Ethereum’s mainnet is busier than ever, with activity surging and the price of ETH at $4,486.68 as of today. Yet, for order book trading – the backbone of professional markets – Ethereum’s base layer has long been constrained by high fees and slow settlement. Enter zk rollups: a new class of Layer 2 solutions that are transforming decentralized order book trading by dramatically improving speed, lowering costs, and maintaining robust security.

How ZK Rollups Power Fast and Secure Order Book Trading

ZK rollups use zero-knowledge proofs to batch hundreds or thousands of transactions off-chain into a single proof that is submitted to Ethereum for verification. This approach slashes congestion and gas fees while inheriting the security guarantees of the mainnet. For order book DEXs, this means:

- High-throughput trade execution – Orders are matched and settled off-chain in near real time.

- Ultra-low fees – Costs per trade drop from dollars on mainnet to cents or less on Layer 2.

- Censorship resistance and security – All trades are ultimately secured by Ethereum’s consensus.

This paradigm shift is already live on several leading platforms:

Top ZK Rollup Projects Powering Order Book Trading

-

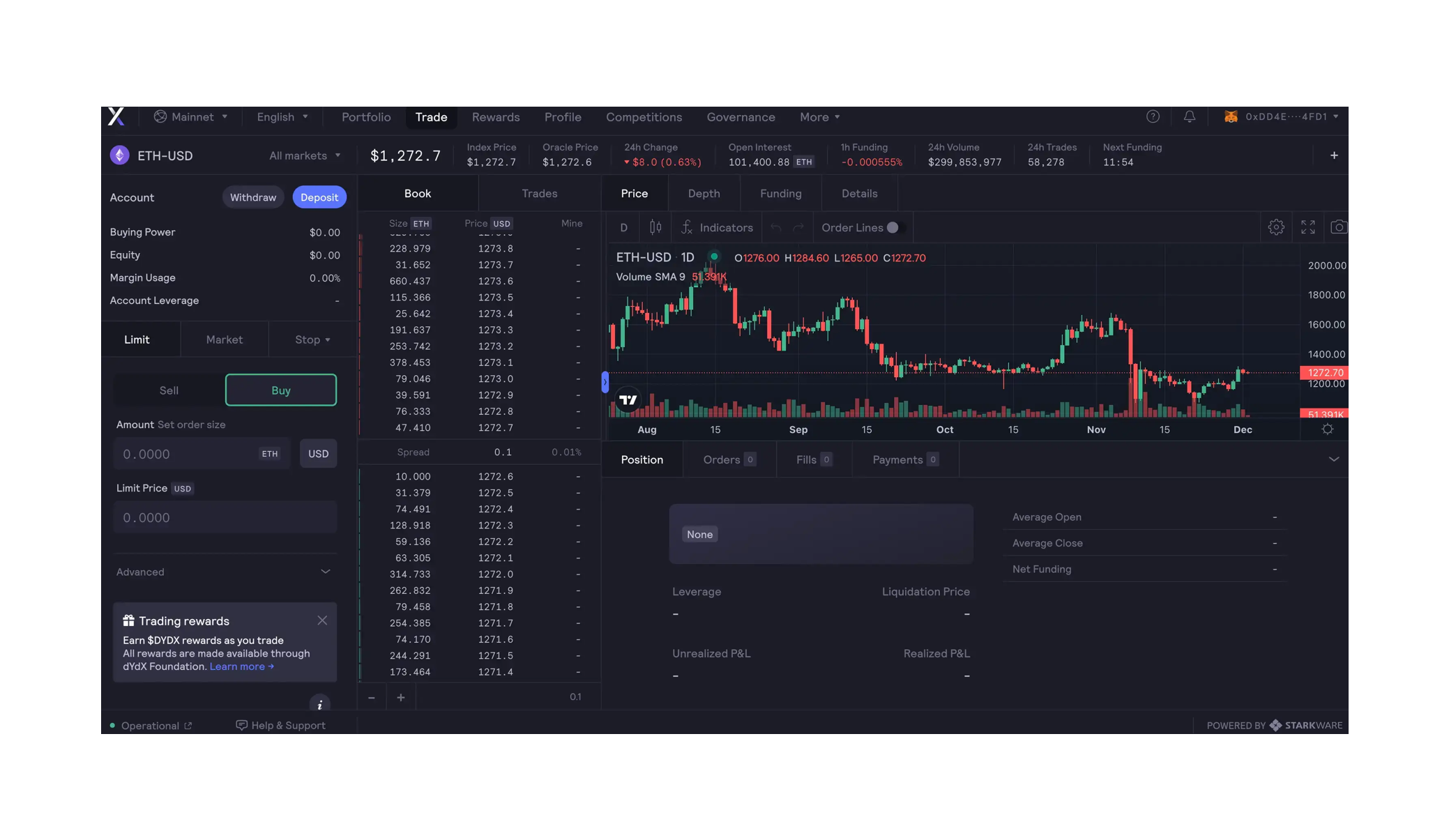

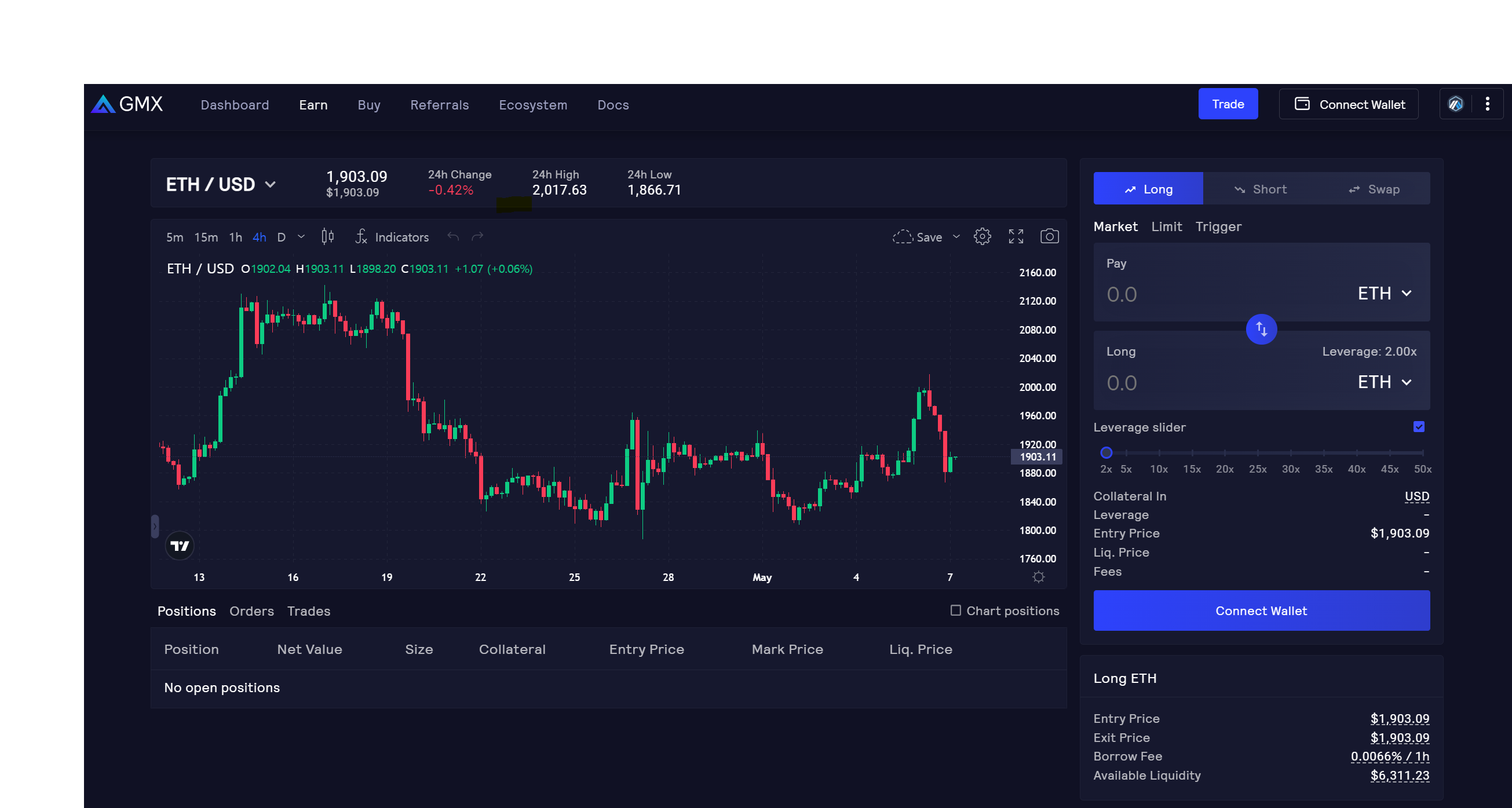

dYdX: A leading decentralized exchange leveraging zk-rollups to enable fast, low-cost, and non-custodial order book trading on Ethereum. dYdX offers advanced trading features and deep liquidity, all while maintaining user control over assets.

-

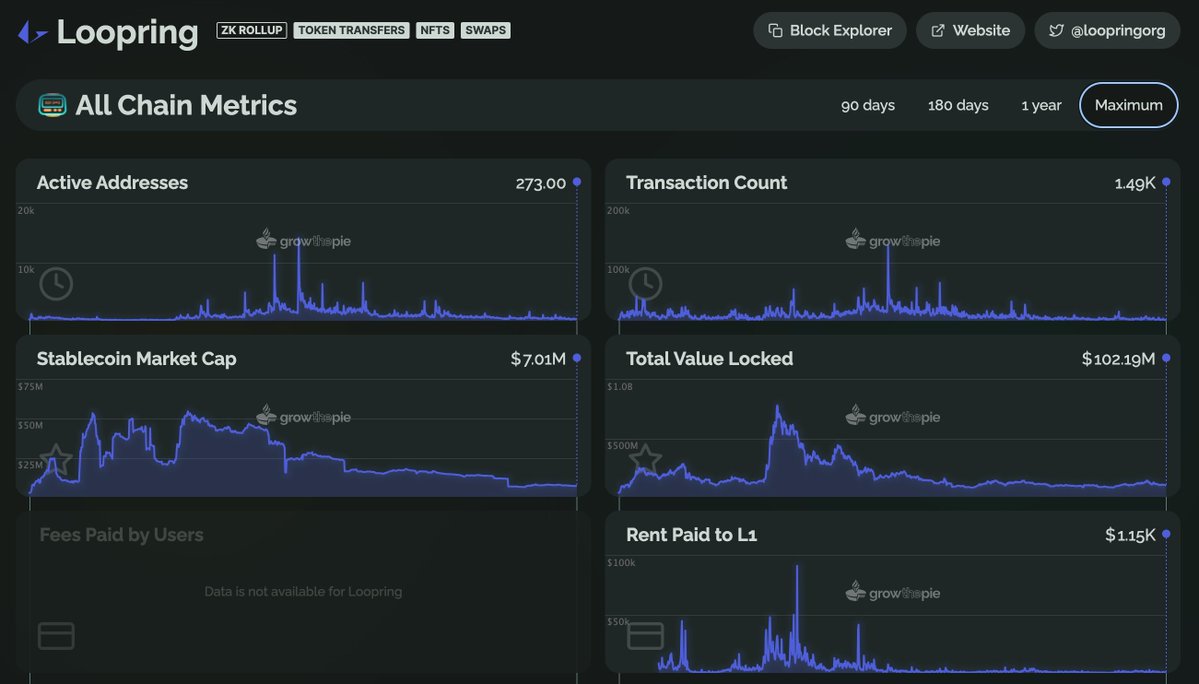

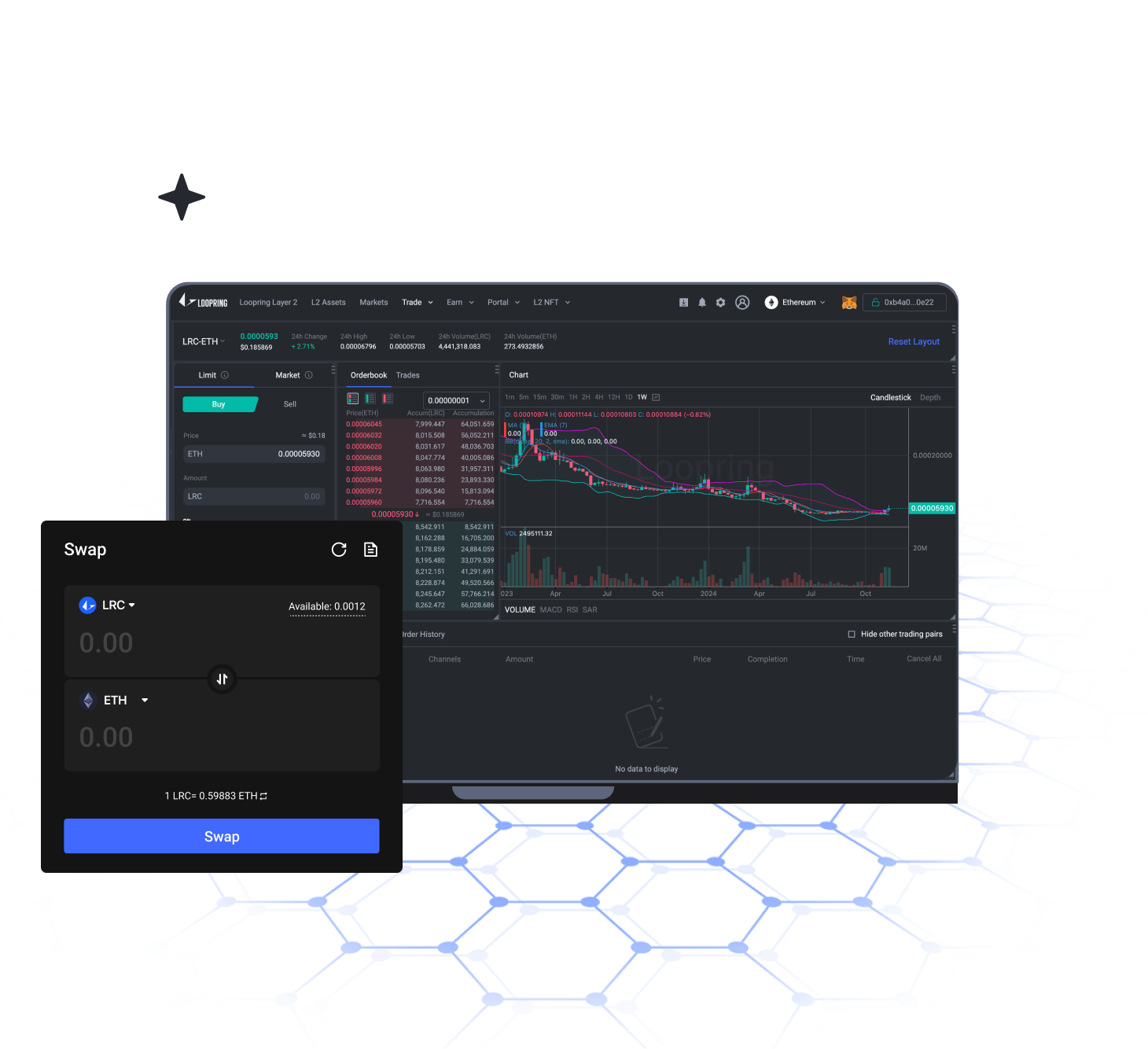

Loopring: Loopring utilizes zk-rollups to power its high-throughput, low-fee decentralized exchange. It provides a secure order book trading experience with instant settlement and Ethereum-level security.

-

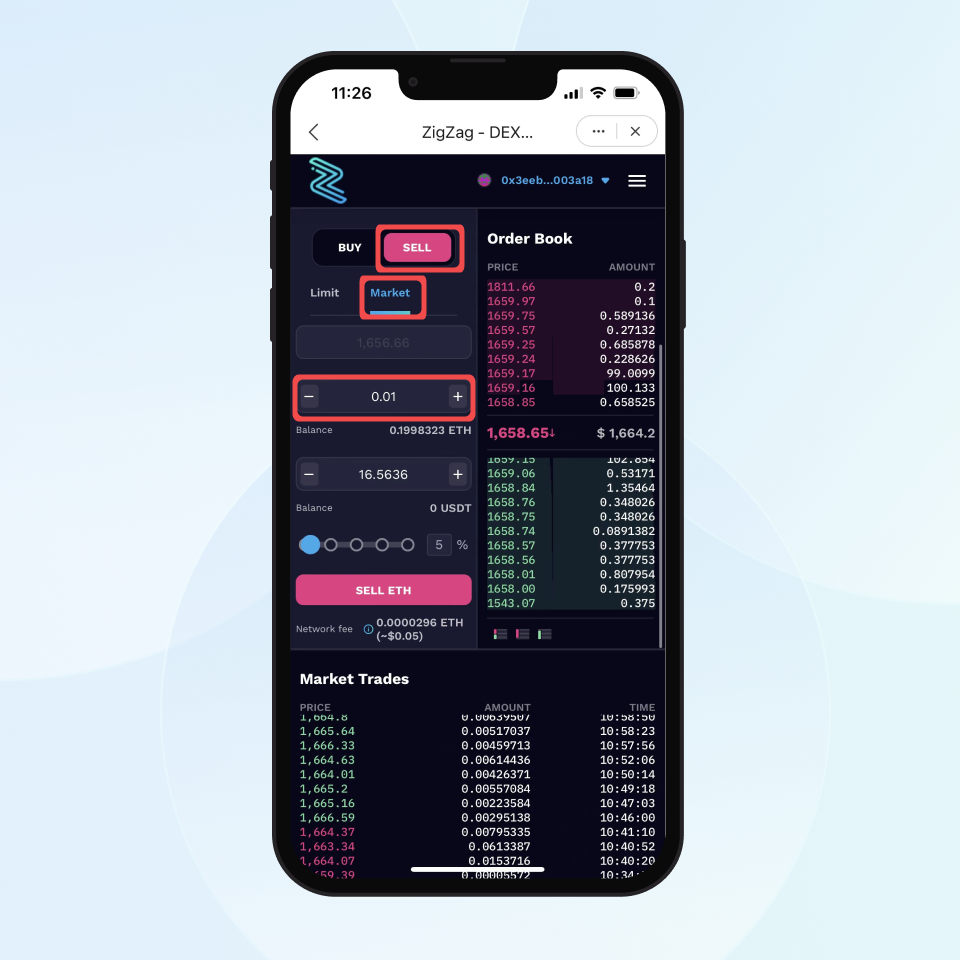

zkSync Era: Developed by Matter Labs, zkSync Era is a general-purpose zk-rollup platform supporting scalable and secure order book DEXs. Its low fees and fast finality make it ideal for high-frequency trading applications.

-

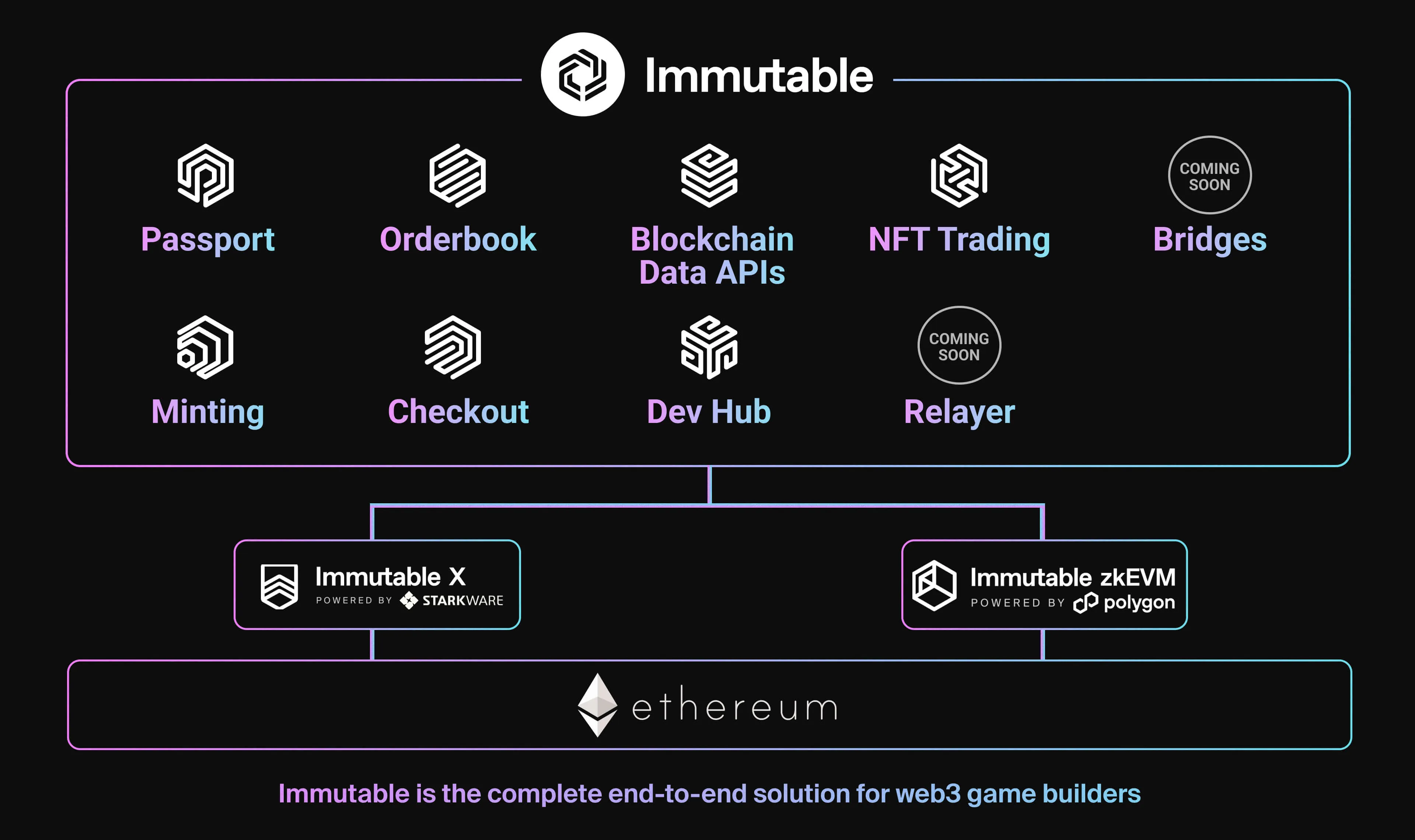

Immutable X: While best known for NFT trading, Immutable X also leverages zk-rollups to deliver instant, gas-free order book trading for digital assets, ensuring both scalability and security on Ethereum.

-

DeversiFi: DeversiFi is a non-custodial exchange built on zk-rollup technology, offering professional-grade order book trading with low fees and high privacy, all secured by Ethereum.

The Leading ZK Rollup Order Book Platforms

The following five projects are at the forefront of integrating zk rollups into their trading infrastructure:

- dYdX: One of the first large-scale DEXs to fully embrace zk rollup technology for perpetual futures trading. dYdX leverages StarkWare’s zero-knowledge proofs to offer high-speed matching and sub-second settlement while keeping user funds non-custodial.

- Loopring: A pioneer in Layer 2 DEX design, Loopring uses zkSNARK-based rollups to power its non-custodial exchange protocol. Traders enjoy near-instant order execution with fees measured in cents rather than dollars.

- zkSync Era: Built by Matter Labs, zkSync Era brings general-purpose EVM compatibility to zk rollups. It enables developers to launch scalable DeFi protocols, including advanced order book DEXs with native Ethereum-level security.

- Immutable X: Primarily known for NFT scaling but increasingly relevant for gaming asset exchanges using order books. Immutable X delivers gas-free trades via zk rollup batches without compromising user custody or transparency.

- DeversiFi: Focused on professional-grade DeFi trading tools, DeversiFi utilizes StarkEx’s ZK technology for deep liquidity pools and fast order matching directly on Layer 2.

Together these platforms demonstrate how zero-knowledge cryptography is not just an academic breakthrough but a practical force reshaping decentralized finance infrastructure.

ZK Rollups: The Engine Behind Censorship-Resistant Matching

A critical advantage of these platforms is their ability to provide censorship-resistant matching engines without sacrificing performance or cost efficiency. By executing trades off-chain but verifying them on-chain via succinct proofs, they remove centralized intermediaries from the equation while still delivering sub-second finality.

This model unlocks new possibilities for traders who demand speed and privacy alongside trustlessness. As highlighted by ongoing research at StarkWare and Matter Labs, zk rollup-powered exchanges can process thousands of orders per second – all while keeping transaction data secure from prying eyes yet fully auditable on Ethereum’s public ledger (see official documentation).

Ethereum (ETH) Price Prediction 2026-2031

Professional forecast based on ZK Rollup adoption, market cycles, and technology trends. Prices are based on the current ETH price of $4,486.68 (as of Q4 2025).

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,200 | $6,800 | +16% | Continued ZK Rollup adoption, ETH benefits from increased DEX activity and reduced fees; volatility from macroeconomic factors |

| 2027 | $4,500 | $6,100 | $8,200 | +17% | Regulatory clarity improves institutional participation, rollup ecosystem matures, but competition from other L1s grows |

| 2028 | $4,900 | $7,000 | $9,500 | +15% | Layer 2 scaling mainstream, ETH demand rises for DeFi and NFT trading, possible market correction mid-year |

| 2029 | $5,600 | $8,100 | $11,800 | +16% | Global adoption accelerates, ETH becomes key settlement layer, ZK Rollups drive further scalability |

| 2030 | $6,400 | $9,400 | $14,000 | +16% | Major enterprises adopt Ethereum, regulatory frameworks stabilize, tokenization and real-world assets on-chain expand use cases |

| 2031 | $7,200 | $10,600 | $16,200 | +13% | ETH cements its role as web3 backbone, ZK tech reaches maturity, but increased competition from modular blockchains and new tech |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is broadly bullish, driven by technological advancements like ZK Rollups, increasing adoption in DeFi, and institutional participation. While the average price is projected to rise steadily, significant volatility is expected due to market cycles, regulation, and competition. Minimum and maximum price ranges reflect both bearish and bullish scenarios, making ETH a high-potential but still risky investment.

Key Factors Affecting Ethereum Price

- ZK Rollup adoption enhancing scalability and lowering fees

- Growth of order book DEXs and DeFi applications

- Regulatory developments globally (US, EU, Asia)

- Competition from alternative Layer 1 and Layer 2 solutions

- Institutional and enterprise adoption of Ethereum

- Macro-economic trends and global risk appetite

- Advancements in Ethereum protocol (e.g., Danksharding, Proto-Danksharding)

- Potential for new use cases including tokenization of real-world assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Each of the five leading zk rollup platforms brings distinct innovations to the order book trading landscape, but all converge on a shared vision: making Ethereum-based trading as seamless and efficient as centralized alternatives, without compromising on decentralization or user control.

Key Features and Comparative Strengths

dYdX stands out for its perpetual contracts and deep liquidity, enabling professional traders to execute complex strategies with minimal slippage. Its integration of StarkWare’s ZK engine means that even at high volumes, execution remains fast and withdrawal delays are minimized, a critical factor for active traders seeking both speed and self-custody.

Loopring has carved a niche among retail and algorithmic traders alike by offering a user-friendly interface, robust API access, and transparent fee structures. Its zkSNARK-driven architecture enables batch settlement of thousands of orders at once, drastically reducing per-trade costs. The protocol’s open-source ethos also encourages ecosystem experimentation around order book models and liquidity incentives.

zkSync Era is rapidly gaining traction thanks to its EVM compatibility. This allows existing DeFi protocols to port over sophisticated order book logic without rewriting core components. Developers can deploy advanced DEX features, such as multi-asset trading pairs or programmable liquidity, while benefiting from the scalability and privacy upgrades inherent to zk rollups.

Immutable X, while best known for NFTs, is setting new standards for trading in-game assets and collectibles using order books. Its gas-free model, powered by bundled ZK proofs, lets users trade digital goods in real time with zero friction, paving the way for liquid markets in Web3 gaming economies.

DeversiFi targets power users with advanced order types (like TWAP/VWAP), analytics dashboards, and integrations with institutional-grade custody solutions. By anchoring every trade batch to Ethereum via StarkEx’s proofs, DeversiFi delivers both compliance-level auditability and the assurance that user funds remain under cryptographic control at all times.

The Impact on Traders: Speed, Cost Efficiency, Security

The practical benefits are clear: traders now enjoy near-instant confirmations even during periods of peak network demand. Transaction fees are consistently below $0.10 per trade, a fraction of mainnet costs, making strategies like high-frequency trading viable on-chain for the first time (see more about Loopring’s L2 solution). Most importantly, all trades are ultimately secured by Ethereum’s consensus mechanism at $4,486.68, ensuring that no single party can freeze withdrawals or manipulate markets behind closed doors.

User Experience and Developer Ecosystem Growth

The maturation of these platforms is driving rapid growth in both user adoption and developer activity. As zkSync Era opens up EVM-compatible smart contracts on Layer 2, and as Immutable X brings millions of NFT traders into the fold, the network effects compound. Liquidity deepens across venues; arbitrage opportunities become more accessible; new financial primitives emerge atop censorship-resistant matching engines.

Top ZK Rollup Projects Powering Order Book DEXs

-

dYdX is a leading decentralized exchange that leverages zk-rollups for high-speed, low-cost order book trading on Ethereum. It offers users non-custodial trading with deep liquidity and advanced features, all secured by zero-knowledge proofs.

-

Loopring utilizes zk-rollups to enable scalable, non-custodial order book DEX trading. Its protocol allows for near-instant settlement and extremely low transaction fees, making it a popular choice for active traders seeking efficiency and security.

-

zkSync Era is a zk-rollup protocol designed for general-purpose Ethereum scaling. It supports order book DEXs by providing high throughput and minimal fees, while maintaining Ethereum-level security and enabling fast, reliable trade execution.

-

Immutable X is a zk-rollup-based platform focused on NFT and gaming assets, but also supports order book trading with zero gas fees and instant trade settlement. Its technology ensures high scalability and a seamless trading experience for digital assets.

-

DeversiFi is a decentralized exchange that integrates zk-rollups to deliver high-speed, private, and low-cost order book trading. It empowers users with self-custody and efficient trading without sacrificing security or transparency.

What Comes Next for ZK Rollup Order Books?

The trajectory is set for further innovation as zero-knowledge technology advances. Upcoming improvements include recursive proofs (for even greater scalability), decentralized sequencers (to further reduce trust assumptions), and enhanced privacy features that will allow private order placement without sacrificing transparency or regulatory compliance (learn more about future developments here).

For investors monitoring Ethereum’s evolution at $4,486.68, these projects signal a new era where professional-grade trading infrastructure is not only possible but thriving in a decentralized setting. With zk rollups enabling fast, low-cost, secure order book DEXs like dYdX, Loopring, zkSync Era, Immutable X, and DeversiFi to flourish, and with ongoing research pushing boundaries further, the future of on-chain markets looks increasingly competitive with their centralized counterparts.