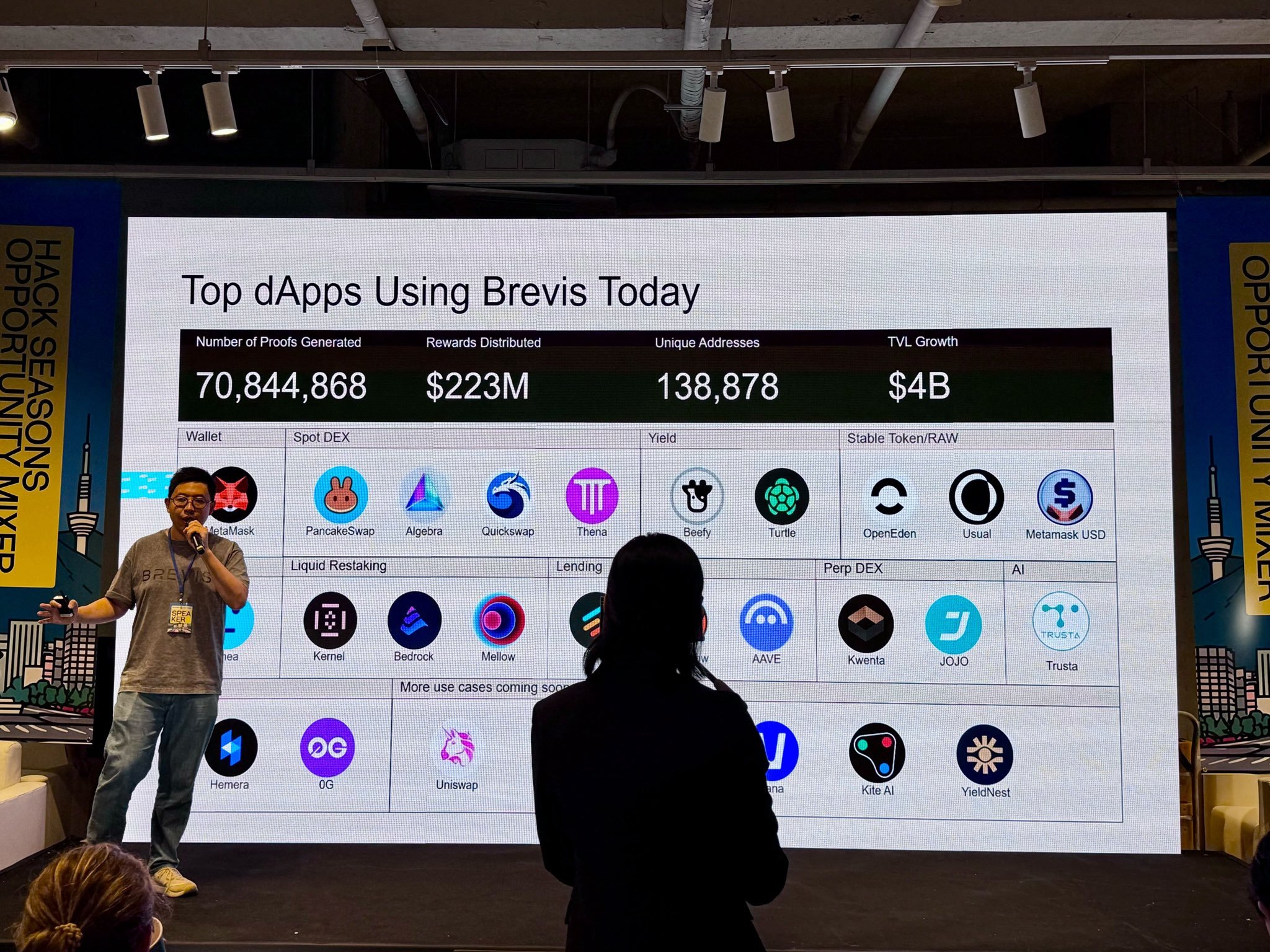

Zero-knowledge (ZK) coprocessors are rapidly emerging as the backbone of next-generation decentralized finance (DeFi) incentive systems. By allowing complex computations to be performed off-chain and verified on-chain via succinct proofs, these technologies are redefining how protocols distribute rewards, recognize participation, and foster sustainable user engagement. At the forefront of this transformation is Brevis, whose zkCoprocessor solutions are enabling trustless, transparent, and privacy-preserving incentive mechanisms across multiple DeFi ecosystems.

How ZK Coprocessors Reshape DeFi Incentives

Traditional DeFi incentive programs often face critical challenges: centralized intermediaries, opaque reward calculations, high operational costs, and limited cross-chain compatibility. ZK coprocessors like Brevis address these pain points by providing a verifiable layer for data-driven reward logic. This means user actions across different protocols or chains can be authenticated without revealing sensitive data or relying on trusted third parties.

The result is a new paradigm for verifiable DeFi airdrops, automated DAO incentives, and cross-chain participation rewards that are efficient and resistant to manipulation. By leveraging zero-knowledge proofs (ZKPs), platforms can offer users proof-backed assurances that their contributions are recognized fairly, without sacrificing privacy or scalability.

Case Study: OpenEden’s ZK-Powered Rewards Program

A prime example of this evolution is the collaboration between OpenEden and Brevis. Their upcoming rewards program utilizes the Continuous Protocol Incentivization (CPI) framework and the Brevis zkCoprocessor SDK to track participation across OpenEden’s DEXs, yield vaults, lending markets, and liquid restaking platforms. Zero-knowledge proofs ensure every action is counted accurately while keeping user data confidential.

This approach eliminates manual auditing and reduces administrative overheads, rewarding users in a manner that’s both trustless and fully auditable in real time. The CPI framework also enables granular targeting: incentives can be directed at specific liquidity venues or behaviors most beneficial to protocol growth.

Key Benefits of zk Coprocessor DeFi Incentives

-

Trustless and Verifiable Reward Distribution: Zero-knowledge coprocessors like Brevis enable DeFi protocols to distribute incentives transparently and without intermediaries. For example, OpenEden’s ZK-Powered Rewards Program uses Brevis technology to ensure that user participation is authentically tracked and rewards are distributed in a trustless, verifiable manner across their ecosystem.

-

Cross-Chain Data Access and Computation: Brevis’s zk coprocessor allows smart contracts to securely access and compute on historical on-chain data from multiple blockchains. This capability powers initiatives like Bedrock’s Incentra ZK-powered reward program, which efficiently tracks and rewards user activity across various DeFi venues.

-

Personalized and Privacy-Preserving Incentives: By integrating Brevis’s ZK infrastructure, platforms like PancakeSwap Infinity offer adaptive fee models that reward users based on verifiable historical behavior while maintaining user privacy. Features such as the VIP Discount Hook and Token Holding Fee Discount Hook personalize incentives and encourage long-term engagement.

-

Scalable and Cost-Efficient Reward Calculations: Programs like Linea’s Ignition Rewards leverage Brevis’s zkCoprocessor and Pico zkVM to process complex reward calculations off-chain, providing concise on-chain proofs. This reduces operational costs by over 90% and enables real-time, transparent distribution of incentives to liquidity providers.

-

Enhanced Transparency and User Trust: The use of zero-knowledge proofs ensures that all incentive mechanisms are fully auditable and transparent. Users can verify reward calculations and distributions on-chain, fostering greater trust and sustained participation in DeFi ecosystems.

PancakeSwap Infinity and Personalized On-Chain Rewards

PancakeSwap’s integration with Brevis further showcases how zero-knowledge infrastructure can personalize incentives at scale. Through adaptive fee models powered by Brevis Hooks in PancakeSwap Infinity, trading costs adjust dynamically based on verifiable user history, all without exposing private information.

The VIP Discount Hook, for example, lowers trading fees for high-volume traders by referencing their historical activity on-chain via ZK proofs. Meanwhile, the Token Holding Fee Discount Hook incentivizes long-term $CAKE holders with reduced fees, each adjustment cryptographically proven yet privacy-preserving. This model not only increases transparency but also aligns incentives with protocol health and user loyalty.

Linea Ignition and Bedrock: Scalable Cross-Chain Incentive Distribution

The scalability of Brevis’s zkCoprocessor is best illustrated by its adoption within large-scale programs like Linea’s Ignition campaign and Bedrock’s multi-asset restaking protocol. Linea’s Ignition distributes one billion LINEA tokens to liquidity providers across Etherex, Aave, Euler, and more, processing complex calculations off-chain using Pico zkVM technology before posting concise verification proofs on-chain. This design slashes operational costs by over 90%, while ensuring every participant can verify their reward eligibility independently (source).

Similarly, Bedrock leverages Brevis to run its Incentra ZK-powered reward system on Base mainnet, tracking user actions across its ecosystem with cryptographic certainty (source). This architecture allows for seamless cross-chain recognition of staking activity and native token distribution without introducing trust assumptions or bottlenecks.

What sets these zk coprocessor-powered systems apart is their ability to automate and scale incentive distribution across fragmented DeFi ecosystems. By abstracting away the complexity of cross-chain data aggregation and verification, Brevis enables protocols to target high-value actions, such as providing liquidity, staking, or protocol governance participation, no matter where they occur. This is a distinct leap from legacy models that often struggle with siloed data and manual reconciliation.

Moreover, the modularity of Brevis’s architecture means that protocols can rapidly deploy new reward logic or update incentive structures without forking core contracts or pausing operations. This flexibility is crucial as DeFi continues to evolve at breakneck speed, with user behaviors and market conditions shifting faster than ever before.

“With Brevis’s ZK coprocessor, we can finally reward users based on real participation, not just wallet snapshots or arbitrary metrics. It’s a game-changer for protocol growth. “

Privacy, Trust, and Compliance in Modern DeFi Incentives

One persistent challenge for incentive programs has been balancing transparency with privacy. Traditional on-chain rewards often expose sensitive user information or require users to trust opaque backend processes. ZK coprocessors elegantly resolve this tension: all calculations are verifiable by anyone on-chain, but underlying user data remains confidential thanks to zero-knowledge proofs.

This architecture not only enhances user trust but also provides important compliance advantages for protocols operating in regulated environments. Reward eligibility can be cryptographically proven without disclosing personally identifiable information or transaction histories, a key factor as institutional players begin exploring DeFi participation at scale.

How ZK Coprocessors Enhance Privacy and Compliance in DeFi Rewards

-

Trustless, Privacy-Preserving Reward Distribution: ZK coprocessors like Brevis enable DeFi platforms to compute and distribute rewards without exposing sensitive user data. Zero-knowledge proofs ensure that participation and reward calculations are verified on-chain, but individual user actions remain confidential, significantly reducing privacy risks.

-

Regulatory Compliance Through Verifiable On-Chain Proofs: By generating concise, cryptographically secure proofs for reward eligibility and distribution, ZK coprocessors help DeFi protocols like Bedrock and OpenEden demonstrate compliance with regulatory requirements. Auditors and users can independently verify that rewards are distributed according to protocol rules, without accessing private transaction details.

-

Cross-Chain Incentive Programs with Confidentiality: Brevis-powered solutions allow platforms such as OpenEden and Bedrock to track and reward user activity across multiple blockchains. Zero-knowledge proofs facilitate secure, privacy-preserving data aggregation and incentive distribution, supporting cross-chain growth while maintaining user confidentiality.

-

Personalized Incentives Without Sacrificing User Data: PancakeSwap uses Brevis hooks to offer adaptive trading fee discounts based on verifiable user behavior—such as trading volume or token holdings—without revealing personal trading histories. This approach enables tailored rewards while upholding strict privacy standards.

-

Transparent and Auditable Reward Mechanisms: Programs like Linea’s Ignition leverage Brevis’s zkCoprocessor and Pico zkVM to process complex reward calculations off-chain and publish succinct on-chain proofs. This ensures that all reward distributions are transparent, auditable, and resistant to manipulation, fostering greater trust among users and regulators.

The Road Ahead: Automated DAO Incentives and Beyond

The implications of zk coprocessor technology extend far beyond current use cases. As DAOs seek more sophisticated ways to incentivize contributors and align stakeholder interests, automated reward engines powered by ZK infrastructure will become foundational. Imagine DAOs distributing governance tokens based on provable off-chain work contributions or multi-protocol activity, without manual intervention or centralized oversight.

Similarly, verifiable DeFi airdrops could become the norm rather than the exception, targeting participants across chains based on complex behaviors while maintaining full auditability and privacy. For end users, this means fairer recognition of their engagement; for protocols, it means more efficient capital allocation and reduced risk of Sybil attacks or gaming.

Key Takeaways for Builders and Investors

- ZK coprocessors like Brevis are ushering in an era of trustless, scalable DeFi incentives.

- Cross-chain participation can now be rewarded efficiently without compromising privacy or security.

- Protocols benefit from reduced operational costs and increased transparency, two drivers of long-term growth.

- Modular incentive logic allows rapid adaptation to changing market dynamics and regulatory landscapes.

As adoption accelerates across blue-chip projects like OpenEden, PancakeSwap Infinity, Bedrock, and Linea Ignition, zk coprocessors are quickly becoming the gold standard for next-generation DeFi incentives. For both builders seeking robust infrastructure and investors looking for sustainable protocol growth signals, understanding this shift is no longer optional, it’s essential.