Ethereum’s landscape is evolving rapidly, and few voices carry as much weight as Vitalik Buterin’s. On January 19,2026, he shared on X that he’s “definitely more in favor of native rollups than before. ” This pivot from a former skeptic marks a pivotal moment for native rollups Ethereum, especially as advancements in ZK provers Ethereum L2 address longstanding hurdles. With Ethereum’s price holding steady at $2,893.60 amid a 24-hour dip of $-60.52 (-0.0205%), the timing feels prescient, signaling confidence in Layer 2 innovations.

Buterin’s endorsement of Vitalik Buterin native rollups stems from maturing ZK-EVM precompile technology. Previously, native rollups forced a binary choice: “optimistic mode” with 2-7 day withdrawals secured by Ethereum’s Layer 1, or “ZK mode” offering fast exits but relying on self-managed proofs with weaker guarantees. This dilemma pushed many projects toward optimistic rollups or multisig bridges, fragmenting liquidity and eroding Ethereum L2 composability ZK.

Vitalik’s Past Reservations and What Changed

Reflecting on his earlier stance, Buterin highlighted how immature ZK-EVMs couldn’t fully verify proofs on Ethereum’s base layer. Native rollup precompiles, as outlined in proposals like EIP-8079, demanded projects pick a lane, often defaulting to optimistic setups for Ethereum-backed security. This compromised seamless interactions across L2s, as users faced delays or trusted third parties.

Fast-forward to 2026: ZK-EVMs have leaped forward. Projects now deliver full zero-knowledge verification compatible with “EVM and a few features, ” enabling unified precompiles. Buterin notes careful design is key, allowing rollups to leverage Ethereum’s L1 zero-knowledge proofs without mode switches. It’s a pragmatic evolution, not a complete overhaul, but one that aligns based rollups ZK mode with Ethereum’s security model.

This shift matters because it tackles composability head-on. Imagine L2s interacting natively, without bridges or delays, fostering a true multi-chain ecosystem on Ethereum. As someone who’s tracked zk tech for years, I see this as Buterin’s nod to real progress, empowering developers to build without compromises.

How Native Rollups with ZK Provers Work

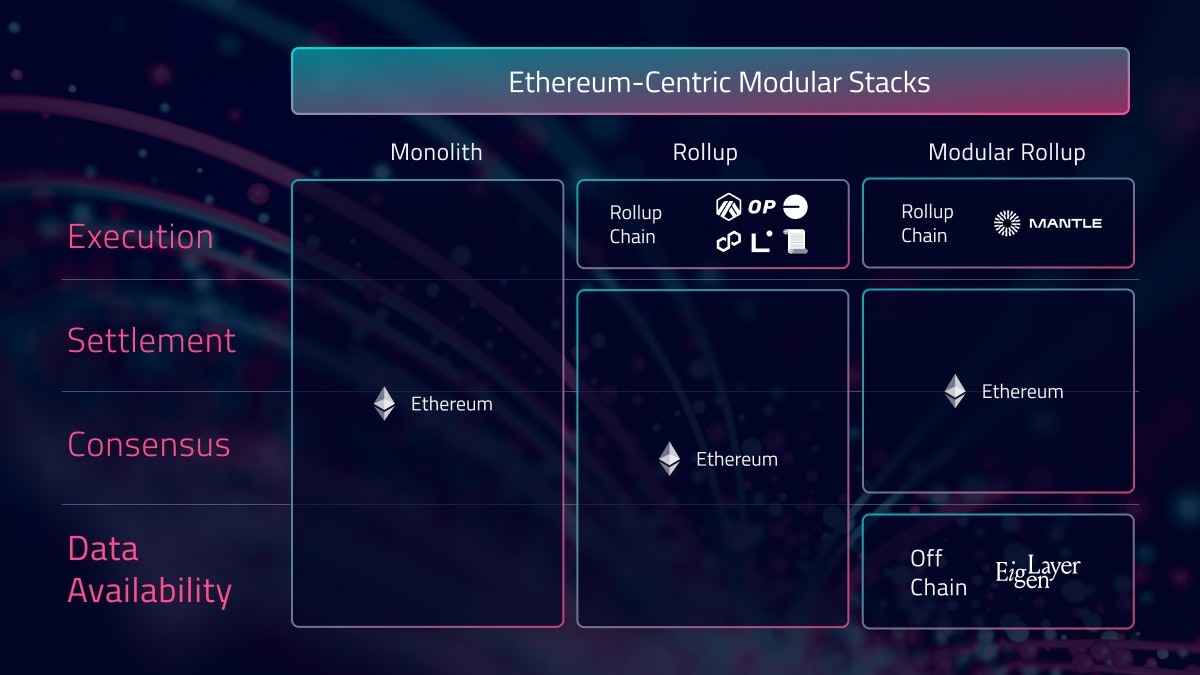

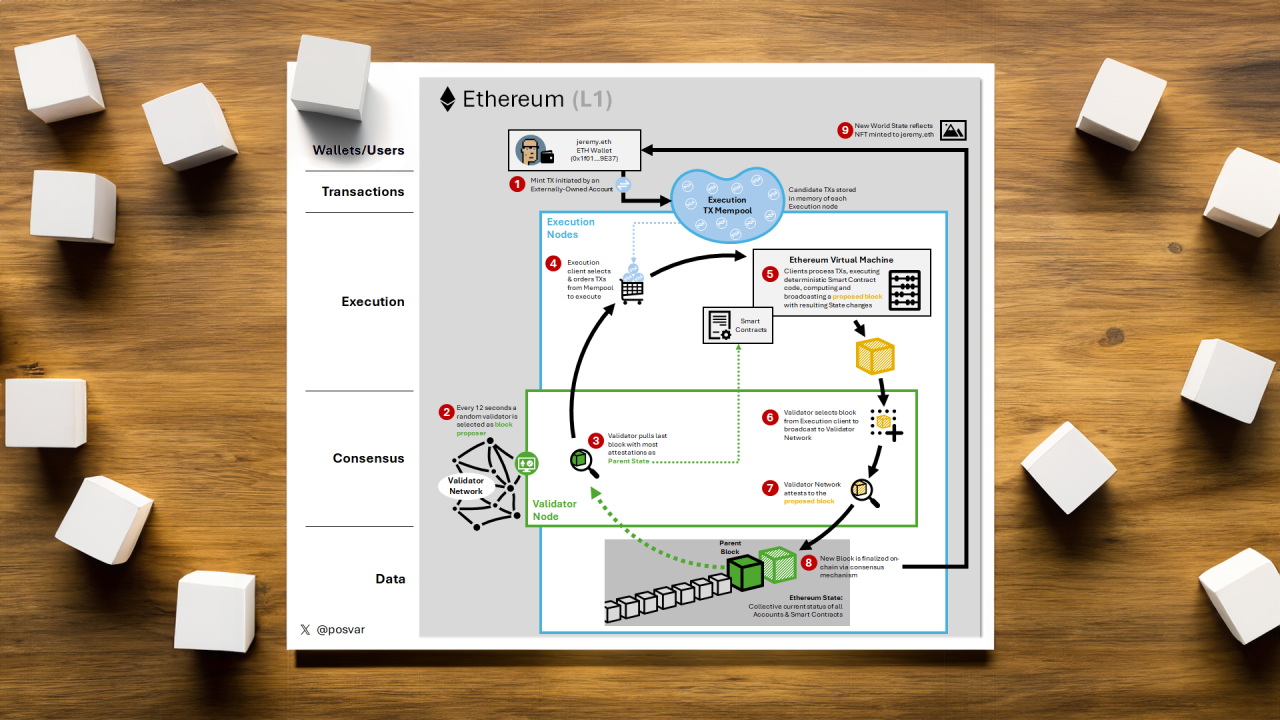

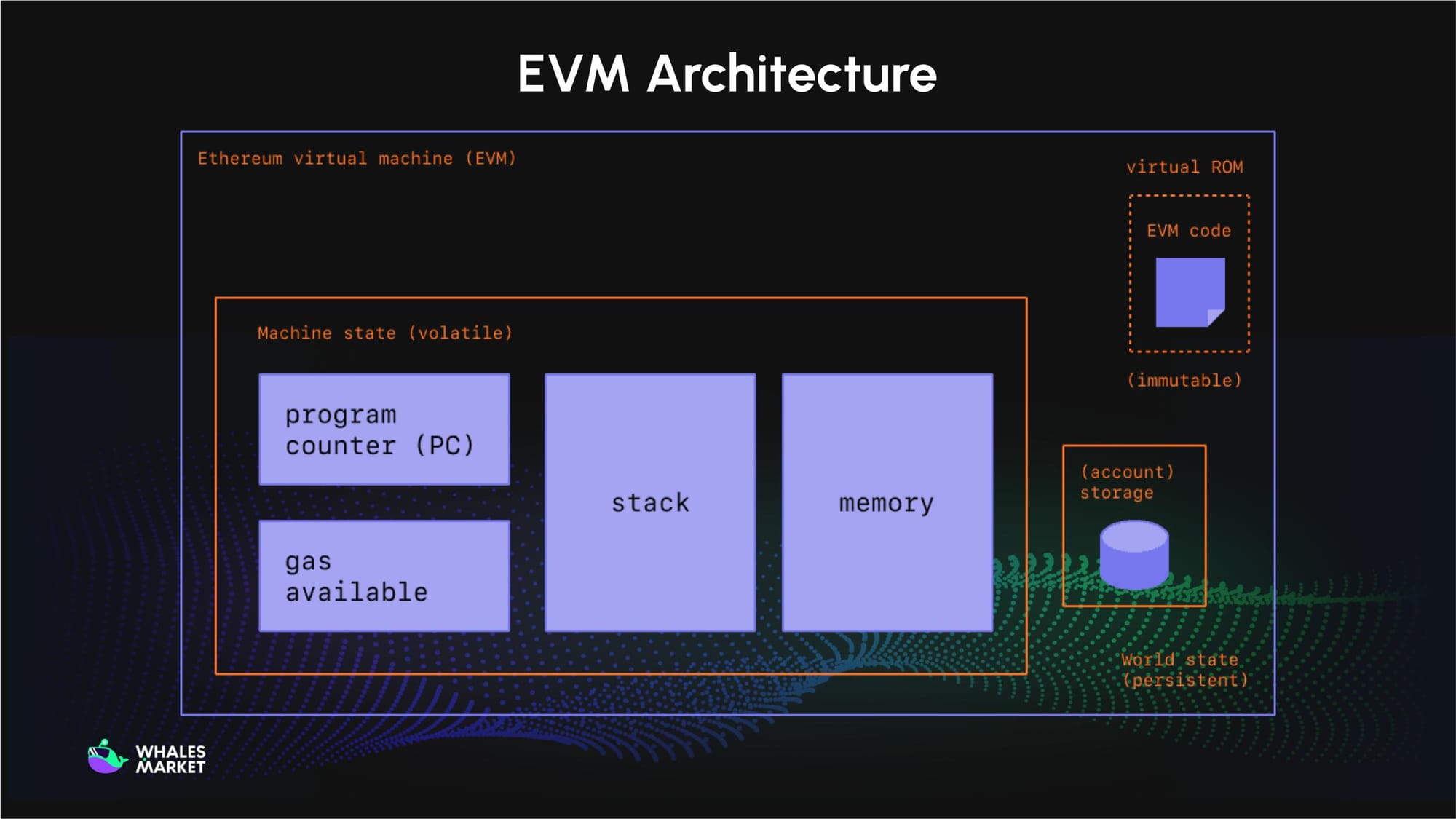

At their core, native rollups embed rollup execution directly into Ethereum’s EVM via precompiles. Instead of off-chain VMs posting state roots, they use L1 opcodes for proving and verification. In ZK mode, provers generate succinct proofs batched to L1, achieving sub-second finality when paired with Ethereum’s native zk support.

Here’s the beauty: no more validity vs fraud proofs tradeoff. ZK provers handle computation off-chain while Ethereum verifies instantly, slashing fees and boosting throughput. For ZK-EVM precompile setups, this means rollups like those exploring programmable rollups can scale horizontally without liquidity silos.

Consider the data: Ethereum’s 24-hour range swung from a high of $2,963.17 to $2,880.37, underscoring market resilience amid L2 hype. Buterin’s support amplifies this, positioning native rollups as the bridge to a composable future.

Path to True Ethereum L2 Composability

Composability has been Ethereum’s holy grail, yet L2 fragmentation stalled it. Native rollups change that by standardizing execution. Developers can call across chains via precompiles, inheriting L1 security without withdrawal waits. ZK provers ensure proofs are as robust as Ethereum’s consensus, eliminating bridge risks.

Buterin’s optimism ties into broader zk momentum. With L1 integrating zk circuits, rollups in ZK mode gain fast withdrawals backed by Ethereum, not operators. This unifies the stack, letting DeFi protocols span L2s fluidly. It’s opinionated engineering at its best: prioritize proofs over optimism where tech allows.

Ethereum (ETH) Price Prediction 2027-2032

Predictions factoring native rollups adoption, ZK-EVM maturity, and enhanced L2 composability impacts

| Year | Minimum Price | Average Price | Maximum Price | YoY Change % (Avg from prior year) |

|---|---|---|---|---|

| 2027 | $3,500 | $4,800 | $7,200 | +66% |

| 2028 | $4,200 | $6,200 | $9,500 | +29% |

| 2029 | $5,000 | $8,000 | $12,000 | +29% |

| 2030 | $6,000 | $10,500 | $16,000 | +31% |

| 2031 | $7,200 | $13,000 | $20,000 | +24% |

| 2032 | $8,500 | $16,500 | $25,000 | +27% |

Price Prediction Summary

Bullish outlook for ETH with average prices climbing from $4,800 in 2027 to $16,500 by 2032 (470%+ cumulative growth from 2026 baseline of ~$2,900), driven by technological upgrades; min/max reflect bearish consolidation and extreme bull scenarios amid market cycles.

Key Factors Affecting Ethereum Price

- Native rollups (EIP-8079) adoption boosting L2 efficiency and composability

- ZK-EVM maturity enabling fast, secure withdrawals without mode trade-offs

- Vitalik Buterin’s endorsement signaling developer and ecosystem confidence

- Ethereum L1 ZK proof integration reducing reliance on multisig bridges

- Market cycles post-2024/2028 halvings favoring recovery and new highs

- Regulatory clarity and institutional adoption expanding use cases

- Competition from Solana/L2s but ETH’s network effects and DeFi dominance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

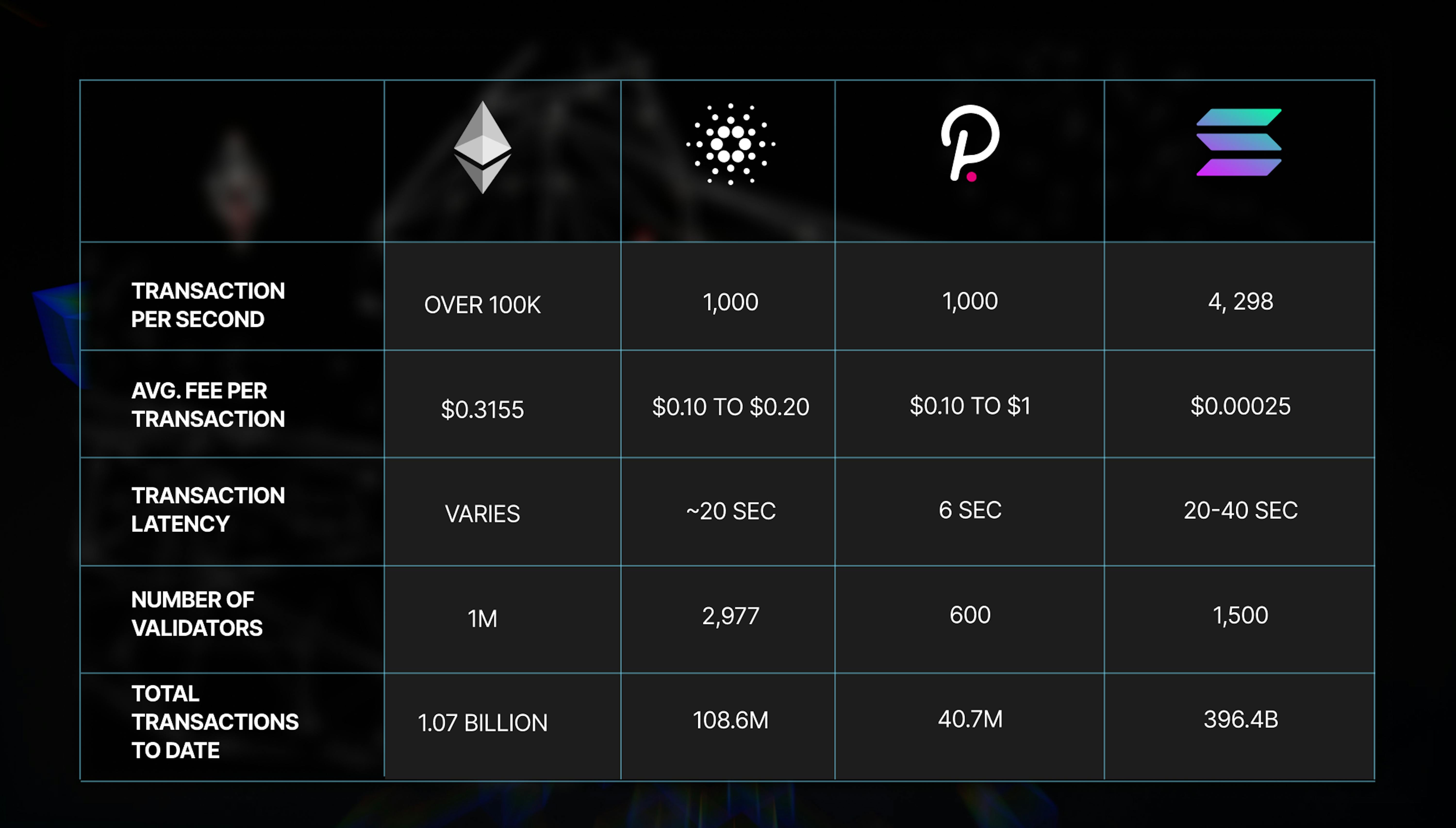

Early adopters are testing these waters, proving concepts in devnets. As ZK hardware accelerates proving times, native rollups could handle 100k and TPS while maintaining EVM familiarity. For investors eyeing $2,893.60 ETH, this scalability upgrade bolsters long-term value.

ZK hardware isn’t just hype; specialized chips from the likes of RISC Zero and Succinct Labs are slashing proving times from minutes to milliseconds, making native rollups viable for high-throughput apps. This hardware-software synergy positions Ethereum to rival Solana’s speeds while preserving decentralization.

Advantages of Native Rollups Over Traditional L2s

Why does Buterin’s shift resonate so strongly? Native rollups sidestep the pitfalls of external bridges and mode toggles. They inherit Ethereum’s full security model directly through precompiles, enabling atomic cross-rollup transactions. Developers gain EVM and a few features compatibility, easing porting from L1 without rewriting codebases.

Key Advantages of Native Rollups with ZK Provers

-

Seamless L2 Composability: Enables direct interactions between rollups without bridges or multisigs, fostering a unified Ethereum L2 ecosystem as Vitalik Buterin now supports.

-

Instant Withdrawals in ZK Mode: Mature ZK-EVMs allow fast withdrawals with strong zero-knowledge proof guarantees, overcoming past limitations of self-managed proofs.

-

Unified Ethereum Security: Leverages Ethereum L1’s native security model for both optimistic and ZK modes, eliminating trade-offs in proof systems.

-

Reduced Fees via L1 ZK Proofs: Ethereum L1 integration of zero-knowledge proofs cuts verification costs, making scaling more efficient for rollups.

-

EVM Compatibility without Bridges: Supports full EVM + key features via unified precompiles (EIP-8079), avoiding fragmented modes and bridge risks.

In practice, this means DeFi apps can lend across rollups instantly, NFTs can trade fluidly, and DAOs can vote chain-agnostically. No more liquidity traps or challenge periods; ZK proofs provide mathematical certainty from block one. For users, it’s simpler onboarding: deposit once, move freely.

Tracing this path reveals Ethereum’s deliberate pace. From ZK-EVM prototypes struggling with full EVM opcode support to today’s production-grade provers verifying complex states, progress has been relentless. Ethereum’s L1 now hosts zk circuits natively, a foundation Buterin champions for based rollups ZK mode.

Yet, thoughtful precompile design remains crucial. Buterin warns against overcomplicating; rollups should support core EVM plus extensions like blobs for data availability. This balance prevents bloat while unlocking scalability. As ETH trades at $2,893.60 with a 24-hour low of $2,880.37, market participants are betting on these upgrades to drive demand for L1 blocks.

Addressing Common Concerns

Critics might point to proving costs, but economies of scale are kicking in. Shared prover networks distribute workloads, much like mining pools did for Bitcoin. Ethereum’s roadmap, including Verkle trees and peerDAS, complements this by optimizing data handling for rollups.

For investors, the calculus is clear: mature ZK provers Ethereum L2 infrastructure promises sustained ETH burn from L1 settlements, supporting price stability even in choppy waters like today’s $-60.52 (-0.0205%) dip. Developers, meanwhile, get tools to build without fragmentation fears.

Buterin’s evolved view underscores a broader truth in zk tech: iteration beats perfectionism. Native rollups aren’t a panacea, but paired with ZK-EVMs, they forge Ethereum’s path to a cohesive L2 ecosystem. Watch for testnets launching soon; they could redefine sub-second finality in action. As ZkToday. com followers know, staying tuned to these shifts equips you to navigate the zk revolution ahead.