In early 2026, Ethereum’s Layer 2 ecosystem processes 47 million daily transactions, dwarfing the mainnet’s volume by 15 times, with total value locked exceeding $85 billion. Arbitrum and Optimism lead in adoption among optimistic rollups, while zkSync Era, StarkNet, and Polygon zkEVM advance zk rollups. Ethereum trades at $2,206.19, down 5.28% in 24 hours from a high of $2,354.60. This zk rollups vs optimistic rollups rivalry hinges on validity proofs versus fraud proofs, shaping Ethereum L2 scaling in 2026.

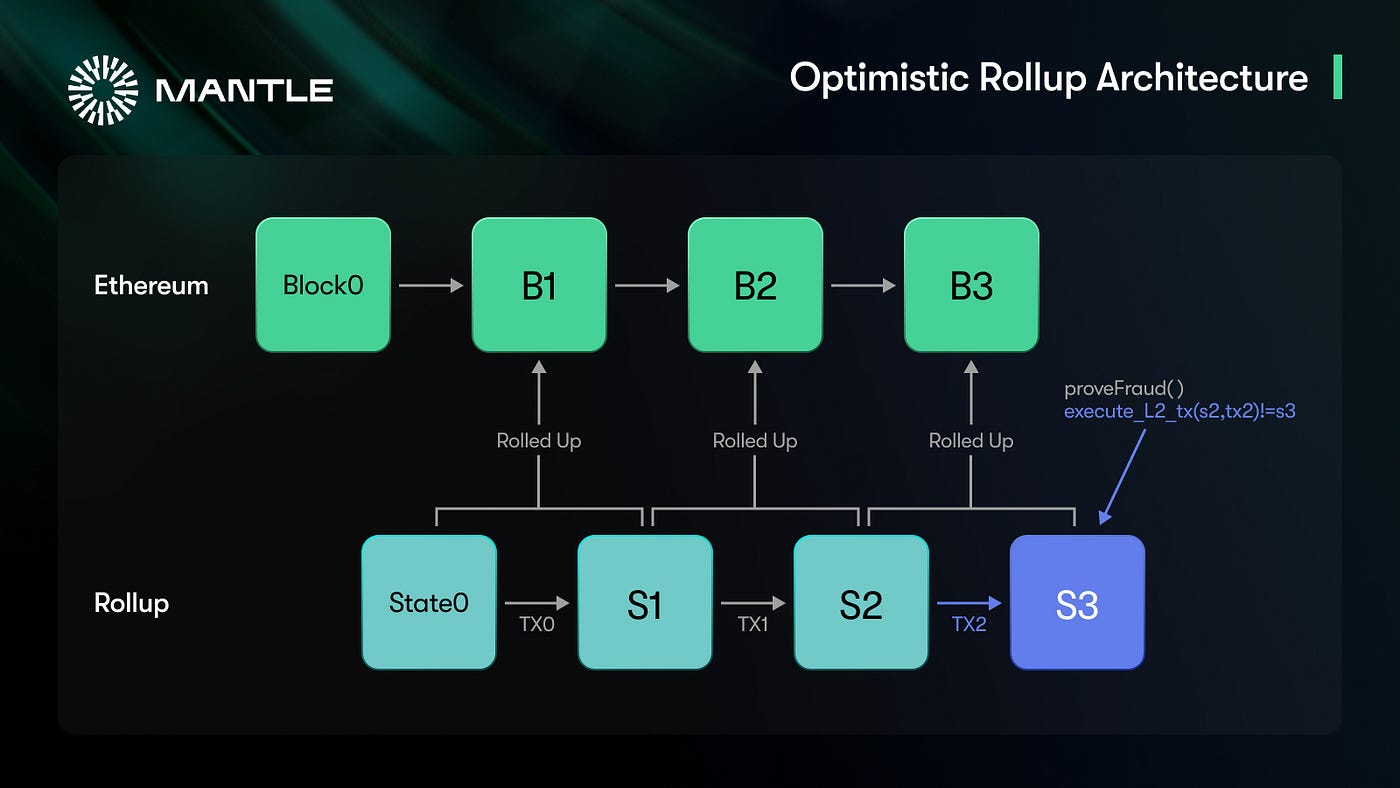

Optimistic rollups assume transaction validity by default, posting compressed data to Ethereum L1. Operators batch thousands of transactions off-chain, publishing state roots and calldata. Anyone can challenge invalid states during a 7-day dispute window using interactive fraud proofs. This game-theoretic security relies on economic incentives: challengers post bonds, slashed if wrong.

Optimistic Rollups: Efficiency Through Assumed Honesty

Arbitrum and Optimism exemplify this model, achieving 2,000-4,000 TPS with fees under $0.05. Their EVM compatibility accelerates dApp migration, fostering mature ecosystems. However, the challenge period delays withdrawals, exposing users to sequencer risks and potential centralization. Recent sequencer decentralization efforts mitigate this, but finality lags at days versus minutes.

Vitalik Buterin’s January 2026 nod to native rollups underscores optimistic mode’s role, yet highlights ZK-EVM maturation as a pivot point. Optimistic rollups excel in throughput and developer accessibility, trading instant finality for computational lightness.

ZK Rollups: Validity Proofs for Cryptographic Certainty

ZK rollups employ zero-knowledge succinct non-interactive arguments of knowledge (zk-SNARKs or zk-STARKs) as validity proofs. Provers compute a compact proof attesting batched transactions’ correctness, verified on L1 in seconds. No challenge window needed; invalid batches are rejected outright, ensuring zk rollups advantages in security and finality.

zkSync Era and StarkNet hit 10-20 minute finality, with fees at $0.05-$0.20. Polygon zkEVM bridges EVM gaps via type-1 equivalence. Proving overhead remains, but hardware acceleration and recursive proofs slash costs. Privacy inherits from zk tech, bundling transactions without revealing details.

Vitalik Buterin: ZK-EVMs now make zk mode feasible for native rollups.

Fraud Proofs vs ZK Proofs: Security Models Dissected

Fraud proofs vs zk proofs define the divide. Optimistic systems probabilistically secure via watchtowers; a dormant network risks unchallenged fraud. ZK rollups deterministically validate via math, inheriting Ethereum’s full security sans trust assumptions.

Throughput matches at 2k-4k TPS, but ZK edges finality: 10-20 minutes versus 7 days. Costs converge as ZK proving optimizes; optimistic saves on proof gen but incurs dispute gas. Real-world: optimistic dominates DeFi TVL, zk surges in high-security apps like payments.

Quantitative edge? ZK’s succinct proofs scale horizontally, enabling 100k and TPS visions via aggregation. Optimistic’s simplicity suits rapid iteration, yet ZK’s app-chain flexibility wins privacy-focused chains.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts Amid L2 Scaling Dominance: ZK Rollups vs Optimistic Rollups

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $2,800 | $4,200 | $6,800 | +68% |

| 2028 | $3,800 | $6,300 | $10,500 | +50% |

| 2029 | $5,000 | $9,000 | $15,000 | +43% |

| 2030 | $6,500 | $12,500 | $21,000 | +39% |

| 2031 | $8,000 | $17,000 | $28,000 | +36% |

| 2032 | $10,000 | $23,000 | $38,000 | +35% |

Price Prediction Summary

Ethereum’s price is projected to experience robust growth from 2027 to 2032, driven by L2 scaling advancements. Starting from a 2026 baseline of ~$2,500, average prices could reach $23,000 by 2032, with minimums reflecting bearish market cycles and maximums capturing bullish adoption surges. Min/max ranges account for volatility, regulatory shifts, and tech maturation.

Key Factors Affecting Ethereum Price

- Maturing ZK Rollups (zkSync, StarkNet) offering instant finality and superior security

- Optimistic Rollups (Arbitrum, Optimism) ecosystem dominance with high TVL ($85B+ in 2026)

- Explosive L2 transaction volume (47M daily) reducing fees and boosting ETH utility

- Vitalik Buterin’s endorsement of native rollups and ZK-EVM advancements

- Crypto market cycles, institutional adoption, and regulatory clarity

- Competition from alt-L1s and macroeconomic factors influencing min/max scenarios

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

L2 adoption metrics signal convergence: combined TVL at $85B reflects hybrid futures, with ZK gaining 20% market share quarterly.

ZK rollups’ proving systems, once compute-intensive, now leverage specialized hardware like GPUs and FPGAs, driving costs toward parity. Optimistic rollups, meanwhile, face rising dispute gas fees amid Ethereum’s $2,206.19 price volatility, where network congestion amplifies challenge expenses.

Optimistic Rollups vs ZK Rollups: Key Comparison (2026)

| Metric | Optimistic Rollups (Arbitrum/Optimism) | ZK Rollups (zkSync/StarkNet) |

|---|---|---|

| TPS | 2,000–4,000 | 2,000–4,000 |

| Avg. Fees | ~$0.05 | ~$0.05–$0.20 |

| Finality | 7 days | 10–20 min |

| TVL Share | 60% | 25% |

| Security | Fraud Proofs | Validity Proofs |

| EVM Compatibility | Full | Near-Full |

Throughput and Cost Dynamics: Converging Economics

Both camps deliver 2,000-4,000 TPS today, but ZK rollups scale toward 100,000 TPS via proof recursion and aggregation. Optimistic setups cap at batch sizes limited by L1 calldata costs, hovering at $0.05 per transaction. ZK fees, historically higher due to proof generation, dip to $0.05-$0.20 as prover networks decentralize. In high-volume scenarios, ZK’s fixed verification gas trumps optimistic’s variable disputes, especially with Ethereum at $2,206.19 and base fees spiking 20% daily.

This convergence favors ZK for sustained growth. Optimistic rollups shine in bursty DeFi traffic, where EVM parity slashes porting costs. Yet ZK’s succinctness enables succinct scalability, packing more data per L1 post without calldata bloat.

Use Cases: DeFi Muscle vs Privacy Precision

Arbitrum and Optimism lock $50B and in DeFi TVL, fueling DEXes like Uniswap and lending protocols. Their fraud-proof model suits permissionless liquidity, where rapid iterations outpace proof overhead. Developers flock here for AnyTrust optimizations, slashing costs 90% on trusted setups.

ZK rollups target precision: zkSync Era powers EraSwap with shielded transfers, StarkNet excels in perpetuals via Cairo’s expressiveness. Polygon zkEVM hosts enterprise pilots, leveraging type-1 equivalence for seamless Solidity ports. Privacy edges ZK ahead in payments and identity, where optimistic’s transparency invites front-running.

Hybrid models emerge, like optimistic chains adopting ZK validity for withdrawals. StarkWare’s shared sequencer previews multi-rollup worlds, pooling liquidity across proofs.

2026 Predictions: ZK Momentum Accelerates

With L2s at 47 million daily txs, ZK’s 20% quarterly share gain projects 40% dominance by year-end. Vitalik’s native rollup push tilts toward ZK-EVMs, enabling protocol-level bundling. Prover marketplaces commoditize computation, dropping ZK fees below optimistic baselines.

Challenges persist: ZK’s quantum resistance via STARKs contrasts optimistic’s upgrade paths. Yet as Ethereum hovers at $2,206.19, down 5.28% amid macro pressures, L2 efficiency dictates survival. ZK rollups, with cryptographic rigor, position for mass adoption in gaming, socialFi, and beyond.

Investors eye ZK infrastructure: sequencer fault proofs decentralize, validity proofs secure. The proof wars evolve into symbiosis, but ZK’s math-backed finality cements long-term leads in a $85B L2 arena.