Ethereum’s ongoing journey toward scalability has been defined by a relentless search for solutions that can reduce gas fees without compromising security or decentralization. As of September 22,2025, the price of Ethereum sits at $4,152.00, a figure that underscores both its market significance and the persistent demand for affordable transactions. In this context, zero-knowledge (zk) rollups have emerged as the most pragmatic answer to Ethereum’s fee dilemma, leveraging cryptography to compress transaction data and minimize on-chain congestion.

How ZK Rollups Reshape Ethereum Gas Fees

At their core, zk rollups function as Layer 2 scaling solutions that aggregate thousands of transactions off-chain before submitting a single succinct proof to the Ethereum mainnet. This approach dramatically reduces the number of individual operations that must be processed by Ethereum’s base layer, resulting in lower gas fees per user.

The technical mechanics are straightforward yet powerful:

- Transaction Aggregation: Multiple transactions are bundled off-chain into a batch.

- Zero-Knowledge Proofs: A cryptographic proof attesting to the validity of all batched transactions is generated and posted on-chain.

- Data Compression: Only compressed state data and proofs are recorded on Ethereum, further cutting storage costs.

This means users no longer pay full price for each transaction’s computational and storage requirements. Instead, they share the overhead with everyone else in their batch. The result? Far less congestion on the mainnet and a dramatic drop in average gas fees per transaction. For an in-depth breakdown of how zk rollups achieve these efficiencies, see Ethereum. org’s developer guide.

The Compounding Effect: Scale Lowers Costs

A unique feature of zk rollups is how their cost savings scale with usage. The fixed expense of submitting a batch proof to Ethereum is distributed across every transaction within it. As more users transact during peak periods, each individual pays less in gas, an economic flywheel that rewards adoption.

This effect isn’t just theoretical; it’s observable in real-world fee structures. For example, during periods when zk rollup throughput surges due to DeFi or NFT activity spikes, users experience even steeper reductions in per-transaction costs compared to periods of low network utilization (source). This dynamic has made zk rollups not only a technical upgrade but also an economic catalyst for broader blockchain adoption.

The Latest Innovations: Batch Proof Optimization and Cost Declines

The landscape hasn’t stood still. In 2025 alone, zk-Rollup gas fees increased by 35% since January as Layer 2 adoption soared, a side effect of success as more users flocked to these networks. However, innovation quickly followed market pressure: zkSync Era 4.0 rolled out advanced batch proof optimization techniques capable of slashing costs by up to 40%. These upgrades have been instrumental in keeping zk rollup solutions competitive despite rising demand (source).

The cost structure for generating zero-knowledge proofs has also improved dramatically; what once cost over $80 per proof now averages just $1.30, a staggering 98% reduction since late 2023 (source). These advancements reinforce the role of zk rollups as not just a stopgap but a long-term pillar for affordable blockchain computation.

Ethereum (ETH) Price Prediction Table (2026-2031)

Professional ETH Price Forecast Incorporating ZK Rollup Adoption and Gas Fee Dynamics

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-on-Year % Change (Avg) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,700 | $4,600 | $6,200 | +11% | ZK Rollup scaling matures, ETH stabilizes post-2025 volatility. Regulatory clarity in the US/EU supports institutional adoption. |

| 2027 | $4,000 | $5,200 | $7,300 | +13% | Layer 2 adoption surges, major DeFi and NFT platforms fully migrate. Competition from alternative L1s increases, but ETH retains network effect. |

| 2028 | $4,300 | $6,000 | $8,900 | +15% | Mainstream fintech integrations boost demand. Gas fees remain low due to advanced zkEVMs. Global macro uncertainty introduces volatility. |

| 2029 | $4,800 | $7,150 | $10,800 | +19% | ETH benefits from Layer 3 innovations and cross-chain interoperability. Regulatory frameworks solidify, unlocking new use cases. |

| 2030 | $5,200 | $8,400 | $13,000 | +17% | Web3 and enterprise adoption accelerate. ETH staking and deflationary tokenomics drive scarcity narrative. Potential ETF approval boosts liquidity. |

| 2031 | $5,600 | $9,800 | $15,700 | +17% | ETH cements position as decentralized finance backbone. Advanced ZK tech keeps network competitive; macro bull run possible. |

Price Prediction Summary

Ethereum is projected to experience steady growth through 2031, driven by the widespread adoption of ZK Rollups, ongoing Layer 2 innovations, and increased institutional participation. While volatility will persist due to market cycles and macroeconomic factors, Ethereum’s role as the leading smart contract platform should sustain robust price appreciation, especially as gas fee reductions and network upgrades improve user experience.

Key Factors Affecting Ethereum Price

- Adoption and evolution of ZK Rollups and Layer 2 solutions, reducing gas fees and scaling throughput.

- Regulatory clarity in major jurisdictions, enabling greater institutional and enterprise participation.

- Competition from other smart contract platforms (e.g., Solana, Avalanche, Polkadot) affecting market share.

- Macro market cycles (bull/bear markets), global economic conditions, and crypto-specific sentiment.

- Continued development of Ethereum (e.g., upgrades, EIPs, Layer 3, zkEVMs) supporting new use cases and efficiency.

- Technological breakthroughs in zero-knowledge proofs and scalability.

- Potential approval of Ethereum-based ETFs and increased integration with traditional finance.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Yet, it’s important to recognize that while zk rollups have driven costs down, the ecosystem is still subject to market cycles and adoption curves. As we’ve seen in 2025, surging on-chain activity led to a temporary uptick in gas fees across Layer 2s. This underscores a key pragmatic point: no scalability solution is immune to exponential demand, but zk rollups are uniquely positioned to adapt through ongoing technical refinement.

“The real innovation is not just in compressing data, but in the relentless iteration of proof systems and batch mechanisms. Every percentage shaved off cost brings us closer to mass adoption. ”

For developers and users alike, the implications are significant. Lower transaction costs mean more experimentation with decentralized applications (dApps), broader access for smaller users, and a more robust environment for NFT and DeFi projects. The cascading effect of these savings can be seen in the uptick of new protocols launching directly on zk rollup platforms rather than mainnet Ethereum, an indicator of where developer mindshare is moving.

Strategic Considerations for Investors and Builders

For investors tracking Ethereum’s trajectory at $4,152.00, the proliferation of zk rollups signals more than just lower fees; it marks a shift in network economics. Projects that integrate zk rollup infrastructure early are poised to capture outsized value as user activity migrates toward cheaper execution layers. Conversely, protocols slow to adapt may see diminishing relevance as cost-conscious users seek alternatives.

Leading Ethereum dApps Leveraging ZK Rollups

-

Uniswap v3 on zkSync Era: Uniswap, the largest decentralized exchange by volume, has deployed its v3 protocol on zkSync Era, harnessing ZK Rollups to offer lower gas fees and faster trades while maintaining Ethereum-level security.

-

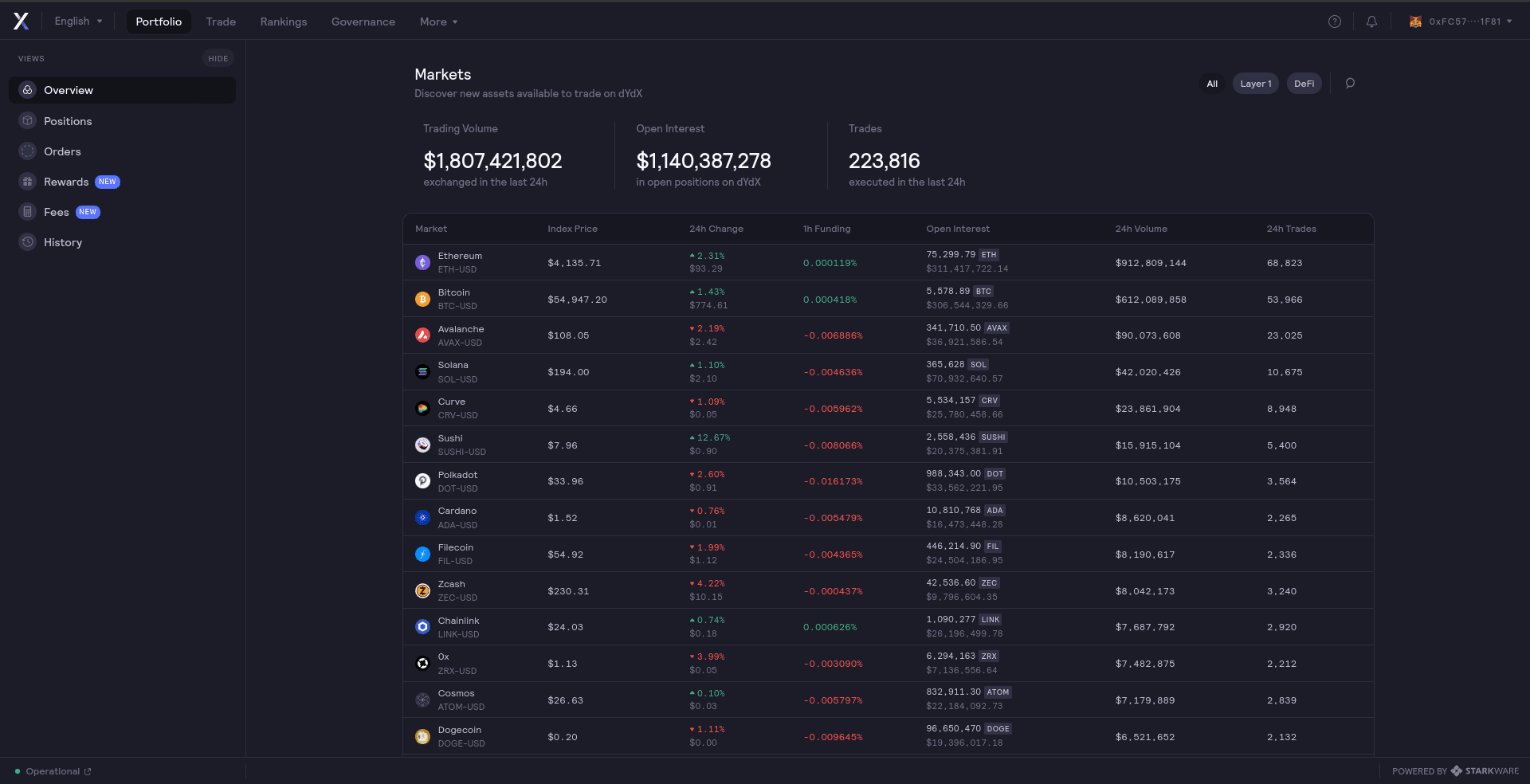

dYdX: dYdX is a premier decentralized derivatives exchange that utilizes StarkWare’s ZK Rollup technology to deliver high-speed, low-cost perpetual trading directly on Ethereum Layer 2.

-

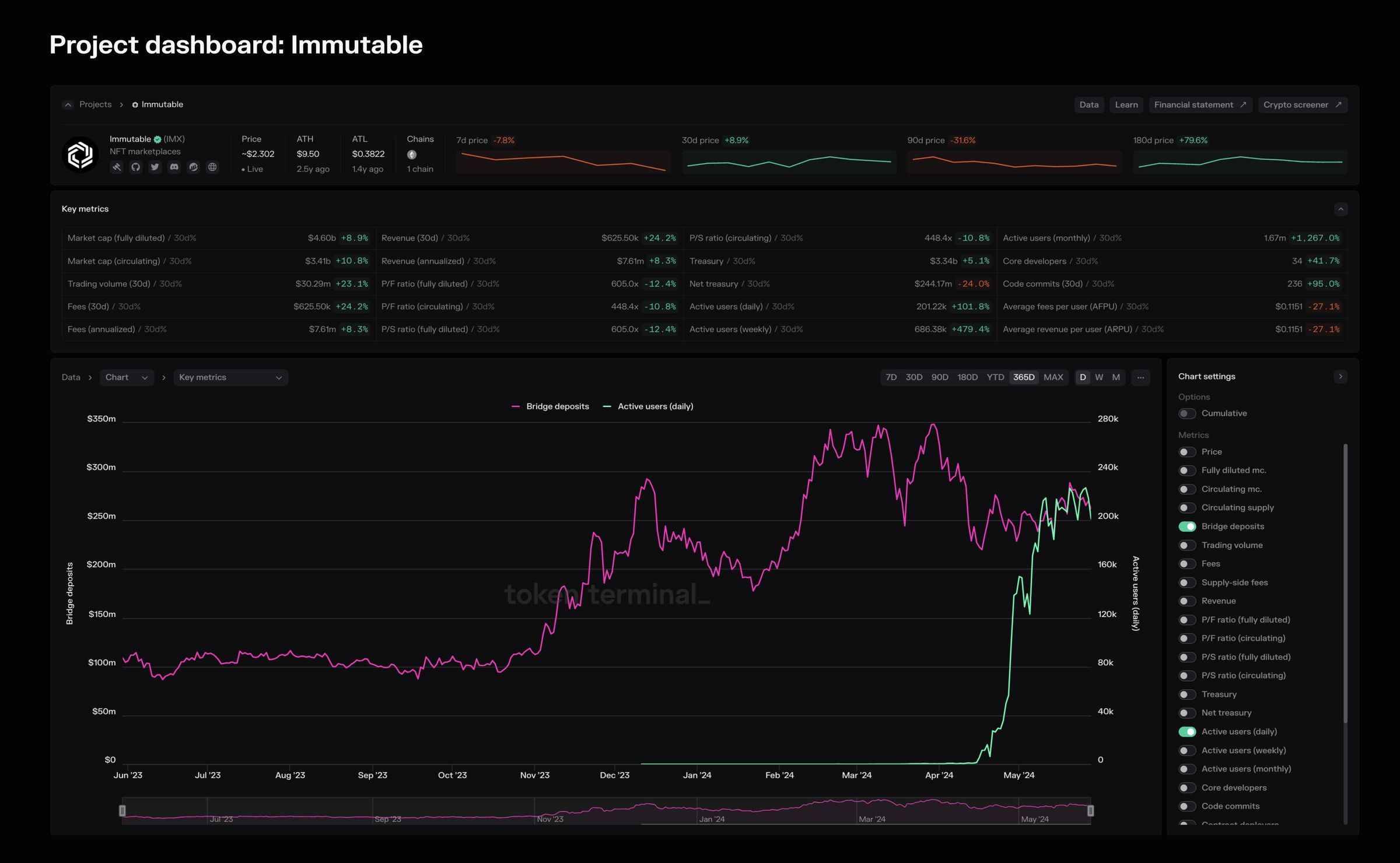

Immutable X: Focused on NFTs and blockchain gaming, Immutable X uses ZK Rollups to enable instant, gas-free NFT minting and trading, making it a leading choice for digital asset marketplaces.

-

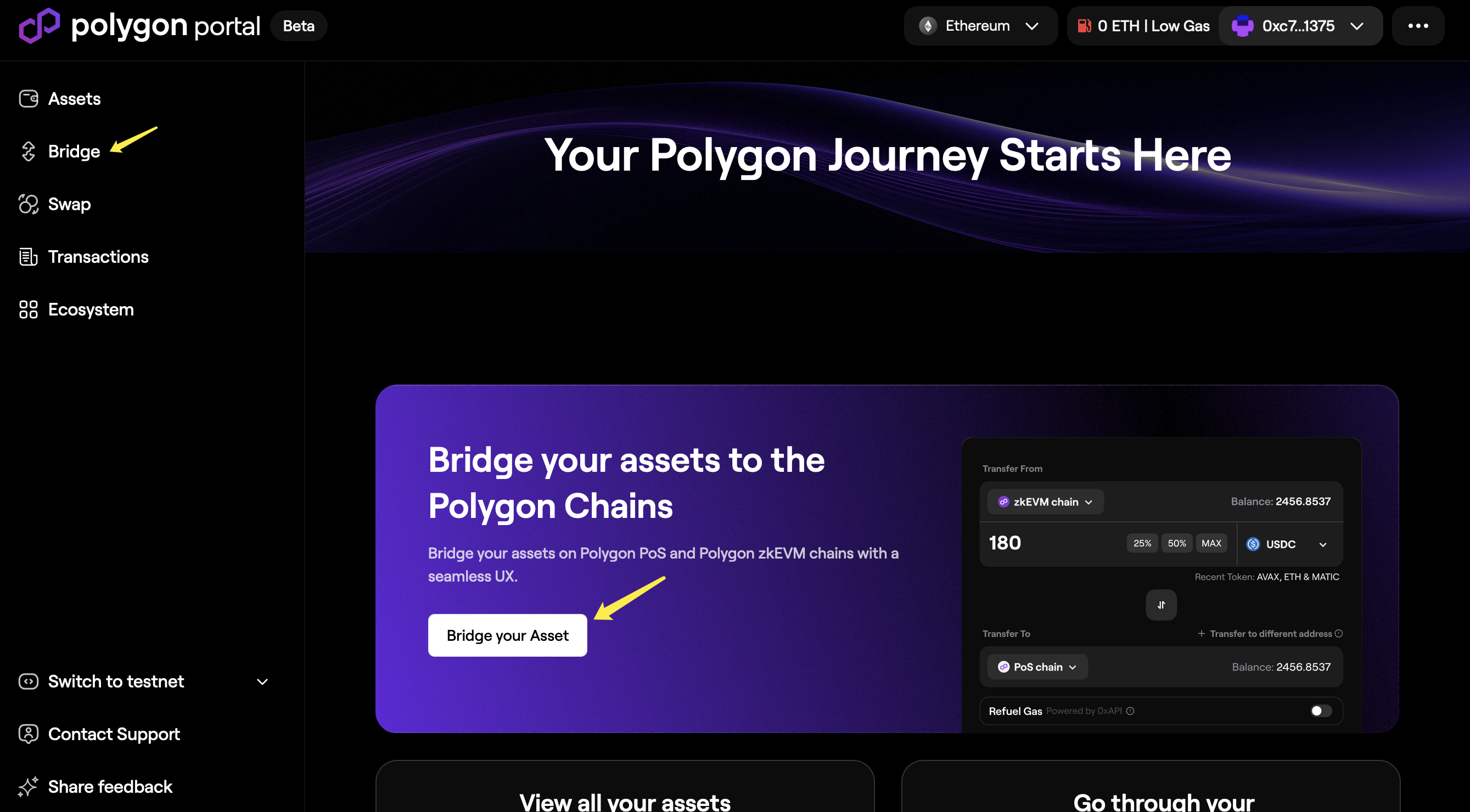

Polygon zkEVM: Polygon zkEVM brings EVM compatibility to ZK Rollups, allowing popular dApps like Aave and Lens Protocol to operate with reduced fees and increased throughput on Ethereum.

-

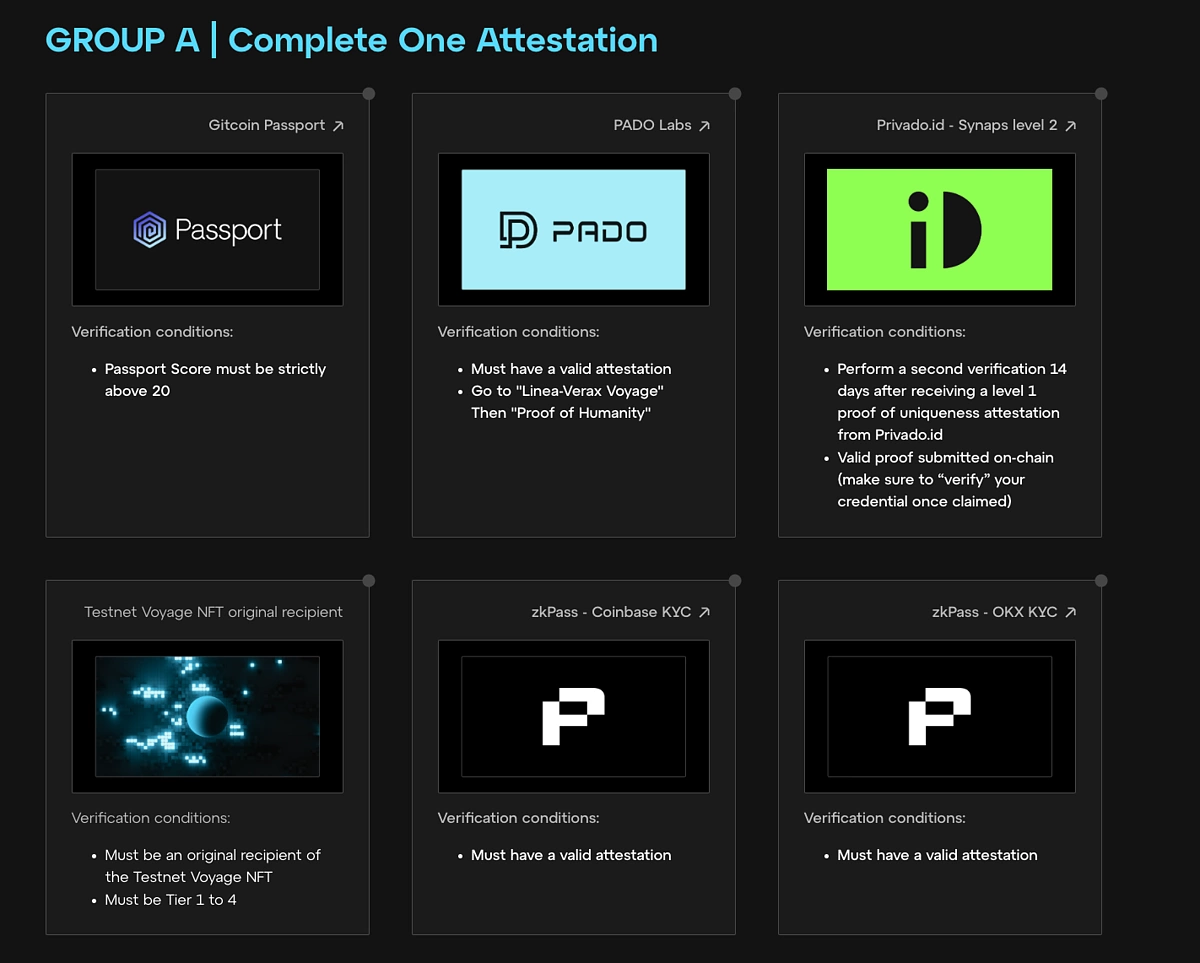

Gitcoin Passport on Linea: Gitcoin Passport leverages ConsenSys’ Linea ZK Rollup to provide identity verification and Sybil resistance for web3 users, benefiting from the scalability and efficiency of ZK technology.

Builders should also note the rapid pace of zero-knowledge proof advancements. Staying current with proof system upgrades, such as recursive proofs or next-gen data compression, can yield substantial competitive advantages both in terms of user experience and operational expenditure.

The Road Ahead: EIP-4844 and Beyond

The next major milestone for zk rollups will be EIP-4844 (proto-danksharding), which promises even greater data availability efficiencies by introducing “blobs”: a new way for Layer 2s to post data on Ethereum at dramatically reduced costs. This will further amplify the benefits outlined above, keeping gas fees manageable even as activity spikes.

Ultimately, zk rollups are not just an incremental improvement, they represent a paradigm shift toward scalable, affordable blockchain computation. By continually optimizing how transactions are processed and validated, these solutions ensure Ethereum remains accessible at any price point, even as ETH holds steady at $4,152.00.