As Bitcoin trades at $112,055.00, its ecosystem is undergoing a structural transformation. For years, Bitcoin’s base layer has been considered secure but limited in programmability and scalability, restricting its role in the decentralized finance (DeFi) movement. However, the introduction of zk rollups on Bitcoin is rapidly changing this narrative. At the forefront is GOAT Network, a project that has launched the first production-ready zk rollup tailored for Bitcoin, unlocking native BTC yield and scalable DeFi applications without compromising security or decentralization.

Bitcoin at $112,055: Why Scaling Solutions Matter More Than Ever

Bitcoin’s recent surge past the $100,000 threshold has intensified pressure on its infrastructure. High-value transactions and increased user demand are straining block space and fee markets. Traditional scaling solutions like Lightning Network have improved payments but fall short for complex DeFi operations or yield strategies that require composability and programmability.

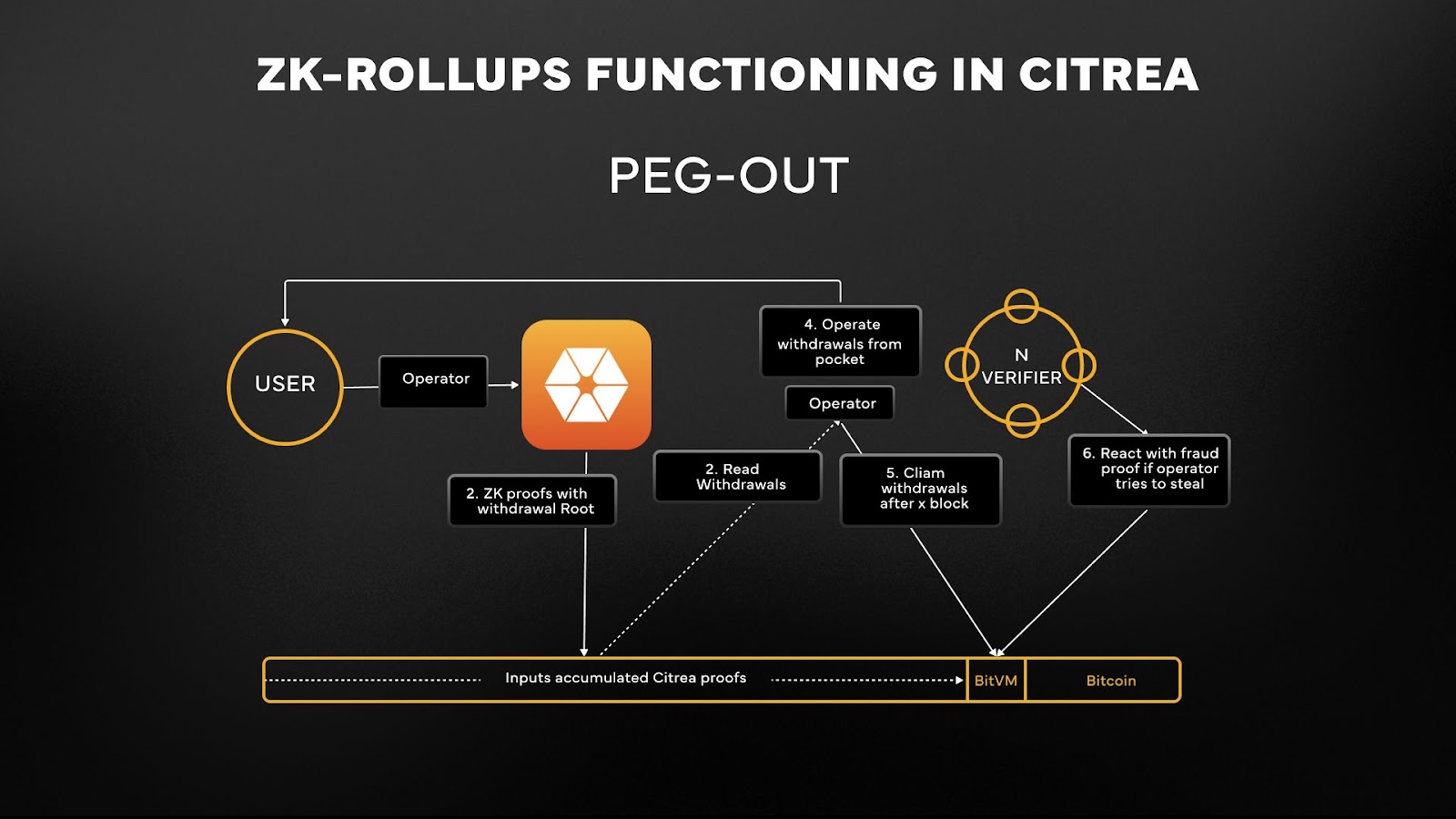

This is where zk rollups emerge as a pivotal solution. By batching transactions off-chain and submitting succinct validity proofs to the mainnet, zk rollups deliver higher throughput and lower costs while inheriting Bitcoin’s security guarantees. Yet, implementing this technology on Bitcoin poses unique challenges due to its scripting limitations and consensus rigidity, a problem GOAT Network claims to have solved through technical innovation.

The GOAT Network Architecture: Universal Operators and Real-Time Proving

GOAT Network’s architecture introduces several breakthroughs for bringing scalable DeFi natively to Bitcoin:

- Universal Operator Role: Unlike Ethereum-based rollups where sequencing, proving, and publishing are siloed roles (often leading to centralization), GOAT unifies these into a single rotating operator identity. This rotation ensures fair profit distribution, balanced costs, and lowers entry barriers for smaller participants, key for decentralization.

- Multi-Round Challenge Model: Security is enhanced by randomly assigning challengers who verify transaction correctness in successive rounds. This reduces finality time from weeks to under 24 hours, crucial for DeFi users seeking liquidity agility.

- Dual-Slashing Incentives: GOAT enforces honest participation with penalties for both operators and challengers at both Layer 1 and Layer 2 levels, deterring collusion or malicious activity.

The network’s BitVM2 Beta testnet demonstrates real-time proving capabilities, a major leap forward. With block proofs generated in roughly 2.6 seconds and SNARK proofs in about 10.38 seconds (thanks to a distributed GPU prover network), users can withdraw assets almost instantly after proof generation instead of waiting days or weeks.

Sustainable BTC Yield: Native DeFi Without Custodial Risk

A core value proposition of bitcoin DeFi zk technology is enabling users to earn yield directly on their BTC holdings, without relinquishing custody or relying on centralized intermediaries. GOAT Network offers products like ‘GOAT Safebox, ’ which provides a non-custodial 2% APY in native BTC, an unprecedented offering given Bitcoin’s historical lack of yield-generating primitives outside of mining or lending platforms with rehypothecation risk.

The network’s architecture supports both low-risk options (like Safebox) and higher-yield strategies tailored to varying risk appetites, all secured by transparent smart contracts enforced by zk rollup logic rather than opaque off-chain arrangements.

Key Features of GOAT Network’s zk Rollup Architecture

-

Universal Operator Rotation: GOAT Network introduces a rotating ‘Universal Operator’ role, unifying sequencing, proving, and publishing under a single identity. This rotation ensures balanced cost/profit distribution and promotes decentralization by lowering entry barriers for smaller participants.

-

Multi-Round Challenge Model: The architecture implements a multi-round challenge process, where randomly assigned challengers verify transactions in successive rounds. This reduces withdrawal finality time from two weeks to under 24 hours, enhancing both security and user experience.

-

Aligned Incentives & Dual-Slashing Mechanism: GOAT Network’s economic model features role rotation and cross-subsidization, with penalties for dishonest behavior. A dual-slashing mechanism on both Layer 1 and Layer 2 deters malicious actors and secures the network.

-

Real-Time Proving via Distributed GPU Prover Network: The BitVM2 Beta testnet enables real-time proof generation, with block proofs processed in approximately 2.6 seconds and SNARK proofs in about 10.38 seconds. This allows immediate withdrawals and improved asset liquidity.

-

Native, Sustainable BTC Yield Products: GOAT Network offers chain-level Bitcoin yield options, such as ‘GOAT Safebox,’ providing non-custodial, risk-free yield of 2% APY in native BTC. These products let users earn real BTC yield without centralized custody or mining rigs.

The Competitive Edge: Decentralized Sequencers and Permissionless Participation

A significant differentiator for GOAT Network is its decentralized sequencer design, an aspect often criticized in other L2 projects for being too centralized or opaque. By rotating operator roles among participants using cryptographic randomness, GOAT minimizes MEV extraction risks while maximizing network fairness.

Bitcoin (BTC) Price Prediction Table: 2026–2031 (Impact of ZK Rollup & DeFi Adoption)

Forecasts incorporate the latest advancements in Bitcoin-native zkRollup technology, DeFi yield products, and evolving global crypto market conditions. Prices are based on a current BTC price of $112,055 (as of October 2025).

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Annual % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $88,000 | $124,000 | $162,000 | +10.7% | Post-halving volatility; early ZK Rollup DeFi adoption |

| 2027 | $101,000 | $145,000 | $195,000 | +16.9% | Steady DeFi growth; ZK Rollup scaling matures; institutional entry |

| 2028 | $120,000 | $172,000 | $238,000 | +18.6% | Bitcoin DeFi mainstream; improved regulatory clarity |

| 2029 | $138,000 | $202,000 | $285,000 | +17.4% | Layer 2 ecosystem expansion; robust BTC yield markets |

| 2030 | $158,000 | $238,000 | $338,000 | +17.8% | Wider real-world adoption; competition from other L1s |

| 2031 | $178,000 | $275,000 | $400,000 | +15.5% | Global institutional integration; ZK Rollup tech standardizes |

Price Prediction Summary

Bitcoin is poised for a new era of growth driven by the maturation of native DeFi protocols enabled by ZK Rollup technology. While short-term volatility remains, the integration of scalable, secure, and yield-generating infrastructure like GOAT Network positions BTC for sustained upward momentum. By 2031, average prices could reach $275,000, with bullish scenarios exceeding $400,000 if adoption accelerates and macro conditions remain favorable. Bearish outcomes, while less likely, reflect potential regulatory headwinds or broader risk-off events.

Key Factors Affecting Bitcoin Price

- Widespread adoption of ZK Rollups and Bitcoin-native DeFi protocols (e.g., GOAT Network)

- Increased BTC utility through yield generation and non-custodial DeFi products

- Regulatory clarity and institutional acceptance of Bitcoin and related DeFi yields

- Market cycles, including post-halving supply shocks and macroeconomic trends

- Competition from alternative Layer 1s and rollup technologies

- Network security and resilience of new Layer 2 models (e.g., operator rotation, dual-slashing)

- Broader crypto market sentiment and global economic factors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This approach not only improves the user experience for BTCFi applications but also broadens access for a new class of participants. Small-scale operators, previously priced out by high collateral requirements or technical complexity, can now contribute to sequencing and proving, strengthening the network’s resilience and decentralization. The permissionless entry model aligns incentives across the ecosystem, reducing points of failure and making it harder for any single entity to dominate transaction ordering or proof generation.

Security remains at the forefront. By combining dual-slashing with multi-round challenges, GOAT Network addresses both external and internal risks. Operators and challengers are held accountable on both Layer 1 and Layer 2; this creates a robust deterrent against collusion or inactivity that could threaten user funds or network liveness. The system’s transparency is further reinforced by open-source smart contracts and on-chain auditability, allowing stakeholders to independently verify protocol mechanics, an essential feature for institutional adoption in the evolving BTCFi landscape.

BTC Yield in a $112,055 Market: Redefining Bitcoin’s Utility

With Bitcoin holding firm at $112,055.00, yield generation is no longer an afterthought but a core demand among holders seeking productive assets in a high-value environment. GOAT Network’s suite of products, from Safebox (risk-free 2% APY) to advanced DeFi strategies, offers a spectrum of opportunities for users who want exposure to native BTC yield without sacrificing security or self-custody.

Importantly, these products are not mere wrappers around synthetic assets or IOUs. Yields are paid directly in native BTC, with all processes governed by transparent zk rollup logic rather than centralized intermediaries. This shift could catalyze a new era for Bitcoin as a programmable asset base for decentralized finance, potentially rivaling Ethereum in composable financial primitives while retaining its unique security model.

Key Benefits of Earning BTC Yield via Non-Custodial ZK Rollups

-

Native BTC Yield Without Centralized Custody: Solutions like GOAT Network allow users to earn real Bitcoin yield (e.g., 2% APY via GOAT Safebox) directly on-chain, eliminating the need to trust centralized platforms or custodians with your assets.

-

Enhanced Security Through Zero-Knowledge Proofs: ZK Rollups aggregate and validate transactions with cryptographic proofs, ensuring asset safety and privacy while inheriting Bitcoin mainnet security. This minimizes attack surfaces compared to traditional custodial or multi-sig DeFi platforms.

-

Faster Withdrawals and Improved Liquidity: GOAT Network’s multi-round challenge model and real-time proving architecture reduce withdrawal latency from weeks to under 24 hours, allowing users to access their BTC quickly without compromising security.

-

Decentralized Sequencing and Operator Rotation: By rotating the Universal Operator role among participants, GOAT Network ensures fair cost/profit distribution, reduces centralization risks, and lowers entry barriers for smaller users.

-

Aligned Incentives and Robust Slashing Mechanisms: Honest participation is incentivized through dual-slashing on both Layer 1 and Layer 2, deterring malicious activity and fostering a trustworthy environment for yield generation.

-

Lower Transaction Costs and Higher Efficiency: ZK Rollup technology batches transactions, reducing on-chain fees and increasing throughput, making BTC yield strategies more cost-effective for participants.

-

Permissionless, Transparent, and Auditable Yield Generation: All yield strategies and transaction flows are verifiable on-chain, giving users full transparency and auditability over how their BTC is deployed and yields are generated.

Challenges Ahead: Adoption Hurdles and Ecosystem Maturation

Despite these advancements, several roadblocks remain before zk rollups on Bitcoin reach mass adoption. Onboarding developers familiar with Ethereum-style smart contracts will require continued tooling improvements and educational outreach. Liquidity migration from centralized platforms may be gradual as users test the robustness of new protocols like GOAT Network under real-world stress scenarios. Regulatory clarity around non-custodial DeFi remains an open question globally.

Nevertheless, GOAT Network’s progress signals that Bitcoin-native DeFi is not just possible but increasingly practical at scale, especially as market participants seek alternatives to custodial risk amid volatile price swings like those seen with Bitcoin’s current valuation at $112,055.00. The protocol’s blend of decentralized infrastructure, transparent incentives, rapid finality, and sustainable yields positions it as a bellwether for future scaling solutions across major blockchains.

The Road Ahead: What ZK Rollups Mean for Bitcoin’s Future

The integration of zk rollup yield bitcoin models into the world’s most valuable blockchain represents more than just technical progress, it marks an ideological shift toward unlocking utility without compromising core principles like self-sovereignty and censorship resistance. If GOAT Network’s model proves resilient under wider adoption, it could set precedent for how other UTXO-based chains approach scalability and programmability.

The coming year will be pivotal as more users interact with these systems during periods of high volatility and as institutional players evaluate their risk-return profiles versus traditional custodial offerings. For now, projects like GOAT Network are redefining what it means to put idle BTC to work, and challenging assumptions about what is possible within Bitcoin’s famously conservative architecture.