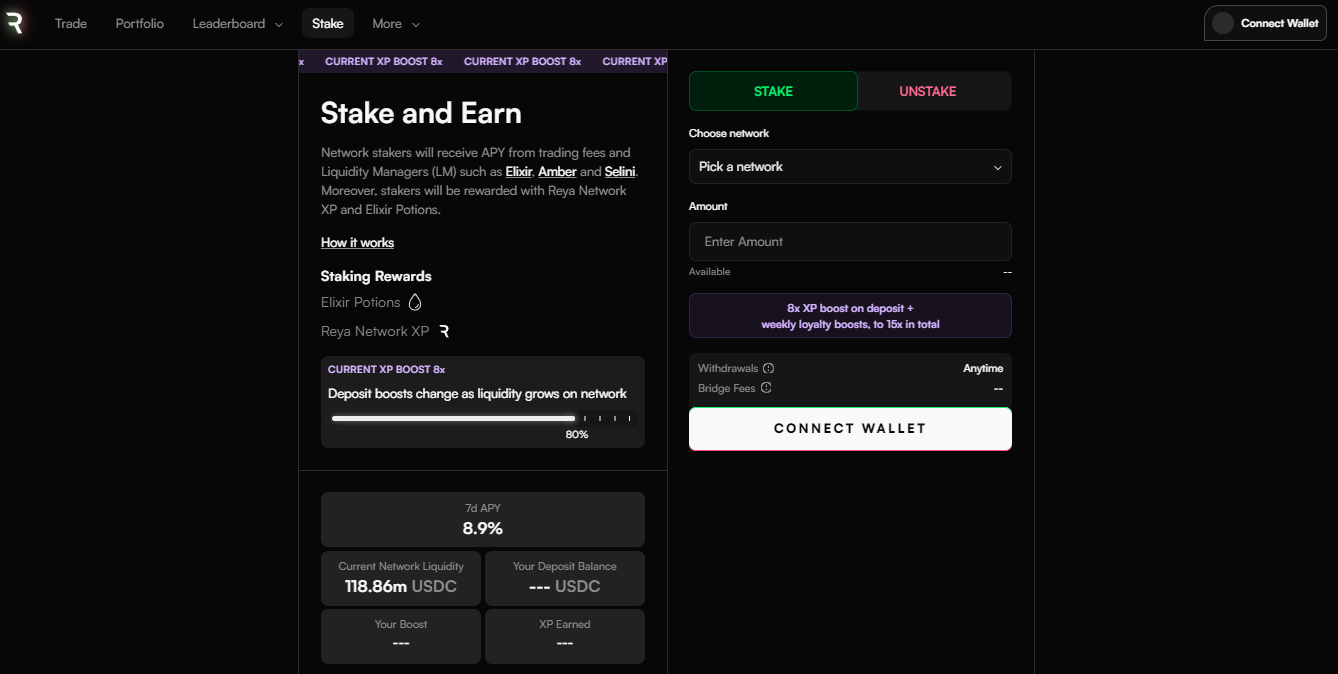

In the relentless pursuit of blending TradFi speeds with DeFi’s trustlessness, Reya Network has shattered expectations by launching the world’s first decentralized exchange on a based rollup infrastructure. Picture this: trades settling in under 0.1 milliseconds, all while inheriting Ethereum’s ironclad security through zero-knowledge proofs and meticulous off-chain execution. With over $32 billion in cumulative perpetual volume already under its belt, Reya isn’t just another DEX, it’s a paradigm shift for high-frequency trading on blockchain, delivering gasless, MEV-free experiences across more than 70 markets.

This leap forward stems from Reya’s unique position as a trading-specific Layer 2, evolving from its roots on Arbitrum Orbit to a full-fledged based ZK rollup DEX settled directly on Ethereum. Traditional rollups often stumble with single sequencers creating centralization chokepoints and latency bottlenecks. Reya flips the script by leveraging Ethereum’s native block production for sequencing, eliminating those risks and unlocking true on-chain performance at sub-millisecond scales.

Reya’s Based Rollup Architecture: Redefining ZK Rollup Ethereum Sequencing

At its core, a based rollup borrows Ethereum Layer 1’s sequencing power, distributing the workload and slashing the vulnerabilities of proprietary sequencers. Reya takes this further with custom ZK circuits fine-tuned for derivatives trading, batching orders, matching them off-chain, and proving everything on-chain via succinct proofs. No more waiting for block times or sequencer queues; trades zip through in and lt;1ms, verified instantaneously on Ethereum.

Reya achieves superior speed, deep liquidity, and Ethereum-grade security as a novel trading-specific based ZK rollup.

This design isn’t hype, it’s engineered precision. Reya’s multi-sequencer setup ensures no single point of failure, while its hybrid data availability layer shines: EigenDA handles voluminous order data efficiently, and Ethereum L1 anchors transaction commitments for ultimate verifiability. Developers at Reya didn’t stop there; they optimized every circuit for perpetuals, enabling sub-ms ZK DEX performance that rivals centralized exchanges without the custody nightmares.

Breaking Down the Tech: Multi-Sequencer Magic and ZK Optimization

Let’s unpack how Reya pulls off these feats. Off-chain order books process intents at blinding speeds, far beyond on-chain gas limits. These get batched into ZK proofs that Ethereum settles in batches, inheriting full security. The Reya based sequencing model means anyone can propose blocks using Ethereum’s mempool, fostering competition among sequencers for better fees and uptime.

Proprietary ZK circuits are the secret sauce here. Tailored for trading scenarios like high-throughput matching and liquidation engines, they compress gigabytes of trade data into tiny proofs, verifiable in seconds. This isn’t generic ZK; it’s purpose-built, allowing Reya to handle TradFi-level volumes without compromising decentralization. Early adopters rave about the responsiveness, with latency profiles that make even optimistic rollups look sluggish.

| Feature | Reya Based ZK Rollup | Traditional Rollups |

|---|---|---|

| Sequencing | Multi/Ethereum-based | Single sequencer |

| Trade Latency | and lt;0.1ms | 100ms and |

| MEV Protection | Native | Variable |

| Settlement | ZK on Ethereum L1 | Optimistic/Validium |

Security remains paramount. Every trade is provably fair, with no front-running thanks to encrypted mempools and threshold signatures. Reya’s $32 billion volume milestone underscores trust: institutions and retail alike flock to its 70 and perp markets for that elusive combo of speed and sovereignty.

Trade Latency Comparison: Reya Network vs Competitors

| Network | Latency (ms) |

|---|---|

| Reya Network | <0.1ms 🚀🚀🚀 |

| dYdX | ~50ms |

| GMX | ~250ms |

From Perps Dominance to Ecosystem Expansion

Reya started with perpetuals, where it excels, but the roadmap pulses with ambition. Spot markets, real-world asset (RWA) perps, and even a launchpad loom on the horizon, all powered by this robust Reya Network ZK rollup stack. A massive $300 million token generation event slated for late March 2026 signals ecosystem maturity, potentially injecting liquidity that propels adoption further. For traders weary of CEX downtimes or sluggish L2s, Reya offers a glimpse of DeFi’s endgame: performance without peril. As based rollups mature, expect Reya to set the pace, proving ZK tech can scale Ethereum for real-world finance.

Dive deeper into Reya’s sub-1ms execution mechanics

Traders diving into Reya today experience more than just blistering speeds; they tap into a system engineered for sustainability. The platform’s gasless trades eliminate those pesky fees that erode profits during volatile swings, while MEV protections keep front-runners at bay. Across 70 perpetual markets, liquidity pools deepen by the day, fueled by institutional interest drawn to Ethereum’s settlement guarantees without the operational headaches of CEXs.

Reya’s Roadmap: Spot Markets, RWAs, and Beyond

What sets Reya Network ZK rollup apart is its forward momentum. Having nailed perpetuals, the team eyes spot trading integration next, bringing unified order books under one high-performance roof. Real-world asset perpetuals follow, tokenizing yields from treasuries and commodities with sub-ms precision. A launchpad rounds out the vision, enabling seamless token debuts with built-in liquidity mechanisms. This phased rollout leverages the based architecture’s scalability, ensuring each addition amplifies without strain.

Reya’s Key Upcoming Features

-

Spot Markets: Instant liquidity for seamless trading on Reya’s based ZK rollup, enabling sub-millisecond executions with Ethereum security.

-

RWA Perps: Perpetual futures on real-world assets (RWAs) bridging TradFi like tokenized treasuries to DeFi speeds.

-

Launchpad: Project bootstrapping platform for fair launches, liquidity bootstrapping, and ecosystem growth on the rollup.

These expansions address DeFi’s liquidity fragmentation head-on. Imagine swapping ETH for tokenized gold perps in under 0.1ms, all verifiable on Ethereum. Reya’s multi-sequencer model scales horizontally, inviting more participants to compete on sequencing, which drives costs down and reliability up. It’s a self-reinforcing loop that could redefine based ZK rollup DEX standards.

Why Reya Leads in Sub-Millisecond ZK DEX Performance

In a sea of L2s chasing throughput, Reya’s Reya based sequencing carves a niche through specialization. Generic rollups juggle diverse apps, diluting optimizations; Reya hones ZK circuits solely for order matching, risk engines, and settlements. This yields compression ratios that shrink proofs dramatically, settling batches Ethereum can’t ignore. Developers benefit too: SDKs for custom perps lower barriers, fostering an app layer atop the DEX.

Full decentralization remains a roadmap priority, evolving the multi-sequencer setup toward permissionless operation.

Community buzz underscores the traction. With $32 billion volume, Reya proves demand for ZK rollup Ethereum sequencing that mirrors TradFi without intermediaries. Early metrics show 99.99% uptime, outpacing rivals mired in sequencer downtimes. As the $300 million TGE approaches, expect governance proposals to shape sequencing auctions and RWA integrations, handing power to users.

For builders eyeing sub ms ZK DEX primitives, Reya’s open-source circuits offer a blueprint. Plug into Ethereum’s mempool for sequencing, batch via custom ZK, settle provably; that’s the formula scaling DeFi to billions daily. Reya doesn’t chase hype; it delivers the infrastructure letting traders focus on alpha, not architecture.

Explore ZK rollups powering secure order books ZK for censorship-resistant matching