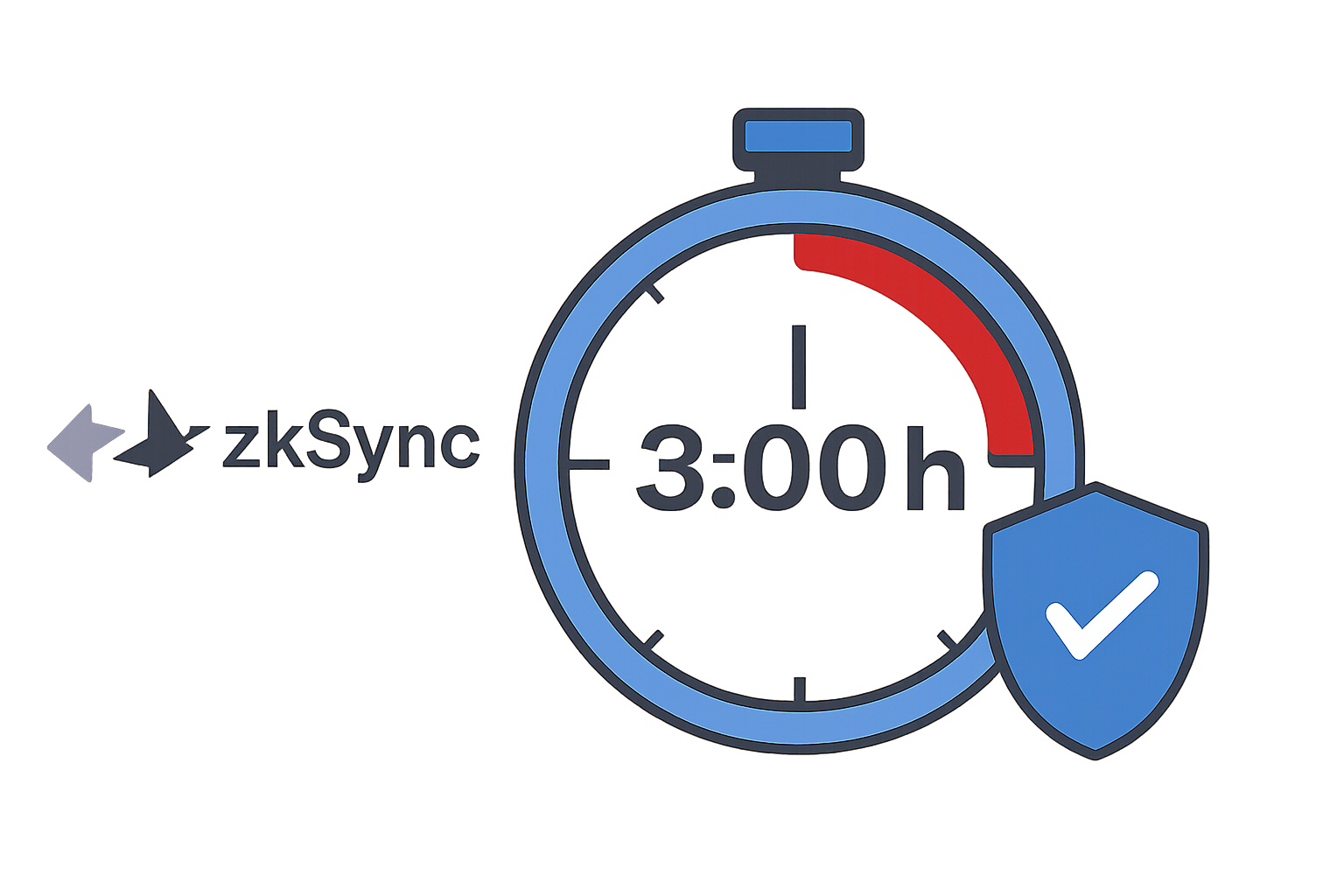

zkSync users often encounter a puzzling wait when bridging funds back to Ethereum’s Layer 1: a mandatory 3-hour withdrawal delay. This zk rollup withdrawal delay, while frustrating for those expecting near-instant finality, serves a critical security purpose in the Layer 2 ecosystem. Unlike optimistic rollups burdened by week-long challenge periods, ZK rollups like zkSync promise faster transactions through validity proofs. Yet, this specific timelock highlights a nuanced trade-off between speed and safeguards against exploits.

Decoding the zkSync Withdrawal Process

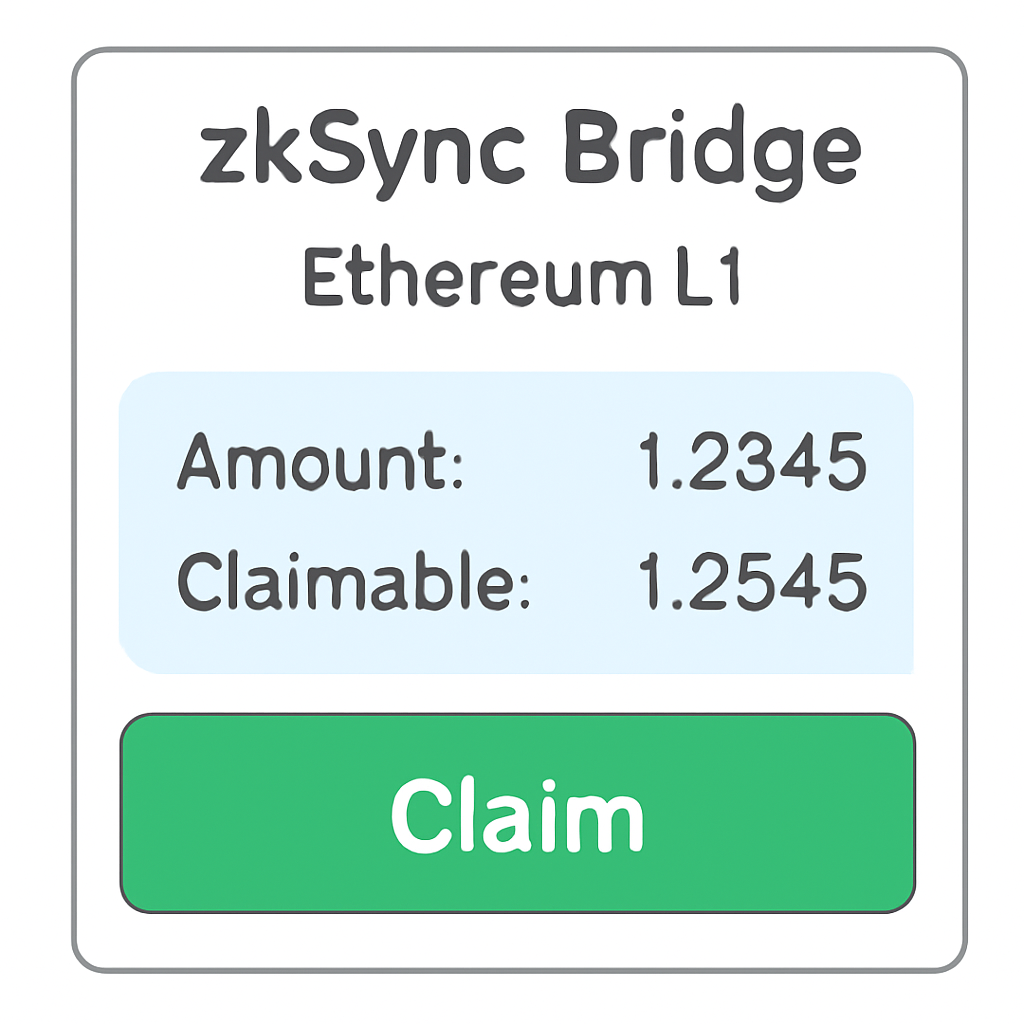

Withdrawals from zkSync to Ethereum involve a multi-step orchestration that underscores the protocol’s commitment to security. Transactions first aggregate into batches on the Layer 2 network. These batches commit to Layer 1, followed by proof generation and submission for verification. Finality arrives only after Ethereum validates the cryptographic proof, rendering transactions irreversible.

Central to this is the block execution delay, a minimum 3-hour timelock designed to thwart rapid fund drains during potential vulnerabilities. Without it, a discovered bug could enable attackers to siphon assets before mitigations deploy. This delay ensures batches finalize post-verification, but users must endure the wait before funds appear on Etherscan.

Why 3 Hours? Balancing Security and Usability in zkSync

The 3-hour mark isn’t arbitrary; it emerged from governance-driven evolution. Initially, zkSync enforced a 24-hour (later adjusted to 21-hour) delay to allow thorough monitoring for anomalies like sudden large outflows. Community proposals, such as ZIP-4, successfully petitioned a reduction to 3 hours, optimizing zksync withdrawal time without eroding protections.

This period empowers the zkSync team to scan for threats, intervening if needed to preserve network integrity.

Contrast this with optimistic rollups’ 7-day fraud-proof windows, where withdrawals languish in uncertainty. ZK rollups theoretically offer instant finality via decisive proofs, yet zkSync’s timelock addresses real-world risks like proof submission intervals or prover bottlenecks. Data from finality trackers reveals that while proofs validate swiftly, the delay enforces prudent caution, preventing why zk rollups slow perceptions from overshadowing their scalability advantages.

zkSync’s Delay in Broader ZK Rollup Context

zkSync’s approach diverges from peers like Starknet, where L2-to-L1 withdrawals demand 12 and hours across two transactions. General ZK rollup literature touts near-instant finality, but practical implementations vary. Provers generate validity proofs off-chain, posting minimal data to Ethereum, which processes just 15 transactions per second on mainnet. This efficiency eases congestion, yet withdrawal delays persist as a deliberate friction point.

Monitoring tools track proof submission cadences, exposing bottlenecks in zk rollup proving that could extend beyond 3 hours during peak loads. zkSync mitigates this through refined infrastructure, positioning it as a leader in Ethereum scaling. Investors and developers must weigh these delays against optimistic alternatives’ longer uncertainties, recognizing the 3-hour window as a mature compromise.

Ultimately, this mechanism underscores a core tenet: in blockchain, speed without security invites peril. As zkSync matures, its delay evolves from a hurdle to a hallmark of resilience.

Looking ahead, zkSync’s governance process positions it well for iterative improvements to the zk rollup withdrawal delay. Proposals like ZIP-4 demonstrate community influence in refining parameters, and similar efforts could target even shorter timelocks as prover efficiency advances.

Probing the Technical Bottlenecks Behind Delays

Delays stem partly from zk rollup proving bottlenecks, where generating succinct validity proofs demands computational intensity. Provers aggregate thousands of transactions into a single SNARK or STARK, verifying correctness off-chain before submission. Intervals between proof batches vary, influenced by network load and hardware scaling. Trackers monitoring these cadences reveal that while average finality hovers near three hours, spikes occur during high throughput, amplifying user waits.

This contrasts sharply with optimistic rollups, where zksync withdrawal time benefits from no proof computation but suffers prolonged challenge periods. ZK rollups prioritize validity over optimism, yet real-world friction arises from Ethereum’s sequencer dependencies and gas constraints. zkSync counters this through optimized batching and parallel proving, steadily compressing timelines.

Comparison of L2 Withdrawal Finality Times

| L2 Solution | Finality Time | Mechanism | Security Trade-off | User Impact |

|---|---|---|---|---|

| zkSync | 3 hours | ZK Rollup with 3-hour timelock | Timelock allows detection of anomalies and prevents rapid exploitation | Short wait improves UX over longer delays; funds accessible after monitoring period |

| Starknet | 12+ hours | ZK Rollup (STARK proofs) with L1 verification delay | Ensures cryptographic proof acceptance on Ethereum | Longer delay impacts timely liquidity access |

| Optimism / Arbitrum | 7 days | Optimistic Rollup with challenge period | Fraud proofs enable dispute resolution | Significant wait time risks funds being locked longer if challenged |

| Polygon zkEVM | ~1 hour (variable) | ZK Rollup with validity proofs | Fast cryptographic verification without challenge | Minimal delay enhances user experience and fund mobility |

From a risk management perspective, these delays enforce discipline. Rapid finality tempts overexposure, but zkSync’s measured pace allows anomaly detection, such as unusual withdrawal patterns signaling exploits. Investors eyeing Layer 2 yields must factor this into liquidity planning, treating the three-hour window as a conservative buffer rather than a flaw.

Fixes on the Horizon: Shorter Delays and Enhanced Tools

zkSync’s roadmap emphasizes infrastructure hardening to slash delays further. Enhanced provers, leveraging GPU clusters and recursive proofs, promise sub-hour finality. Governance forums buzz with discussions on dynamic timelocks, adjusting based on threat levels or proof confidence. As Ethereum’s Dencun upgrade bolsters blob data availability, zk rollups gain cheaper state commitments, indirectly accelerating withdrawals.

Monitoring evolves too. Advanced dashboards now track proof submission latencies in real-time, empowering users to anticipate delays. For developers building on zkSync, APIs expose batch status, mitigating surprises. These tools transform opacity into predictability, aligning with prudent portfolio strategies.

Yet, challenges persist. Why zk rollups slow queries often overlook that privacy engines, like zk-SNARKs in rollups, inherently trade speed for compression. Distinguishing zk privacy engines from full rollups clarifies: the former verifies single claims succinctly, while rollups bundle ecosystems. zkSync blends both adeptly, but scaling prover throughput remains pivotal.

Future governance could halve the timelock to 90 minutes, provided monitoring scales proportionally, a data-driven pivot I endorse cautiously.

Developers and users benefit from proactive tracking. Finality estimators, drawing from historical proof intervals, forecast completion times accurately. Pair this with diversified bridging strategies, and the delay becomes manageable overhead.

zkSync’s trajectory signals maturity: from 24-hour caution to three-hour efficiency, with sub-hour ambitions next. This evolution fortifies Ethereum scaling, rewarding patient participants with robust security. For those navigating zk ecosystems, understanding these mechanics informs sharper decisions, minimizing risks in a volatile space.