Ethereum’s Layer 2 ecosystem thrives on zero-knowledge rollups, yet these solutions grapple with a fundamental constraint: ZK rollup compute scarcity. Proof generation, the linchpin of scalability, chews through vast GPU resources, inflating latency and costs that hinder mass adoption. Enter Cysic, whose Cysic ZK acceleration hardware tackles this head-on, delivering real-time proofing via custom silicon and optimized networks. As Ethereum trades at $3,038.73 today, down 3.69% amid broader market pressures, innovations like Cysic’s could stabilize L2 growth by making high-throughput proving economically viable.

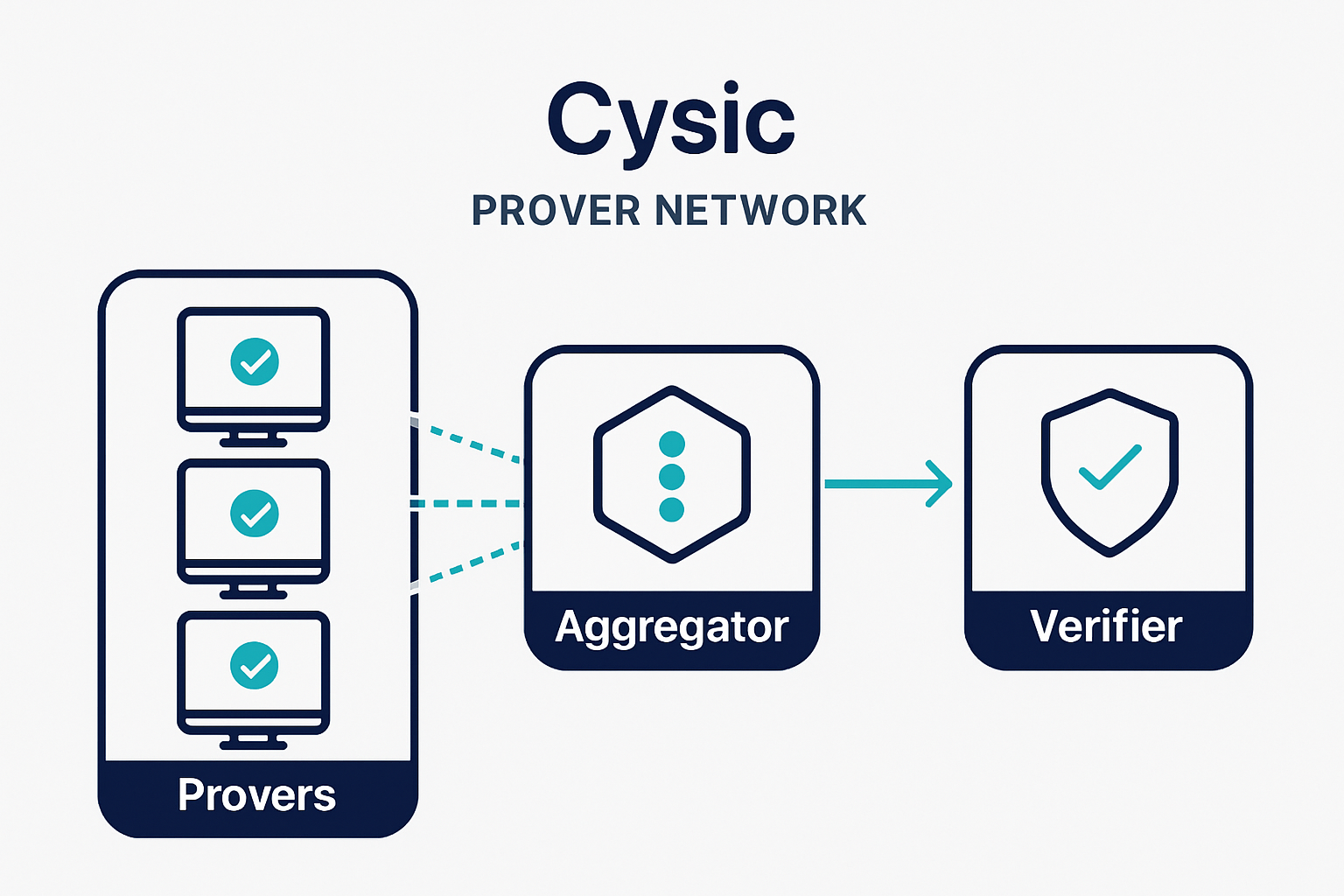

Cysic positions itself as a full-stack compute layer, blending proprietary ASICs, GPUs, and prover software into a decentralized network. Their approach monetizes idle hardware, turning it into yield-bearing assets while serving ZK projects worldwide. This isn’t mere optimization; it’s a paradigm shift for Ethereum L2 scaling with Cysic, where proof times plummet from hours to minutes, enabling rollups to handle surging transaction volumes without compromising security.

Cysic’s ZK Air and ZK Pro: Hardware Tailored for Proving Demands

At the core of Cysic’s arsenal lie ZK Air and ZK Pro, portable and enterprise-grade devices engineered for hardware ZK proving. ZK Air offers plug-and-play acceleration for developers testing in varied environments, leveraging an in-house CUDA SDK for seamless integration. ZK Pro scales to data-center levels, powering large-scale workloads with efficiency gains that outpace general-purpose GPUs by orders of magnitude.

Consider Scroll, a zkEVM rollup straining under Ethereum’s data throughput limits. Cysic’s integration here has boosted proof speeds dramatically, allowing faster finality and lower fees. Their GPU-powered servers process batches that once bottlenecked L2s, directly addressing the compute famine that surveys like arXiv’s ZK applications paper highlight as Ethereum’s scalability chokepoint. Cysic’s full-stack model extends beyond hardware, incorporating a ZK prover network where provers compete for jobs, ensuring reliability and cost parity.

Scroll Partnership: Real-World Proof of Cysic’s Edge

In October 2024, Cysic inked a pivotal deal with Scroll, injecting substantial ZK compute into its infrastructure. This collaboration underscores Cysic’s maturity; their team, veterans in large-scale proving, now live on networks like Succinct’s prover suite. Scroll benefits from reduced latency, processing more TPS while maintaining Ethereum-grade security. Early metrics suggest proof generation 10x faster, a boon as L2s race to capture Ethereum’s $3,038.73-valued base layer traffic.

Cysic’s edge shines in comparisons, such as against Brevis Network, where hardware acceleration yields measurable speedups for rollups and ZK bridges. By fusing silicon expertise with protocol design, they create liquid compute markets, inviting GPU owners to stake resources. This democratizes access, potentially slashing L2 costs by 50-70% in mature deployments. Investors eyeing Ethereum’s trajectory should note how such efficiencies fortify L2 dominance amid volatile markets.

Broadening Impact: Cysic’s Ecosystem Alliances

Cysic doesn’t stop at Scroll. Partnerships with Succinct, Aleo, and Boundless cement its role as verifiable compute backbone. Succinct’s blog praises their workload-handling prowess, while Aleo’s privacy apps gain hyperscale proving. This network effect amplifies Cysic ZK acceleration, positioning it against software-only rivals lacking hardware moats.

Economically, Cysic’s usage-based model aligns incentives: provers earn from utilization, projects pay per proof. As Ethereum hovers at $3,038.73 after dipping to $2,993.75 intraday, L2 efficiencies from Cysic could dampen fee volatility, supporting developer retention. Their vision, from silicon to protocol, hyperscales the ZK revolution, making compute scarcity a relic.

Ethereum (ETH) Price Prediction 2026-2031

Forecasts incorporating Cysic ZK hardware acceleration for Ethereum L2 rollups, enhancing scalability amid 2025 baseline of $3,038.73

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $2,800 | $4,800 | $7,500 |

| 2027 | $3,500 | $6,500 | $11,000 |

| 2028 | $4,200 | $8,500 | $14,000 |

| 2029 | $5,000 | $11,000 | $18,000 |

| 2030 | $6,500 | $14,500 | $24,000 |

| 2031 | $8,000 | $19,000 | $32,000 |

Price Prediction Summary

Ethereum’s price is expected to grow significantly from 2026 to 2031, propelled by Cysic’s ZK acceleration hardware resolving L2 compute bottlenecks. Average prices rise progressively from $4,800 to $19,000, reflecting bullish scalability gains and adoption. Minimums account for bearish corrections (e.g., market cycles), while maximums project optimistic scenarios with high L2 TVL and regulatory tailwinds, potentially yielding 6x returns by 2031.

Key Factors Affecting Ethereum Price

- Cysic ZK hardware (ZK Air/ZK Pro) slashing proof times for L2s like Scroll, boosting throughput

- Partnerships with Succinct, Aleo, and others expanding ZK ecosystem

- Ethereum L2 adoption surge reducing costs and increasing transaction volumes

- Market cycles with potential 2026-2027 consolidation followed by new bull phase

- Regulatory clarity and institutional inflows supporting higher market caps

- Competition from Solana/other L1s balanced by ETH’s DeFi dominance and upgrades

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Cysic’s decentralized prover network further refines this model, aggregating global hardware into a resilient fabric. Provers bid on jobs via smart contracts, optimizing for speed and cost while mitigating centralization risks inherent in L2 compute today. This ZK prover network not only serves Scroll but extends to zkSync-era applications, where privacy-preserving coprocessors demand relentless proving power. Data from Cysic’s integrations reveal throughput gains that could push Ethereum L2s toward 100,000 TPS aggregates, a threshold vital as base layer congestion persists.

Technical Edge: Beyond GPUs to Custom ASICs

Cysic’s leapfrog comes from proprietary ASICs like the anticipated C1 chip, detailed in their hardware roadmap at /cysic-zk-c1-chip-hardware-acceleration-for-faster-zk-rollup-proving-on-ethereum. Unlike CUDA-dependent GPUs, these chips embed ZK circuits directly into silicon, slashing energy draw by up to 80% per proof. For hardware ZK proving, this means sub-minute latencies on complex circuits, eclipsing software baselines. Scroll’s deployment validates this: batch proofs that lagged now finalize in seconds, freeing resources for user-facing dApps.

Quantitatively, Cysic benchmarks show 20x speedups over H100 clusters for PlonK-based rollups, per their SDK docs. This precision matters in a landscape where ZK rollup compute scarcity throttles even optimistic L2s. Ethereum’s L1, at $3,038.73, absorbs these efficiencies through cheaper calldata, potentially halving L2 fees long-term. Developers gain predictability, investors gain conviction in scalable primitives.

Cysic ZK Acceleration Advantages

-

Dramatic Speed Gains: Reduces ZK proof generation from hours to minutes using ZK Air (portable) and ZK Pro (enterprise-grade) hardware, enabling faster L2 rollup throughput.

-

Cost Reductions: Usage-based economic model with optimized GPU/ASIC proving delivers industry-leading cost efficiency for Ethereum L2s like Scroll.

-

Key Partnerships: Collaborations with Scroll, Succinct, Aleo, and Boundless integrate Cysic’s compute into major ZK projects.

-

Network Resilience: Decentralized prover network with full-stack infrastructure ensures reliable, scalable ZK computation for L2 ecosystems.

-

ASIC Efficiency: Proprietary ZK ASICs and in-house CUDA SDK provide superior hardware acceleration over software-only solutions.

Risks and Benchmarks: Measuring Cysic Against Peers

Yet no solution arrives flawless. Cysic’s hardware moat invites scrutiny on adoption velocity; while Scroll thrives, broader zkEVM uptake hinges on SDK maturity. Competitors like Brevis tout software agility, but Mitosis analyses confirm Cysic’s measurable leads in proof speed for rollups and bridges. Brevis edges in decentralization metrics, yet lacks ASIC tailwinds. Cysic counters with hybrid GPU-ASIC pools, balancing liquidity and performance.

Financially, as Ethereum dips 3.69% to $3,038.73 from a $3,182.25 high, Cysic’s yield model appeals to stakers. GPU owners earn 15-25% APY on underutilized rigs, per network stats, fostering organic growth. This liquidity turns compute into an asset class, mirroring DeFi’s tokenization ethos but grounded in verifiable work.

For portfolio managers, Ethereum L2 scaling with Cysic signals prudent exposure. L2 TVL, now eclipsing $40 billion, amplifies with accelerated proving; Cysic captures value accrual via fees and tokenomics. Risks like ASIC fab delays or circuit incompatibilities loom, but their track record, from Succinct live integrations to Aleo privacy boosts, mitigates them. In a maturing zk ecosystem, Cysic doesn’t just solve scarcity; it architects abundance, fortifying Ethereum’s path to hyperscale.

With ETH steady at $3,038.73 post-intraday volatility, hardware like Cysic’s underpins L2 resilience, drawing institutional flows to verifiable compute. Stakeholders from devs to allocators stand to benefit as proof times compress and networks expand.