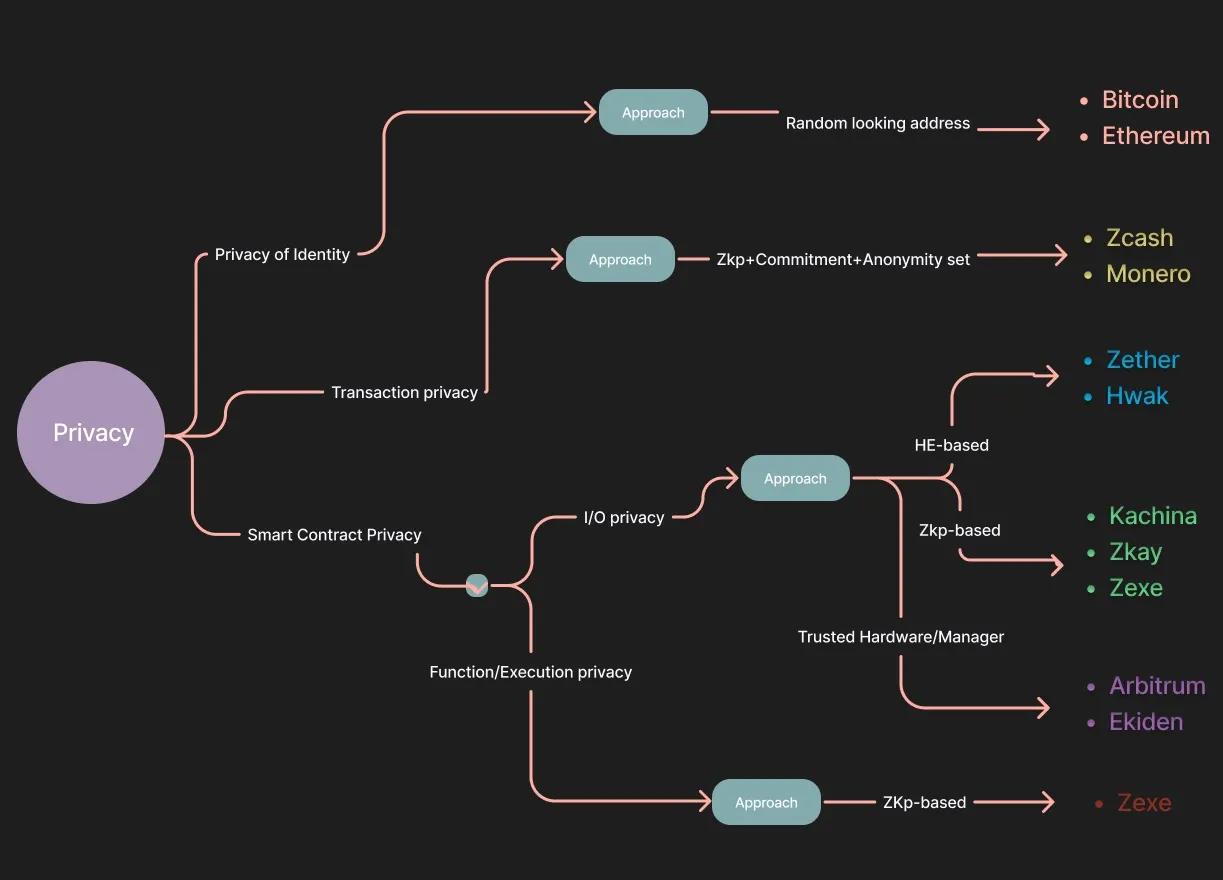

As of February 16,2026, zkVerify has verified over 16 million ZK proofs on its mainnet, marking a pivotal moment for zk proof verification layers. This dedicated blockchain tackles the core bottleneck in zero-knowledge rollups: the high computational cost and latency of proof checks on settlement layers like Ethereum. By handling verification off-chain at scale, zkVerify slashes costs by over 90 percent and verifies proofs in under a second, directly boosting zk rollups efficiency.

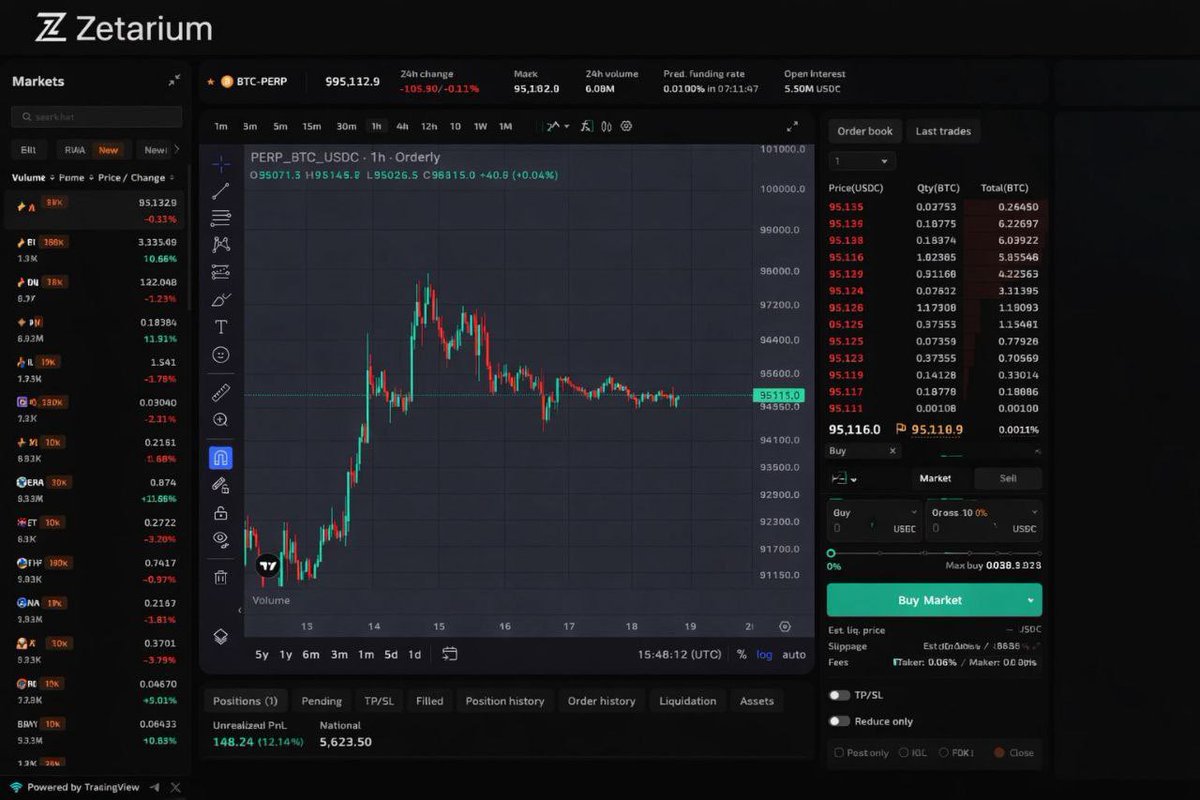

Launched as the first purpose-built chain for ZK proof aggregation, zkVerify abstracts verification away from expensive L1s. Rollups submit validity proofs here instead of clogging Ethereum blocks, preserving space for high-value transactions. This modular approach aligns with the zk ecosystem’s shift toward specialized infrastructure, as seen in projects like ZKsync, currently trading at $0.0217 with a 24-hour change of -0.2630%.

Engineering Scale: From Mainnet Launch to 16 Million Proofs

zkVerify’s mainnet journey began in 2025, evolving from a conceptual fix for ZK verification woes to real infrastructure verifying millions of proofs. Sources like the zkVerify blog highlight 2025 as the year it laid foundations for scale: ultra-fast verification without tradeoffs. Delphi Digital notes how such layers optimize ZKPs for rollups, bridges, and ZkApps, enhancing scalability and finality.

The math is compelling. Traditional on-chain verification demands thousands of Ethereum gas units per proof, scaling poorly with volume. zkVerify batches and aggregates proofs using recursive SNARKs, collapsing verification into succinct checks. Result: 16 million zk proofs verified with minimal overhead. For developers, this means deploying modular zk verification without custom prover networks.

Cost Collapse and Rollup Throughput Surge

Quantitatively, zkVerify’s 90 percent cost reduction is game-changing for rollup operators. Consider a ZK rollup processing 1,000 transactions per batch: pre-zkVerify, verification alone could exceed $10 in fees during congestion. Post-integration, it’s pennies, freeing capital for sequencer incentives or user rebates. House of ZK reports emphasize how based rollups, paired with verification layers, cut latency while bolstering decentralization via Ethereum validators.

zkVerify (VFY) Price Prediction 2027-2032

Predictions factoring 16M ZK proofs milestone, ZK ecosystem growth, and market cycles

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.02 | $0.10 | $0.50 |

| 2028 | $0.05 | $0.30 | $2.00 |

| 2029 | $0.15 | $1.00 | $5.00 |

| 2030 | $0.50 | $3.00 | $10.00 |

| 2031 | $1.50 | $7.00 | $20.00 |

| 2032 | $3.00 | $12.00 | $35.00 |

Price Prediction Summary

zkVerify (VFY) is set for strong growth potential driven by its mainnet milestone and critical role in ZK proof verification, enabling 90% cost reductions for rollups. Bearish mins reflect market downturns; bullish maxes assume widespread ZK adoption and favorable regulations, with avg projections showing 10x+ growth by 2032.

Key Factors Affecting zkVerify Price

- ZK rollup adoption and Ethereum scalability demands

- 90%+ proof verification cost collapse

- Institutional partnerships (e.g., Copper) and mainnet maturity

- Market cycles influenced by Bitcoin halvings

- Regulatory clarity on privacy/scalability tech

- Competition from modular L1s and other verifiers

- Technological advancements in ZK efficiency

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This efficiency cascades to dApps. DeFi protocols on rollups see faster finality; AI systems and bridges gain verifiable trust at fraction of costs, per Copper’s collaboration insights. Robert on The Defiant YouTube channel dubs it a novel project for cost-effective, stable ZK modularity. For investors eyeing zkVerify mainnet proofs, this milestone signals maturity, potentially driving VFY adoption as verification demand explodes.

Integration Dynamics: Provers, Verifiers, and L1 Abstraction

At its core, zkVerify acts as a universal layer, compatible with Groth16, Plonk, and beyond. Provers generate proofs off-chain; zkVerify aggregates and timestamps them for settlement. This decouples sequencing from verification, a pattern echoed in trustless scaling architectures. Yahoo Finance covered the mainnet launch, stressing privacy, scalability gains from offloading compute.

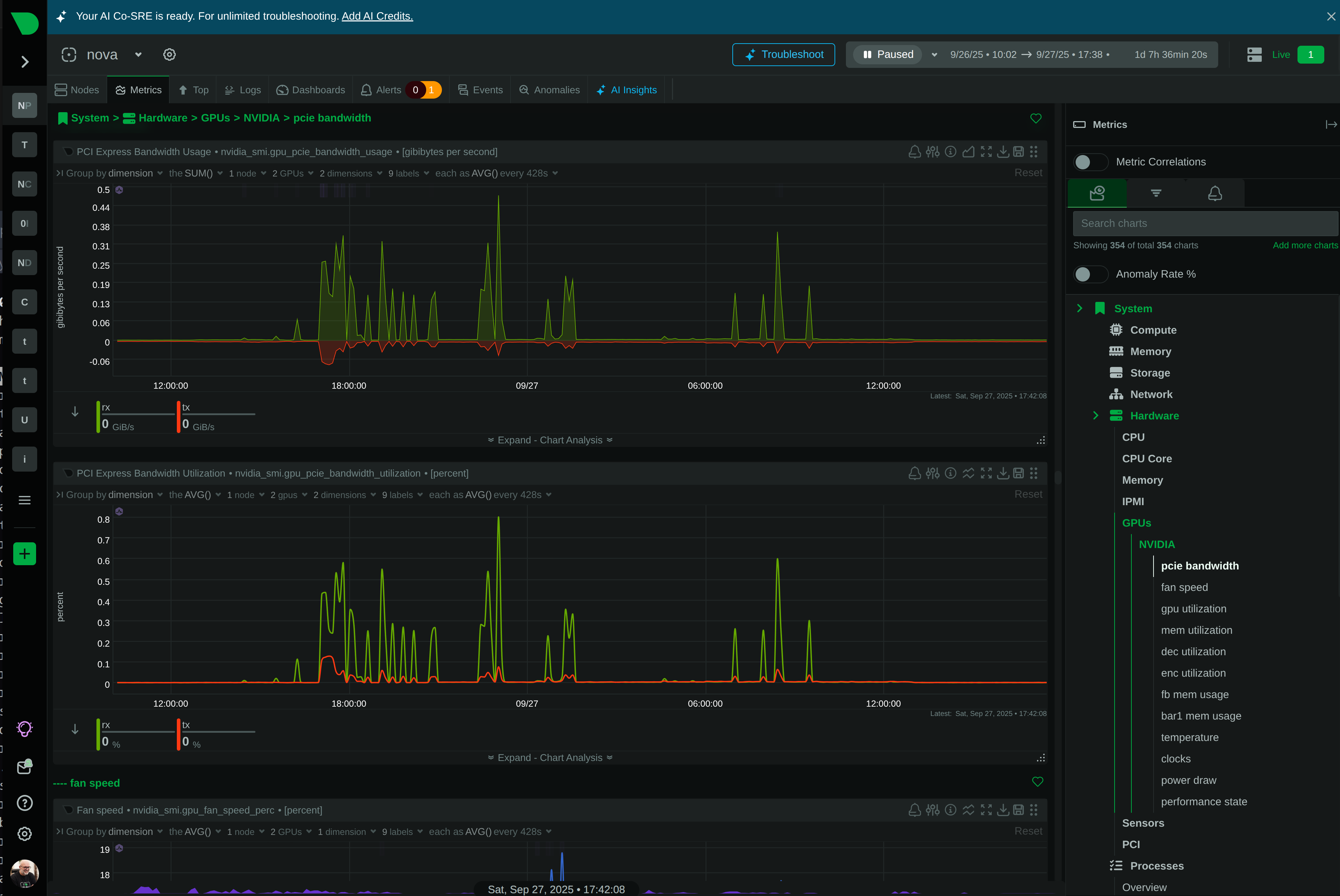

Throughput metrics tell the story: 16 million proofs equate to billions of transactions indirectly scaled, assuming average batch sizes. Compared to native Ethereum verification, zkVerify processes equivalents 100x faster per Good Audience analysis on purpose-built L1s. Rollup teams like those behind ZKsync benefit indirectly, as ecosystem-wide efficiency lifts all boats amid ZK’s $0.0217 price stabilization.

Developers integrating zkVerify report seamless compatibility across proof systems, from Groth16 to newer Plonk variants. This universality lowers barriers for rollup teams experimenting with hybrid validity schemes. As cryptographic proofs address verification bottlenecks, zkVerify’s aggregation tech ensures no single point of failure, with recursive SNARKs distributing compute load efficiently.

Ecosystem Ripple Effects: From DeFi to AI and Bridges

The 16 million zk proofs verified milestone amplifies beyond rollups. DeFi platforms on ZKsync-era chains gain sub-second finality, critical during volatility spikes when ZKsync holds at $0.0217 amid a -0.2630% 24-hour dip. Bridges leveraging zkVerify settle cross-chain assets with ironclad proofs, slashing dispute windows from days to minutes. Copper’s institutional push highlights verifiable trust for AI models, where ZKPs anonymize data while proving computations.

Institutional adoption accelerates as verification scales. zkVerify’s purpose-built L1, per Good Audience, abstracts complexity from Ethereum’s modular stack, letting rollups focus on UX. House of ZK points to based rollups enhancing this via Ethereum sequencing, blending decentralization with speed. For Bitcoin rollups, the layer hints at zk scaling synergies, as explored in ecosystem analyses.

Quantifying Rollup Efficiency Gains

Let’s break down the numbers. A typical ZK rollup batch of 1,000 txs might generate 10-50 proofs; at Ethereum gas prices, verification hits 200k and units, or $5-20 per batch during peaks. zkVerify compresses this to under 1k gas equivalents via batching, a 90% and drop. Scaled to 16 million proofs, that’s trillions in cumulative savings for the ecosystem, assuming $1 average pre-discount cost.

Key zkVerify Efficiency Metrics

-

90% cost reduction in ZK proof verification expenses compared to Ethereum.

-

Sub-second verification times, enabling ultra-fast proof processing.

-

Groth16 & Plonk compatibility for versatile proof types.

-

Billions of transactions indirectly scaled via efficient rollup verification.

-

Modular integration with rollups, bridges, and AI systems.

This throughput surge empowers high-TPS dApps. Imagine NFT minting at 10k/sec or perpetuals with instant proofs; zkVerify makes it feasible without L1 strain. Delphi Digital underscores how such optimization bolsters ZkApps’ privacy, vital as adoption grows.

Challenges remain: prover centralization risks and cross-chain composability. Yet zkVerify mitigates via decentralized verifier sets and EVM compatibility. For rollup operators, the pitch is clear: plug in, verify at scale, reclaim margins. As ZK rollups process real volume, per cartist00’s insight, layers like this turn theoretical scalability into operational reality.

Looking ahead, zkVerify’s trajectory ties to ZKsync’s ecosystem and broader modular chains. With VFY enabling zk rollups efficiency at unprecedented levels, expect integrations from AltLayer RaaS to Bitcoin DeFi. This isn’t just infrastructure; it’s the verification engine propelling zk toward mass utility, where proofs are cheap, fast, and everywhere.