Zero-knowledge rollups (ZK-rollups) are rapidly redefining what’s possible for programmable DeFi on Bitcoin, without the need to alter its foundational protocol. As of November 2025, Bitcoin trades at $86,189.00, reflecting sustained institutional interest and a growing appetite for advanced features that rival those on programmable blockchains like Ethereum. The emergence of ZK-rollups on Bitcoin is now bridging this gap, enabling scalable, privacy-preserving DeFi applications while preserving Bitcoin’s security and decentralization.

How ZK-Rollups Work: Off-Chain Computation, On-Chain Security

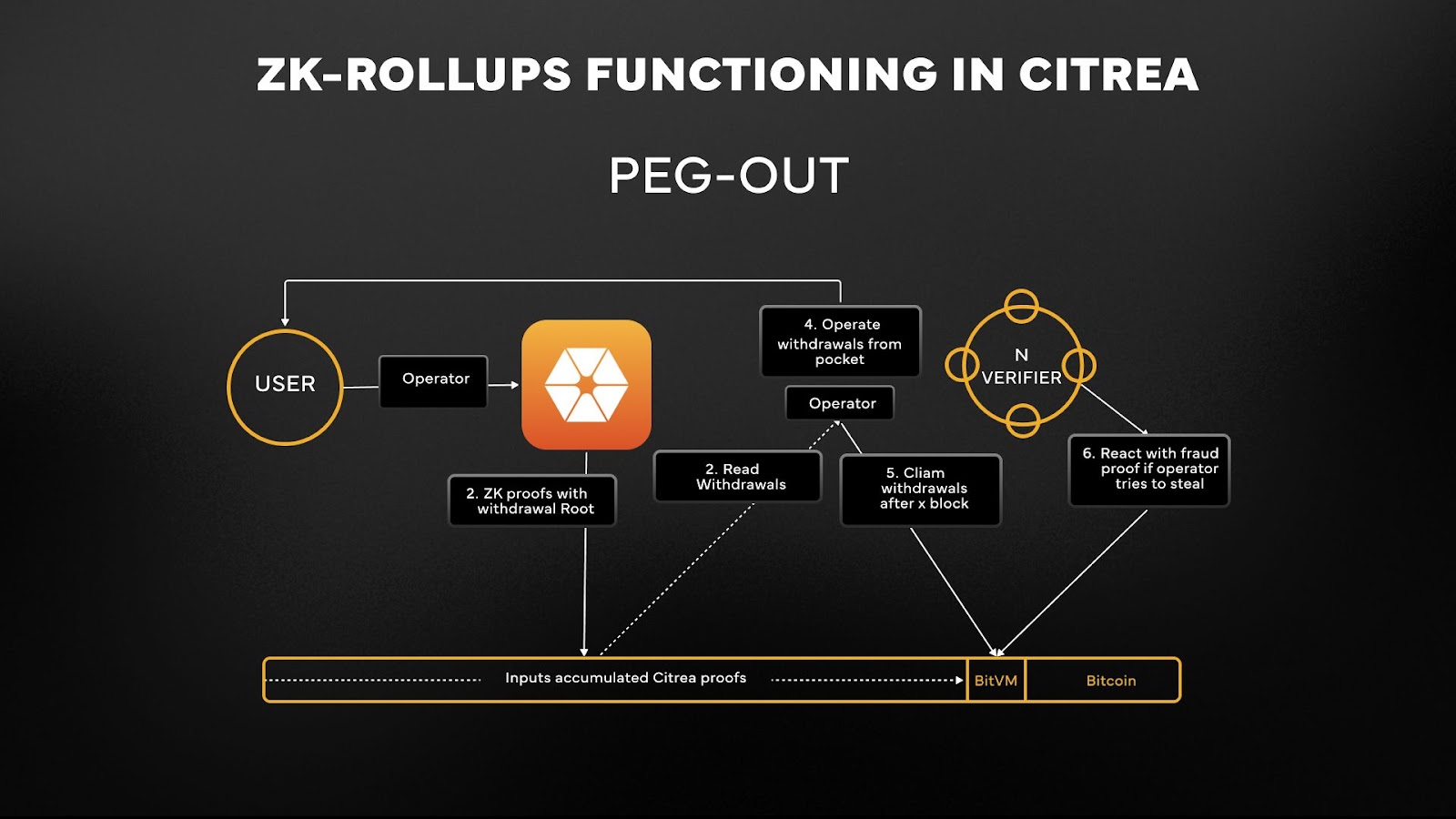

ZK-rollups operate by aggregating hundreds or thousands of transactions off-chain into a single bundle. Instead of submitting every transaction to the base layer, only a succinct cryptographic proof (typically a zk-SNARK) is posted to the main chain. This proof attests to the validity of all included transactions without revealing their specifics or requiring each one to be individually processed by miners.

This architecture dramatically reduces congestion on the Bitcoin network, slashes transaction fees, and enables near-instant finality for users interacting with DeFi protocols built atop these rollups. Critically, it does so without sacrificing security; the validity proofs are mathematically guaranteed to be correct, and any attempt at fraud is easily detectable by the network.

No Protocol Change Required: The Breakthrough in Bitcoin Layer 2

Historically, adding smart contract capabilities or scaling solutions to Bitcoin required contentious soft forks or even hard forks, a process fraught with political risk and potential fragmentation. ZK-rollups sidestep this entirely by leveraging existing scripting capabilities within Bitcoin’s consensus rules.

The pivotal moment arrived in July 2024 when BitcoinOS (BOS) verified its first zero-knowledge proof directly on the mainnet, without any change to core protocol code. This achievement demonstrated that permissionless innovation is possible atop Bitcoin’s robust foundation. As BOS contributor Edan Yago highlighted, this was an “upgrade” accomplished entirely outside of consensus-layer governance debates.

This breakthrough means developers can now launch highly programmable DeFi protocols, such as decentralized exchanges (DEXs), lending markets, and synthetic assets, using ZK scaling solutions on Bitcoin’s existing infrastructure. For a technical deep dive into how these rollups enhance scalability without protocol changes, see this resource.

The New Era: Programmable DeFi Arrives on Bitcoin

With ZK-rollup technology maturing into production deployments, and over $28 billion in total value across leading projects as of late 2025, the landscape for Bitcoin programmable DeFi is evolving rapidly. Projects like Goat Network and StarkNet are rolling out execution environments that allow users to access advanced DeFi services while settling transactions back onto Bitcoin’s battle-tested base layer.

This paradigm shift not only brings Ethereum-style programmability to BTC holders but also unlocks privacy features through zero-knowledge proofs, enabling confidential swaps and lending activities natively denominated in BTC.

Bitcoin Price Prediction Post-ZK Rollup Adoption (2026-2031)

Professional Analyst Projections Based on ZK-Rollup Integration and DeFi Enablement on Bitcoin

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $72,000 | $98,000 | $128,000 | +13.7% | Early ZK-rollup DeFi growth; volatility from integration risks |

| 2027 | $80,000 | $112,000 | $145,000 | +14.3% | Mainstream DeFi adoption on Bitcoin; increased institutional interest |

| 2028 | $94,000 | $127,500 | $168,000 | +13.8% | Regulatory clarity and scaling; Layer 2 composability expands |

| 2029 | $105,000 | $143,000 | $192,000 | +12.2% | Global macro tailwinds; competitive pressure from other L1s |

| 2030 | $120,000 | $162,000 | $220,000 | +13.3% | Bitcoin DeFi rivals Ethereum DeFi TVL; network effects mature |

| 2031 | $135,000 | $185,000 | $252,000 | +14.2% | Mass adoption of BTC DeFi; new use cases and cross-chain liquidity |

Price Prediction Summary

Bitcoin’s adoption of ZK-rollups for programmable DeFi is a game-changer, unlocking new utility and scaling for the network without compromising its security or requiring protocol changes. Our projections anticipate a steady, progressive price appreciation, driven by increased DeFi activity, institutional inflows, and the maturation of Bitcoin’s Layer 2 ecosystem. While volatility and competition remain, the overall outlook is strongly bullish, especially as Bitcoin’s programmability attracts a broader user base and developer community.

Key Factors Affecting Bitcoin Price

- Adoption and successful deployment of ZK-rollups on Bitcoin mainnet

- Expansion of DeFi use cases and total value locked (TVL) on Bitcoin Layer 2s

- Regulatory developments and global crypto policy clarity

- Competition from Ethereum, Solana, and other programmable blockchains

- Institutional participation and Bitcoin ETF flows

- Macro-economic conditions and global risk appetite

- Advancements in cross-chain interoperability and Layer 2 composability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The implications are profound: with no need for risky protocol upgrades or forks, developers can now build sophisticated financial products directly atop the world’s most secure blockchain asset. For an up-to-date look at how native BTC Layer 2 scaling is progressing, visit our coverage here.

As the ZK-rollup ecosystem expands, competition among Layer 2 protocols is intensifying, driving innovation in both performance and user experience. Notably, recent ZK advances have enabled transaction throughput on par with leading Ethereum rollups, while maintaining Bitcoin’s signature security guarantees. For example, StarkNet’s integration with Bitcoin wallets allows seamless access to DeFi primitives, yield markets, perpetuals, and automated market makers, without ever leaving the Bitcoin environment or relying on wrapped assets.

This marks a decisive shift in the narrative around Bitcoin’s programmability. Where once the network was seen as slow to adapt or resistant to change, it is now at the forefront of scaling research, demonstrating that robust decentralization and advanced functionality are not mutually exclusive. The ability to deploy programmable DeFi atop Bitcoin at $86,189.00 is a testament to both user demand and technical ingenuity.

Risks and Opportunities: What Investors Should Watch

While the promise of ZK-rollups on Bitcoin is immense, prudent investors must remain vigilant regarding key risks. Smart contract risk migrates from Layer 1 to Layer 2; exploits or bugs in rollup logic could still jeopardize user funds. Additionally, liquidity fragmentation across multiple rollups may create challenges for seamless asset movement and price discovery.

However, these risks are being actively addressed by open-source audits, permissionless validator sets, and cross-rollup bridges that preserve atomicity of settlement. As capital continues to flow into ZK-driven Bitcoin DeFi protocols (with TVL surging above $28 billion globally), market participants should monitor both technical progress and regulatory responses closely.

The Road Ahead: Sustainable Scaling Without Sacrifice

The trajectory for hybrid ZK-rollup architectures suggests that composable DeFi on Bitcoin will only become more sophisticated in coming years. Already we see experiments with NFT settlement, one-human-one-wallet authentication via zero-knowledge proofs, and even native stablecoins, all settling back onto the base chain without altering its core ruleset.

The competitive landscape is also evolving rapidly: projects like Goat Network are promising faster withdrawals and decentralized order routing directly on BTC; BOS’s Charms protocol enables programmable tokens and NFTs natively secured by Bitcoin; while platforms such as StarkNet are bridging Ethereum’s developer ecosystem with BTC capital pools. For a comprehensive look at how these solutions combine security with scalability, see this analysis.

Ultimately, zero-knowledge technology has redefined what’s possible for Bitcoin without compromising its ethos or requiring disruptive upgrades. As institutional adoption grows and mainstream users seek both privacy and programmability at scale, ZK-rollups are poised to be the linchpin for the next era of decentralized finance, anchored by the world’s most valuable digital asset.