Reya Network tackles DeFi’s persistent latency bottleneck head-on, delivering sub-1ms zk rollup trades on Ethereum through a purpose-built ZK rollup architecture. Traditional blockchains struggle with trade speeds measured in seconds, far from the millisecond precision of centralized exchanges. Reya’s based rollup design delegates execution to specialized nodes while anchoring security to Ethereum L1, enabling ZK rollup Ethereum speed that rivals TradFi without compromising decentralization.

This innovation stems from Ethereum validators outsourcing sequencing and execution to third-party Execution Nodes. Traders receive rapid pre-confirmations, followed by batched ZK-proven finality on L1. The result: a verifiable order book handling up to 200,000 transactions per second, powered by high-throughput data availability.

Execution Nodes and Dual Confirmation Layers

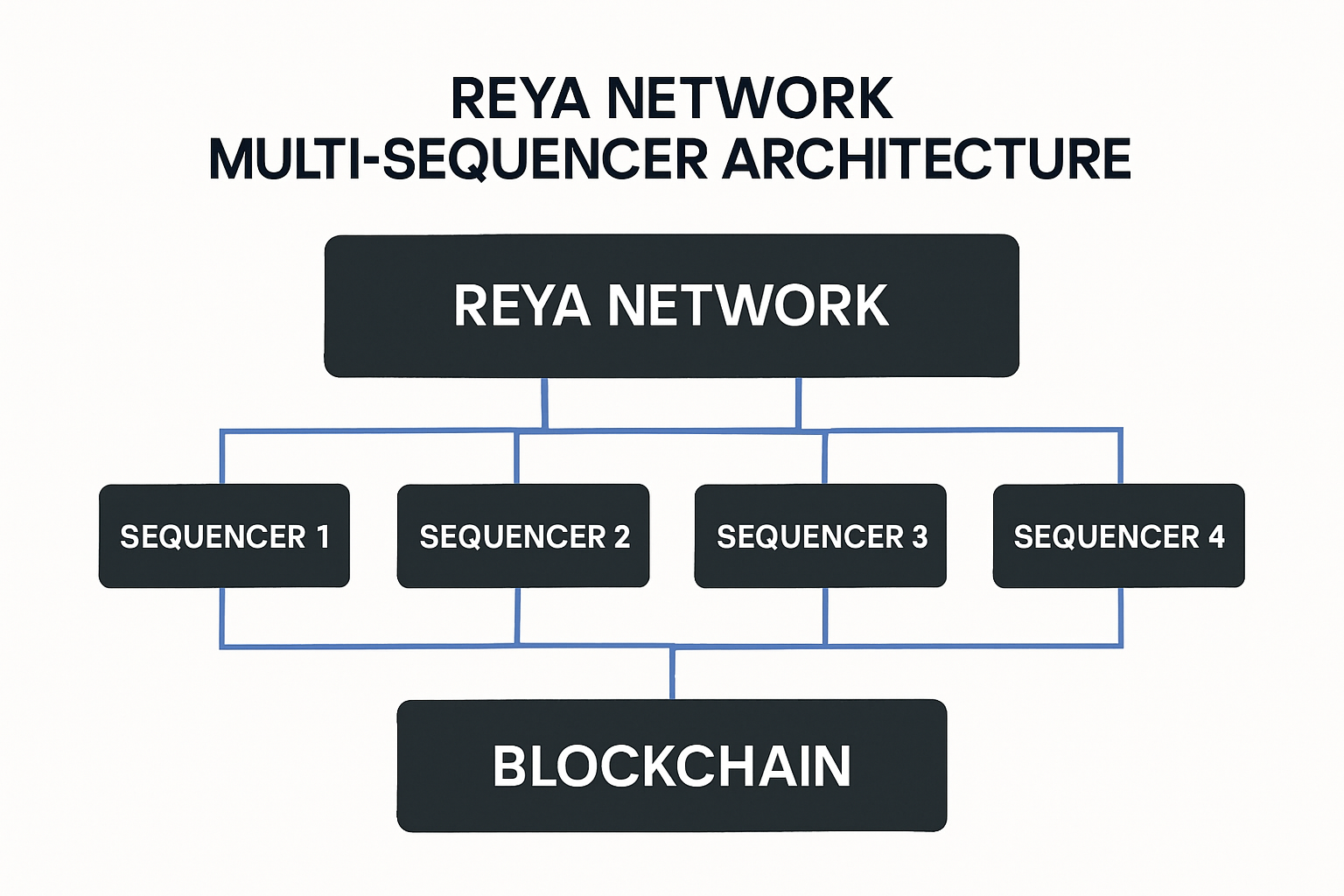

At the core of Reya’s Reya based rollup design lies a multi-sequencer setup with rotating Layer 2 nodes. Each Execution Node processes trades in under 1 millisecond, issuing execution receipts instantly. This pre-confirmation layer ensures low-latency feedback, critical for high-frequency strategies.

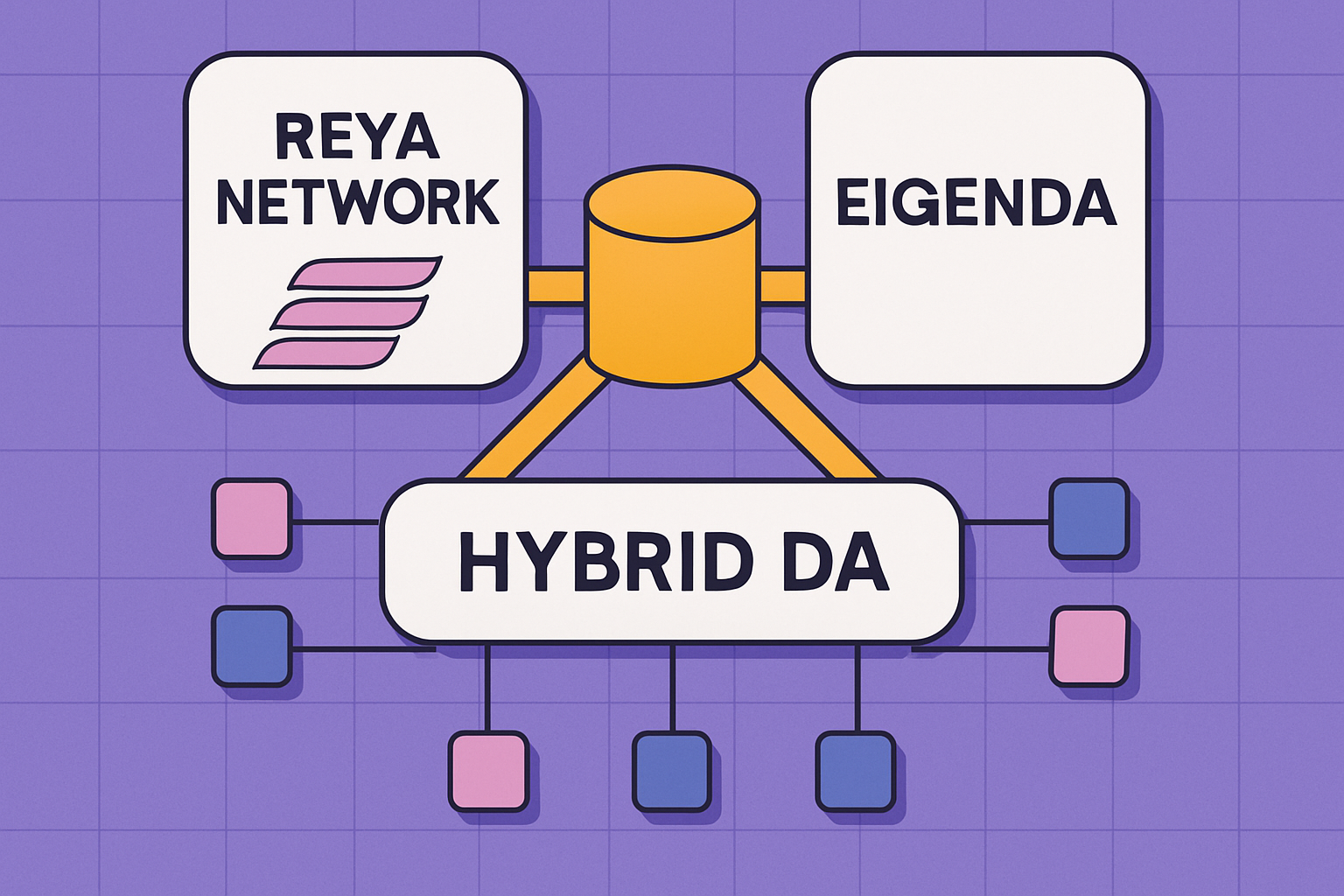

Final settlement batches transactions into Ethereum blocks, verified via ZK proofs. Trade execution data posts directly to L1 for immediate availability, while voluminous order data leverages EigenDA. This hybrid approach balances cost and verifiability, sidestepping the data bloat that hampers general-purpose rollups.

Reya ZK Rollup Key Features

-

Sub-1ms Trade Execution: Achieves under 1ms speeds via based rollup with execution nodes.

-

ZK-Verified Ethereum Settlement: Uses ZK proofs for verifiable execution and mainnet settlement.

-

Hybrid DA with EigenDA: L1 for trades, EigenDA for orders, enabling 200k TPS.

-

Multi-Sequencer Resilience: Rotating L2 nodes prevent single points of failure.

-

Zero Trading Fees: Eliminates fees for high-frequency trading.

Such partitioning optimizes for trading workloads, where order matching generates massive data but execution proofs remain compact. Reya’s system processes orders on-chain yet offloads non-critical storage, inheriting Ethereum’s uptime and censorship resistance.

EigenCloud Partnership Unlocks Institutional Throughput

Reya’s collaboration with EigenCloud supercharges its data layer. EigenDA, an Ethereum-native solution, absorbs order book payloads, enabling a fully on-chain experience without sidechains. ZK proofs reconstruct full trade histories, ensuring transparency for auditors and regulators.

Its unique based-rollup architecture delivers sub-millisecond execution speed, zero trading fees, and Ethereum’s 100% uptime and security.

This setup positions Reya as a fast zk scaling solution for liquidity provision. Unlike sequencer-dependent rollups prone to MEV extraction, Reya’s delegation model distributes power, mitigating centralization risks. Traders stake $REYA tokens to secure the network, aligning incentives with performance.

Resilient Architecture Eliminates Single Points of Failure

Reya’s rotating Execution Nodes form a decentralized sequencer pool, with leadership shifting to prevent downtime. Stage 3 of the roadmap introduces this fully, building on initial single-node tests. Reliability metrics already surpass L2 averages, with no outages reported in simulations.

Security audits validate ZK circuits for order matching and settlement, guarding against front-running. By posting execution data to L1, Reya enables real-time monitoring, fostering trust in automated strategies.

Automated trading bots thrive here, executing strategies with minimal slippage thanks to predictable pre-confirmations. In my analysis, this dual-layer finality outpaces optimistic rollups, where invalid state roots delay resolutions by minutes.

Roadmap to Full Decentralization

Reya’s phased rollout minimizes risks while scaling ambitions. Stage 1 launches the order book in Q1 2026, proving core matching logic. Stage 2 migrates to a single Execution Node based rollup in Q2, testing delegation mechanics. By Q3, multiple rotating nodes activate, fully realizing resilient sub-1ms zk rollup trades.

This progression echoes successful L2 evolutions but tailors to trading volatility. Early metrics from testnets show 99.99% uptime, with ZK proof generation under 100ms per batch. Developers can already integrate via SDKs, simulating high-frequency order flows.

$REYA token anchors the ecosystem, staked by node operators for sequencing rights. Slashing enforces honest execution, while fees burn supply, creating deflationary pressure. Stakers earn from trade volume, tying rewards to network throughput, a model I favor for aligning throughput with value accrual.

Compared to generalist rollups like Optimism or Arbitrum Orbit, Reya’s current stack, Reya discards AnyTrust for hybrid DA, prioritizing auditability over pure cost savings. L2BEAT data highlights Reya’s trading optimizations, but its based design leapfrogs to Ethereum-native sequencing.

Benchmarking Against TradFi and DeFi Peers

Reya’s ZK rollup Ethereum speed closes the gap with CEXs like Binance, where latencies hover at 0.5ms but lack on-chain verifiability. DeFi alternatives like Hyperliquid offer speed via appchains, yet forfeit L1 security. Reya threads the needle: 200k TPS capacity via EigenDA, ZK-proven, no bridges.

Ethereum Technical Analysis Chart

Analysis by Alicia Patel | Symbol: BINANCE:ETHUSDT | Interval: 1h | Drawings: 5

Technical Analysis Summary

On this ETHUSDT 1H chart snapshot from Dec 5, 2025, draw a descending channel with trend_line from 2025-12-05T12:00:00Z@4300 to 2025-12-05T17:00:00Z@3750 (downtrend, conf 0.85), then bullish divergence hint with arrow_mark_up at recent low. Mark S/R: horizontal_line at 3700 (support, strong red), 4000 (resistance, moderate blue). Rectangle accumulation zone 2025-12-05T14:00@3850 to T16:00@3700. Fib retracement 0.618 at 3920. Entry long zone rectangle 3700-3720, PT 4100, SL 3680. Volume spike callout at T15:00 ‘buying climax’. MACD bear cross arrow_mark_down but histogram divergence text note. Risk high, code your bots to scalp this bounce leveraging Reya ZK speed for ETH infra plays.

Risk Assessment: high

Analysis: Volatile crypto setup with ZK narrative tailwind but channel breakdown risk; suits aggressive HFT styles

Alicia Patel’s Recommendation: Go long aggressively at 3720, automate with Python TA-Lib + CCXT for Reya-speed entries—target 8% RR.

Key Support & Resistance Levels

📈 Support Levels:

-

$3,700 – Strong demand zone, multiple tests + volume shelf

strong -

$3,600 – Psycho + prior low extension

moderate

📉 Resistance Levels:

-

$4,000 – Recent swing high, channel top

moderate -

$4,100 – Fib 0.618 retrace target

weak

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$3,720 – Aggressive long on channel support bounce, volume confirmation

high risk -

$3,700 – Break below invalidates, but high RR scalp

high risk

🚪 Exit Zones:

-

$4,100 – Measured move target from range, fib extension

💰 profit target -

$3,680 – Tight stop below support structure

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: increasing on downside then spike reversal

Climax selling exhausted, buyers stepping in at lows

📈 MACD Analysis:

Signal: bearish cross but bullish histogram divergence

Momentum weakening, setup for upside cross

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Alicia Patel is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

In simulations, Reya handles 10x BlackRock ETF volume without congestion, a boon for institutional inflows. MEV resistance shines: rotating sequencers randomize order inclusion, curbing sandwich attacks that plague Uniswap.

For quants, Reya’s API exposes raw execution traces, enabling backtesting with ZK fidelity. Code a simple HFT bot? Deploy on Reya for live fast zk scaling solutions, iterating faster than EVM gas wars allow.

This architecture redefines DeFi’s trading layer, proving ZK tech matures for production workloads. Ethereum gains a hyper-specialized executor without bloating L1, while traders unlock TradFi alpha on-chain. Reya doesn’t just scale; it recalibrates expectations for decentralized markets.