Ethereum’s scaling landscape has reached a new inflection point: ZK rollups like Lighter are now consistently pushing beyond 4,000 transactions per second (TPS), a milestone that would have seemed unthinkable just a year ago. With Ethereum trading at $3,428.89 and network demand on the rise, these breakthroughs are more than technical feats, they’re critical to the future of DeFi and on-chain applications.

How Lighter Achieves 4,000 and TPS: The Power of Ethereum Blobs

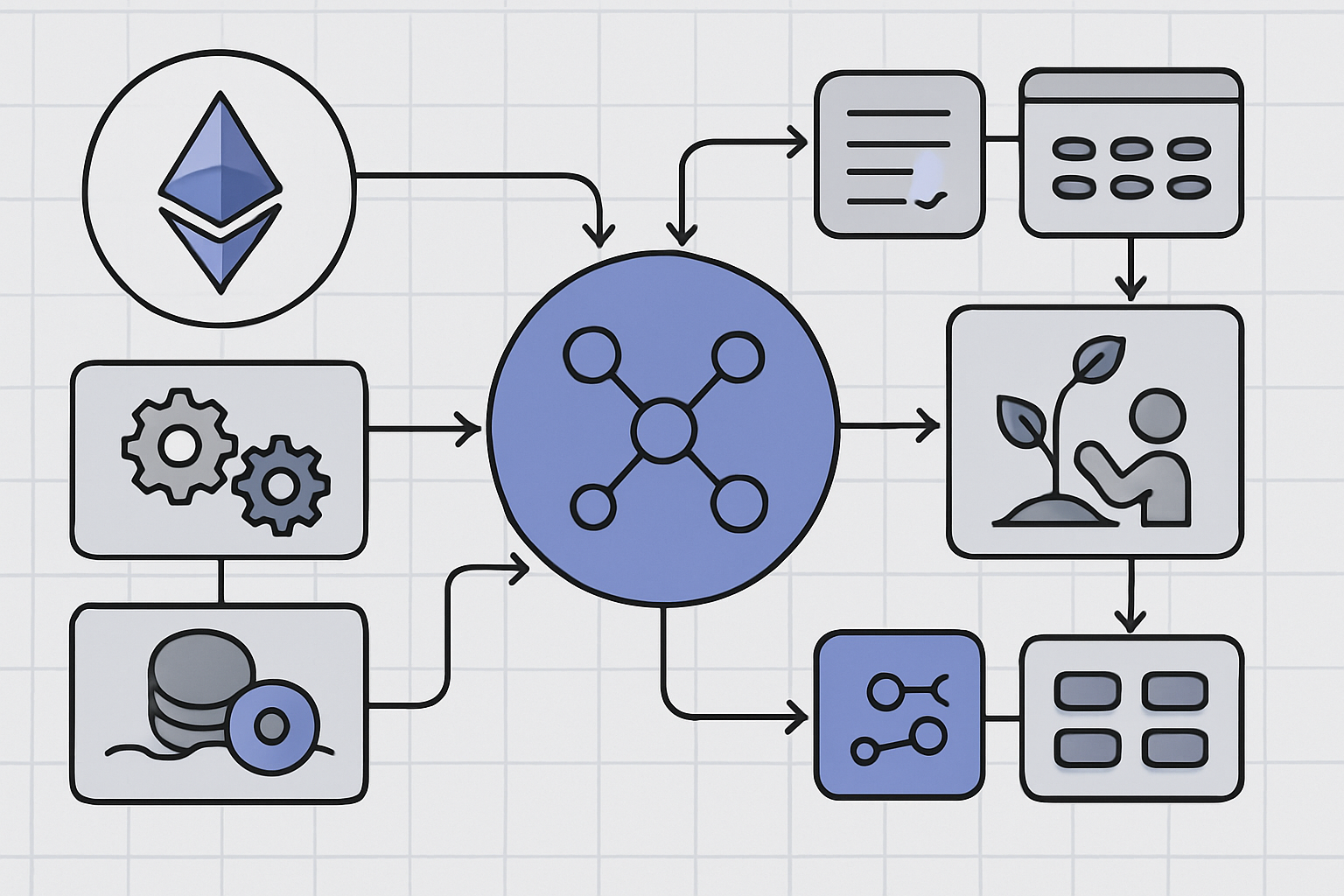

The secret behind Lighter’s explosive throughput is its innovative use of Ethereum blobs, introduced with the Dencun upgrade in March 2024. Blobs allow rollups to post large volumes of data to Ethereum’s mainnet efficiently and at a fraction of previous costs. Lighter capitalizes on this by publishing only about 100MB of data daily, even as it processes thousands of transactions per second.

This is possible because Lighter doesn’t post every transaction in full. Instead, it leverages state diffs: only the changes to account states are recorded and compressed into blobs. This dramatically reduces the data footprint while maintaining full verifiability for users and auditors.

The Architecture: State Diffs and App-Specific Design

Lighter’s architecture is purpose-built for high performance. Rather than serving as a generic Layer 2, it focuses on being an application-specific rollup, optimized for decentralized perpetuals trading. This focus enables more aggressive compression strategies and custom logic tailored to its user base.

The core innovation lies in how state information is handled. Instead of posting entire Merkle trees or account lists, Lighter publishes succinct state updates (diffs) that can be used by anyone to reconstruct their own balances or trade histories using data from Ethereum blobs. This not only keeps blob sizes minimal but also empowers users with direct access to verifiable proof of ownership, an essential feature for trustless finance.

Why This Matters for Scalability in 2024

The ability to achieve thousands of TPS while using just ~100MB/day is a paradigm shift for Ethereum scaling solutions. For context, many earlier rollups struggled with the tradeoff between throughput and cost due to calldata limitations and expensive Layer 1 storage fees. With blobs, these bottlenecks are eased, allowing projects like Lighter to leap ahead without compromising on decentralization or security.

This approach not only benefits traders seeking CEX-level performance on-chain but also sets a precedent for future app-specific rollups targeting other verticals, NFTs, gaming, payments, and beyond.

Ethereum (ETH) Price Prediction Table: 2026-2031

Reflecting the impact of ZK Rollup scaling (e.g., Lighter) and current market dynamics as of November 2025 ($3,428.89 ETH price)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Yearly % Change (Avg) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $2,850 | $3,700 | $4,800 | +7.9% | Consolidation after Dencun and rollup scaling; regulatory clarity improves |

| 2027 | $3,200 | $4,350 | $6,000 | +17.6% | Broader L2 adoption, DeFi resurgence, ETH ETF approval speculated |

| 2028 | $3,800 | $5,150 | $7,800 | +18.4% | Strong DeFi/NFT growth; ZK tech becomes mainstream; institutional inflows |

| 2029 | $4,200 | $5,950 | $9,200 | +15.5% | Global integration of ETH in fintech, continued scaling, moderate regulation |

| 2030 | $4,800 | $6,800 | $11,500 | +14.3% | ETH used widely in real-world assets, rollups drive mass adoption |

| 2031 | $5,400 | $7,650 | $13,800 | +12.5% | ETH cements position as leading programmable money; competition from new chains |

Price Prediction Summary

Ethereum’s price outlook remains robust, supported by major technological advances like ZK rollups (e.g., Lighter), Dencun upgrade (blobs), and expanding real-world adoption. While volatility is expected, the average price trend is upward, with significant upside in bullish scenarios as ETH’s utility and scalability drive institutional and retail demand.

Key Factors Affecting Ethereum Price

- Rollup scalability (e.g., Lighter’s 4,000+ TPS) boosts Ethereum’s throughput and lowers transaction costs, enhancing network value.

- Dencun upgrade and data blobs reduce L2 costs, supporting DeFi and NFT growth.

- Regulatory clarity and potential ETH ETF approvals could accelerate institutional adoption.

- Macro cycles: global economic recovery or downturns will influence capital flows into crypto.

- Competition from new L1s and alternative scaling solutions may introduce volatility.

- Real-world asset tokenization and ETH’s use in global fintech could drive demand.

- Security, decentralization, and continued developer activity remain crucial for long-term value.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Beyond the impressive raw numbers, Lighter’s approach signals a new era for Layer 2 scalability: by focusing on state diffs and leveraging Ethereum blobs, it achieves data efficiency that was previously out of reach. Every transaction processed on Lighter ultimately results in a minimal update to the global state, which is then compressed and published as part of a daily bundle. This not only slashes costs for users but also ensures that the rollup remains decentralized and censorship-resistant, since anyone can reconstruct their account from the posted blob data.

For developers and power users, this architecture offers something even more powerful: composability with transparency. By making all state transitions verifiable and public (yet privacy-preserving via ZKPs), Lighter enables a new generation of DeFi protocols to interoperate atop its infrastructure without sacrificing user sovereignty or auditability. This is particularly relevant as more teams look to build application-specific rollups tailored to unique workloads.

Comparing Lighter’s Efficiency to Other ZK Rollups

While several ZK rollups have made headlines for their scaling prowess, few have matched Lighter’s balance of throughput and data efficiency. Many generalized rollups still rely on posting full transaction lists or large Merkle roots, resulting in higher blob usage and cost per transaction. In contrast, Lighter’s app-specific model allows it to fine-tune what gets posted on-chain, maximizing TPS while minimizing mainnet bloat.

This efficiency isn’t just theoretical. According to recent market data, Lighter routinely posts just ~100MB/day while sustaining over 4,000 TPS, a level that positions it at the forefront of Ethereum scaling in 2024. For comparison, some legacy rollups would require several times that data footprint for similar throughput.

The Broader Impact: What Comes Next?

Lighter’s breakthrough is already influencing how other projects think about ZK rollup design. Expect more teams to adopt state diff-based publication, custom compression pipelines, and app-specific optimizations as standard practice for maximizing performance on Ethereum’s Layer 2 ecosystem.

The implications stretch far beyond just trading applications. As Ethereum continues to evolve, bolstered by upgrades like Dencun and new blob markets, these techniques will become foundational for everything from NFT marketplaces to decentralized gaming platforms seeking sub-second finality at scale.

The result? A future where Ethereum can support millions of users without congestion or prohibitive fees, all while preserving the network’s values of openness and verifiability.

Key Takeaways for Builders and Users

- Lighter demonstrates that high TPS doesn’t require massive data overhead, thanks to blobs and state diffs.

- App-specific rollup architectures unlock aggressive optimizations not feasible with generic solutions.

- ZK proofs ensure trustless verification while keeping user balances private yet auditable.

- The current ETH price ($3,428.89) reflects renewed confidence in scalable Layer 2 solutions driving network adoption.

Lighter’s success story is a compelling case study in how technical innovation can transform blockchain usability at scale. As more builders embrace these advancements, expect Ethereum’s capacity, and its ecosystem, to grow exponentially in the months ahead.