Blockchain scalability has long been a bottleneck for real-time decentralized applications. Yet, a new solution is emerging from the heart of Solana’s ecosystem: ephemeral rollups. These temporary, high-throughput execution environments are redefining what’s possible for both developers and users, especially as Solana’s native token (SOL) currently trades at $221.66. The concept is simple but powerful: create elastic capacity only when needed, then seamlessly vanish without fragmenting state or liquidity.

What Are Ephemeral Rollups?

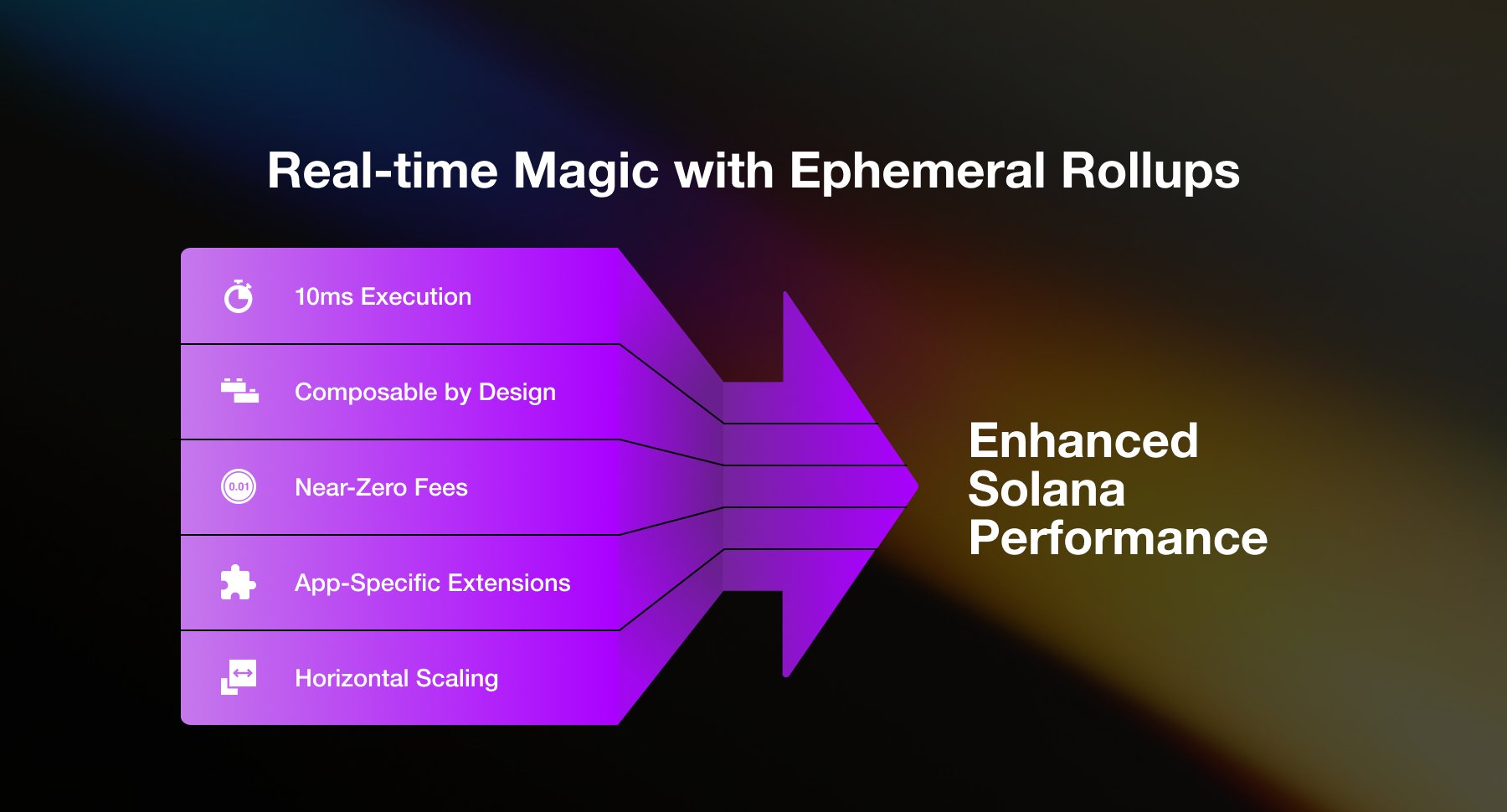

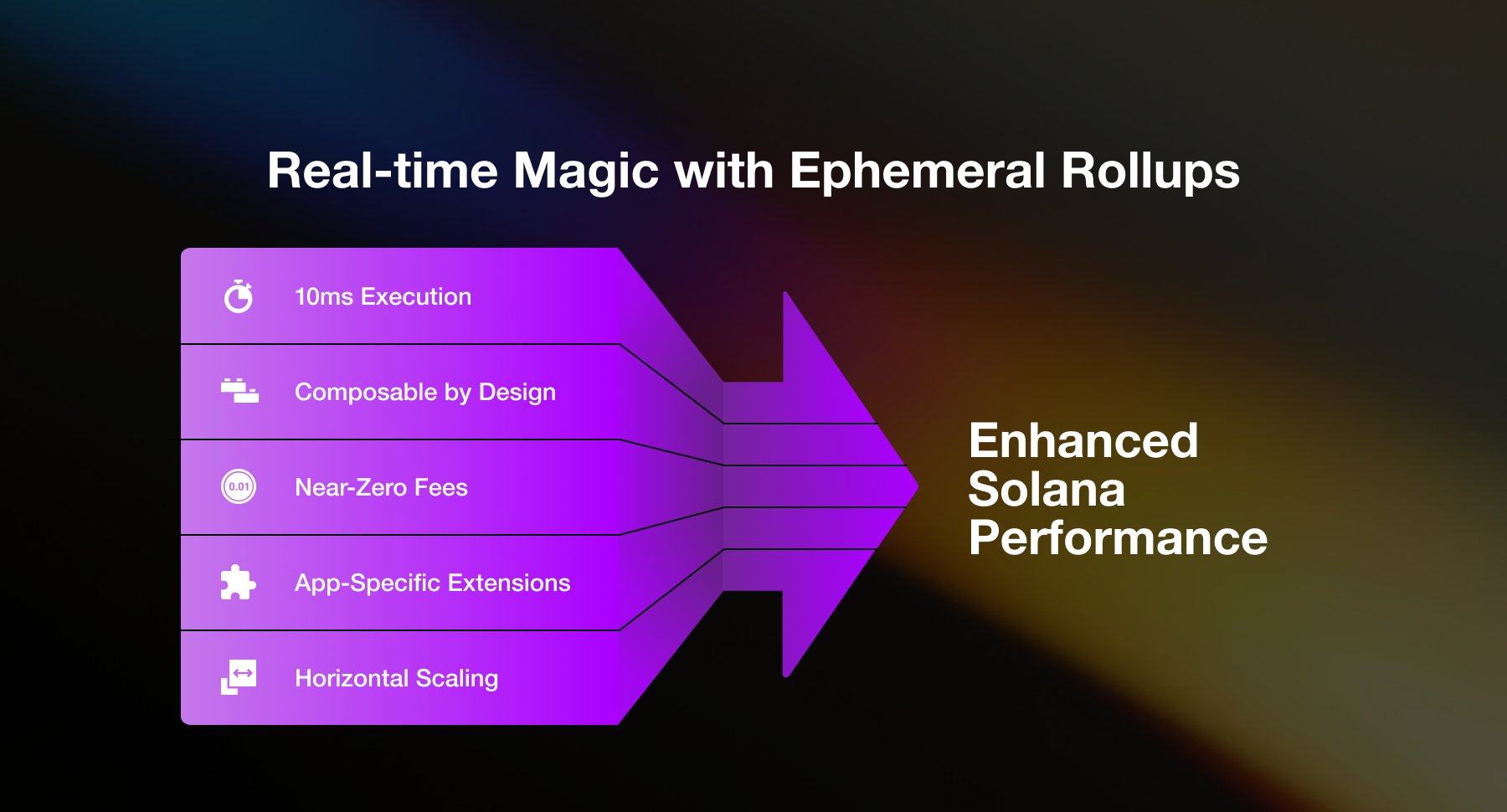

Ephemeral rollups (ERs) are not your typical layer 2 solution. Unlike traditional rollups that persistently process transactions off-chain and periodically settle back to the base layer, ERs are temporary, spinning up on demand to handle bursts of activity, think high-frequency trading, fully on-chain games, or live auctions, before settling their final state back to Solana’s mainnet. This model delivers latencies as low as 10 milliseconds, a game-changer for applications where responsiveness is non-negotiable.

The architecture leverages a non-voting instance of the Solana Virtual Machine (SVM), running parallel to the main network. When demand spikes, an ER can be spun up to process transactions at scale; when activity subsides, it dissolves, returning all state and liquidity to the main chain without fragmentation or trust compromises. This approach introduces true elastic blockchain scaling, providing adaptive infrastructure that matches real-world usage patterns.

Solana’s Edge: Low-Latency and Composability Without Bridges

Solana has always positioned itself as a high-performance blockchain, but ephemeral rollups take this ethos further. By allowing execution environments to exist only as long as needed, and directly integrating with Solana’s SVM, developers avoid the headaches of bridges, fragmented liquidity pools, and cumbersome cross-chain communication. The result is full composability: assets and data flow freely between ERs and the main chain without friction.

This innovation is particularly impactful for blockchain gaming and DeFi protocols that require both scale and real-time feedback. As highlighted by MagicBlock’s Bolt framework, ERs provide dedicated run-times for fully on-chain games (source). Players experience near-instantaneous actions while developers maintain confidence in security and settlement finality.

Economic Implications: Liquid Blockspace Meets Adaptive Demand

The economic model underlying ephemeral rollups is as innovative as its technical implementation. By creating “liquid blockspace” that can be allocated elastically, Solana avoids persistent over-provisioning while still supporting dramatic surges in demand. This is particularly relevant in today’s market context, with SOL at $221.66, even modest transaction fees can translate into significant revenue when processed at scale during peak events.

This adaptive approach also addresses longstanding concerns about state fragmentation and network congestion that have plagued other scaling efforts. Instead of siloing liquidity or requiring complex bridges between networks, ERs ensure that all value remains composable within Solana’s ecosystem. For a deeper dive into how this model unlocks scalable DeFi and gaming experiences without compromising trust assumptions or fragmenting user assets, see this detailed analysis.

Pushing Beyond Solana: Elastic Scaling Across Ecosystems

The principles behind ephemeral rollups aren’t limited to Solana alone. Other ecosystems are taking note, Polkadot has introduced elastic scaling for parachains by enabling multiple cores per relay chain block and reducing block times to just two seconds. But it’s on Solana where the synergy between high-speed execution and composable architecture is most fully realized today.

This cross-pollination of ideas signals a broader shift in blockchain design philosophy, from static resource allocation toward truly adaptive infrastructure capable of responding instantly to unpredictable demand spikes. As more networks experiment with temporary rollup architectures and liquid blockspace concepts, we’re witnessing the dawn of a new era in scalable decentralized application development.

For developers, the emergence of ephemeral rollups unlocks a new paradigm: build for peak demand without overcommitting resources or fragmenting user experience. The ability to spin up high-throughput environments on demand means that real-time applications, whether in gaming, trading, or social dApps, can remain both performant and economically viable. This is especially crucial as latency expectations tighten and user bases grow more global and demanding.

From a technical perspective, ERs also sidestep many of the pitfalls that have historically dogged layer 2 solutions. By avoiding persistent sidechains or bridges, they eliminate many attack vectors related to cross-chain settlement and liquidity fragmentation. Every transaction ultimately settles back to Solana’s base layer, preserving both security guarantees and composability. This is a significant leap forward compared to previous attempts at horizontal scaling, which often sacrificed either trust assumptions or seamless user experience.

Key Benefits for Real-Time Blockchain Applications

Key Benefits of Ephemeral Rollups for dApps

-

Ultra-Low Latency Execution: Ephemeral Rollups enable transaction processing with latencies as low as 10 milliseconds, making them ideal for real-time applications like on-chain gaming and high-frequency trading. This is a significant leap over traditional blockchain execution speeds.

-

Elastic, On-Demand Scalability: Developers can spin up high-performance execution environments only when needed, thanks to the elastic scaling model. This adaptive capacity ensures resources are efficiently allocated without over-provisioning or wasted costs.

-

No State Fragmentation or Liquidity Silos: Unlike many layer 2 solutions, Ephemeral Rollups maintain full composability with Solana’s mainnet. dApps and users avoid the pain of bridges and fragmented liquidity, enabling seamless asset and data flow.

-

Enhanced Security via Mainnet Settlement: Transactions executed in Ephemeral Rollups are settled back to Solana’s main chain, leveraging its robust security model and consensus without sacrificing speed or decentralization.

-

Customizable Runtime Environments: Developers can configure Ephemeral Rollups to suit specific dApp requirements—such as custom logic for games or DeFi protocols—without affecting the core Solana network or requiring separate infrastructure.

-

Cost-Efficient Scaling for dApps: By utilizing compute resources only when demand spikes, Ephemeral Rollups help dApps minimize operational costs compared to always-on scaling solutions, making high-performance blockchain applications more economically viable.

These benefits extend beyond just performance metrics. For instance, fully on-chain games can now offer true real-time interactivity without the lag or bottlenecks that previously limited gameplay mechanics on blockchains. DeFi protocols can dynamically scale during periods of volatility, handling sudden influxes of arbitrageurs or liquidators without risking network congestion or price oracle delays.

Perhaps most importantly, ephemeral rollups represent a step toward adaptive blockchain infrastructure. Instead of treating blockspace as a fixed commodity, Solana (and soon other chains) are beginning to treat it as a fluid resource, allocated precisely when and where it’s needed most. This is the foundation for scalable DeFi, next-generation gaming experiences, and any application where responsiveness is paramount. For further reading on how temporary app chains unlock elastic scalability in practice, refer to this resource.

The Road Ahead: Challenges and Open Questions

Despite their promise, ephemeral rollups are not without challenges. Managing state transitions between temporary environments and the base chain requires robust coordination protocols, a nascent area still being actively developed by teams like MagicBlock. Security assumptions must be rigorously tested to ensure that short-lived execution environments don’t inadvertently introduce new vulnerabilities.

Moreover, questions remain around how best to incentivize validators participating in these transient SVM instances. Will fee markets for ephemeral rollup blockspace be sufficient to attract reliable operators? And how will governance adapt as elastic scaling becomes more prevalent across ecosystems?

“Ephemeral rollups are doing for blockchain what cloud computing did for enterprise IT: making capacity elastic, affordable, and available on-demand. “

The answers will shape not just Solana’s trajectory but potentially set new standards across all high-performance blockchains seeking to balance speed with decentralization.

Market Context: SOL at $221.66, A Platform Ready for Scale

With SOL holding steady at $221.66, the market is signaling confidence in Solana’s ability to deliver on its scalability promises. As demand for low-latency dApps rises, and with innovations like ephemeral rollups reducing friction, Solana is uniquely positioned to capture developer mindshare in sectors that require both speed and security.

A Glimpse Into the Future of Elastic Blockchain Scaling

The rise of ephemeral rollups marks an inflection point in blockchain infrastructure design: adaptive capacity is no longer theoretical but operational today on Solana’s mainnet. As more projects leverage this technology, especially those building real-time games or scalable DeFi protocols, the boundaries between base layers and execution environments will continue to blur.

For those watching closely, the message is clear: elastic blockchain scaling isn’t just possible, it’s already reshaping what decentralized applications can achieve in practice.

If you’re interested in exploring further technical details or use cases around temporary app chains and their impact on modular blockchain scalability, see this analysis.