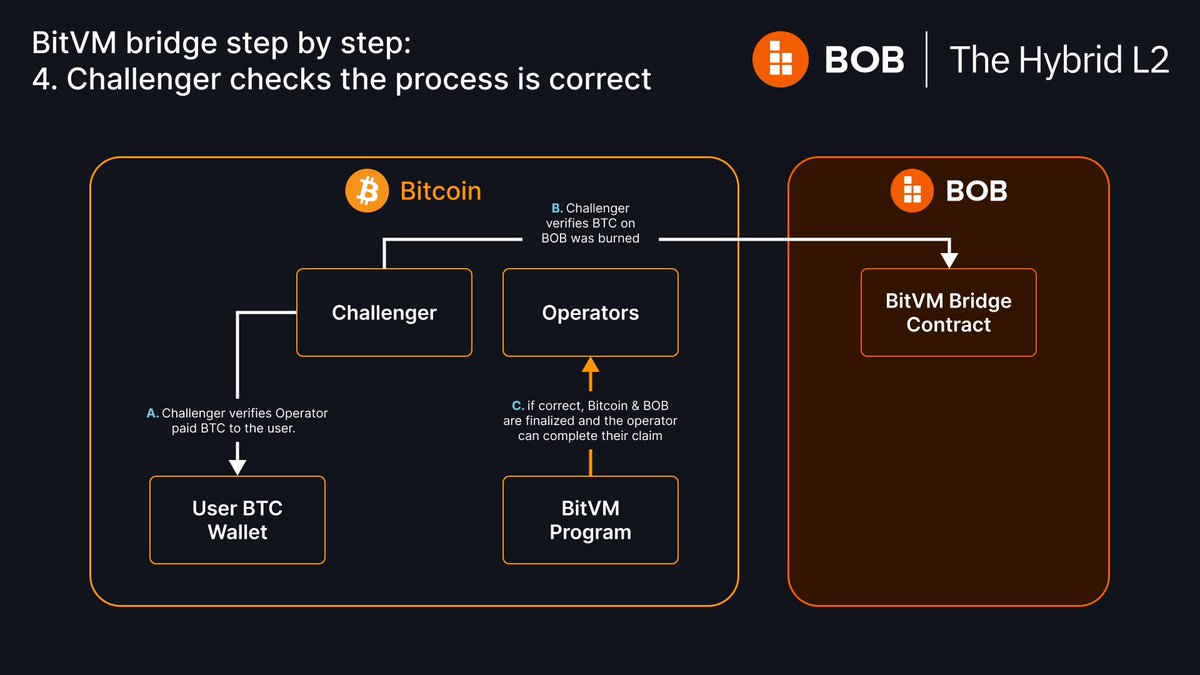

The hybrid approach fuses these models: transactions are processed optimistically for speed, but any disputes trigger a requirement for succinct ZK proofs as final arbiter. This not only slashes the challenge period but also reduces gas consumption and collateral requirements for fraud proofs. For Bitcoin DeFi users seeking both speed and uncompromising security, this is a game-changer.

“Hybrid ZK rollups are about more than just speed – they’re about trust-minimization at scale without sacrificing user experience. ”

BOB Chain: The Flagship of Hybrid ZK Rollup Innovation

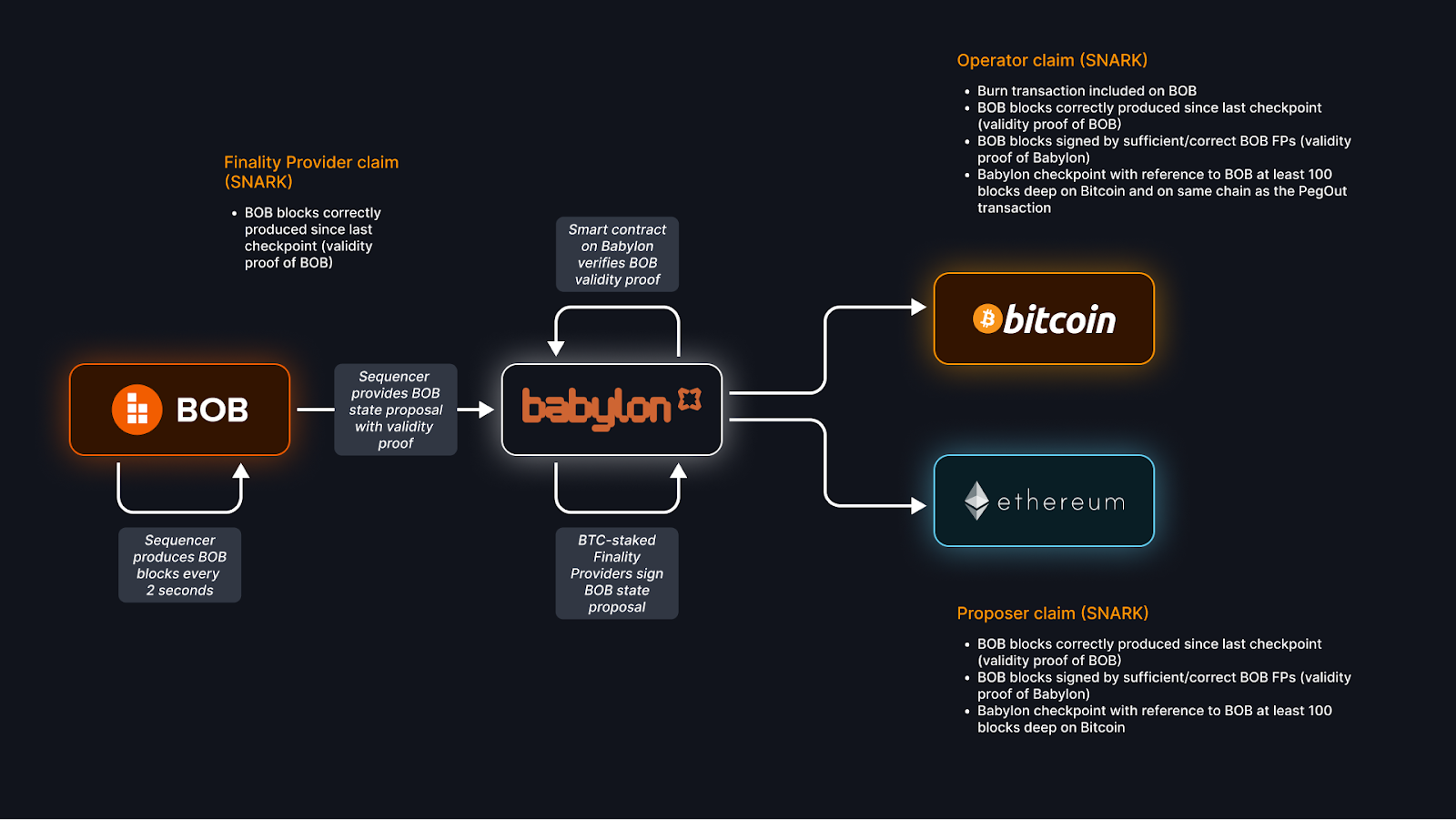

The BOB (Build on Bitcoin) chain exemplifies this new paradigm. By integrating RISC Zero’s Boundless protocol in 2024, BOB became the first hybrid zk rollup to deploy cross-chain zero-knowledge compute at scale. Here’s how BOB is setting industry benchmarks:

Key Advantages of BOB’s Hybrid ZK Rollup Model for Bitcoin DeFi

-

Enhanced Security Through ZK Proofs: BOB leverages zero-knowledge proofs to provide strong cryptographic guarantees, ensuring all state transitions are correct and significantly reducing the risk of fraudulent activity in Bitcoin DeFi.

-

Faster Transaction Finality: By combining optimistic processing with ZK-based dispute resolution, BOB shortens withdrawal challenge periods to around four days, with plans for further reduction—enabling users to access funds more quickly.

-

Cost-Efficient Proof Generation and Verification: BOB’s model reduces the financial and computational burden of fraud proofs, with proof generation costing approximately $3 and on-chain verification consuming about 250,000 gas units, making DeFi more accessible.

-

On-Demand Validity Proofs for Instant Finality: Users can submit validity proofs alongside transactions for immediate finality and faster withdrawals, offering flexibility for those who prioritize speed.

-

Scalability for Bitcoin DeFi: By processing and aggregating transactions off-chain, BOB’s hybrid zk rollup increases throughput and reduces mainchain congestion, supporting the growth of Bitcoin’s DeFi ecosystem.

Withdrawal challenge periods have dropped from seven days to just four – with further reductions on the horizon as cryptographic infrastructure matures. Fraud proof submission now requires only 0.5 ETH in collateral rather than prohibitive sums; proof generation costs hover around $3 per dispute with verification using roughly 250,000 gas units.

Perhaps most importantly for power users and liquidity providers: BOB offers on-demand validity proofs. Anyone can submit a validity proof alongside their transaction for instant finality – enabling near-instant withdrawals when speed matters most.

Cross-Chain ZK Scaling: Syscoin and The Rise of Multichain DeFi

The hybrid zk rollup model isn’t limited to BOB or even to Bitcoin alone. Syscoin’s partnership with ZKCross demonstrates how multichain zk scaling can empower users to trade assets across blockchains while maintaining full custody and privacy guarantees. By combining Layer 2 throughput with cross-chain interoperability, projects like these are laying the groundwork for a truly borderless DeFi community – one where efficiency meets uncompromising cryptographic assurance.

Why Hybrid ZK Rollups Matter Now, At $113,376 Bitcoin

The surge in Bitcoin price past $113,000 amplifies every scalability bottleneck on its network. High-value transactions require not just throughput but also ironclad security and fast settlement times. Hybrid zk rollup technology addresses these needs by:

- Enhancing Security: Succinct proofs ensure all state transitions are correct without exposing sensitive data.

- Boosting Scalability: Off-chain processing increases network capacity while reducing mainnet congestion.

- Catalyzing Adoption: Lower fees and faster withdrawals make DeFi accessible even as asset prices soar.

This synergy between technological innovation and market momentum is why hybrid zk rollups are rapidly gaining traction among developers and institutional investors alike. For deeper analysis of how these solutions bridge Bitcoin security with Ethereum-style scaling, see our coverage at ZkToday. com.

With Bitcoin’s price holding steady at $113,376.00, the urgency for robust scaling solutions is no longer theoretical. As DeFi activity on Bitcoin accelerates, hybrid zk rollup frameworks are emerging as a critical enabler, delivering the performance required for high-volume trading, lending protocols, and cross-chain swaps without compromising Bitcoin’s foundational security guarantees.

Zero-Knowledge Proofs: The Backbone of Secure Bitcoin Layer 2 Scaling

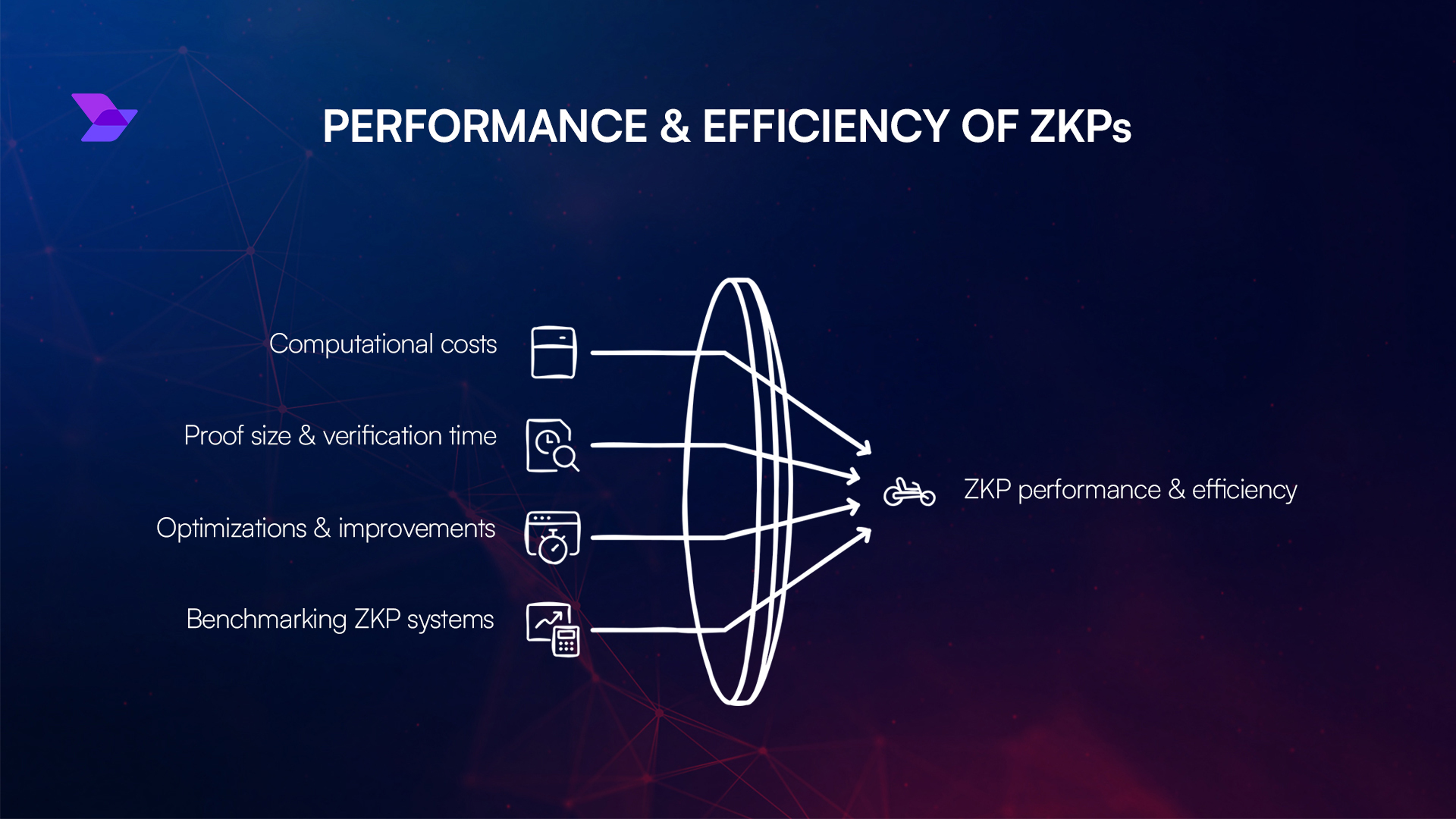

Zero-knowledge proofs (ZKPs) are at the heart of this technological leap. By allowing transaction validators to prove correctness without revealing underlying data, ZKPs enable both privacy and trust-minimization, a dual benefit especially attractive in a high-value environment like Bitcoin DeFi. Hybrid zk rollups employ these proofs selectively: most transactions clear quickly via optimistic assumptions, while only suspicious or disputed cases require the computational rigor of a full ZKP challenge.

This approach not only streamlines network operations but also addresses one of the main criticisms leveled at pure ZK rollups: excessive computational cost. By using ZKPs on-demand rather than universally, hybrid models achieve a sustainable balance between efficiency and uncompromised security.

Key Benefits Driving Institutional Adoption

Top Reasons Institutions Embrace Hybrid ZK Rollups for Bitcoin DeFi

-

Enhanced Security with Zero-Knowledge Proofs: Hybrid ZK Rollups leverage the cryptographic strength of ZK proofs to ensure all transactions are valid, significantly reducing fraud risk in Bitcoin DeFi environments.

-

Faster Transaction Finality: By combining optimistic processing with ZK-based dispute resolution, hybrid rollups like BOB cut withdrawal challenge periods from a week to as little as four days, with on-demand instant finality options.

-

Cost Efficiency and Lower Barriers: Institutions benefit from lower proof generation costs (around $3 per proof) and reduced on-chain verification fees, making large-scale DeFi operations more economically viable.

-

Scalability for High-Volume Operations: Hybrid ZK Rollups process and aggregate transactions off-chain, dramatically increasing throughput and reducing mainnet congestion—critical for institutional-scale DeFi.

-

Cross-Chain DeFi Expansion: Platforms like Syscoin integrate cross-chain ZK Rollups, enabling institutions to securely interact with multiple blockchains while maintaining asset control.

Institutional players are drawn to hybrid zk rollups because they offer predictable settlement windows, transparent fee structures, and reduced operational risk. With withdrawal times now measured in days, not weeks, and proof costs kept under control, capital can move more fluidly across platforms. This is particularly impactful as more traditional finance entities experiment with tokenized assets and on-chain collateral management.

“The real breakthrough isn’t just speed, it’s programmable trust that scales with market demand. “

Looking Ahead: The Roadmap for Hybrid ZK Rollups in 2025

The evolution of hybrid zk rollup technology is far from over. Projects like BOB are already exploring further reductions in challenge periods by optimizing proof generation algorithms and integrating hardware acceleration for ZKP computation. Meanwhile, multichain initiatives such as Syscoin and ZKCross point toward a future where users can seamlessly interact with DeFi protocols across multiple blockchains, all secured by cryptographic proofs rather than trusted intermediaries.

As these innovations mature, expect to see broader adoption not just among crypto-native projects but also within regulated financial infrastructure seeking compliance-friendly scalability solutions. The fusion of Bitcoin’s security model with Ethereum-style zero-knowledge scaling could ultimately reshape how digital assets move globally, unlocking new liquidity channels while preserving user autonomy.

What’s Next for Bitcoin DeFi Scaling?

The race to scale Bitcoin layer 2 is entering its most pivotal phase yet. Hybrid zk rollups stand out by delivering the best of both worlds, speed from optimistic execution and integrity from zero-knowledge validation, at a moment when network congestion and high-value transactions demand nothing less than excellence.

For those tracking the intersection of bitcoin defi scaling, zk rollup bitcoin, and ethereum zk tech, staying informed is essential. Follow ongoing developments at ZkToday. com, where we break down each protocol upgrade and analyze their impact on users, developers, and markets alike.