In the ever-evolving landscape of Ethereum scaling, ZK rollups vs optimistic rollups remains a pivotal debate, especially as we hit February 2026 with Ethereum’s price steady at $2,072.07, up 5.47% in the last 24 hours. Both technologies batch transactions off-chain and post proofs or commitments to Ethereum’s Layer 1, slashing costs and boosting speed. Yet, their approaches diverge sharply: optimistic rollups assume validity and rely on fraud proofs during a challenge window, while ZK rollups use zero-knowledge proofs for instant validity. This fundamental split shapes everything from TPS to fees and TVL, fueling intense competition.

Decoding the Mechanisms: Optimistic Rollups Rely on Trust, ZK on Math

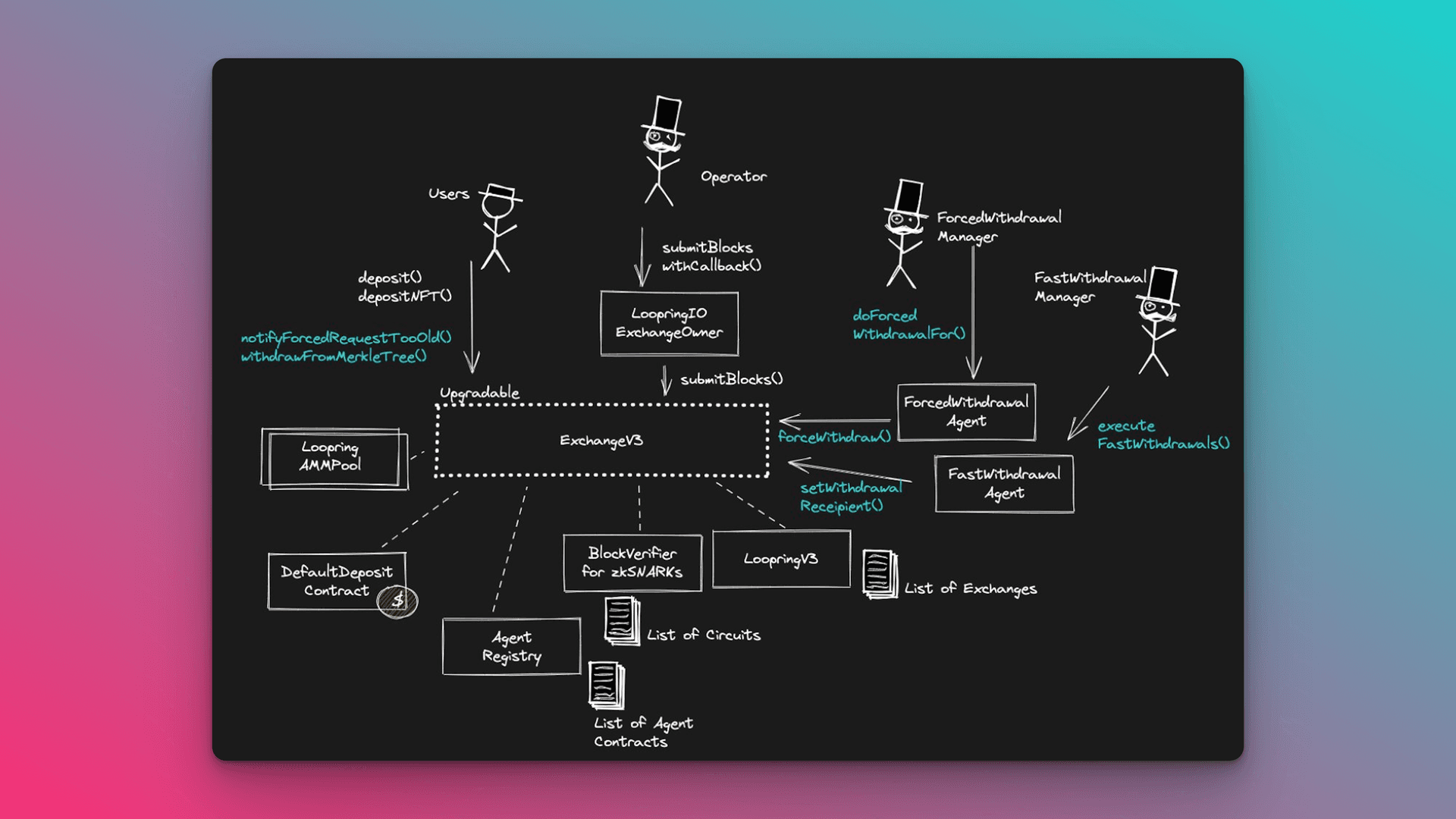

Optimistic rollups, powering giants like Arbitrum and Base, post transaction data optimistically to L1. Anyone can challenge invalid batches within a 7-day window using interactive fraud proofs. This simplicity yields full EVM compatibility, letting developers port dApps seamlessly. But that challenge period means delayed finality, tying up capital longer.

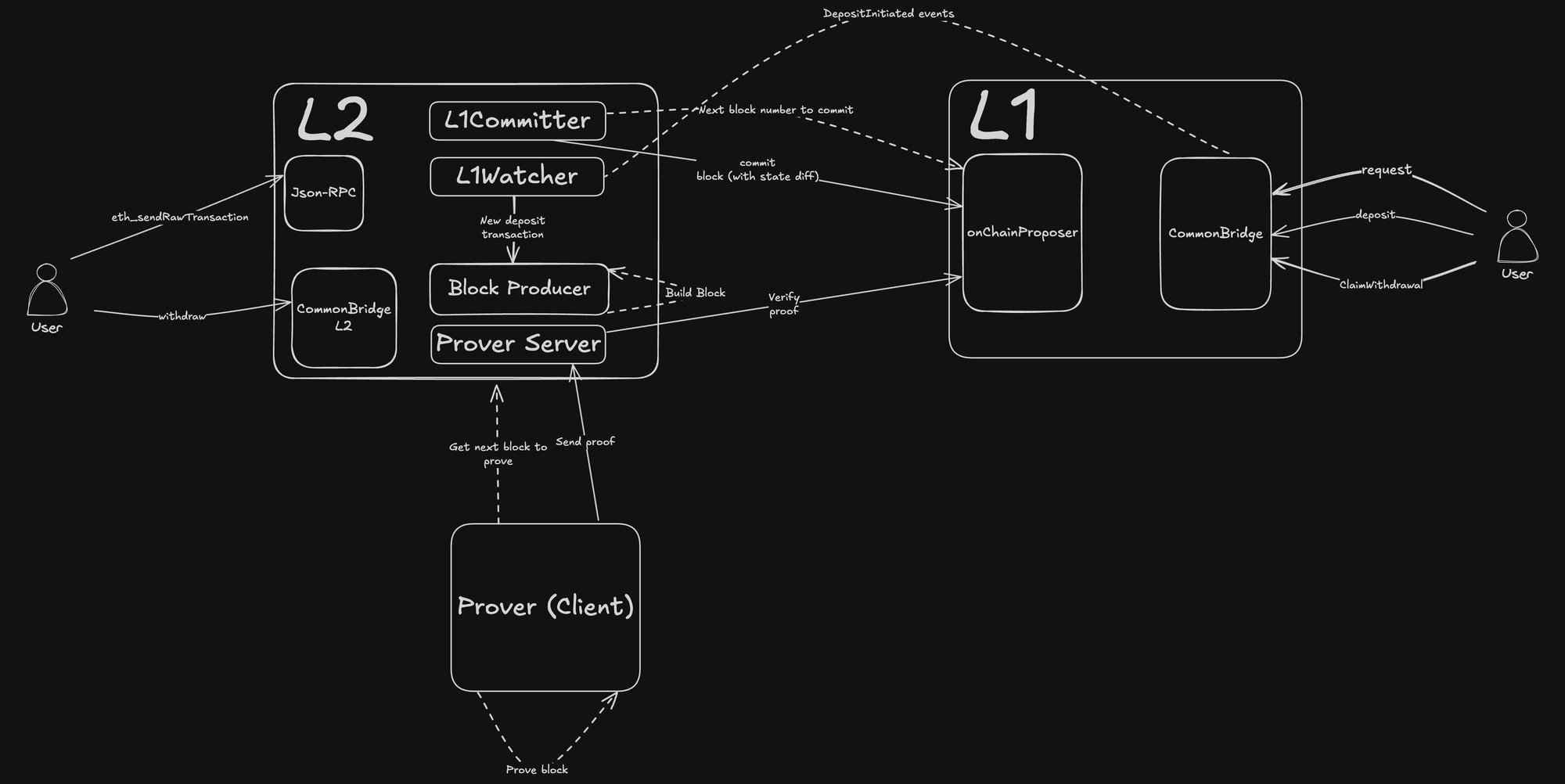

ZK rollups flip the script with cryptographic wizardry. Projects like zkSync Era and Starknet generate succinct validity proofs, compressing thousands of transactions into a tiny SNARK or STARK verifiable on Ethereum in seconds. No challenges needed; finality hits immediately upon verification. Trade-offs? Proving is compute-heavy today, though hardware advances and recursion are slashing costs. zkSync Era’s performance shines here, blending speed with provable security.

ZK rollups offer immediate finality, ideal for high-stakes DeFi where every second counts.

Transaction Throughput (TPS): ZK Rollups Pull Ahead in Raw Speed

Throughput defines scalability’s promise. As of early 2026, ZK rollups dominate with over 15,000 TPS, some implementations touching 20,000 TPS. zkSync Era exemplifies this, handling massive loads without bottlenecks. Optimistic rollups lag at 2,000 to 4,000 TPS, constrained by sequencer limits and L1 data posting.

Why the gap? ZK proofs enable tighter batching and parallel execution. Starknet’s fees stay competitive too, often undercutting rivals. Yet optimistic setups like Linea push boundaries, but ZK’s math-backed efficiency positions it for explosive growth in gaming and social dApps craving sub-second confirmations.

ZK Rollups vs Optimistic Rollups: TPS, Fees, TVL Stats & 2026 Projections

| Metric | ZK Rollups | Optimistic Rollups |

|---|---|---|

| ⚡ TPS | 15,000–20,000 (zkSync Era leader) | 2,000–4,000 (Arbitrum example) |

| 💸 Avg. Fees | ~$0.0001 per tx (Polygon zkEVM: ~1.9 Gwei) | ~0.1 Gwei per tx |

| 💰 TVL | zkSync Era: $5B | Arbitrum: $16.63B Base: $10B (Optimistic leads) |

| 📈 2026 Growth Projections | Market to $90B by 2031 Accelerated adoption (zkSync, Starknet) |

Dominates TVL & user adoption (Arbitrum, Base) |

| 🔒 Finality | Immediate (minutes upon proof verification) | 7-day challenge period |

| 🛡️ Security | Cryptographic validity proofs (higher security) | Fraud proofs with challenge window |

| 🔧 Developer Compatibility | Improving (near EVM equivalence) | Full EVM compatibility |

Diving into Fees: Pennies or Micro-Pennies per Tx?

Cost is king for mass adoption. ZK rollups average around $0.0001 per transaction, a steal for everyday use. Polygon zkEVM edges higher at 1.9 Gwei due to proof overhead, but optimizations are relentless. Optimistic rollups hover at 0.1 Gwei, benefiting from lighter verification.

With ETH at $2,072.07, these translate to negligible expenses. ZK’s edge grows as prover networks decentralize, promising even lower Starknet fees. Optimistic’s simplicity keeps it accessible, but ZK’s capital efficiency via faster withdrawals tips the scale for yield farmers.

L2 TVL Comparison: Optimistic Still Rules the Roost, But ZK Closes In

Total Value Locked reveals where money flows. Optimistic rollups command the throne: Arbitrum at $16.63 billion, Base at $10 billion. Ecosystem maturity and EVM ease draw institutions. ZK’s zkSync Era trails at $5 billion but surges with developer-friendly tools and Taiko’s validity proofs gaining traction.

This L2 TVL comparison underscores optimistic’s adoption lead, yet ZK’s zkSync Era performance hints at momentum shift. TVL growth mirrors user activity; ZK’s privacy perks lure privacy-focused protocols.

Arbitrum (ARB) Price Prediction 2027-2032

Optimistic Rollups Market Leader: Projections Amid L2 Scaling, TVL Dominance ($16.63B in 2026), and ZK Competition to $90B by 2031

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Est. YoY % Change (from Prev. Avg.) |

|---|---|---|---|---|

| 2027 | $3.80 | $6.20 | $10.50 | +38% |

| 2028 | $5.50 | $9.50 | $16.00 | +53% |

| 2029 | $7.50 | $13.80 | $23.00 | +45% |

| 2030 | $10.50 | $19.50 | $33.00 | +41% |

| 2031 | $14.00 | $26.00 | $44.00 | +33% |

| 2032 | $17.50 | $33.00 | $56.00 | +27% |

Price Prediction Summary

Arbitrum (ARB), the leading Optimistic Rollup with $16.63B TVL in 2026, is forecasted for robust growth through 2032, driven by EVM compatibility, DeFi adoption, and Ethereum scaling demands. Average prices are projected to rise from $6.20 in 2027 to $33.00 by 2032 (CAGR ~40%), with bullish maxima up to $56 amid market cycles, tempered by ZK Rollups’ rise and regulatory factors.

Key Factors Affecting Arbitrum Price

- Optimistic Rollups’ TVL dominance (Arbitrum/Base) vs. ZK growth to $90B by 2031

- Ethereum L2 adoption surge with TPS >4,000 and fees ~0.1 Gwei

- Full EVM compatibility easing developer migration

- Market cycles, bull runs, and competition from zkSync/Starknet

- Regulatory clarity on scaling solutions and security enhancements

- Technological upgrades improving finality and capital efficiency

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These projections paint a bullish picture for ZK rollups 2026 outlook, with zkSync leading innovation waves. Optimistic rollups, buoyed by Arbitrum and Base’s network effects, project steady climbs, but ZK’s trajectory screams disruption. Imagine DeFi protocols flocking to instant finality, sidelining 7-day waits.

ZK Rollups vs Optimistic Rollups: 2026 Comparison (TPS, Fees, TVL & Projections)

| **Aspect** | **ZK Rollups** ✅🔒🚀 | **Optimistic Rollups** ⏳⚠️📋 |

|---|---|---|

| **Finality** | Immediate post-proof ✅ | 7-day challenge window ⏳ |

| **Security** | Cryptographic validity proofs 🔒 | Fraud proofs with challengers ⚠️ |

| **Developer Experience** | zkEVM emerging (zkSync, Starknet Cairo, Taiko) 🚀 | Full EVM compatibility 📋 |

| **TPS (2026)** | Over 15,000 (up to 20,000) ⚡ | 2,000 – 4,000 📊 |

| **Avg. Fees** | ~$0.0001 💰 (e.g., Polygon zkEVM: 1.9 Gwei) |

~0.1 Gwei 💸 |

| **TVL (2026 Leaders)** | zkSync Era: $5B 📈 Rapid adoption surge |

Arbitrum: $16.63B Base: $10B 🏆 |

| **2026 Projections** | $90B market by 2031 🚀 Higher throughput & finality |

Leading TVL & user adoption 👑 |

Fees factor in too. While optimistic edges at 0.1 Gwei, ZK’s $0.0001 baseline crushes real-world barriers, especially as ETH holds at $2,072.07. Polygon zkEVM’s 1.9 Gwei reflects maturing proofs, but decentralized provers will erase that premium soon. Starknet fees? Predictably lean, fueling AI agents and RWAs.

Top ZK Rollup Advantages in 2026

-

Instant finality for DeFi: ZK Rollups offer immediate finality upon proof verification (zylos.ai), perfect for DeFi apps needing fast confirmations vs. Optimistic Rollups’ 7-day challenge.

-

Superior privacy via ZK proofs: Zero-knowledge proofs hide transaction details while proving validity, outperforming Optimistic Rollups (zylos.ai).

-

Higher TPS for gaming/social: Over 15,000 TPS (up to 20,000 on zkSync Era/Linea), enabling seamless gaming and social dApps vs. Optimistic’s 2,000-4,000 TPS (zylos.ai).

-

Capital efficiency with fast exits: Withdrawals finalize in minutes (e.g., zkSync Era), boosting efficiency over Optimistic Rollups’ delays (zkrollups.io).

-

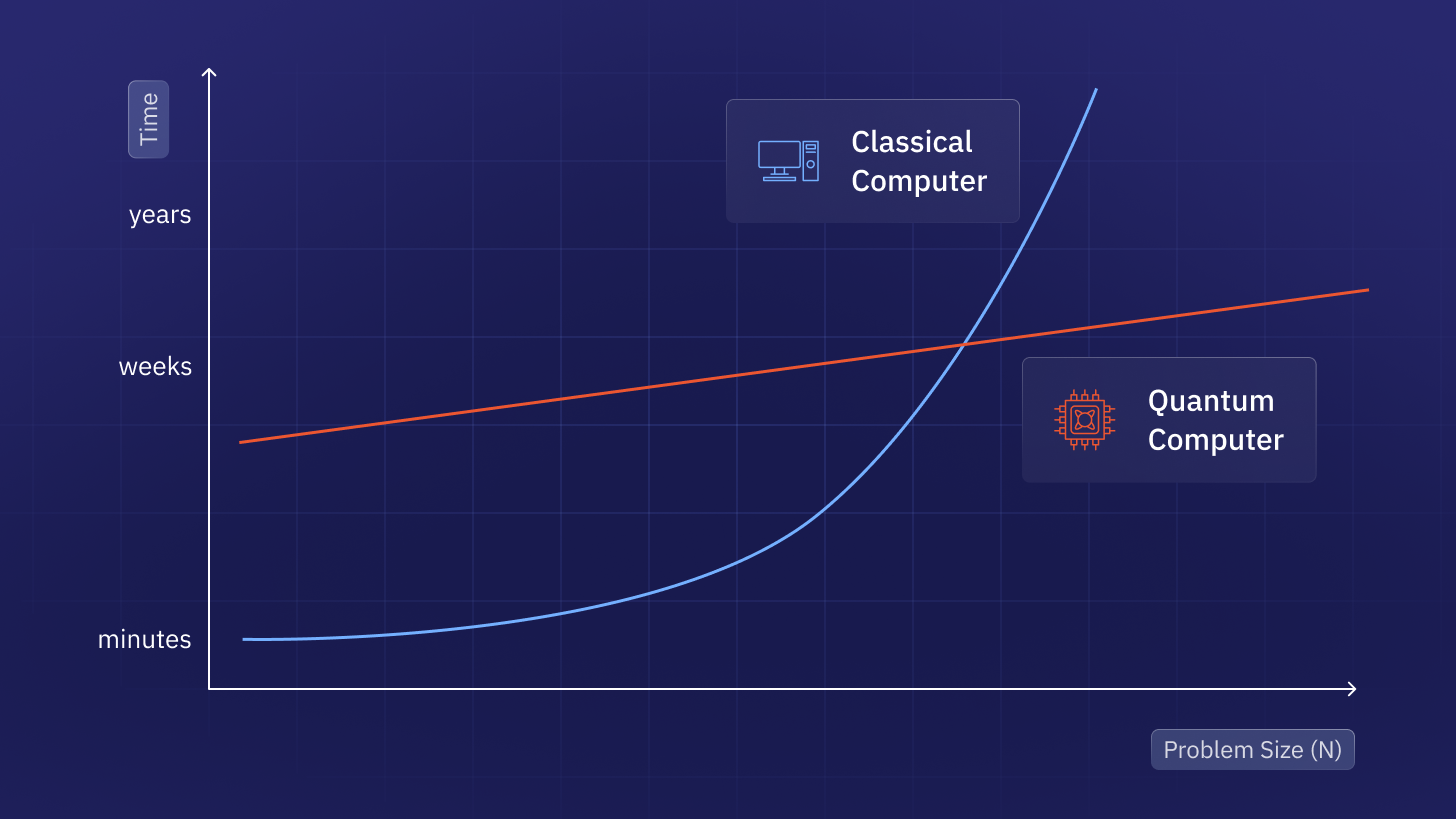

Future-proof against quantum threats: Cryptographic ZK proofs (like STARKs on Starknet) provide quantum-resistant security without challenge periods (zylos.ai).

Risks and Roadblocks: No Silver Bullet in Scaling

ZK isn’t flawless. Proving costs, though plummeting, demand beefy hardware today. Circuit constraints limit complex ops, nudging devs toward custom languages. Optimistic grapples with sequencer centralization risks and dispute resolution bottlenecks. Both face L1 data availability squeezes as Ethereum’s blob space evolves post-Dencun.

Yet ZK’s momentum feels inexorable. zkSync Era’s performance, clocking real-world spikes beyond 15,000 TPS, draws Web2 migrants building socialFi. Arbitrum’s TVL fortress withstands assaults, but ZK’s L2 TVL comparison narrows monthly. By 2031’s $90 billion ZK market, optimistic might cede high-throughput crowns.

The 2026 Verdict: ZK Closes the Gap, Hybrid Futures Beckon

Optimistic rollups own today’s throne through sheer adoption, their $26 billion and TVL war chest proof of ecosystem stickiness. But ZK rollups, with zkSync Era’s $5 billion vault and blistering zkSync TPS, embody tomorrow’s rigor. As Ethereum at $2,072.07 rallies 5.47% daily, L2s amplify that upside.

Expect hybrids: optimistic sequencers piping to ZK validity. Projects like Taiko pioneer this, marrying ease with ironclad math. For devs chasing scale, ZK beckons; investors eyeing TVL flips, watch zkSync and Starknet. In the zk rollups vs optimistic rollups saga, math’s quiet revolution outpaces optimistic bets, priming Ethereum for billion-user eras.