Order book trading has long been the gold standard for price discovery and liquidity in traditional finance, but replicating its efficiency and transparency on public blockchains remains a formidable challenge. Most decentralized exchanges (DEXs) have historically abandoned true order books in favor of automated market makers (AMMs), citing prohibitive gas costs, latency, and scalability issues on Ethereum mainnet. However, the emergence of zk rollup order book trading platforms like Lighter_xyz is rapidly changing this narrative.

The Case for ZK Rollups in Order Book Trading

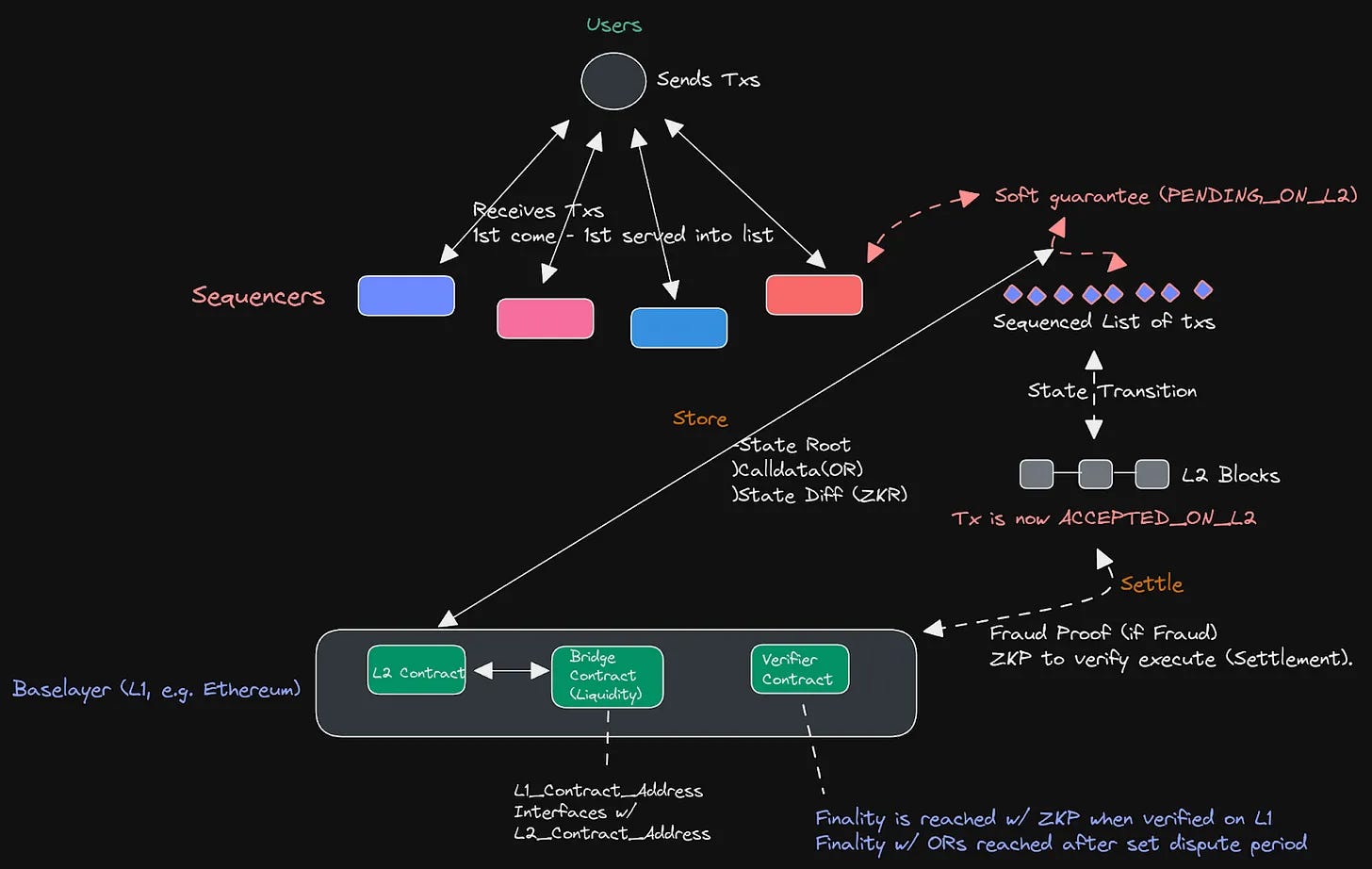

At the heart of Lighter_xyz’s innovation is its application-specific zk rollup, zkLighter, which processes trades off-chain and submits succinct zero-knowledge proofs to Ethereum Layer 1. This approach delivers several critical advantages:

- Scalability: By batching hundreds or thousands of transactions into a single proof, zkLighter dramatically reduces on-chain data requirements and transaction costs.

- Low Latency: Off-chain computation enables near-instantaneous order matching, crucial for high-frequency trading strategies.

- Censorship Resistance: Decentralized sequencers and transparent proof systems ensure that no single party can manipulate execution or exclude users from participating.

- Security and Transparency: All trade executions are verifiable by anyone, thanks to cryptographic proofs submitted to Ethereum’s base layer.

This architecture positions Lighter_xyz as a leading example of how zk rollup trading platforms can finally bring a central limit order book (CLOB) experience to DeFi without sacrificing decentralization or user sovereignty. For those interested in technical details about Lighter’s custom ZK circuits enabling verifiable matching and liquidation engines, see the recent public report by zkSecurity.

Lighter_xyz: Features Redefining On-Chain Perpetual Trading

Lighter_xyz’s rapid ascent is not accidental. Its protocol introduces several novel features that are resonating with both retail traders and professionals:

- Zero-Fee Trading: By eliminating trading fees entirely, Lighter attracts liquidity providers and active traders seeking cost efficiency. This zero-fee model is especially powerful when combined with deep liquidity and tight spreads enabled by an efficient on-chain CLOB.

- Verifiable Order Matching: Every match in the order book is proven using ZK-SNARKs for price-time priority. This ensures fairness while protecting users from potential frontrunning or manipulation, issues that have plagued less transparent venues.

- Diverse Leverage Offerings: The platform recently added new pairs such as $XMR at 10x leverage and $PYTH at 5x leverage during its private beta phase (source). These additions reflect an agile development approach responsive to community demand.

- Mainnet Private Beta and Community Engagement: Gradual onboarding with deposit limits, regular AMAs, and feature updates have fostered trust within the community while allowing rigorous testing before full public launch.

The Broader Context: Why ZK Rollups Matter for Exchange Infrastructure

The technical leap represented by Lighter_xyz goes beyond just one protocol. ZK rollups are widely recognized as pivotal to Ethereum scaling, processing thousands of trades off-chain while submitting succinct proofs back to Layer 1 (source). For high-frequency markets like perpetual futures or spot CLOBs, this means unprecedented efficiency gains without compromising security or transparency.

The ability to generate cryptographic proofs for every aspect of exchange operation, including order matching, funding rate calculations, liquidations, sets a new bar for what decentralized infrastructure can achieve. As the only major DEX currently delivering this level of verifiability at scale, Lighter_xyz stands out as a case study in next-generation censorship resistant trading infrastructure powered by zero-knowledge technology.

Yet, the road to a fully decentralized and scalable order book is not without its challenges. Generating zk-SNARK proofs for an entire exchange, covering order book updates, trade settlements, and liquidations, requires advanced cryptography and significant engineering resources. Lighter_xyz’s approach, which leverages custom application-specific circuits, has been publicly audited and dissected by independent security researchers such as zkSecurity. This ongoing scrutiny is critical for building trust in a space where transparency is non-negotiable.

Performance Metrics and User Experience

Lighter_xyz’s mainnet private beta has already demonstrated impressive traction. According to recent data, it has rapidly climbed to become the #2 perpetual DEX by trading volume, trailing only Hyperliquid. This momentum can be attributed to its unique blend of zero-fee trading, deep liquidity, and ultra-low latency, all made possible by zk rollup architecture. Traders benefit from a CEX-like experience on-chain: orders are matched in real time, with every execution cryptographically proven for fairness.

Importantly, the protocol’s censorship-resistant design ensures that no single actor can block or reorder transactions. The sequencer-prover-smart contract triad distributes responsibility across multiple entities while keeping all activity verifiable on Ethereum Layer 1. This model not only enhances user protection against manipulation but also sets a precedent for future zk rollup trading platforms aiming to bridge the gap between DeFi ideals and professional-grade infrastructure.

What Comes Next for ZK Rollup Order Book Trading?

As Lighter_xyz continues to expand its mainnet offering, adding new pairs like $XMR at 10x leverage and $PYTH at 5x leverage, the broader DeFi ecosystem is watching closely. The gradual lifting of deposit limits signals confidence in both the technology stack and operational security. Community engagement via AMAs and transparent updates further supports robust organic growth (source).

The implications extend beyond just one platform. If Lighter_xyz sustains its trajectory, it could catalyze a new wave of censorship resistant trading venues powered by zero-knowledge proofs. As competition heats up among zk rollup trading platforms, features such as verifiable matching engines, fee-free models, and rapid onboarding will likely become industry standards rather than exceptions.

How ZK Rollups Are Transforming Exchange Infrastructure

-

Scalable, Low-Latency Trading: ZK rollups like those used by Lighter_xyz enable high-throughput, low-latency trading by processing transactions off-chain and submitting succinct proofs to Ethereum, dramatically reducing congestion and costs.

-

Verifiable Order Book Matching: Custom ZK circuits on Lighter_xyz allow for verifiable, tamper-proof order matching and liquidations, ensuring fairness and transparency in decentralized trading environments.

-

Zero-Fee Trading Model: By leveraging ZK rollups to cut operational costs, Lighter_xyz offers zero-fee perpetual trading, attracting a wider user base and boosting trading volumes.

-

Decentralized Yet Secure Architecture: ZK rollups facilitate a decentralized exchange structure with sequencers, provers, and smart contracts, maintaining security and transparency without sacrificing speed.

-

Enhanced User Protection: Succinct ZK proofs on Lighter_xyz ensure order execution and liquidations are provably fair, protecting users from manipulation and increasing trust in the platform.

For developers, investors, and traders alike, the success of Lighter_xyz underscores the potential of zk rollup order book trading as a cornerstone of next-generation financial markets, delivering both scale and trust without compromise.