The race to build censorship-resistant, secure decentralized exchanges is heating up, and zk rollup order matching is right at the heart of this revolution. As crypto traders demand faster, cheaper, and more private trades without sacrificing trustlessness, zero-knowledge (ZK) rollups are emerging as a game-changer for DEX infrastructure. But how do ZK rollups actually deliver on the promises of security and censorship resistance in order matching? Let’s dig in.

How ZK Rollups Secure Decentralized Trading

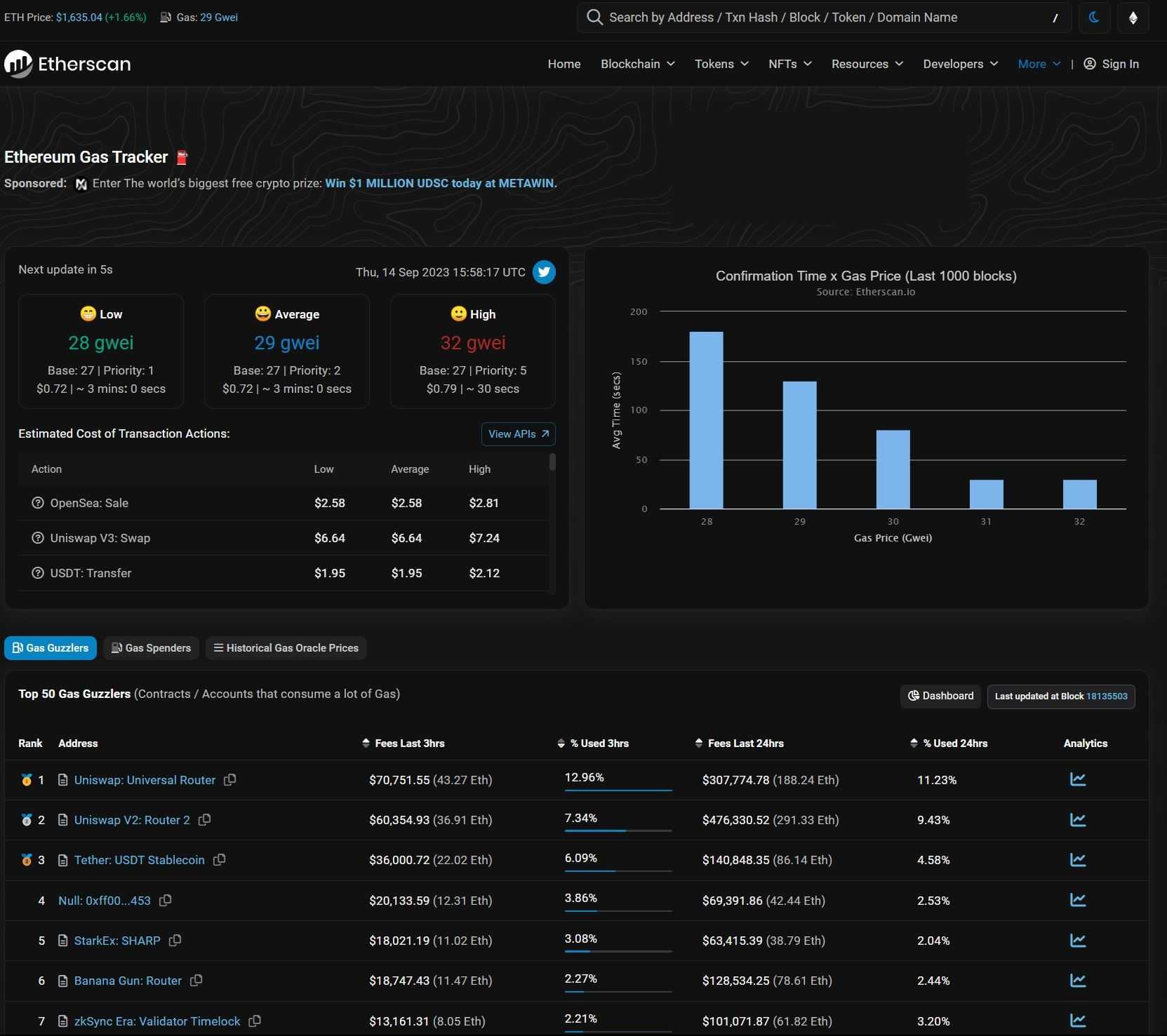

ZK rollups work by processing transactions off-chain in batches, then submitting succinct validity proofs to Ethereum’s mainnet. This means every batch of orders matched off-chain must be proven valid using cryptographic proofs that Ethereum itself verifies. The result? No invalid trades can slip through, even if the sequencer or operator is compromised or malicious. This architecture massively strengthens security guarantees for DEX users compared to legacy L2s or centralized exchanges.

Let’s break it down:

- Transaction correctness: Each batch includes a ZK proof showing all trades followed protocol rules, no double-spending or unauthorized asset movement.

- Mainnet settlement: Ethereum only accepts state updates with valid proofs, making it impossible to sneak in fraudulent orders.

- Censorship resistant liquidations: If an operator tries to censor your trade or liquidation, you can submit directly to mainnet for inclusion.

Censorship Resistance: More Than Just a Buzzword

Censorship resistance isn’t just about avoiding government crackdowns – it’s about ensuring that no single party can block or reorder your trades for profit. Most ZK rollups today use a centralized sequencer (or “supernode”) to aggregate orders and produce blocks. While this setup offers speed and efficiency, it does introduce potential vulnerabilities if the sequencer acts maliciously or goes offline.

The good news? Modern zk rollup protocols bake in several layers of defense against censorship:

Key Features Enhancing Censorship Resistance in ZK Rollup Trading

-

Direct Submission to Ethereum Mainnet: Users can bypass the rollup operator by submitting transactions directly to Ethereum’s Layer 1, ensuring their trades are included even if the operator tries to censor them.

-

Decentralized Sequencer Networks: New zk rollup designs like Espresso and Fairblock are working on decentralized sequencer models, reducing reliance on a single party and making it much harder for anyone to block or reorder transactions.

-

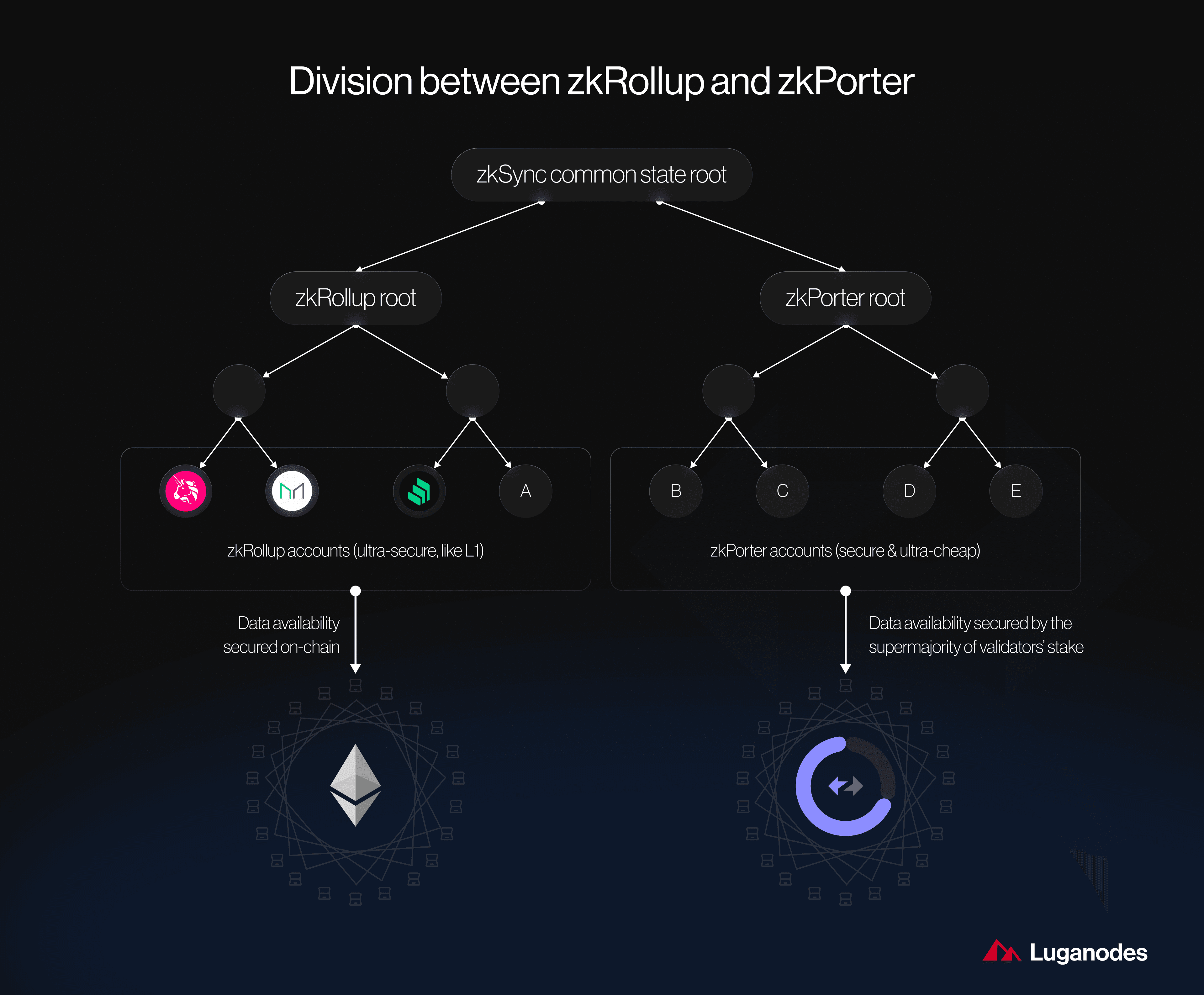

On-Chain Data Availability: By storing essential transaction data on Ethereum’s mainnet, zk rollups ensure that anyone can reconstruct the rollup state, preventing operators from hiding or withholding information.

-

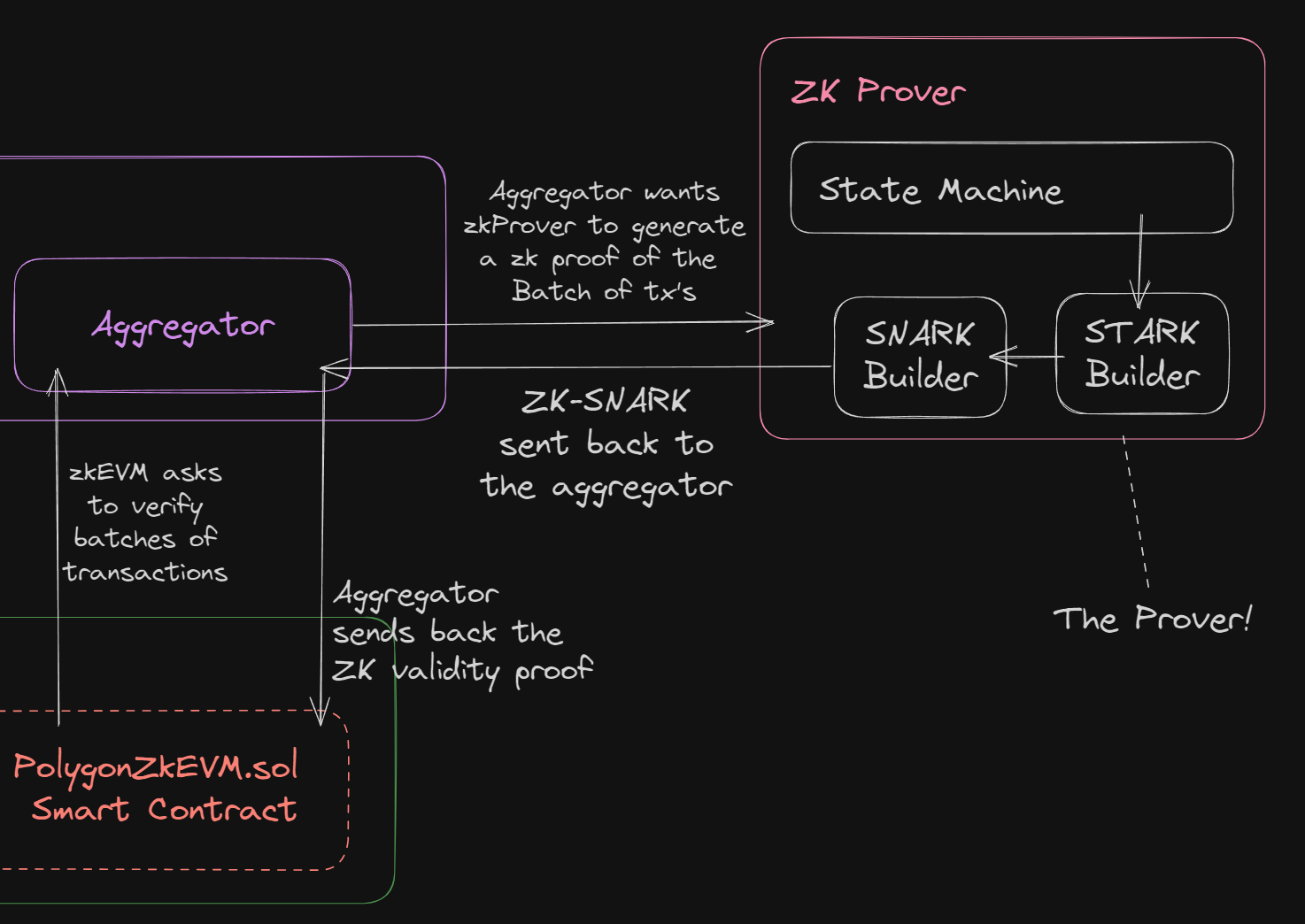

Cryptographic Validity Proofs: Every batch of trades is accompanied by a zk-SNARK or zk-STARK proof, which is verified on Ethereum. This guarantees that all included transactions are valid, making censorship attempts auditable and transparent.

-

Open Participation for Relayers: Some zk rollups allow anyone to become a relayer or operator, lowering barriers to entry and increasing the diversity of entities who can help process and submit transactions.

The most critical tool here is direct submission to mainnet. If you suspect your transaction is being delayed or dropped by the sequencer, you have the power to bypass them entirely and force your trade onto Ethereum L1, no permission needed. This mechanism keeps operators honest and preserves user autonomy even in adversarial scenarios (source).

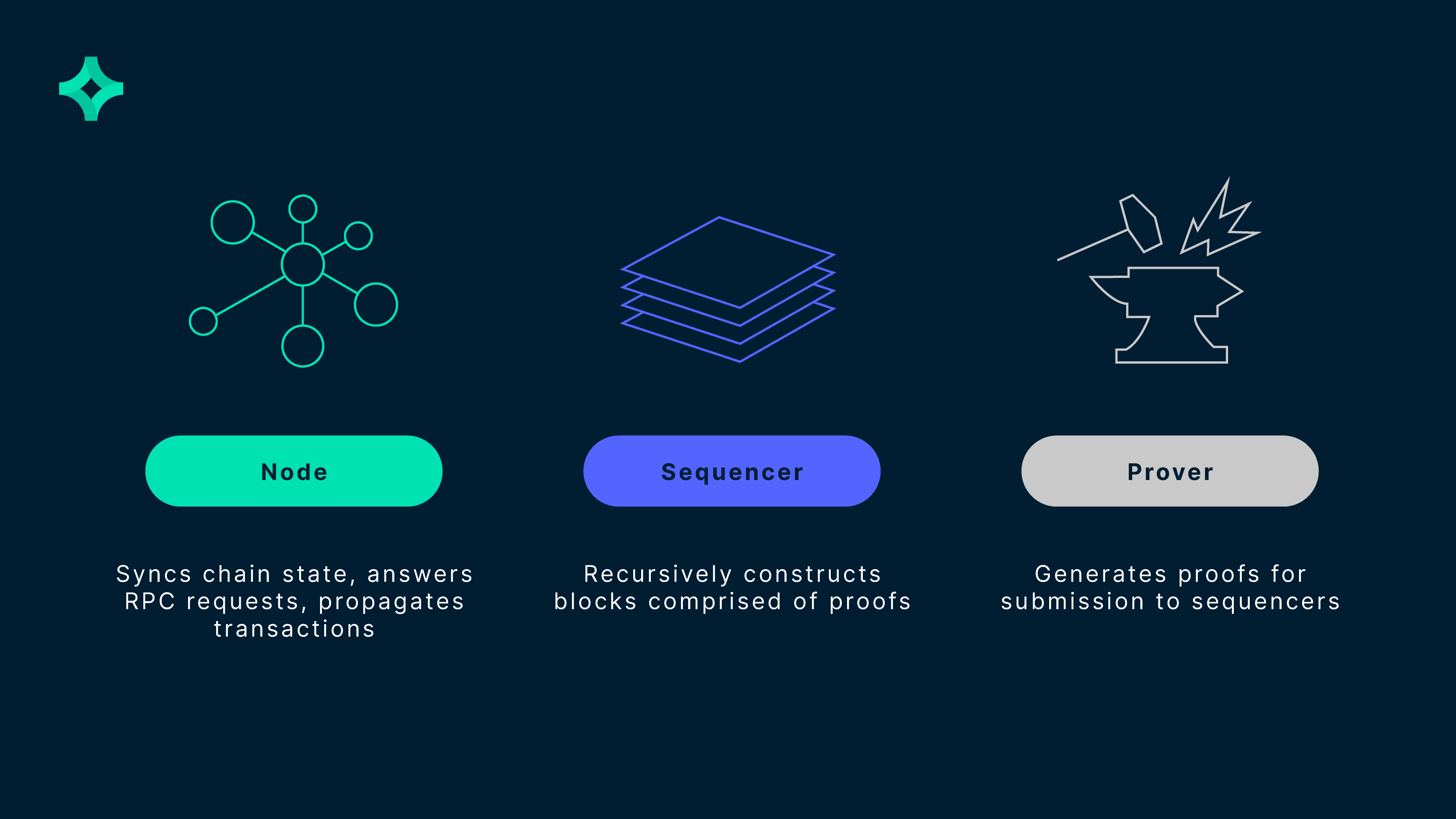

The Push Toward Decentralized Sequencers

If we want truly censorship-resistant DEXs powered by zk rollups, we need to move beyond single-point-of-failure sequencers. That’s why research into decentralized sequencer networks has exploded over the past year. These systems distribute control of transaction ordering across multiple independent parties, making it far harder for anyone to manipulate markets or block specific users (see details here).

This shift isn’t just theoretical; leading projects are already experimenting with shared liquidity pools and builder networks that allow anyone to participate in sequencing, further democratizing access and reducing risks of collusion.

Still, even as we see progress toward decentralized sequencing, there are practical hurdles to overcome. Generating zk proofs for complex trading activity demands specialized hardware and technical expertise. This can create a power imbalance, where only well-resourced entities can participate in sequencing or proof generation, nudging us back toward centralization if not carefully addressed.

That’s why some of the most exciting innovations in zk rollup order matching focus on lowering these barriers. From open-source proof systems to collaborative networks where smaller operators pool resources, the ecosystem is working hard to keep censorship resistance and security at the forefront.

Security Trade-Offs and Real-World Implications

For traders and liquidity providers, the security guarantees of zk rollups are not just theoretical. The cryptographic proof layer means that even if a sequencer tries to cheat, by reordering trades for MEV (maximal extractable value), blocking liquidations, or attempting double-spends, the system simply won’t let it happen without producing a valid proof. If no valid proof is generated, Ethereum’s mainnet rejects the batch outright.

This has major implications for censorship resistant liquidations during periods of market stress. On legacy DEXs or optimistic rollups with fraud windows, liquidations can be delayed or censored by malicious actors. With zk rollup trading security, every action is either provably correct or it doesn’t make it on-chain, period.

The Road Ahead for ZK Rollup Order Matching

The next phase of adoption will hinge on usability and composability. As more decentralized exchanges integrate zk rollups for order matching, expect a wave of new products offering near-instant settlement, reduced gas fees, and robust privacy, all while keeping user sovereignty intact.

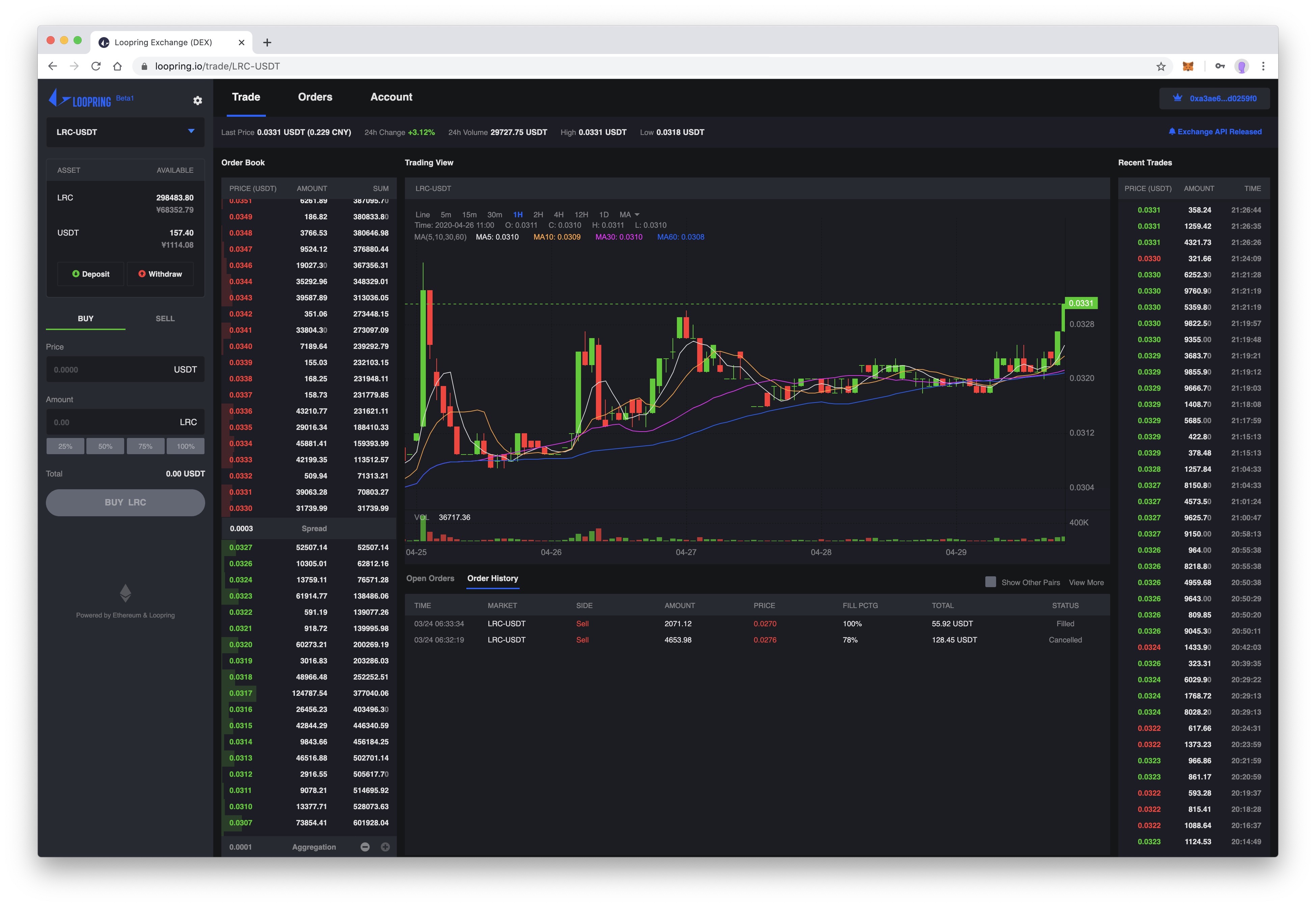

- Decentralized exchange zk rollup protocols like Loopring are already demonstrating how high-throughput order books can run trustlessly atop Ethereum.

- New research into shared sequencers and open participation will further harden systems against censorship attacks.

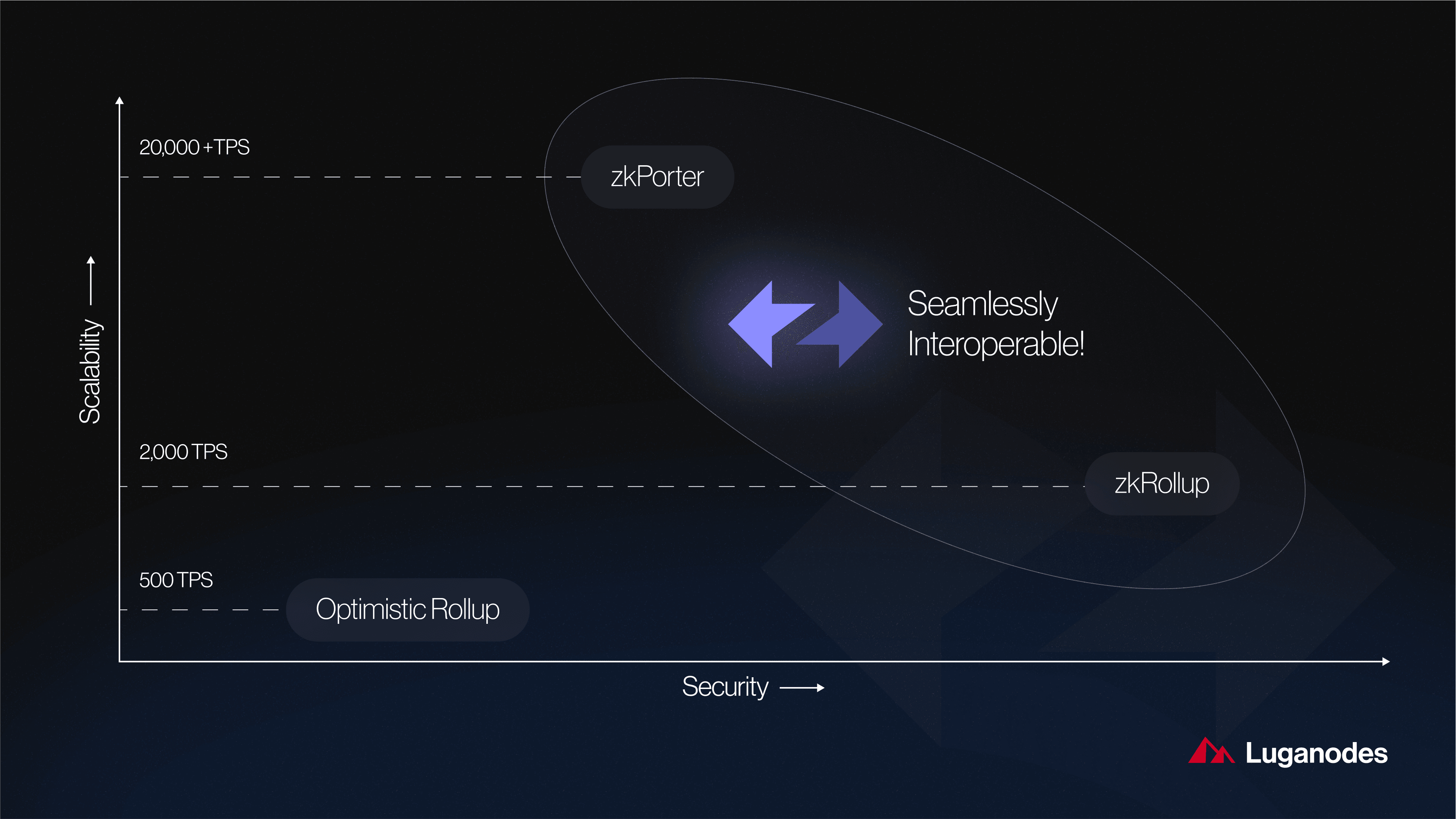

- Watch for cross-rollup interoperability as projects seek to unify liquidity across multiple chains and L2s.

Top Censorship-Resistant ZK Rollup Trading Platforms

-

dYdX – A leading decentralized exchange built on StarkWare’s ZK-STARK rollup technology. dYdX offers non-custodial trading, high throughput, and allows users to submit transactions directly to Ethereum L1 if censorship is suspected. Its open-source protocol and transparent order book enhance both security and censorship resistance.

-

Loopring – One of the earliest ZK rollup DEXs, Loopring leverages ZK-SNARKs for secure, low-cost trades. The protocol includes a mechanism for users to force-withdraw funds or submit transactions to L1, protecting against sequencer censorship and ensuring user autonomy.

-

zkSync Era – Developed by Matter Labs, zkSync Era supports decentralized order books and integrates with multiple DEXs. It features a robust security model with validity proofs and allows users to bypass sequencer censorship through direct L1 submission.

-

Immutable X – Focused on NFTs and gaming assets, Immutable X uses StarkWare’s ZK rollups for instant, gas-free trades. The platform’s design ensures that users retain control over assets and can always exit to Ethereum L1, maintaining censorship resistance.

-

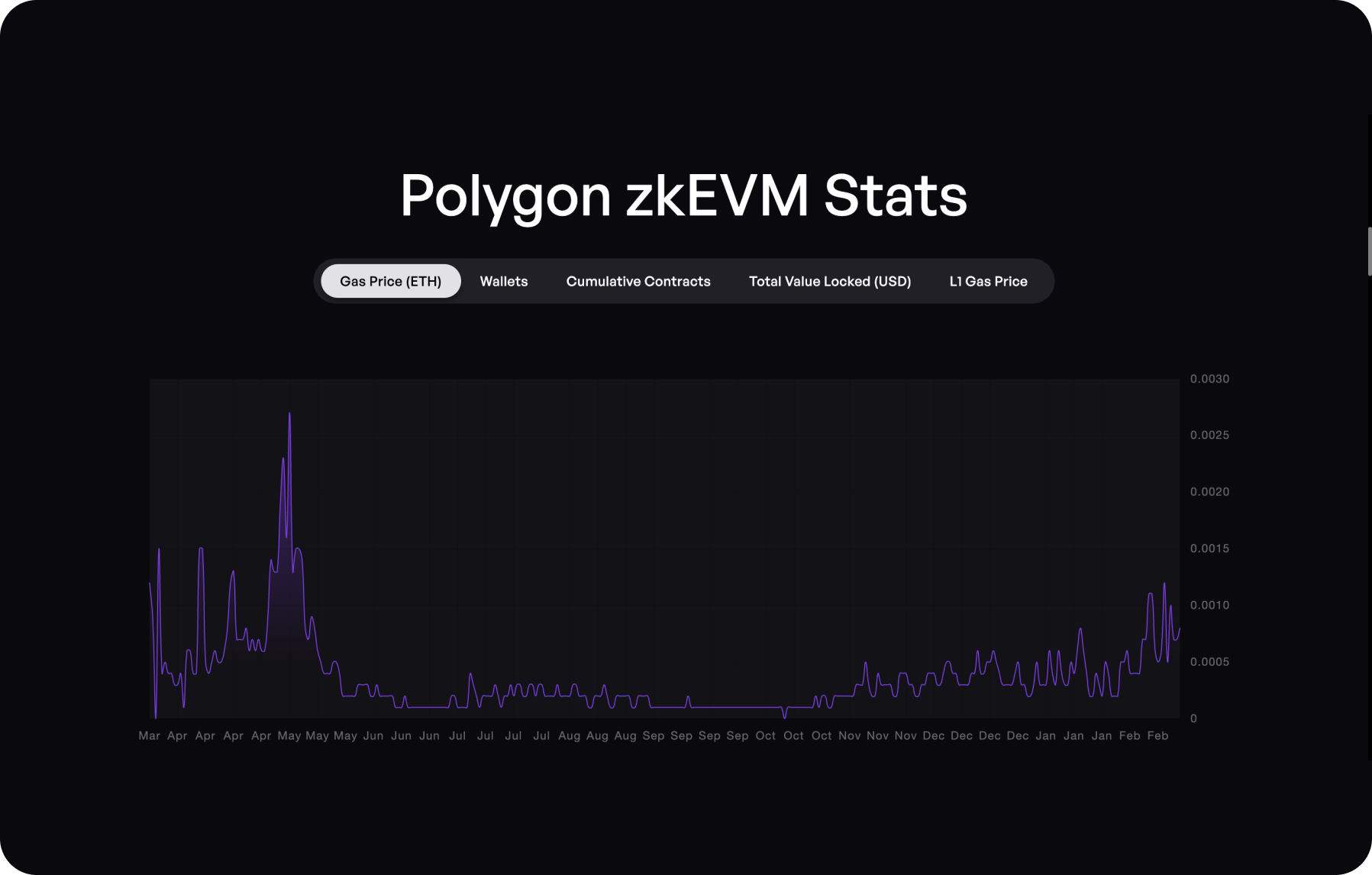

Polygon zkEVM – Polygon’s zkEVM rollup brings EVM compatibility to ZK rollups, enabling decentralized exchanges to operate securely and efficiently. It employs validity proofs for transaction security and is progressing toward decentralized sequencer models to further enhance censorship resistance.

The bottom line? ZK rollups aren’t just scaling Ethereum, they’re redefining what’s possible for secure, censorship-resistant decentralized finance. As the technology matures and decentralizes further, we’ll see more resilient DEX ecosystems where users truly control their assets and trades from start to finish.