In the relentless pursuit of Ethereum layer 2 scaling, zk rollups vs optimistic rollups stands as the defining debate. Developers crave speed, users demand security, and investors eye the path to dominance. ZK rollups deliver instant validity proofs, slashing withdrawal times to minutes, while optimistic rollups impose a 7-day withdrawal delay through their challenge period. This isn’t just technical nuance; it’s a pragmatic fork in the road for decentralized finance and beyond.

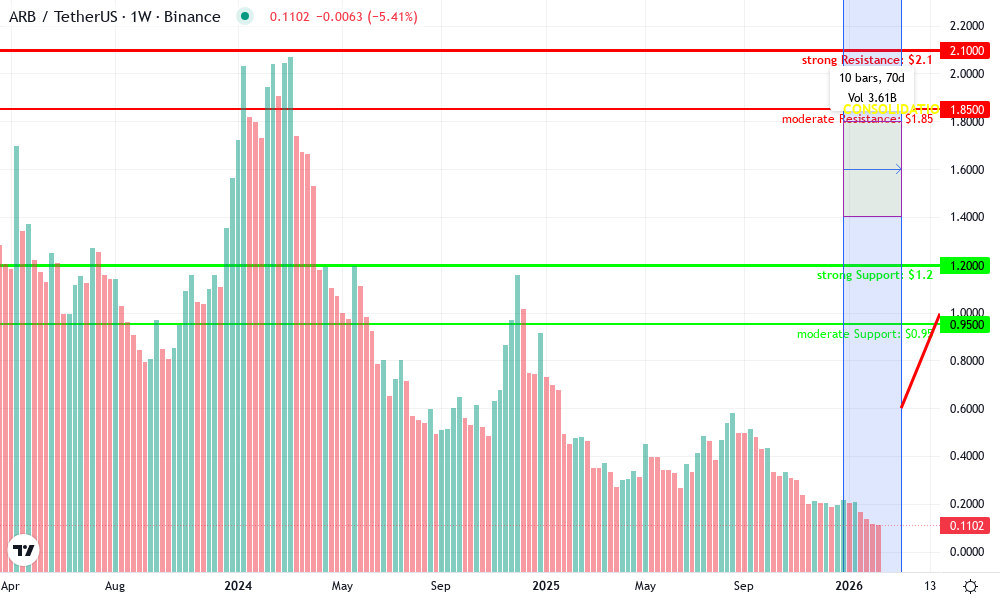

Arbitrum Technical Analysis Chart

Analysis by Marcus Holloway | Symbol: BINANCE:ARBUSDT | Interval: 1W | Drawings: 7

Technical Analysis Summary

On this weekly volume chart for ARBUSDT, draw horizontal lines at key volume nodes: strong support volume cluster at 0.8-1.0 (green bars base), resistance at 1.8-2.0 (peak red/cyan spikes mid-2025 extending into early 2026). Connect the declining volume envelope from the 2025 Q4 peak (high pink/red bars around Sep 2025) to current low-volume greens in Q1 2026 with a downtrend line, starting at 2025-09-15 high volume 2.2, ending at 2026-03-01 low 0.6. Add fib retracement from 2025 low to peak (38.2% at 1.6 for pullback target). Mark consolidation rectangle from 2026-01-01 to now, price implied 1.4-1.9 via volume nodes. Vertical line at 2026-02-13 for recent context update on L2 scaling news. Callouts on volume divergence: ‘Declining volume signals consolidation amid Optimistic Rollup TVL dominance’. Long position marker at 1.50 support, profit target 2.10, stop 1.35. Use arrow_mark_down on MACD bearish cross.

Risk Assessment: medium

Analysis: Declining volume indicates reduced volatility but ZK competition adds macro uncertainty; Arbitrum’s TVL lead mitigates downside.

Marcus Holloway’s Recommendation: Accumulate on dips to 1.35-1.50 with tight stops, targeting 2.10. Big picture favors holding through consolidation for L2 rally.

Key Support & Resistance Levels

📈 Support Levels:

-

$1.2 – Strong volume cluster base (green bars Q1 2026), aligns with historical accumulation node

strong -

$0.95 – Moderate volume shelf from late 2025 lows

moderate

📉 Resistance Levels:

-

$1.85 – Recent volume peak resistance (cyan/pink bars early 2026)

moderate -

$2.1 – Major 2025 high volume ceiling

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.35 – Bounce from strong volume support cluster, confirmed by MACD bullish divergence

medium risk -

$1.5 – Retest of moderate support with increasing green volume

low risk

🚪 Exit Zones:

-

$2.1 – Profit target at major resistance volume node

💰 profit target -

$1.2 – Stop loss below strong support

🛡️ stop loss -

$1.95 – Trailing stop at minor resistance

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining with base building

Volume spiked to 2.5 in 2025, now contracting to 0.6-1.0 in 2026, forming potential accumulation base amid L2 TVL stability

📈 MACD Analysis:

Signal: bearish crossover but histogram contracting (potential divergence)

MACD line crossed below signal in late 2025 peak, but recent flattening suggests momentum loss and reversal setup

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Marcus Holloway is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Both solutions batch transactions off-chain to ease Ethereum’s congestion, posting compressed data back to layer 1 for settlement. Yet their validation paths diverge sharply, shaping everything from user experience to economic incentives.

Optimistic Rollups: Betting on Honesty with a Safety Net

Optimistic rollups, powering giants like Arbitrum and Optimism, operate on a simple premise: transactions are valid unless proven otherwise. Operators post transaction roots to Ethereum, and anyone can challenge fraud during a optimistic rollups challenge period, typically seven days. This “fraud proof” system leverages Ethereum’s full security but introduces friction. Withdrawals to layer 1? Brace for that week-long wait, as the window closes only after no disputes arise.

Proponents argue this compatibility with Ethereum’s EVM makes deployment straightforward. Retail traders flock to low-fee environments, evidenced by Arbitrum’s $18 billion TVL and Optimism’s $9.5 billion as of Q4 2025. Liquidity providers sometimes bridge the gap for faster exits, but they add counterparty risk. In a pragmatic lens, this suits high-volume dApps tolerant of delays, like perpetuals exchanges where capital efficiency trumps immediacy.

ZK Rollups: Cryptographic Certainty Without Compromise

Enter zero knowledge rollups advantages: zk rollups like zkSync Era and StarkNet generate succinct validity proofs, mathematically verifying entire transaction batches before layer 1 submission. No assumptions, no challenges, just instant finality. Users reclaim funds in minutes, not days, transforming zk rollups withdrawal time into a non-issue.

This rigor stems from zero-knowledge proofs, which pack computational heavy-lifting off-chain while proving correctness on-chain with minimal gas. Sure, proof generation was computationally intensive, but innovations like CrowdProve distribute the load across communities, matching centralized speeds. Result? ZK rollups’ combined TVL tops $4 billion, with transaction throughput tripling year-over-year, fueled by gaming and wallet integrations.

Key Metrics Comparison: Optimistic vs ZK Rollups

| Metric | Optimistic Rollups (Arbitrum/Optimism) | ZK Rollups (zkSync/StarkNet) |

|---|---|---|

| Finality Time | After 7-day challenge period | Near-instant ⚡ |

| Withdrawal Delay | Up to 7 days | Within minutes |

| TVL (Q4 2025) | Arbitrum: >$18 billion, Optimism: $9.5 billion (Total: ~$27.5 billion) | zkSync Era & StarkNet: >$4 billion combined |

| Throughput Growth | Substantial adoption (Arbitrum >40% L2 market share) | 3x YoY increase |

| Security Model | Fraud proofs with challenge period (relies on challengers) | Validity proofs (cryptographic guarantees, no challenge period) |

Security tilts decisively toward ZK. Optimistic setups hinge on vigilant challengers; a sleepy network risks unchallenged fraud. ZK rollups embed trustlessness in math, eliminating such vectors. For ethereum layer 2 scaling zk, this means robust privacy and scalability without the optimism tax.

Adoption Surge: Numbers Don’t Lie

Market share tells the tale. Optimistic rollups command over 40% via Arbitrum’s lead, but ZK’s momentum accelerates. zkSync and StarkNet integrations in consumer apps signal maturity. Throughput leaps underscore viability; ZK now handles complex state transitions that once daunted provers.

Consider withdrawals specifically. While optimistic’s seven-day hurdle persists, ZK’s pipeline, as detailed here, clocks in at 2-3 hours for zkSync due to proof finalization, still leagues ahead. This gap matters for DeFi yield farmers rotating capital or gamers needing fluid liquidity.

Pragmatically, optimistic rollups won the adoption race through EVM ease, but ZK’s technical edge positions it for endurance. As proof systems mature, expect the validity camp to erode delay-dependent moats.

Proof maturation isn’t hype; it’s inevitable. Distributed proving via CrowdProve already rivals centralized setups, slashing ZK rollups’ computational barriers. This shifts the calculus for developers eyeing long-term ethereum layer 2 scaling zk. Optimistic rollups shine in EVM compatibility, porting dApps with minimal rewrites. But as ZK circuits generalize, that edge dulls.

Economic Realities: Gas Fees and Capital Efficiency

Gas economics reveal sharper contrasts in zk rollups vs optimistic rollups. Optimistic rollups front-load low costs, posting cheap calldata to Ethereum. Yet dispute resolutions spike fees during contention, and the seven-day lockup erodes yield on bridged assets. ZK rollups demand upfront proof gas, historically higher, but batch efficiencies and prover optimizations flip the script at scale. For high-throughput apps, ZK’s per-transaction costs plummet, especially post-Dencun upgrade with cheaper blobs.

Capital efficiency favors ZK’s swift withdrawals. DeFi protocols on optimistic chains lose days of compounding; zkSync users rotate positions seamlessly. Institutional players, managing billions, prioritize this fluidity over optimistic’s occasional liquidity hacks. My macro lens sees ZK aligning with global trends toward instant settlement, mirroring tokenized real-world assets demanding sub-hour finality.

Cost Comparison: Optimistic Rollups vs ZK Rollups

| Metric | Optimistic Rollups | ZK Rollups |

|---|---|---|

| Avg. tx fee (cents) | 1-5¢ (mature ecosystems like Arbitrum) | 0.5-3¢ (lower at scale) ⚡ |

| Proof generation time | N/A (fraud proofs rare, if challenged) | Seconds to minutes (improving with CrowdProve) ⚙️ |

| Withdrawal cost impact | High (7-day delay opportunity cost) ⏳ | Low (near-instant finality) 🚀 |

| Scalability at 10k TPS | High (proven adoption, >40% L2 share) | High (3x YoY throughput growth) 📈 |

Security models cement the divide. Optimistic’s game-theoretic reliance on active watchers works today, buoyed by economic incentives. But in bear markets or niche chains, vigilance wanes, exposing fraud vectors. Zero knowledge rollups advantages lie in immutable math; no human element, no single point of slumber. We’ve seen exploits in optimistic watchtowers; ZK’s track record stays clean.

Use Case Fit: Matching Tech to Ambition

Not all roads lead to ZK dominance. Gaming dApps thrive on optimistic rollups’ low latency and EVM familiarity, where millisecond trades rule and withdrawals batch overnight. Enterprise bridges favor optimistic’s audit trails. Conversely, privacy-centric apps, cross-chain composability, and high-stakes DeFi lean ZK. StarkNet’s Cairo language unlocks custom compute; zkSync’s account abstraction simplifies UX.

Pragmatism dictates hybrids. Some protocols layer optimistic execution atop ZK settlement, blending speed with proofs. As wallets like MetaMask integrate zk proofs natively, user friction vanishes. Watch for 2026: ZK TVL crossing $10 billion as gaming ports accelerate.

The withdrawal chasm defines user trust. Optimistic’s optimistic rollups challenge period suits patient capital; ZK’s minutes-long zk rollups withdrawal time captures the impatient majority. In volatile markets, this translates to billions in idle capital unlocked.

Macro forces amplify ZK’s trajectory. Regulatory scrutiny favors provable privacy; institutional inflows demand efficiency. Optimistic rollups hold incumbency, but ZK’s validity proofs forge the scalable future. Allocate accordingly: diversify across both, overweight ZK for the long haul. Ethereum’s layer 2 mosaic thrives on this tension, propelling the ecosystem toward mass adoption.