On November 5,2025, Zama, a leader in Fully Homomorphic Encryption (FHE) for blockchains, made waves by acquiring KKRT Labs, better known as Kakarot. This zama kkrt labs acquisition isn’t just another consolidation in the crypto space; it’s a calculated power-up for confidential zk rollups, aiming to hit over 10,000 transactions per second by 2026. With KKRT’s zero-knowledge proof prowess backed by Vitalik Buterin and StarkWare, Zama is positioning itself to deliver scalable privacy that could redefine on-chain finance.

Zama has long championed FHE, a cryptographic primitive that lets computations happen on encrypted data without decryption. This means blockchains can process sensitive operations, like DeFi trades or stablecoin transfers, while keeping user details hidden. But FHE alone struggles with the raw speed needed for high-throughput applications. Enter KKRT Labs, whose modular ZK rollup designs have pushed Ethereum-compatible chains toward extreme scalability. Their tech focuses on high-performance proving systems, making ZK proofs faster and cheaper.

Zama’s Confidential Blockchain Protocol Meets ZK Scaling

The Zama Protocol already enables confidential smart contracts across public chains. Now, integrating KKRT’s rollup architecture promises a zama zk rollup power up. Imagine bundling thousands of private transactions into a single ZK proof, settling them on Ethereum or Solana without exposing balances or strategies. Sources from ETF. com and Yahoo Finance highlight how this merger targets 10,000 TPS zk rollups, unlocking confidential stablecoin payments and private lending pools that comply with real-world regulations.

From a risk management standpoint, this move addresses a core vulnerability in public blockchains: transparency breeds front-running and MEV exploitation. Confidential ZK rollups layer privacy atop scalability, reducing systemic risks in DeFi. Zama’s FHE handles the encryption, while KKRT’s provers generate succinct proofs at blistering speeds. Early tests suggest they could surpass current leaders on the zama leaderboard zk, where throughput and proof times are king.

KKRT Labs’ Pedigree and Strategic Fit

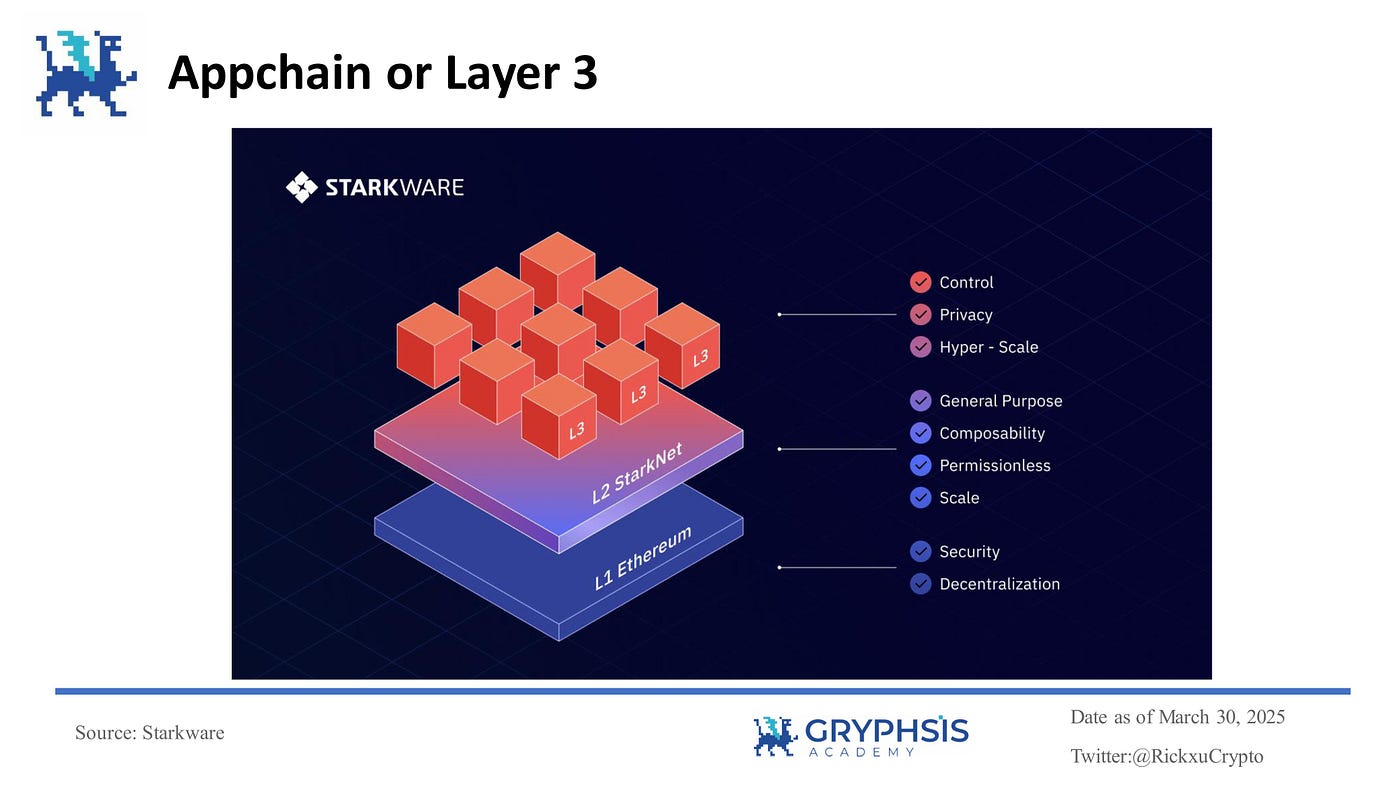

KKRT Labs wasn’t built overnight. Backed by Ethereum’s co-founder and StarkWare’s scaling veterans, they’ve specialized in Ethereum Virtual Machine (EVM)-compatible rollups with custom provers. Their work on modular systems allows rollups to plug into any chain, optimizing for specific workloads. Acquiring them gives Zama instant access to this R and amp;D firepower, accelerating the path to production-grade confidential rollups.

KKRT Labs’ Key ZK Milestones

-

Vitalik Buterin backing: Ethereum co-founder invests in KKRT Labs’ ZK scaling vision.

-

StarkWare support: Backed by leading ZK firm for rollup advancements.

-

**Modular rollup designs**: Pioneered flexible architectures for Ethereum-compatible chains.

-

High-performance provers: Built efficient proving systems targeting massive TPS gains.

Industry outlets like The Globe and Mail and Holder. io report the duo’s ambition: over 10,000 confidential TPS on Ethereum and Solana. This isn’t hype, it’s grounded in complementary tech stacks. FHE ensures data stays encrypted during execution; ZK proofs verify correctness publicly. Together, they solve the blockchain trilemma of scalability, security, and privacy without compromises.

Implications for On-Chain Finance in 2026

By 2026, expect confidential zk rollups to power enterprise-grade apps. Confidential DeFi could mean yield farming without oracle leaks or liquidation cascades from visible positions. Stablecoin issuers gain tools for private transfers, dodging regulatory scrutiny on user flows. For investors, this lowers tail risks: no more black swan exposures from on-chain sleuthing.

Read more on foundational scalability via ZK rollups’ efficiency. Zama’s acquisition sidesteps the pitfalls of standalone scaling solutions, blending privacy with performance in a pragmatic package. As volatility persists, security-first innovations like these will separate enduring protocols from fleeting trends.

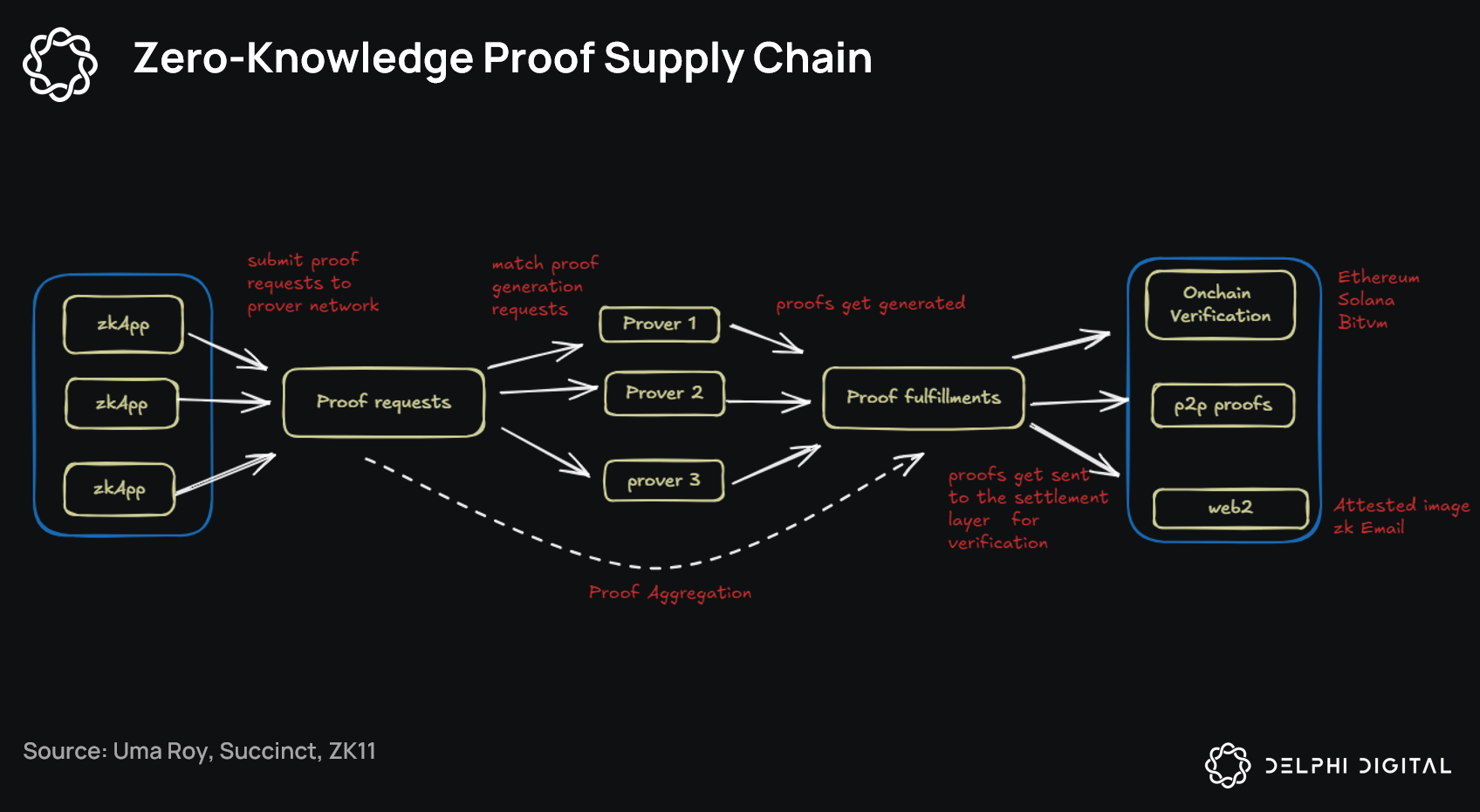

The path to 10,000 TPS zk rollups demands rigorous testing. Zama’s team must harmonize FHE computation overhead with KKRT’s lean provers. Proof aggregation will be crucial; batching thousands of encrypted transactions into one verifiable proof cuts Ethereum gas costs by orders of magnitude. Yet, proof generation latency remains a hurdle. KKRT’s custom recursion techniques, honed for EVM chains, should slash times from minutes to seconds.

Benchmarking ZK Rollups

| Project | Peak TPS | Confidentiality | EVM Compatibility | Major Backers |

|---|---|---|---|---|

| Starknet | ~1,000 TPS 🚀 | ❌ No privacy | ⚠️ Partial | StarkWare, Paradigm |

| Polygon zkEVM | ~2,000 TPS ⚡ | ❌ No privacy | ✅ Full | Polygon, a16z |

| Optimism | ~1,500 TPS 📈 non-ZK | ❌ No privacy | ✅ Full | Optimism, Paradigm |

| Zama-KKRT | 10,000 TPS target 2026 🔒 | ✅ Native FHE-ZK confidential | ✅ Full | Zama, KKRT Labs (Vitalik Buterin, StarkWare) |

Risk managers like myself watch these metrics closely. High TPS without privacy invites exploits; front-runners scan mempools for edges. Zama’s stack enforces encrypted state transitions, verifiable via ZK. On Solana, where speeds already top 50,000 TPS raw, confidentiality unlocks private high-frequency trading without leaks.

Investor sentiment echoes this synergy. Bitget and MEXC coverage notes Buterin’s backing as a signal of Ethereum alignment. Zama climbs the zama leaderboard zk, where FHE-enabled proofs outpace rivals in cost per transaction. Post-acquisition, expect mainnet rollouts by mid-2026, starting with testnets on Sepolia and Solana devnets.

Regulatory Tailwinds and Enterprise Adoption

Privacy scales with compliance. EU’s MiCA and U. S. clarity on stablecoins favor confidential ledgers. Zama-KKRT enables on-chain KYC without exposing identities, perfect for tokenized assets. Banks testing private DeFi could migrate billions, insulated from public scrutiny. From a portfolio view, this diversifies beyond transparent L1s, capping drawdowns from MEV or oracle failures.

Challenges persist: FHE key management adds complexity, demanding robust governance. KKRT’s StarkWare ties bring battle-tested recursion, mitigating centralization risks. Zama’s open-source ethos ensures community audits, vital for trustless finance.

ZyCrypto frames this as scaling ZKPs for mass adoption. Practical frameworks emerge: confidential DEXs with hidden order books, yield optimizers shielding APYs from copycats. Investors gain alpha through early positioning in Zama’s ecosystem tokens or related ZK primitives.

A Pragmatic Bet on Confidential Scalability

This zama kkrt labs acquisition exemplifies security-first evolution. Blending FHE privacy with ZK speed crafts resilient infrastructure for 2026’s bull cycles. Volatility tests protocols; only those balancing growth and safeguards endure. Zama’s trajectory, powered by KKRT, positions it to lead, fostering a zk ecosystem where privacy fuels prosperity without peril.