Tokenizing real-world assets (RWAs) on blockchain has long promised to unlock liquidity, efficiency, and global access. Yet, privacy concerns and regulatory hurdles have kept institutional players cautious. In 2025, the convergence of zero-knowledge proofs (ZKPs) and Layer 2 solutions is redefining what’s possible for secure, scalable asset tokenization.

Why Zero-Knowledge Proofs Matter for RWA Tokenization

Zero-knowledge proofs are cryptographic protocols that allow one party to prove the validity of a statement without revealing the underlying data. In practice, this means institutions can verify ownership, compliance checks (like AML/KYC), or transaction details without exposing sensitive information on-chain. For asset issuers and investors, this is a game-changer: it’s now possible to meet stringent regulatory requirements while maintaining confidentiality.

Projects like the ZK-RWA Tokenization Library on Cardano are already leveraging ZKPs to enable secure and compliant asset tokenization workflows. By integrating ZKPs at the protocol level, these platforms ensure that critical asset details remain private yet auditable, a crucial balance for both regulators and institutions.

The Role of Layer 2s: Scalability Meets Security

Layer 2 solutions like zk-Rollups have emerged as the backbone of scalable blockchain infrastructure in 2025. By moving computation off-chain and submitting succinct validity proofs back to Ethereum or other base layers, zk-Rollups drastically increase throughput while slashing gas costs. For RWA tokenization, this means asset transfers that are not only faster and cheaper but also inherit strong security guarantees from mainnet.

zkSync, for example, uses zk-Rollups to bundle hundreds of transactions into a single proof, making large-scale RWA issuance practical at institutional scale. The same principle applies across innovations like Dusk Network’s XSC contract, which automates compliant security transfers with built-in privacy via ZKPs.

Privacy-Preserving DeFi: Real-World Examples in Action

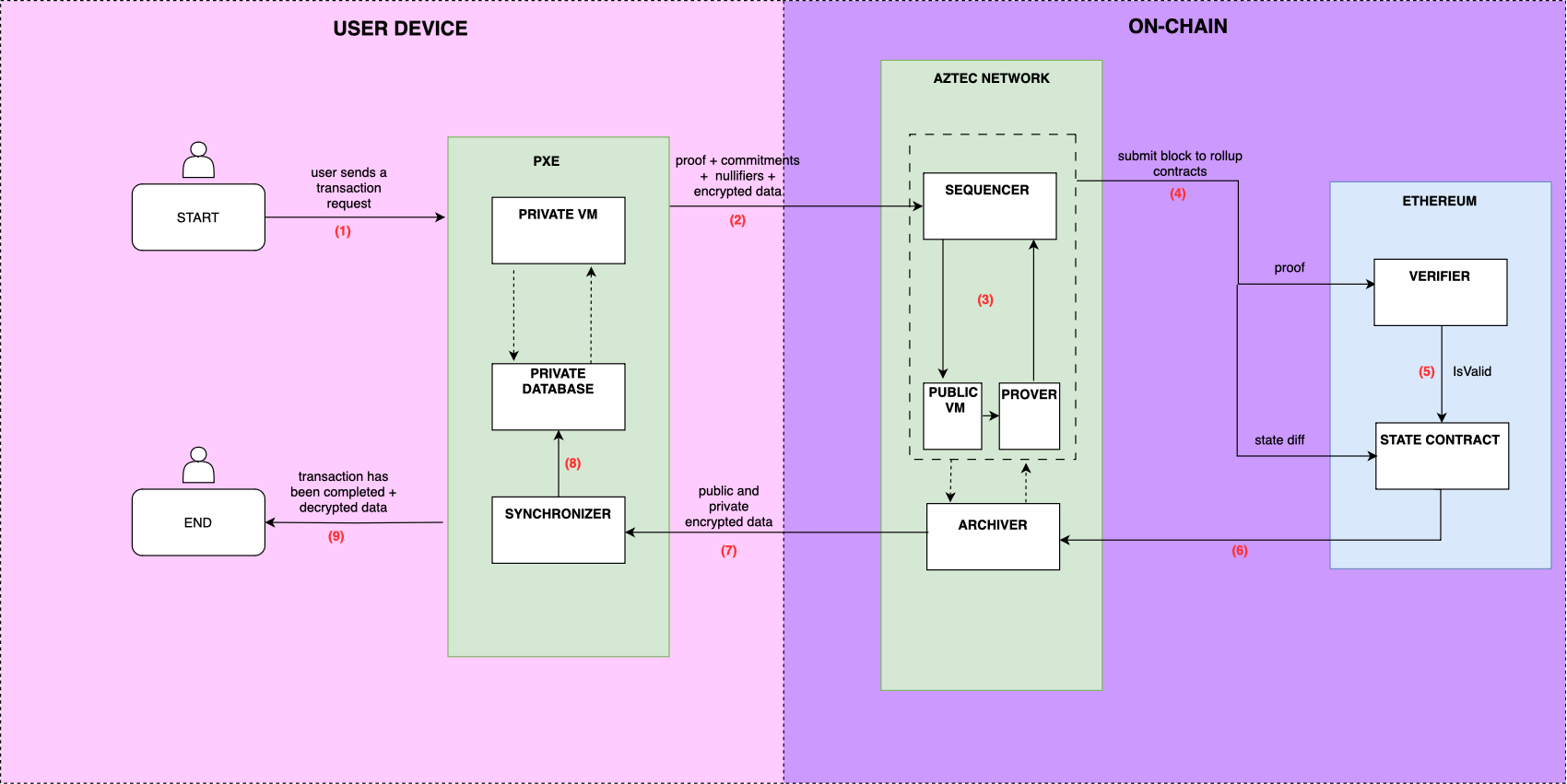

The push for privacy isn’t just theoretical; it’s already reshaping decentralized finance (DeFi) markets. Aztec’s Privacy Execution Environment (PXE) enables private lending and borrowing, institutions can transact without exposing borrower identities or sensitive credit data, all while satisfying regulatory oversight. This blend of confidentiality and compliance is essential for onboarding traditional finance players to blockchain-based RWAs.

Dusk Network stands out with its use of ZKPs in automating confidential securities management, a step forward in making regulated asset transfers seamless on public infrastructure. Meanwhile, zkSync Era, developed by Matter Labs, continues to drive adoption by offering low-cost transactions that don’t compromise on privacy or security standards (source).

Industry adoption is accelerating as more institutions realize the operational and compliance advantages of zk rollup real world asset tokenization. With the cost and speed improvements offered by Layer 2s, it’s now feasible to tokenize everything from real estate to fine art, commodities, or even regulated securities, without sacrificing privacy or auditability. The result: a new breed of digital asset markets where efficiency and confidentiality reinforce each other instead of being mutually exclusive.

Challenges and Considerations Moving Forward

Despite the momentum, several challenges remain for widespread blockchain rwas zk adoption. Interoperability between different Layer 2 networks is still evolving. Many platforms are working toward cross-rollup standards that will enable seamless asset transfers across chains while preserving zero-knowledge security guarantees. Additionally, regulatory clarity is a moving target, jurisdictions differ in their stance on privacy-preserving technologies for financial instruments.

Security is another critical consideration. While zk rollup security asset transfer mechanisms dramatically reduce attack surfaces compared to traditional bridges or sidechains, ongoing audits and robust cryptographic design remain essential. Projects like Aztec and Dusk Network invest heavily in formal verification and third-party assessments to maintain trust with institutional users.

What’s Next for Layer 2 Asset Tokenization?

The next phase will likely see further composability between DeFi protocols and RWA platforms, enabling new products like collateralized lending against tokenized real estate or instant settlement of private securities trades. As scalability improves and compliance tooling matures, we can expect a sharp uptick in both retail and institutional participation.

Top Use Cases for zk-Rollups in RWA Markets

-

Privacy-Preserving Asset Tokenization: zk-Rollups enable confidential tokenization of real-world assets (RWAs) such as real estate and financial instruments. Platforms like Aztec use zero-knowledge proofs to verify ownership and compliance without exposing sensitive asset or user data.

-

Scalable and Low-Cost RWA Transfers: Solutions like zkSync Era leverage zk-rollups to bundle multiple asset transactions off-chain, reducing fees and increasing throughput. This makes large-scale RWA tokenization and trading feasible for both institutions and individuals.

-

Automated Compliance for Tokenized Securities: Dusk Network integrates zk-rollups and zero-knowledge proofs in its XSC contract to automate regulatory compliance and maintain transaction confidentiality for tokenized securities.

-

Private Institutional DeFi Lending: Aztec’s Privacy Execution Environment (PXE) allows institutions to execute private lending and borrowing transactions with RWAs, shielding borrower identities and credit scores while ensuring regulatory alignment.

-

Secure On-Chain Proof of Ownership: Projects like the ZK-RWA Tokenization Library on Cardano use zk-rollups to enable secure, verifiable proof of asset ownership on-chain, supporting compliance without revealing underlying asset details.

For investors and builders alike, now is the time to monitor developments across leading projects such as zkSync Era, Aztec PXE, and Dusk Network’s XSC contract. Their progress will shape not only the future of layer 2 asset tokenization but also set benchmarks for privacy-first financial infrastructure globally.

Ultimately, zero-knowledge proofs are not just a technical upgrade, they represent a paradigm shift in how value moves securely on-chain. By solving core pain points around privacy, compliance, and scalability, ZKPs on Layer 2s are paving the way for a truly global marketplace for tokenized real-world assets.