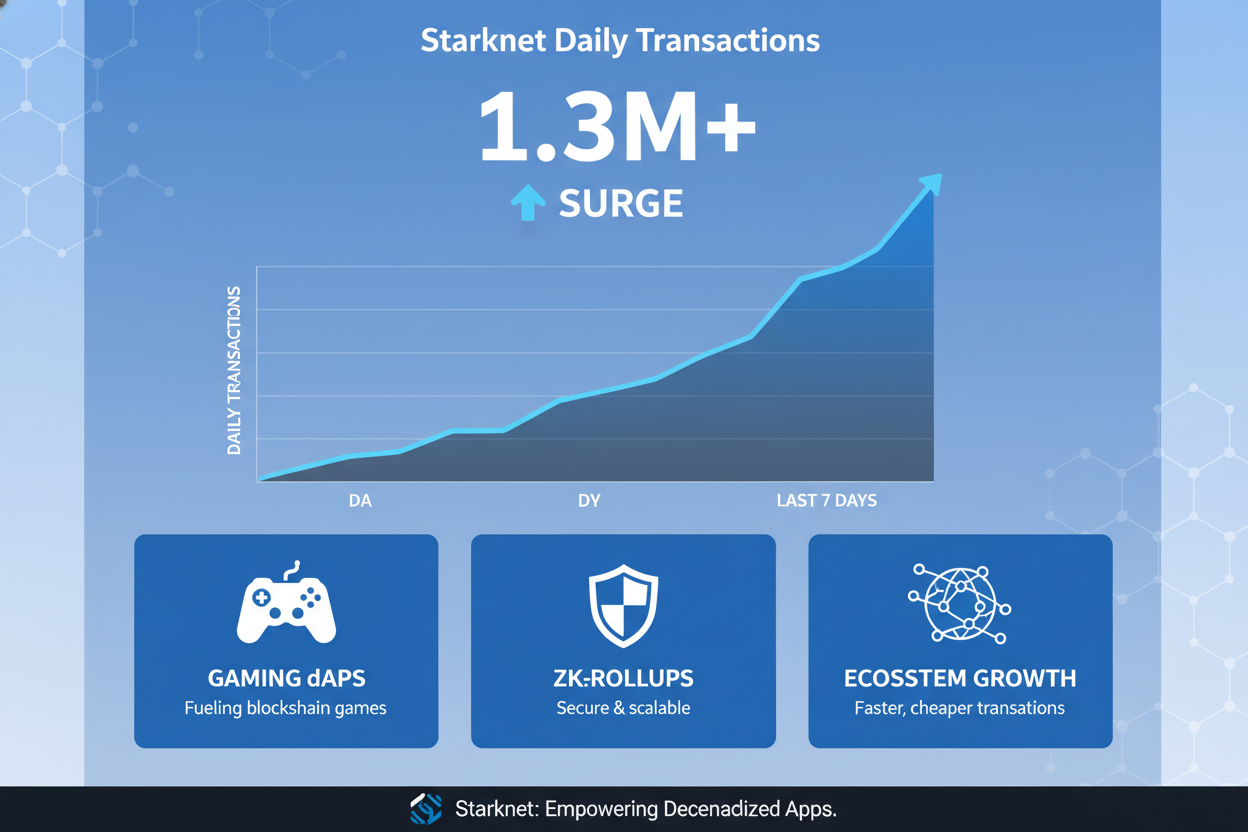

Starknet’s ascent to over 1 million daily transactions marks a pivotal moment for zero-knowledge rollups, with gaming applications at the forefront of this surge. In March 2025, the network hit multiple peaks above 1 million transactions, reaching a half-year high of more than 1.3 million, as detailed in Nansen Research’s H1 2025 report. This Starknet gaming surge underscores the practical scalability of ZK rollups, drawing in users who demand low-latency, cost-effective experiences that Ethereum’s base layer struggles to provide.

Layer 2 solutions like Starknet have long promised to alleviate Ethereum’s congestion, and now the numbers prove it. Daily transaction volumes across zkSync, Starknet, and Scroll collectively exceed 1 million, validating their role in handling real-world scale. Starknet alone saw a 300% increase in daily transactions over the past 30 days, fueled by on-chain activity that traditional blockchains envy.

Gaming Protocols Propel Starknet’s Transaction Milestone

The gaming sector on Starknet has transformed from niche experiments to dominant drivers of network usage. Titles like Loot Survivor topped the charts as of December 18,2024, ranking number one by transactions and number two by fees generated. This momentum carried into 2025, with gaming platforms leveraging ZK-rollups reporting a 300% spike in new user registrations. Developers cite Starknet’s ability to process high-throughput interactions seamlessly, essential for play-to-earn models and real-time multiplayer sessions.

Starknet’s TVL climbed 550% year-to-date to $252 million, largely thanks to the STRK token launch and gaming inflows. (Messari Ecosystem Analysis)

Consider the economics: ZK-rollups batch transactions off-chain, proving validity with succinct proofs on Ethereum. This yields fees often under a cent per transaction, compared to Ethereum’s multi-dollar peaks. Gaming dApps, which generate repetitive micro-interactions, thrive here. Starknet’s STWO upgrade and Bitcoin staking integrations further boosted STRK by 91% in a single week, breaking a 300-day accumulation phase.

Starknet Achieves Stage 1 Decentralization Amid Explosive Growth

Reaching Vitalik Buterin’s Stage 1 rollup criteria, Starknet now leads ZK-rollups in decentralization while scaling aggressively. This milestone, hit in May 2025, means the network exits rapid development into provably secure territory, with provers distributed and no single point of failure. Ethereum’s ETH price, holding at $2,006.24 despite a 3.48% daily dip, reflects broader L2 confidence; Starknet’s TVL hit $150 million amid protocol upgrades.

ZK technology as a whole surged 170% in Q3 2025, driven by institutional adoption and enhancements like zkSync’s 15,000 TPS Atlas upgrade. Starknet processes over 10 million transactions monthly, proving it can sustain a full ecosystem. Investors note the zk rollups 1 million transactions threshold as a liquidity inflection point, where network effects accelerate.

Starknet (STRK) Price Prediction 2027-2032

Forecasts amid ZK rollup gaming surge, TVL growth to $500M, and 2M daily transactions by 2026 baseline

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from 2026 Base) |

|---|---|---|---|---|

| 2027 | $4.00 | $7.50 | $16.00 | +36% |

| 2028 | $6.00 | $11.00 | $24.00 | +47% |

| 2029 | $9.00 | $16.50 | $36.00 | +50% |

| 2030 | $13.00 | $24.00 | $55.00 | +45% |

| 2031 | $18.00 | $34.00 | $80.00 | +42% |

| 2032 | $25.00 | $48.00 | $120.00 | +41% |

Price Prediction Summary

Starknet (STRK) is positioned for robust growth due to exploding gaming adoption, transaction volumes exceeding 1M daily, and ZK tech leadership. From a 2026 base of $5.50 average, projections show ~42% CAGR, with bear cases reflecting market corrections and bull cases capturing full ecosystem dominance.

Key Factors Affecting Starknet Price

- Gaming TVL expansion to $500M driving revenue and fees

- Daily transactions scaling to 2M amid 300% surges

- ETH price correlation at $2,006 base with L2 capturing 95% activity

- Stage 1 decentralization milestone and protocol upgrades like Stwo

- Institutional adoption, ZK competition (zkSync, Scroll), and regulatory clarity

- Market cycles: bull runs post-BTC halvings, potential bear markets in 2028/2032

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

ZK Rollups Outpace Competitors in Scalability Race

While Arbitrum and Base dominate optimistic rollups, Starknet’s ZK proofs offer superior finality and compression. Starknet daily tx volume now rivals the pack, with zk-rollups projected to capture 95% of L2 activity by end-2026 per Vitalik Buterin’s notes. Gaming growth on Starknet highlights this edge: platforms in developing markets saw payment startups integrate seamlessly, amplifying the 300% user boom.

Proto-danksharding amplifies these gains, distributing data availability across Ethereum. Starknet’s execution layer, powered by Cairo VM, enables complex game logic without gas wars. This positions ZK-rollups not just as scaling tools, but as foundational infrastructure for consumer apps. The zk rollups gaming growth narrative is no hype; it’s backed by half-year highs and sustained volumes.

Real-world adoption metrics reveal why Starknet’s Starknet vs Arbitrum Base positioning strengthens. Arbitrum processes high volumes through optimistic mechanisms, yet faces dispute resolution delays that gaming demands instant finality to avoid. Starknet’s ZK proofs settle in minutes, a critical edge for competitive play where every action counts.

Top Gaming dApps Driving Network Dominance

Loot Survivor exemplifies this shift, commanding top spots in transactions and fees through intricate on-chain economies. Other protocols followed suit, with play-to-earn titles and NFT marketplaces amplifying the Starknet gaming surge. Nansen data pinpoints gaming as 60% of recent volume, a leap from DeFi’s prior lead. Developers flock to Cairo’s expressive language, crafting logic that rivals Web2 performance without centralized servers.

| Network | Daily Tx Avg | TVL ($M) | Gaming Share (%) |

|---|---|---|---|

| Starknet | 1.1M | 252 | 60% |

| zkSync | 400K | 180 | 25% |

| Arbitrum | 1.5M | 15B | 10% |

| Base | 800K | 2B | 15% |

This table underscores Starknet’s outsized gaming footprint amid balanced growth. TVL at $252 million reflects sticky capital, up 550% year-to-date, while Ethereum’s $2,006.24 price anchors L2 viability despite volatility. Institutional inflows, eyeing ZK’s privacy primitives, position Starknet for sustained expansion.

Starknet Technical Analysis Chart

Analysis by Evan Callahan | Symbol: BINANCE:STRKUSDT | Interval: 1h | Drawings: 6

Technical Analysis Summary

On this STRKUSDT 1H chart from Feb 15, 2026, draw an aggressive uptrend line from the 12:00 low at $0.410 connecting to the 14:00 swing high at $0.620, then a sharp downtrend channel from that high slashing to the recent 17:00 low at $0.480. Mark horizontal resistance at $0.620 (strong, prior high), support at $0.480 (fresh low). Fib retracement 0.618 from upswing low to high for entry zone around $0.490. Volume spikes on breakout up, now confirming pullback. MACD histogram peaking then diverging bearish. Rectangle consolidation pre-pump. Aggressive long entry now, target $0.650 breakout.

Risk Assessment: high

Analysis: Volatile L2 crypto pullback in uptrend, high reward potential on ZK catalysts but sharp downside risk

Evan Callahan’s Recommendation: Aggressive long entry at $0.490, scale out at $0.650—timing this beats waiting for news!

Key Support & Resistance Levels

📈 Support Levels:

-

$0.48 – Fresh session low with volume support, ZK adoption base

strong -

$0.41 – Prior session low, high conviction hold

moderate

📉 Resistance Levels:

-

$0.62 – Swing high rejection, needs volume to break

strong -

$0.65 – Psych round number extension target

weak

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$0.49 – Fib 0.618 retrace of upswing + uptrend touch, aggressive dip buy

high risk -

$0.48 – Strong support bounce confirmation

medium risk

🚪 Exit Zones:

-

$0.65 – Measured move extension from range, profit target

💰 profit target -

$0.46 – Below support invalidation

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: spike on upthrust then elevated on pullback

Bullish volume confirmation on pump, now distribution watch but holds base

📈 MACD Analysis:

Signal: bearish divergence post peak

MACD slowing momentum but above zero line, setup for re-acceleration

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Evan Callahan is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

Gaming’s ripple effects extend to payments in emerging markets, where ZK-rollups cut remittance costs by 90%. A 300% user registration boom among such platforms validates cross-vertical synergy. As proto-danksharding rolls out, data blobs reduce L2 costs further, potentially doubling Starknet’s Starknet daily tx volume without proportional fee hikes.

Starknet’s trajectory embodies ZK-rollups’ promise: scalability without compromise. From half-year peaks above 1.3 million transactions to Stage 1 decentralization, the network cements Ethereum’s path to mass adoption. Investors and builders alike should monitor gaming TVL trajectories toward $500 million projections, as they herald the next phase of blockchain utility. With Ethereum steady at $2,006.24, the foundation for this explosion remains solid, inviting measured participation in zk’s ascent.