As Ethereum hovers around $2,954.31, up a modest $42.34 in the last 24 hours, the zk-rollup ecosystem is witnessing a transformative moment driven by institutional demand for privacy-preserving scalability. zkSync’s ZK Stack emerges as a cornerstone, offering a modular framework that lets financial giants like Deutsche Bank spin up custom, Ethereum-compatible Layer 2 rollups without compromising on compliance or confidentiality. This isn’t just hype; it’s a blueprint for private zk rollups tailored to the needs of sovereign L2 institutions.

zkSync ZK Stack: Modular Backbone for Institutional Chains

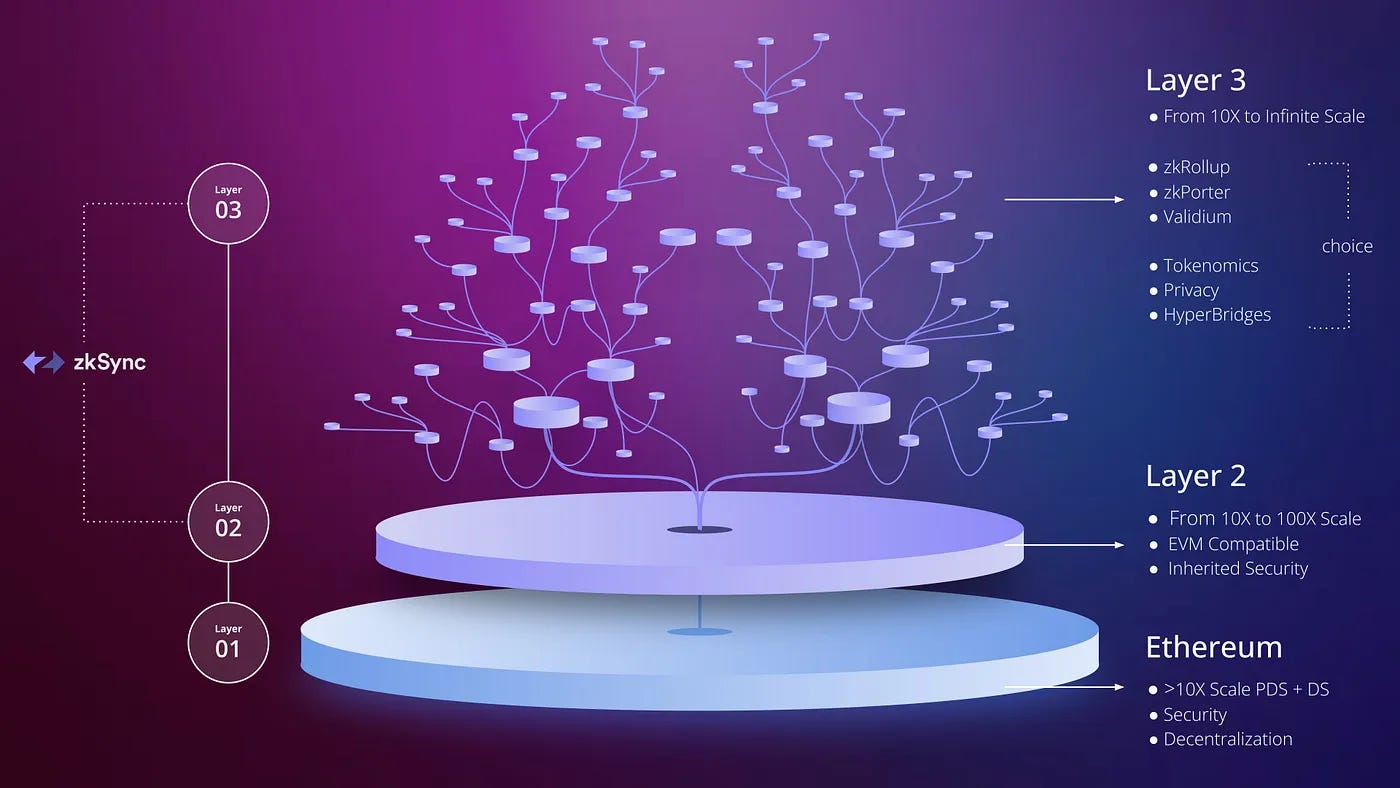

The ZK Stack stands out in the crowded zk-rollup landscape for its deliberate focus on institutional-grade customization. Unlike public L2s optimized for retail throughput, this stack empowers enterprises to launch sovereign chains that interconnect with the broader Ethereum network via cryptographic security. Matter Labs, zkSync’s developers, designed it to bridge public and private ecosystems, allowing institutions to launch, control, and even monetize their own chains.

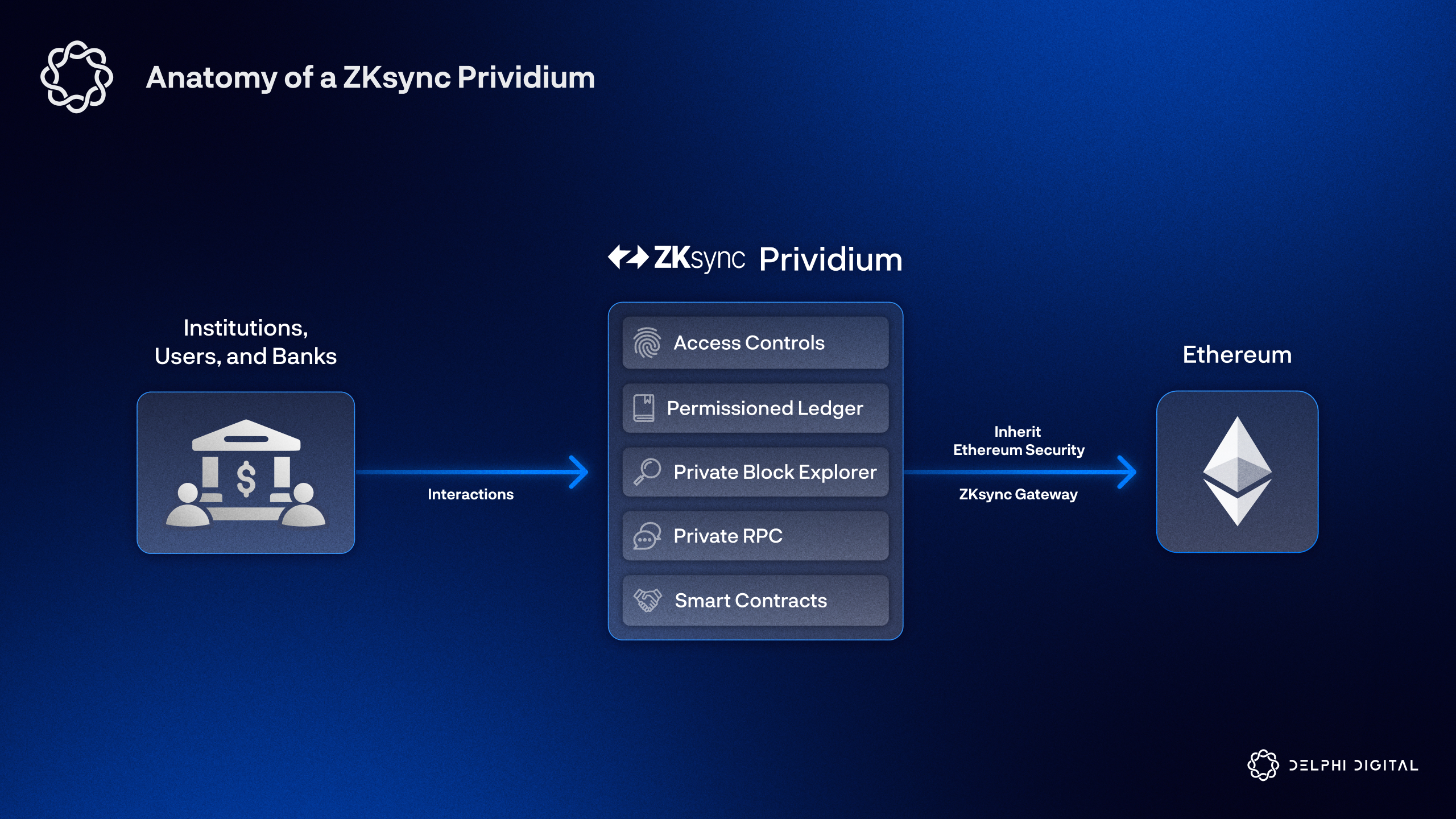

Key to its appeal are features like Elastic Chains, which provide hyper-scalable infrastructure attracting projects across verticals. For institutions, the stack integrates Prividium technology, an enterprise-grade platform that ensures secure, compliant on-chain finance. Reflexivity Research highlights how this setup processes sensitive data off-chain while batching zero-knowledge proofs on-chain, shielding trading strategies from prying eyes. Institutions can thus trade without revealing their positions, a game-changer for high-frequency or proprietary operations.

Over 35 enterprises are already building sovereign L2s on this tech, signaling robust traction. Blockdaemon’s institutional support, including dedicated RPC nodes and managed infrastructure, further de-risks deployments, making zkSync a reliable choice for production environments.

Deutsche Bank’s Bold Bet: Memento ZK Chain and Project DAMA 2

Deutsche Bank catapults zkSync into the institutional spotlight with its Memento ZK Chain, a private, permissioned L2 built atop the ZK Stack and powered by Prividium. This chain targets institutional fund management, tokenizing real-world assets (RWAs) while upholding stringent regulatory standards. As part of Singapore’s Monetary Authority-backed Project Guardian, Project DAMA 2 tests tokenized asset use cases on blockchain ledgers, positioning Deutsche Bank at the forefront of Deutsche Bank zkSync integration.

Memento’s architecture is meticulously engineered for enterprise realities. It operates a dedicated L2 within the bank’s infrastructure, keeping transaction data off-chain and securing it through ZK proofs submitted to Ethereum. Role-based access control (RBAC) ties seamlessly into existing identity systems, ensuring only authorized personnel interact with the chain. This hybrid model delivers scalability and cost efficiency without sacrificing privacy, crucial for handling institutional volumes.

The litepaper for DAMA 2 underscores its role as an institutional blueprint, blending zkSync’s validity proofs with compliant tokenization workflows. Early tests cover fund transfers, custody, and settlement, proving the stack’s viability for zksync rwa scaling.

Sovereign L2s: Redefining Institutional Blockchain Strategy

zkSync’s vision extends beyond single deployments, fostering a network of institutional zk chains that prioritize sovereignty. Enterprises gain full control over governance, sequencing, and data flows, sidestepping the transparency pitfalls of public chains. Delphi Consulting notes how this empowers proprietary ZK Chains fine-tuned for regulatory nuances and business logic.

This momentum reflects a broader trend: traditional banks entering Layer 2s for faster, cheaper processing. zkSync’s off-chain data handling via ZK proofs addresses core institutional pain points, from front-running risks to KYC/AML mandates. With Ethereum’s base layer at $2,954.31, the economic incentives align perfectly; rollups slash fees while inheriting Ethereum’s security.

zkSync (ZK) Price Prediction 2027-2032

Projections based on institutional adoption via ZK Stack, Deutsche Bank onboarding, and sovereign L2 growth amid Ethereum ecosystem expansion

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $0.60 | $1.00 | $1.80 | +100% |

| 2028 | $1.00 | $2.20 | $4.00 | +120% |

| 2029 | $1.50 | $4.00 | $7.50 | +82% |

| 2030 | $2.50 | $7.00 | $13.00 | +75% |

| 2031 | $4.00 | $12.00 | $22.00 | +71% |

| 2032 | $6.00 | $18.00 | $35.00 | +50% |

Price Prediction Summary

zkSync’s ZK token is positioned for strong growth due to institutional catalysts like Deutsche Bank’s Memento ZK Chain and Project DAMA 2 on ZK Stack, enabling private, compliant rollups for asset tokenization. Predictions reflect bearish (regulatory hurdles/market corrections), average (steady adoption), and bullish (widespread enterprise use) scenarios, with average prices potentially reaching $18 by 2032, implying a ~36x rise from assumed 2026 baseline amid bull cycles and Ethereum alignment.

Key Factors Affecting zkSync Price

- Deutsche Bank onboarding via Project DAMA 2 and Memento ZK Chain for institutional private L2s

- ZK Stack framework for sovereign, permissioned rollups with privacy via zero-knowledge proofs

- 35+ enterprises building on ZKsync tech, including under Singapore’s Project Guardian

- Asset tokenization and compliant on-chain finance use cases boosting real-world utility

- Ethereum L2 scalability synergies with ETH at ~$2,950 supporting ecosystem growth

- Institutional infrastructure support from Blockdaemon for reliable deployments

- Market cycles, regulatory developments favoring compliant blockchains

- Competition from other L2s, but ZKsync’s privacy and enterprise focus as differentiator

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Yet this institutional pivot raises pointed questions about interoperability and long-term viability. zkSync’s Elastic Chains aim to knit these sovereign L2s into a unified network, but true federation demands rigorous standards for cross-chain settlement. Early adopters like Deutsche Bank test these waters through Project DAMA 2, where tokenized funds move seamlessly under regulatory oversight. Success here could cascade, drawing more sovereign L2 institutions into the fold.

Technical Deep Dive: Prividium and Memento’s Hybrid Architecture

Prividium, zkSync’s enterprise blockchain layer, forms the technical spine of Memento ZK Chain. It deploys a permissioned L2 that processes transactions off-chain in a controlled environment, then batches ZK proofs for Ethereum settlement. This reflexivity, data stays private, proofs go public, minimizes exposure while leveraging Ethereum’s $2,954.31-anchored security model. Role-based access integrates with LDAP or OAuth systems, enforcing granular permissions down to smart contract calls.

Consider the workflow: a fund manager initiates a tokenized asset transfer. The sequencer, hosted in Deutsche Bank’s vaulted infrastructure, validates it privately. ZK proofs confirm validity without revealing amounts or counterparties. Settlement finalizes on Ethereum L1, inheriting finality. This setup crushes public chain latencies, targeting sub-second confirmations at institutional scale, all while fees plummet below pennies per transaction.

ZKsync Elastic Chains vs. Public Chains: Key Advantages for Institutions

| Feature | ZKsync Elastic Chains | Public Chains |

|---|---|---|

| Latency | Sub-second confirmations ⚡ | Multi-second ⏳ |

| Fees | Below pennies per tx 💰 | Dollars per tx 💸 |

| Throughput | Institutional scale 🚀 | Limited 📊 |

| Privacy | Institutional private rollups 🔒 | Public 👁️ |

Blockdaemon’s node services bolster this, offering 99.99% uptime RPC endpoints tailored for high-throughput ZK proving. For private zk rollups, such infrastructure turns theoretical scalability into operational reality.

Economic Incentives: Monetizing Institutional ZK Chains

zkSync doesn’t just enable chains; it equips them for revenue. Sovereign L2s can impose custom sequencer fees, token-gate access, or even launch native tokens for governance. Deutsche Bank’s deployment hints at this: Project DAMA 2 explores yield-bearing RWAs, where tokenized treasuries generate on-chain returns compliant with Basel III. As zksync rwa scaling matures, institutions stand to capture alpha from programmable finance without ceding control.

Contrast this with competitors like Polygon CDK or Optimism’s OP Stack. zkSync’s native ZK proving edges out optimistic rollups on settlement guarantees, vital for institutions intolerant of challenge periods. With 35 enterprises in the pipeline, network effects compound: shared prover networks reduce costs as adoption swells.

Core ZK Stack Advantages

-

Privacy: Private, permissioned L2s like Memento ZK Chain process data off-chain, secured by zero-knowledge proofs.

-

Compliance: Sovereign ZK Chains with role-based access control and enterprise identity integration for regulatory adherence, as in Deutsche Bank’s Project DAMA 2.

-

Scalability: Modular L2 framework delivers faster, cheaper transactions via Elastic Chains, attracting 35+ enterprises for sovereign L2s.

-

Ethereum Security: Full Ethereum compatibility as a trustworthy settlement layer, inheriting ETH’s security for institutional rollups.

-

Monetization: Launch, control, and tokenize assets on custom chains, enabling revenue from proprietary ZK networks.

Market signals align. Ethereum’s steady $2,954.31 price, with a 24-hour high of $3,007.85, underscores L2 maturity. Institutions hedge volatility by settling on a battle-tested base layer, while zkSync captures value accrual through its stack’s modularity.

Challenges and Risks: Navigating the Institutional Frontier

No rollout escapes scrutiny. Quantum threats loom over elliptic curve cryptography, though zkSync’s post-quantum roadmaps progress. Regulatory flux, Singapore’s Project Guardian succeeds, but Europe’s MiCA or U. S. clarity lags, could fragment adoption. Moreover, sequencer centralization in private chains invites MEV extraction if not mitigated by decentralized alternatives.

Deutsche Bank’s litepaper confronts these head-on, prioritizing auditability via ZK-SNARK verifiability. Yet scale tests remain: can Memento handle trillion-dollar AUM without sequencer bottlenecks? Zeeve’s case studies suggest yes, with Elastic Chains distributing load dynamically.

Broader ecosystem support accelerates fixes. Delphi Digital praises zkSync’s settlement layer for trustworthy off-chain computation, echoing GRVT’s private trading wins. As Blockdaemon scales nodes, reliability hardens.

This convergence, tech prowess meeting institutional capital, positions zkSync as the zksync zk stack leader for Deutsche Bank zkSync plays and beyond. Enterprises no longer tinker; they deploy production chains, tokenizing trillions in RWAs under sovereign veils. Ethereum’s ecosystem, buoyed at $2,954.31, absorbs this influx, proving rollups as the scalability salve. The zk era feels sovereign, private, and inescapably institutional.