Ethereum’s persistent gas fee problem has long been a bottleneck for mainstream adoption, especially during periods of network congestion. In October 2025, with Ethereum priced at $3,846.82, the demand for scalable solutions is more urgent than ever. Enter zkRollups and, more specifically, zkSync: a Layer-2 protocol leveraging zero-knowledge proofs to slash transaction costs by as much as 90%. But how does this technology work under the hood, and why is zkSync’s approach so disruptive?

What Are zkRollups and How Do They Slash Gas Fees?

zkRollups are a class of Ethereum Layer-2 scaling solutions that bundle hundreds or thousands of transactions off-chain and submit a single cryptographic proof (a zero-knowledge validity proof) to the Ethereum mainnet. Instead of every transaction being individually processed and stored on-chain, zkRollups only post the necessary data and a succinct proof, dramatically reducing the amount of data clogging the base layer. This innovation leads to two core outcomes:

- Less on-chain data per transaction, which means lower gas consumption and reduced fees for users.

- Higher throughput, with zkRollups like zkSync now regularly exceeding 2,000 transactions per second (TPS): a massive leap from Ethereum’s base layer capabilities.

This mechanism directly addresses the root cause of high gas fees: network congestion and data bloat. As a result, users can transact on Ethereum at a fraction of the cost, with recent studies showing median gas fees on zkSync dipping as low as 0.00056 ETH during periods of high demand (see: arxiv. org).

zkSync’s Architecture: Efficiency Through Zero-Knowledge Proofs

zkSync’s architecture is built around zero-knowledge proofs, which allow the network to verify the correctness of off-chain transactions without revealing their contents. This not only preserves privacy but also ensures that transaction validity is mathematically guaranteed. Here’s how zkSync achieves its dramatic gas fee reduction:

- Transaction batching: Hundreds of user transactions are aggregated off-chain.

- Proof generation: A single succinct proof is computed to attest to the validity of the entire batch.

- On-chain submission: The proof and minimal transaction data are posted to Ethereum, where smart contracts verify the proof’s integrity.

By minimizing on-chain writes and maximizing computational efficiency off-chain, zkSync can offer average gas fees as low as $1 per transaction, even during network surges. This is a game-changer for DeFi, NFT marketplaces, and microtransaction-heavy dApps that previously struggled with the unpredictability of Layer-1 fees.

zkSync’s Innovations: Beyond Cheap Transactions

While gas fee reduction is the headline, zkSync introduces several additional features that further enhance the Ethereum experience:

- Native account abstraction: Users can pay gas fees in ERC-20 tokens, not just ETH, removing a major friction point for onboarding new users.

- zkPorter: A hybrid solution that combines zkRollups with sharding principles, enabling zkSync to scale beyond 20,000 TPS without compromising on security or decentralization.

- Environmental impact: By drastically reducing on-chain computation, zkSync slashes the carbon footprint of Ethereum transactions by up to 95% compared to traditional on-chain activity.

These advances make zkSync not just a cost-saving tool but a comprehensive upgrade to Ethereum’s usability and sustainability profile. For a more technical breakdown of how zkRollups achieve these efficiencies, see our in-depth guide at How zkRollups Improve Ethereum Gas Fees: A Technical Breakdown.

Ethereum (ETH) Price Prediction 2026–2031

Projections based on zkRollups adoption, zkSync scalability, and evolving market dynamics

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,200 | $5,700 | +9.2% | Adoption of zkSync grows; ETH stabilizes post-2025 rally |

| 2027 | $3,600 | $5,000 | $6,900 | +19.0% | DeFi and NFT resurgence powered by lower fees; regulatory clarity improves |

| 2028 | $4,100 | $5,800 | $8,300 | +16.0% | zkPorter scaling launches; ETH sees increased institutional interest |

| 2029 | $4,600 | $6,500 | $9,700 | +12.1% | Macro conditions favor digital assets; Layer-2 adoption widespread |

| 2030 | $5,200 | $7,200 | $11,000 | +10.7% | Ethereum 3.0 upgrade; competition from other L2s but ETH remains dominant |

| 2031 | $5,700 | $7,900 | $12,500 | +9.7% | Mature L2 ecosystem; mainstream finance and government adoption |

Price Prediction Summary

Ethereum is expected to maintain a steady upward trajectory through 2031, driven by widespread Layer-2 adoption (notably zkSync and zkPorter), lower transaction costs, and increasing transaction throughput. While short-term volatility remains, the overall trend is bullish, with average prices potentially doubling from current levels by 2031. Minimum and maximum ranges reflect both bearish (regulatory or competitive headwinds) and bullish (adoption, upgrades) scenarios.

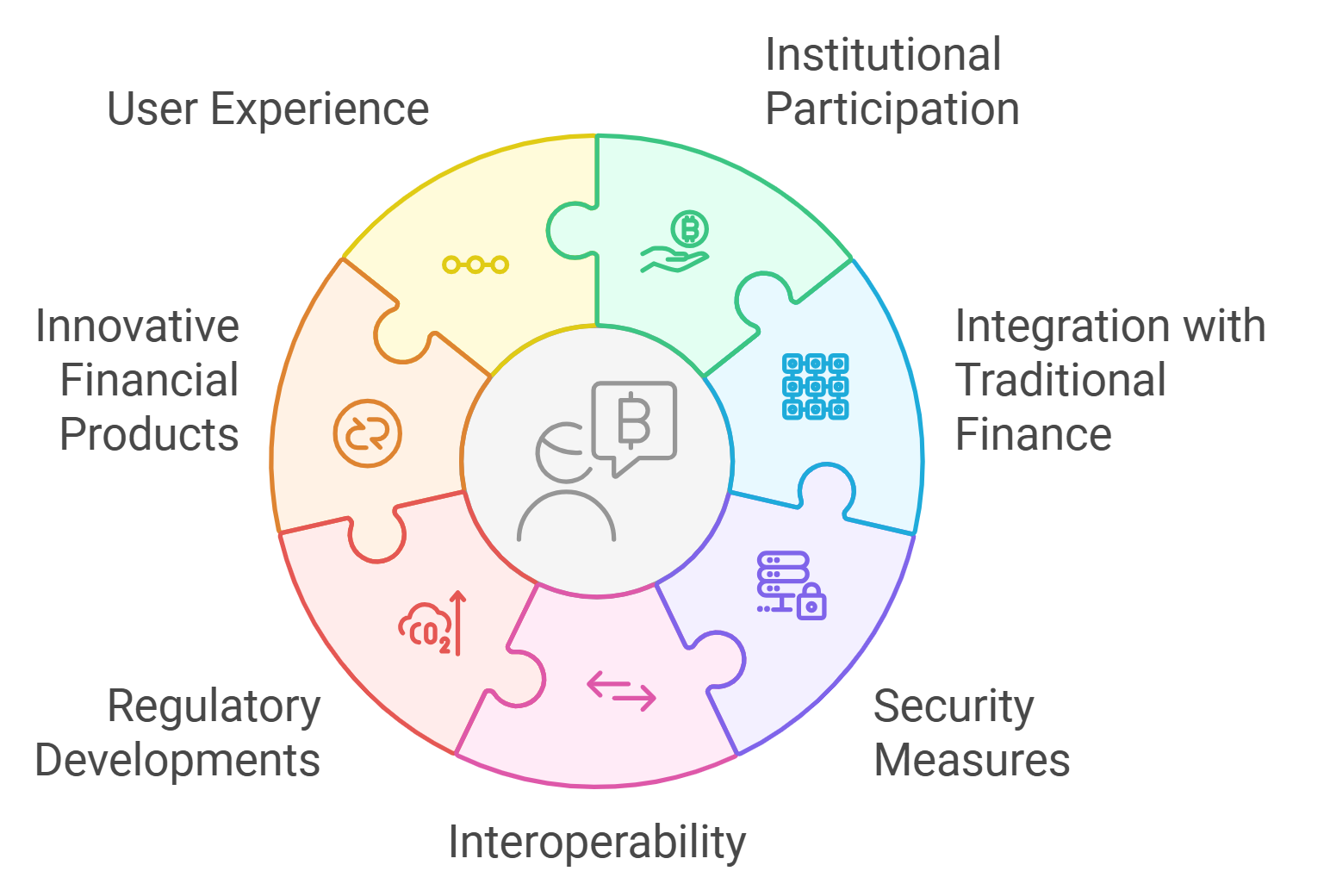

Key Factors Affecting Ethereum Price

- Rapid zkRollup and zkSync adoption reducing gas fees and boosting throughput

- Ethereum’s continued role as DeFi and NFT infrastructure backbone

- Potential regulatory shifts (global and US markets)

- Competition from other Layer-1 and Layer-2 solutions (e.g., Solana, Arbitrum, StarkWare)

- Macroeconomic environment (inflation, global risk appetite for crypto)

- Institutional adoption and integration with traditional finance

- Ethereum protocol upgrades (e.g., sharding, account abstraction)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Can zkSync Maintain Low Fees as Activity Surges?

One of the most critical questions is whether zkSync can sustain its low-fee model as adoption ramps up. Recent data from October 2025 indicates that even during spikes in transaction volume, zkSync’s median gas fees remained stable and significantly lower than those on the Ethereum mainnet. This resilience is attributed to the protocol’s ability to efficiently batch and prove ever-larger sets of transactions without increasing the on-chain data footprint.

As zkSync continues to attract both retail users and institutional DeFi protocols, its ability to maintain sub-$1 transaction fees becomes a litmus test for the scalability of Ethereum Layer 2. The protocol’s use of zero-knowledge proofs means that each additional user does not linearly increase the load on Ethereum’s base layer, a key distinction from earlier scaling approaches. Instead, as more transactions are batched together, the marginal cost per transaction decreases, reinforcing zkSync’s economic moat in the Layer-2 landscape.

However, there are still challenges ahead. Sequencer decentralization remains a hotly debated topic – currently, zkSync operates with a centralized sequencer, which some critics argue could become a bottleneck or point of failure. The team has committed to progressive decentralization, with plans to hand off sequencer duties to a network of independent operators in the coming year. This transition will be crucial for ensuring censorship resistance and trust minimization as zkSync scales toward mainstream adoption.

The Economic Impact: DeFi, NFTs, and Beyond

The implications of zkRollups gas fee reduction extend far beyond simple transfers. For decentralized exchanges (DEXs), lending protocols, and NFT platforms built atop Ethereum, lower transaction costs fundamentally alter business models. Microtransactions become viable, high-frequency trading strategies are unlocked for smaller players, and NFT minting is no longer prohibitively expensive during periods of high demand. This paradigm shift is already visible in the rapid migration of DeFi projects to zkSync Era and similar rollup-based environments.

Top 5 Real-World Use Cases Leveraging zkSync’s Low Gas Fees

-

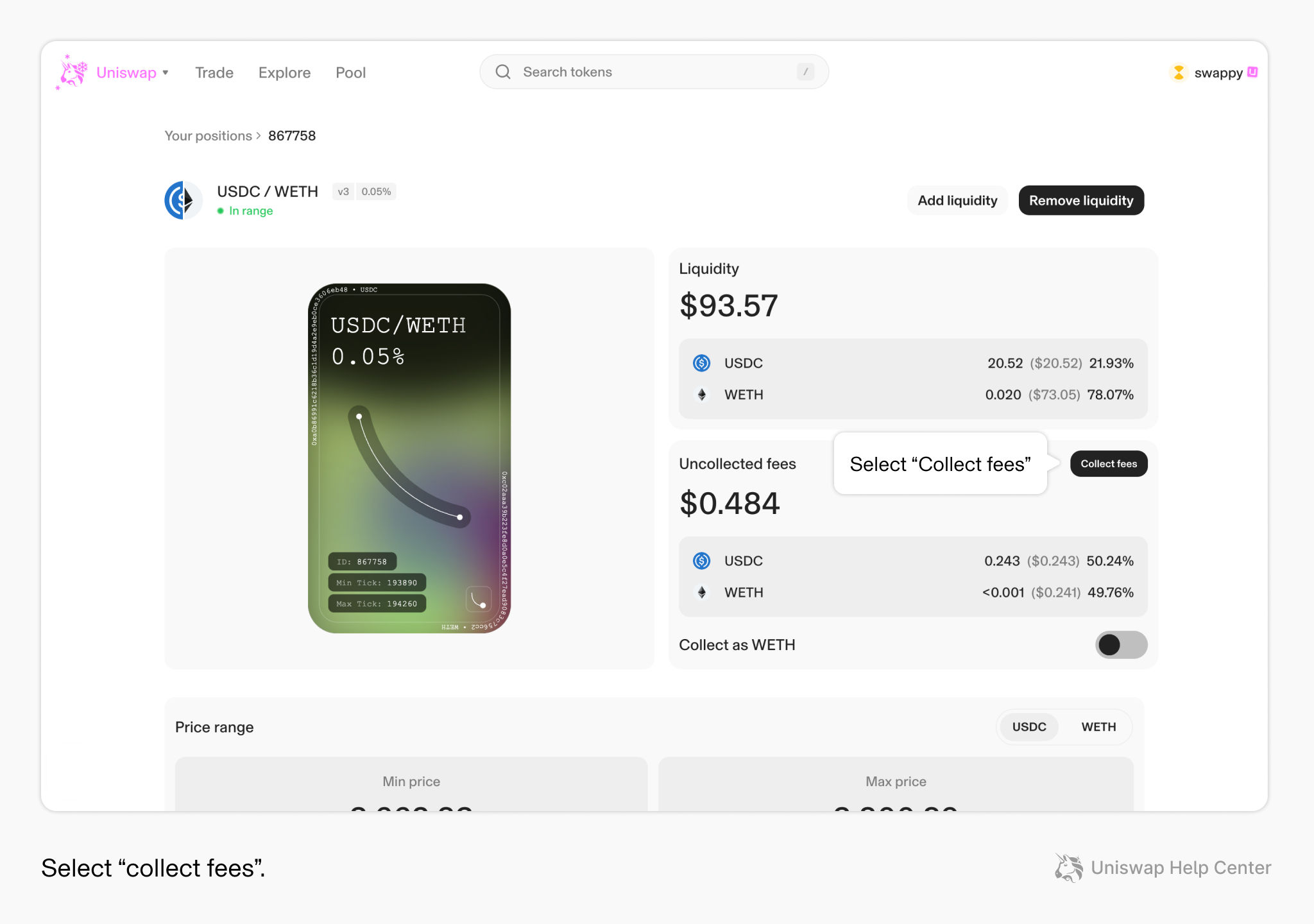

Decentralized Exchanges (DEXs): Uniswap v3 on zkSync Era – By integrating with zkSync Era, Uniswap v3 enables users to swap tokens with gas fees as low as $1, compared to much higher costs on Ethereum mainnet. This makes high-frequency trading and small-value swaps economically viable for a broader user base.

-

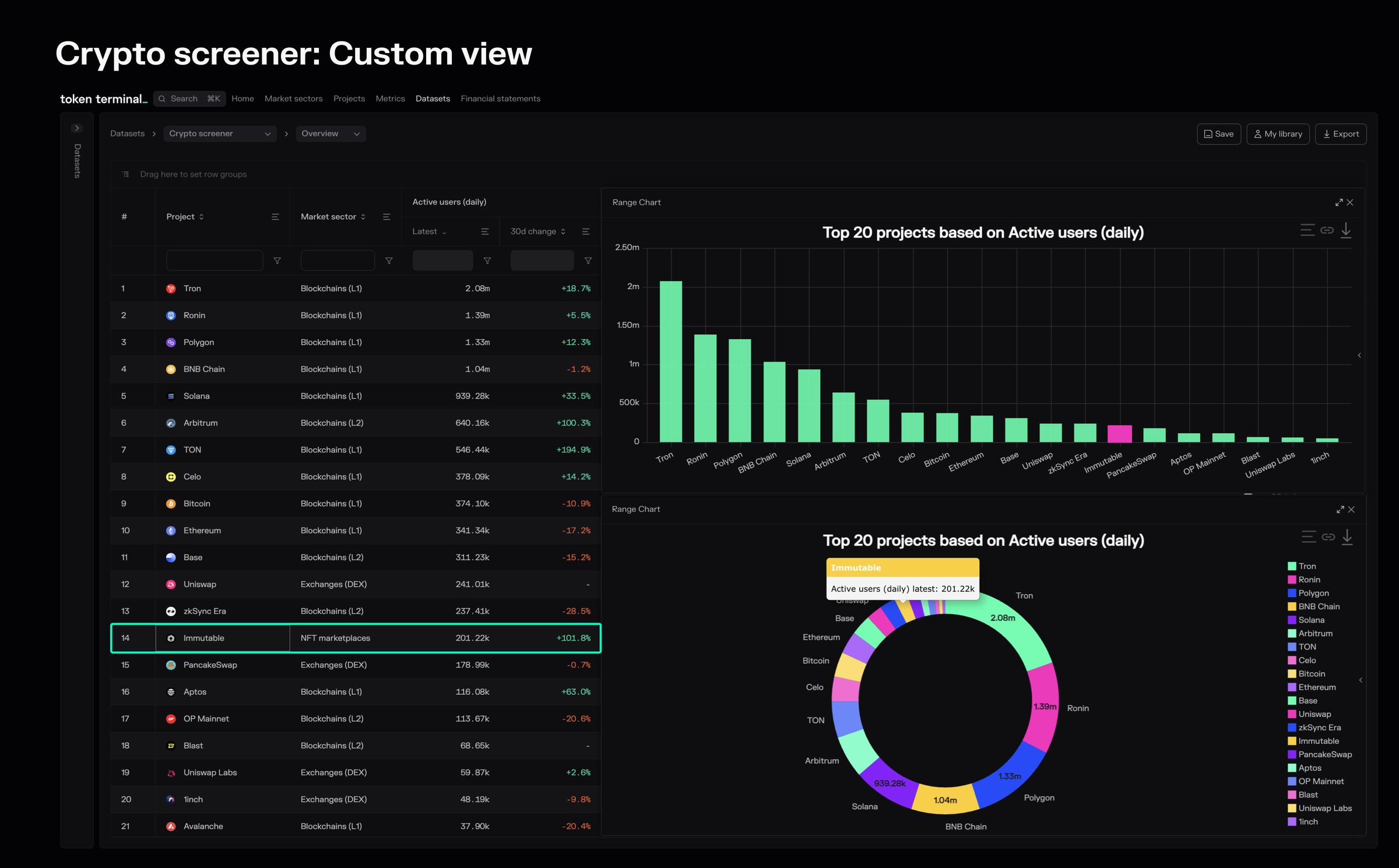

NFT Marketplaces: Immutable zkEVM and zkSync – Platforms like Immutable leverage zkSync to drastically reduce minting and trading costs for NFTs, enabling affordable digital asset creation and transfer without sacrificing Ethereum’s security.

-

Payments and Remittances: Ramp Network on zkSync – Ramp Network utilizes zkSync to facilitate low-cost, instant crypto payments and fiat on-ramps, making microtransactions and cross-border remittances accessible and efficient.

-

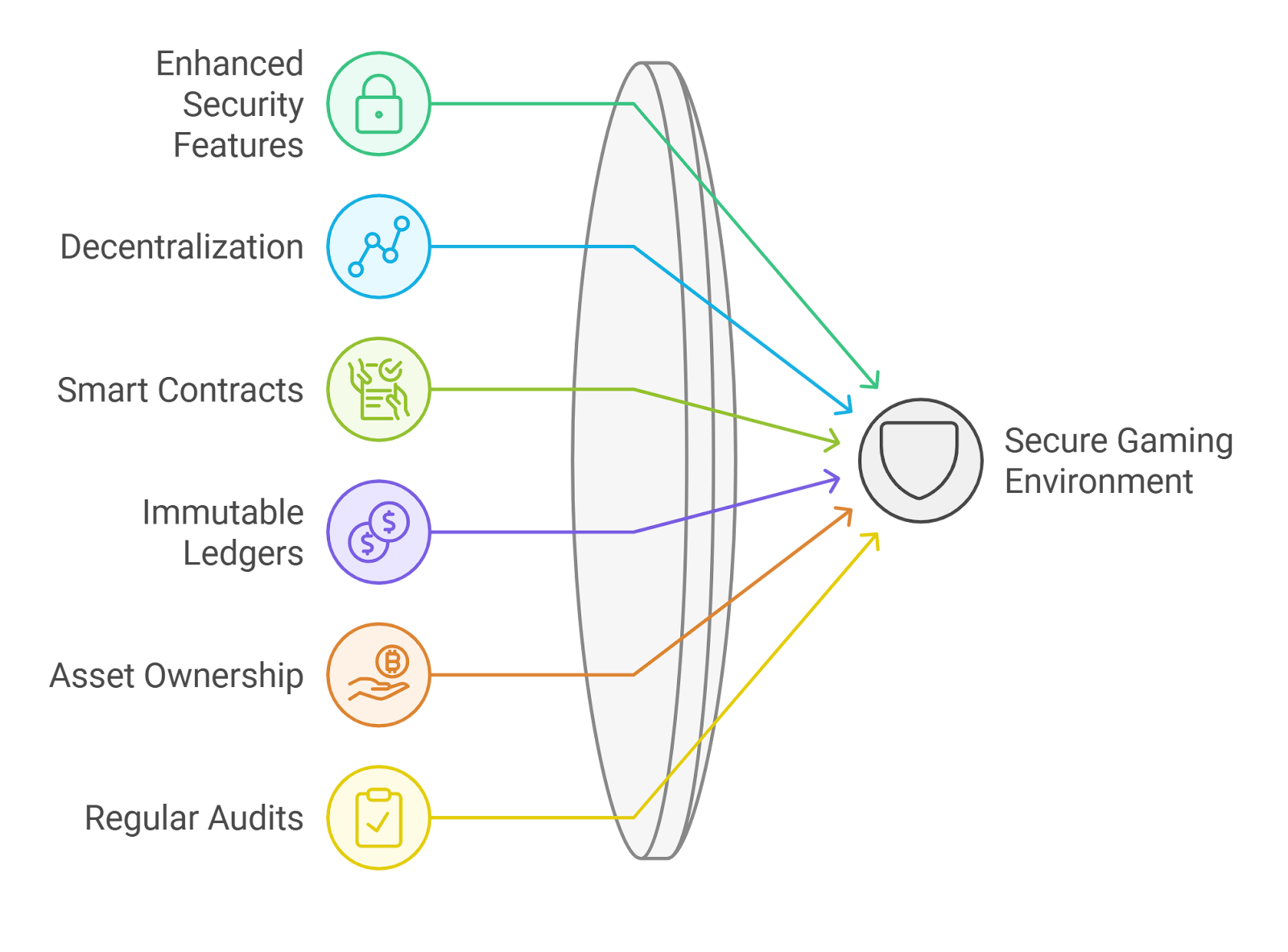

Gaming and Play-to-Earn: zkSync-Powered Web3 Games – Web3 gaming platforms like Axiom Games use zkSync to enable in-game asset transfers and microtransactions with negligible gas fees, supporting scalable play-to-earn economies.

-

DeFi Lending and Yield Platforms: Yearn Finance on zkSync – Yearn Finance is expanding to zkSync, allowing users to deposit, withdraw, and claim yields with minimal transaction costs, making DeFi more accessible and sustainable for smaller investors.

From a user perspective, the ability to pay fees in stablecoins or other ERC-20 tokens removes a persistent onboarding hurdle. For developers, predictable and low transaction costs enable experimentation with new dApp designs that were previously impractical on Layer 1 due to cost constraints.

Looking Ahead: The Future of zkRollups on Ethereum

With Ethereum holding steady at $3,846.82, the pressure to deliver scalable solutions remains intense. As competitors like StarkWare and Scroll advance their own zero-knowledge rollup architectures, zkSync’s continued innovation – from account abstraction to hybrid sharding via zkPorter – positions it as a frontrunner in the race for Ethereum Layer-2 dominance.

Yet, true mass adoption will hinge not only on technical prowess but also on user education and seamless integration with existing wallets and exchanges. If zkSync can successfully decentralize its sequencer layer while maintaining its trademark low fees and high throughput (now regularly exceeding 2,000 TPS), it may well serve as the blueprint for how zero-knowledge technology transforms blockchain usability at scale.

Research is the foundation of conviction. As always, ongoing monitoring of network performance metrics and fee stability will be crucial for investors and builders alike navigating this rapidly evolving ecosystem.