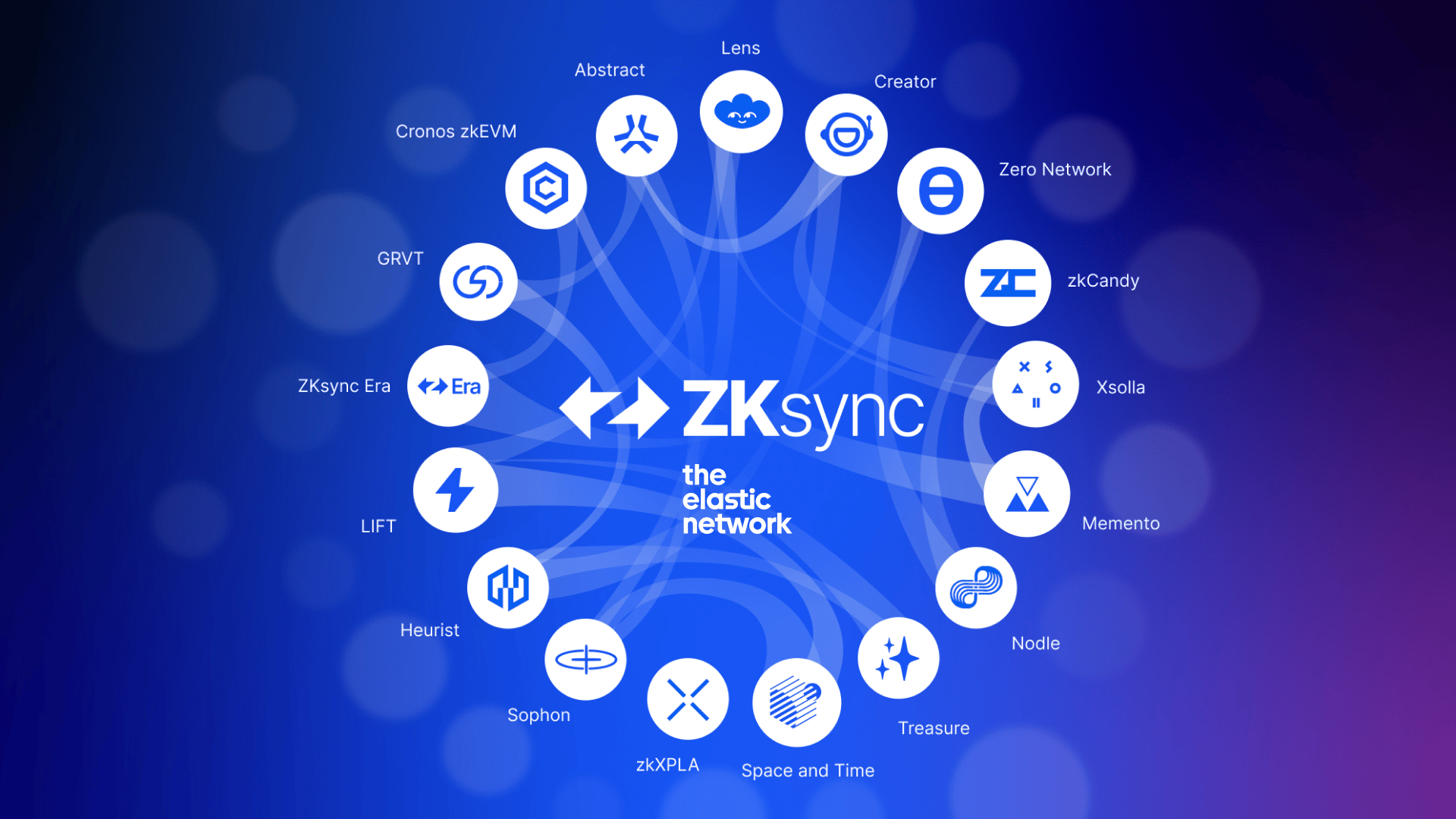

In the sprawling landscape of zk rollups, the ZKsync Elastic Network stands out as a pragmatic powerhouse, interconnecting 21 zkChains that collectively propel the $ZK token’s value flywheel. With $ZK trading at $0.0230, up a modest 0.0555% over the last 24 hours from a low of $0.0192, this ecosystem isn’t chasing moonshots but building sustainable momentum through real usage. The network’s native interoperability via cryptographic proofs and shared liquidity pools creates a unified front, where chains like zkSync Era and Abstract don’t just coexist, they amplify each other, driving fees, burns, and rewards back into $ZK’s orbit.

ZKsync (ZK) Price Prediction 2027-2032

Projections based on zkChains flywheel, Elastic Network adoption, token utility enhancements, and crypto market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.02 | $0.05 | $0.10 | +117% |

| 2028 | $0.04 | $0.12 | $0.28 | +140% |

| 2029 | $0.08 | $0.25 | $0.60 | +108% |

| 2030 | $0.15 | $0.50 | $1.20 | +100% |

| 2031 | $0.30 | $0.90 | $2.00 | +80% |

| 2032 | $0.50 | $1.50 | $3.50 | +67% |

Price Prediction Summary

ZKsync’s ZK token is positioned for strong growth through 2032, fueled by the 21 zkChains Elastic Network, value flywheel tying tokens to revenue, and expanding use cases in DeFi and RWAs. Predictions factor in bull/bear cycles, with averages compounding ~95% annually from current $0.023 levels to $1.50 by 2032.

Key Factors Affecting ZKsync Price

- zkChains flywheel and Elastic Network interoperability boosting TVL and fees

- ZK token utility expansion beyond governance to revenue sharing and validator staking

- RWA tokenization growth (already >$2B, 27% market share) and DeFi adoption

- Regulatory tailwinds for ZK-rollups and L2 scaling solutions

- Competition from Arbitrum, Optimism, and other L2s impacting market share

- Crypto market cycles, Bitcoin halvings, and macroeconomic conditions

- Successful governance approvals and network upgrades

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

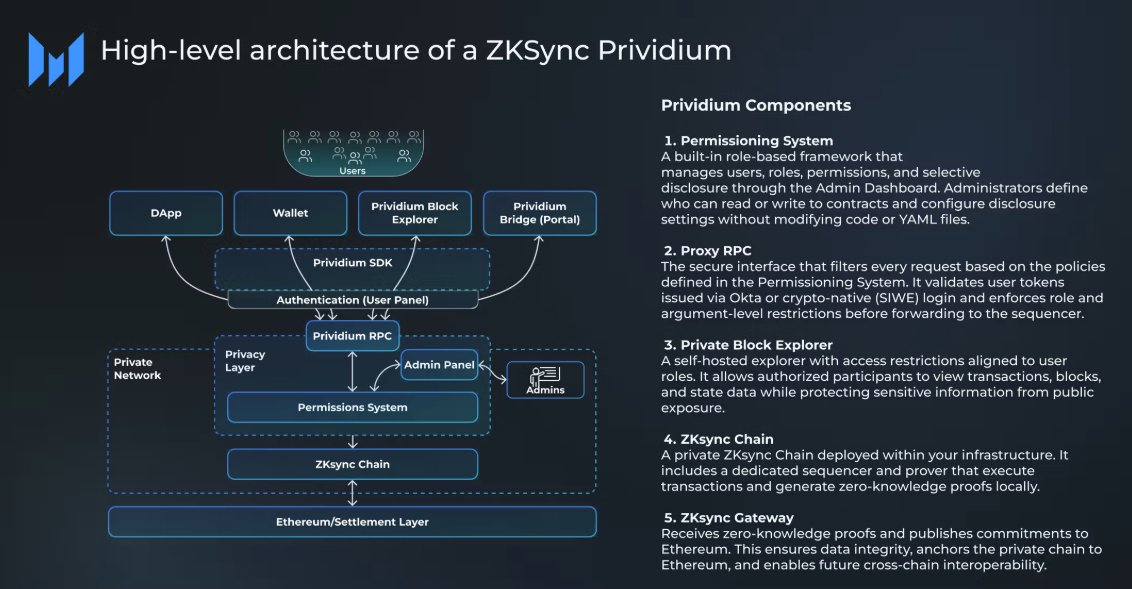

The Architecture Powering zkChains Interoperability

At its core, the ZKsync Elastic Network redefines scalability by linking public and private chains into one cryptographically secured fabric. ZKsync chains, fully interoperable, share bridges and liquidity, enabling seamless asset flows and user experiences across the board. This isn’t theoretical; it’s live with tokenized real-world assets surpassing $2.032 billion, capturing over 27% of the RWA market. The $ZK token, post its June 2024 airdrop of 17.5% of the 21 billion supply, now anchors more than governance, serving as fee collateral for validators and a stake in network revenue.

Think of it as a pragmatic evolution: where governance tokens often languish, $ZK pivots toward utility. Protocol usage generates recurring value, shifting the narrative from votes to velocity. Chains within this network, from Cronos zkChain’s DeFi focus to Plume Network’s RWA specialization, feed into a flywheel where activity begets burns, rewards participation, and liquidity incentives like the 325 million $ZK injection bolster Era’s central role.

Spotlighting the 21 zkChains Driving $ZK Economy Growth

Ordered by relevance and TVL, these 21 zkChains form the backbone of the zksync zkchains ecosystem. Leading the pack is zkSync Era, the flagship with massive liquidity incentives fortifying its position. Abstract follows, optimizing for abstracted accounts and seamless UX, while Sophon targets gaming verticals with low-latency proofs.

Diving deeper, GRVT excels in perpetuals trading, Cronos zkChain bridges Cosmos ecosystems, and Kinto emphasizes account abstraction for safer DeFi. Mint and Zentry push consumer apps, Bluwhale handles RWAs, and Zecrey prioritizes privacy-preserving privacy. Further down, Plume Network tokenizes compliance-heavy assets, Linea scales Ethereum L2s, Scroll advances zkEVM bytecode, and Polygon zkEVM leverages Polygon aggression.

- Taiko: Sovereign zk rollup with based sequencing.

- Manta Pacific: Modular privacy layer.

- Zora Network: Creator economy hub.

- Immutable X: NFT scaling veteran.

- Loopring: DEX and payment rails.

- BOB: Hybrid compute zk.

- Fuel Network: Parallel execution pioneer.

This curated lineup ensures diversified usage, from DeFi to gaming and RWAs, all interoperable to maximize $ZK token value flywheel effects. TVL concentration in top chains like zkSync Era funnels fees upward, while peripherals like Fuel Network expand the total addressable activity.

Dissecting the $ZK Value Flywheel Mechanics

The flywheel’s genius lies in its closed loop: chain usage incurs fees paid in $ZK equivalents, a portion burned to deflate supply, remainder rewarding validators and stakers. Governance proposals now tie revenue streams directly, pending approval, creating compounding demand. At $0.0230, with 24-hour volume echoing $107 million peaks, this model pragmatically counters L1 congestion by distributing load across zkChains.

Interchain interactions, powered by shared proofs, multiply this: a trade on GRVT settles on zkSync Era liquidity, accruing value ecosystem-wide. Incentives like the 325 million $ZK liquidity program supercharge adoption, positioning Era as the settlement hub. For investors eyeing zksync elastic network growth, this isn’t hype; it’s a macro shift where network effects compound token utility.

ZKsync (ZK) Price Prediction 2027-2032

Realistic forecasts based on Elastic Network expansion, tokenomics value flywheel, revenue sharing, and broader crypto market cycles (current 2026 price: $0.023)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.040 | $0.085 | $0.160 |

| 2028 | $0.065 | $0.140 | $0.280 |

| 2029 | $0.100 | $0.220 | $0.450 |

| 2030 | $0.150 | $0.340 | $0.700 |

| 2031 | $0.220 | $0.520 | $1.050 |

| 2032 | $0.320 | $0.780 | $1.500 |

Price Prediction Summary

ZKsync (ZK) shows strong long-term potential with minimum prices reflecting bearish market corrections and regulatory hurdles, average prices assuming steady adoption of zkChains and value flywheel activation, and maximum prices in bullish scenarios driven by mass scaling, RWA growth, and bull cycles. Overall, avg price could 36x from current levels by 2032 amid Elastic Network maturity.

Key Factors Affecting ZKsync Price

- Elastic Network expansion with 21+ interoperable zkChains boosting TVL and usage

- Tokenomics shift tying $ZK to protocol revenue via value flywheel for recurring demand

- Crypto market cycles: potential 2027-2028 bull run post-2024/2025 consolidation

- Regulatory clarity for L2s and ZK tech enhancing institutional adoption

- Competition from other ZK L2s (e.g., Polygon zkEVM) and Ethereum upgrades

- RWA tokenization growth (ZKsync >27% market share) and liquidity incentives

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Recent governance proposals underscore this shift, marking the first phase of tokenomics redesign focused squarely on revenue accrual. As $ZK holds steady at $0.0230, validators staking for Elastic Network security capture yields from cross-chain activity, creating a self-reinforcing loop. Sophon and Zora Network, for instance, channel gaming and creator economies into the mix, where high-volume microtransactions burn $ZK equivalents at scale. Meanwhile, veterans like Immutable X and Loopring bring battle-tested NFT and DEX liquidity, ensuring the flywheel spins without silos.

Top 7 zkChains Fueling $ZK Flywheel

-

zkSync Era: Flagship L2 with major DeFi dApps, drives highest transaction volume generating core fees for $ZK burns and validator rewards.

-

Abstract: Consumer zkChain abstracting Web3 complexities, onboards mass users boosting Elastic Network fee accrual to $ZK flywheel.

-

Sophon: Gaming/entertainment zkChain with high TPS, powers continuous play-to-earn txns fueling $ZK rewards via usage fees.

-

GRVT: DeFi trading zkChain optimized for perps, amplifies high-frequency volume contributing leveraged fees to $ZK value loop.

-

Cronos zkChain: Bridges Cosmos ecosystem to ZKsync Elastic, unlocks cross-chain liquidity driving interoperable fees for $ZK burns.

-

Kinto: Intent-centric smart accounts zkChain, secures DeFi ops enhancing efficiency and sustained reward generation for $ZK.

-

Plume Network: RWA zkChain tokenizing $2B+ assets, captures compliance fees powering $ZK flywheel amid RWA growth.

Pragmatically, this setup counters the L2 fragmentation plaguing Ethereum scaling. Where Solana bets on monolithic speed, ZKsync’s elastic model distributes risk, with shared proofs ensuring no chain drags the network down. At current volumes nearing $108 million daily, even modest upticks in RWA inflows or gaming spikes could pressure $ZK upward, especially if revenue-sharing clears governance.

Risks and Realistic Upside in the $ZK Flywheel

No flywheel hums without friction. Governance remains the wildcard; tying $ZK to revenue demands broad holder buy-in, and delays could cap near-term catalysts. Competition intensifies too, with Polygon zkEVM and Scroll vying for the same zkEVM throne, potentially splintering liquidity. Yet, the Elastic Network’s interoperability moat shines here, cryptographic unity trumping isolated rollups. Fuel Network’s execution edge or BOB’s hybrid smarts could falter without Era’s settlement backbone, underscoring the network’s gravitational pull.

Zoom out macro-style: amid global rate uncertainty and RWA tokenization frenzy, ZKsync captures tailwinds. That 27% RWA share isn’t static; Plume and Bluwhale position for trillions in off-chain assets, fees compounding as compliance layers mature. Investors ignoring this for pure speculation miss the point; zk token value flywheel thrives on usage, not memes. With $ZK at $0.0230 after dipping to $0.0192, dips buy exposure to a network TVL that’s ballooned via incentives.

Big picture thinking leads to smarter allocations: stake in ecosystems where chains compound, not compete.

The Elastic Network’s trajectory points to sustained expansion. As these 21 zkChains mature, expect tighter integrations, like Zentry wallets bridging Mint apps to GRVT trades, all verified in one proof. Validators earn steadily, burns deflate supply post-airdrop, and governance evolves utility. For devs, it’s a launchpad; for holders, a compounding machine. In a zk-dominated scaling race, ZKsync’s pragmatic weave of interoperability and revenue focus sets it apart, steadily accruing value one cross-chain tx at a time.