Ethereum’s ongoing scalability and privacy challenges have driven a wave of innovation in layer-2 solutions. Among these, zkSync’s zkEVM stands out for its ability to bring scalable private smart contracts to the Ethereum ecosystem without sacrificing security or developer experience. With Ethereum currently trading at $4,486.58, network congestion and high gas fees remain hot topics for both users and developers. zkSync’s approach leverages the power of zero-knowledge proofs to address these pain points, making it a crucial player in the race for mass blockchain adoption.

How zkSync’s zkEVM Works: Zero-Knowledge Scaling Meets EVM Compatibility

The core innovation behind zkSync’s zkEVM is its use of zero-knowledge rollups (zk rollups). These rollups bundle hundreds of transactions off-chain, generate a succinct cryptographic proof, and post only this proof and minimal data back to Ethereum mainnet. This dramatically reduces on-chain data requirements while ensuring transactions remain secure and verifiable by anyone.

What sets zkSync apart is its deep compatibility with the existing Ethereum Virtual Machine (EVM). Developers can deploy their Solidity or Vyper smart contracts with minimal changes, thanks to an LLVM-based compiler tailored for zero-knowledge execution. This means existing dApps can migrate or extend functionality onto zkSync Era without learning an entirely new tech stack or rewriting code from scratch.

Privacy by Design: Enabling Confidential Smart Contracts

The privacy benefits of zero-knowledge technology are not just theoretical – they are now practical realities on Ethereum via zkSync. By revealing only state differences (not full transaction details) when updating the mainnet, zkSync enables a new class of private smart contracts. Sensitive business logic, user balances, and transaction flows can be shielded from public view while still inheriting Ethereum’s security guarantees.

This privacy-preserving design opens doors for use cases previously considered unviable on public blockchains. Think confidential DeFi strategies, enterprise settlements, or identity management systems that protect personal data at scale.

Key Features Powering Scalable Private Smart Contracts on Ethereum

- Native Account Abstraction: Users can pay fees in any token or even transact with zero fees under certain conditions – a game-changer for UX and onboarding.

- Data Compression: By sharing only state differences rather than full transaction histories, network updates are faster and more private.

- EVM Compatibility: Supports familiar development languages like Solidity and Vyper, reducing friction for existing projects moving to layer 2.

- Mainnet Security: All proofs are ultimately verified by Ethereum mainnet, so trust assumptions remain minimal.

This robust feature set positions zkSync as one of the most promising solutions for scaling Ethereum while protecting user privacy – all without compromising on decentralization or composability. As more developers explore deploying complex applications on layer 2s, these capabilities will become increasingly critical to unlocking mainstream adoption.

Beyond its technical prowess, zkSync’s zkEVM is reshaping the conversation around what’s possible for Ethereum developers and users. The ability to deploy scalable private smart contracts means that dApps can now offer privacy as a default feature, not an afterthought. This is especially relevant in sectors like DeFi, where front-running and data leakage have long plagued user experience, and in enterprise settings that demand strict confidentiality.

Real-World Use Cases: zkEVM in Action

The practical impact of zkSync’s approach is already visible across the ecosystem. Here are some emerging use cases that illustrate how zero-knowledge Ethereum scaling is moving from theory to production:

Real-World zkEVM Use Cases in Action

-

Confidential DeFi Protocols: Meson Finance leverages zkSync Era’s zkEVM to provide fast, low-cost, and privacy-preserving stablecoin swaps across multiple chains, ensuring user balances and transactions remain confidential.

-

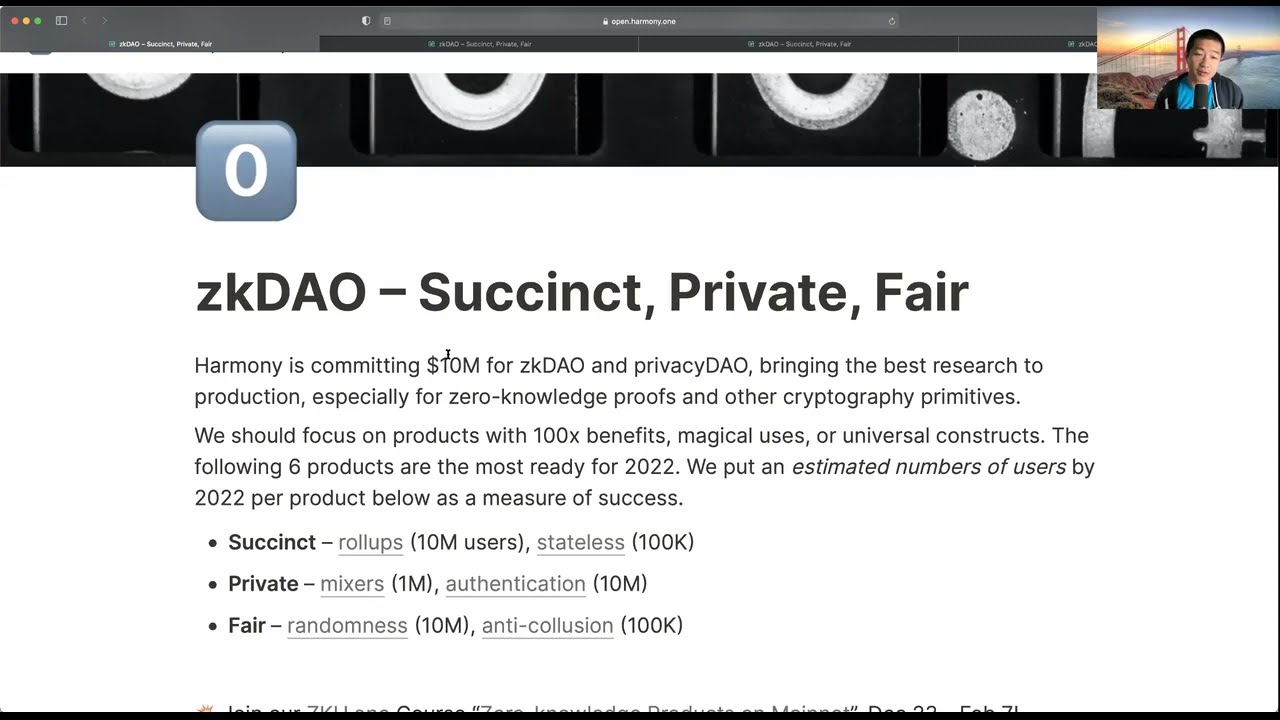

Private DAOs: zkDAO utilizes zkSync’s zero-knowledge proofs to enable private, on-chain governance, allowing members to vote and participate anonymously while maintaining transparency and auditability.

-

Enterprise Settlements: zkLink employs zkSync Era to facilitate secure, scalable, and private settlement of digital assets for enterprises, reducing costs and improving transaction throughput without sacrificing privacy.

-

On-Chain Identity Management: zkPass is building decentralized identity solutions on zkSync, enabling users to prove credentials or attributes privately on-chain without exposing sensitive personal information.

Each of these examples leverages the unique combination of privacy, scalability, and EVM compatibility that zkSync offers. For instance, confidential DeFi protocols can shield trading strategies from public view while still operating transparently for auditors. Private DAOs can coordinate governance without exposing member actions. Enterprises can settle transactions on a public chain without leaking sensitive business logic.

Developer Experience: Building for the Future

For developers, the transition to zkSync’s zkEVM is remarkably smooth. Familiarity with Solidity or Vyper is all that’s needed to get started; the LLVM-based compiler abstracts away most of the complexity associated with zero-knowledge proofs. This means teams can focus on innovating at the application layer rather than reengineering their entire codebase for a new environment.

Moreover, features like native account abstraction and flexible fee payments lower onboarding barriers for end users, a crucial step toward mainstream adoption. The ability to pay fees in any token or even transact gaslessly under certain conditions creates a frictionless experience akin to Web2 applications.

The composability of applications across Layer 1 and Layer 2 also remains intact thanks to two-way hops between Ethereum mainnet and zkSync Era. This ensures that liquidity and interoperability aren’t sacrificed in exchange for privacy or performance gains.

Market Outlook: Ethereum Scaling at $4,486.58

With Ethereum holding steady at $4,486.58, demand for cost-effective transaction throughput has never been higher. As gas costs fluctuate with network activity, solutions like zkSync provide much-needed relief, enabling projects to scale without pricing out users or sacrificing decentralization.

Ethereum Technical Analysis Chart

Analysis by Sophie Tran | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

Start by drawing a major uptrend line from the May low near $1,700 to the current price region around $4,486. Mark horizontal resistance at the $4,750 level (recent local highs in September) and support around $4,250 and $3,750. Use rectangles to highlight the accumulation from May to July ($1,700-$2,500) and the recent consolidation above $4,250. Use arrows to point out potential breakout attempts above $4,750 and callouts for risk areas if price loses $4,250. Annotate the chart with text at key inflection points (mid-July breakout, August rally, September correction, October recovery).

Risk Assessment: medium

Analysis: ETH is in a well-established uptrend but faces overhead resistance at $4,750. Support at $4,250 is crucial for bullish continuation. Given the strong move from May lows and the presence of healthy retracements, the risk of a deeper pullback remains if support fails. However, zkEVM and zkSync narrative keeps long-term structure bullish.

Sophie Tran’s Recommendation: Consider staggered entries on dips toward $4,250 with partial profits near $4,750. Maintain stops below $4,150 to balance risk/reward. Remain agile and monitor for volume confirmation on any breakout attempt.

Key Support & Resistance Levels

📈 Support Levels :

- $42500 – Recent swing low and consolidation base after September correction.moderate

- $37500 – Psychological and previous resistance turned support zone.strong

📉 Resistance Levels :

- $47500 – Local high and clear resistance from early September.strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones :

- $42500 – Buy on retest of support after September correction aligns with recent accumulation zone.medium risk