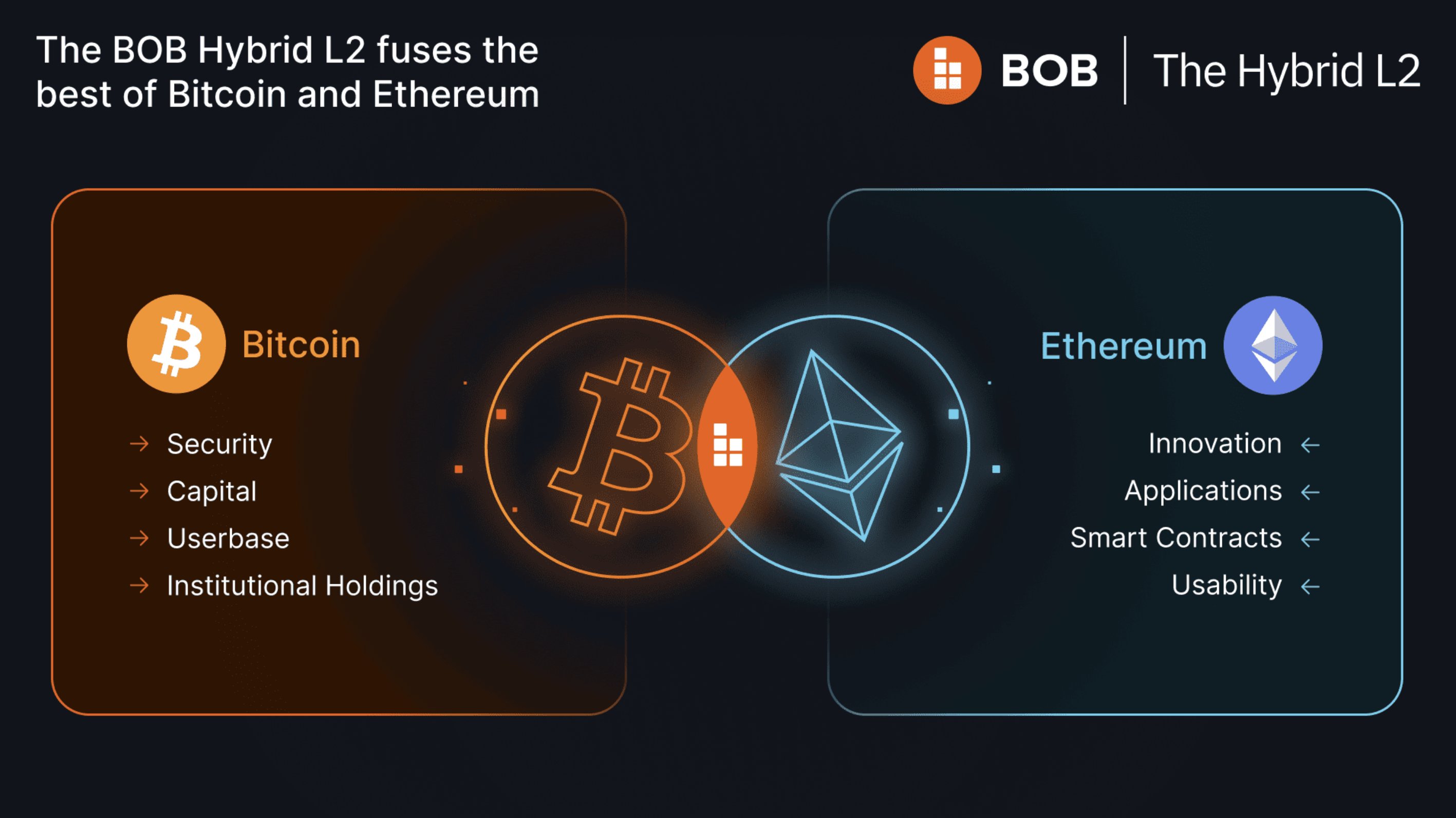

Hybrid ZK Rollups are rapidly emerging as a new paradigm in blockchain scalability, promising to fuse the strengths of Bitcoin’s security with Ethereum’s advanced zk scaling solutions. This architectural leap is not just theoretical: projects like BOB have already launched live systems that blend the cost efficiency of optimistic rollups with the cryptographic certainty of zero-knowledge (ZK) proofs. The result? A blockchain environment where users can access both rapid finality and robust fraud prevention, all while leveraging the security models of both Bitcoin and Ethereum.

Why Hybrid ZK Rollups Matter for Blockchain Scalability

The limitations of existing rollup technologies are well known. Optimistic rollups, for instance, assume transactions are valid by default but require lengthy dispute windows, sometimes up to seven days, to resolve challenges. ZK rollups, on the other hand, offer instant cryptographic validation but demand significant computational resources for proof generation. Hybrid ZK Rollups like BOB sidestep these trade-offs by deploying ZK proofs only when needed: during disputes or when users request immediate withdrawal finality.

This dual-mode approach means withdrawal times can drop from days to mere hours, a game-changer for DeFi participants who need quick access to their assets. It also enables trust-minimized bridges between chains, a crucial step toward unlocking true cross-chain composability without sacrificing security or decentralization.

Inside BOB: How the First Hybrid ZK Rollup Works

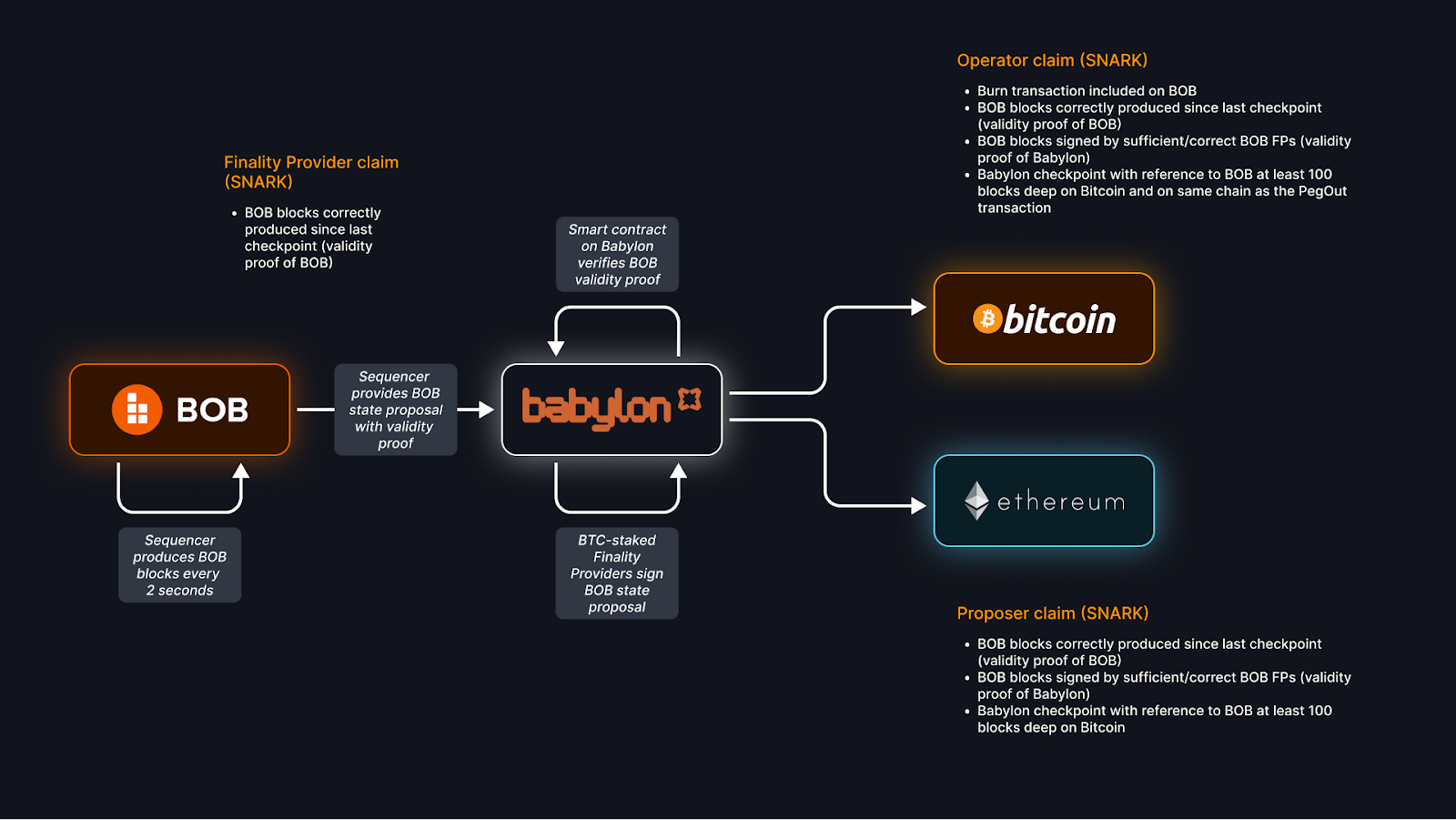

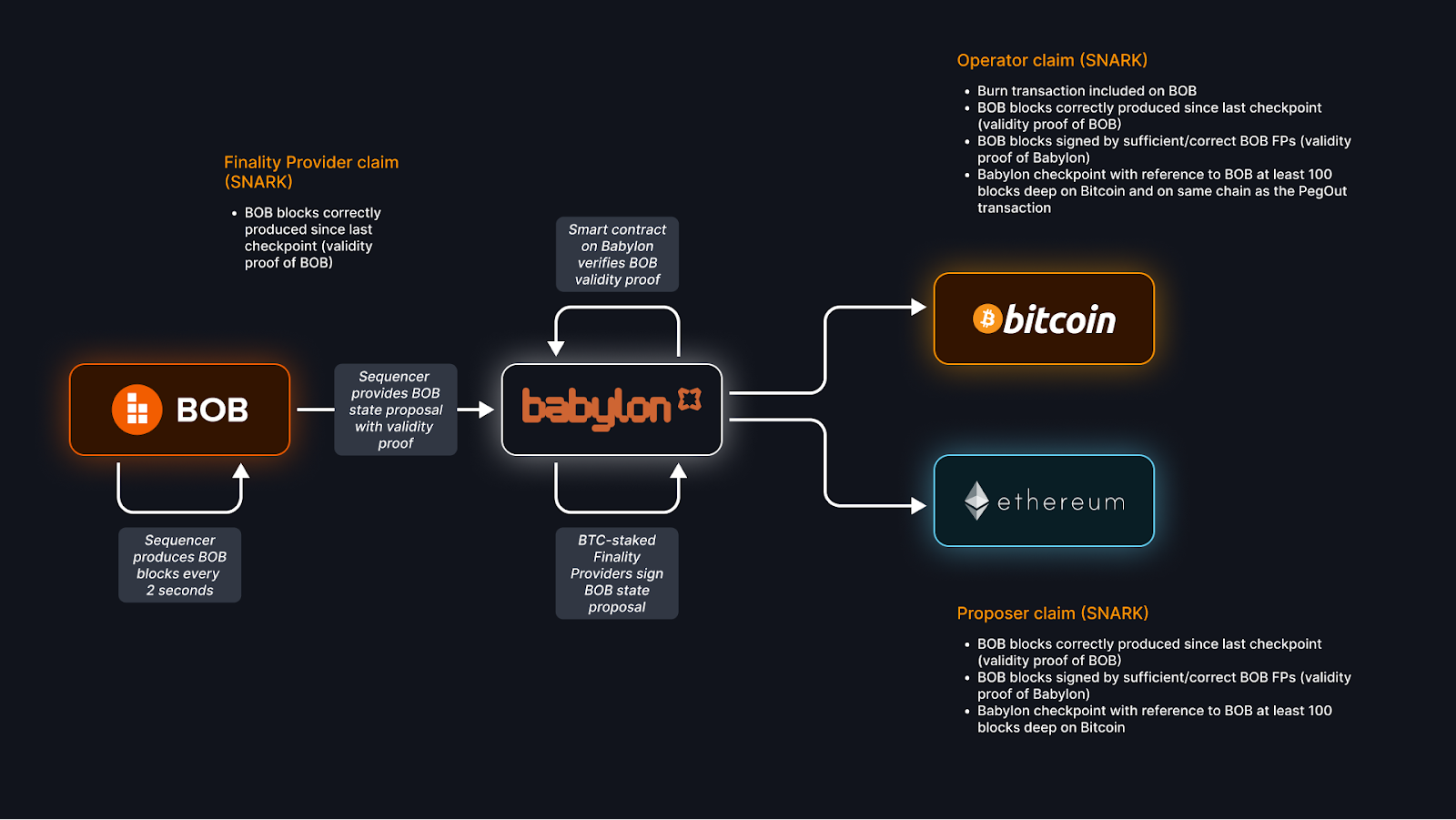

BOB’s architecture leverages OP Kailua, an extension of the OP Stack designed by RISC Zero, and integrates Boundless network’s zk proof generation layer. Transactions are processed optimistically by default, ensuring throughput and low fees. When a dispute arises or rapid settlement is required, BOB calls upon its embedded ZK system to generate a validity proof on demand.

This model allows for minimal collateral requirements and drastically reduced proof costs compared to traditional systems. More importantly, it brings Ethereum-grade security assurances to Bitcoin DeFi applications, a feat previously considered out of reach due to Bitcoin’s limited scripting capabilities. For developers and users alike, this means greater flexibility in building scalable dApps while maintaining confidence in transaction integrity.

Key Advantages of Hybrid ZK Rollups Over Legacy Scaling

-

Rapid Withdrawal Times: Hybrid ZK Rollups like BOB enable withdrawal times measured in hours instead of days by integrating ZK proofs into the dispute resolution process, dramatically improving user experience over legacy optimistic rollups.

-

Ethereum-Grade Security on Bitcoin: By combining ZK proofs with the OP Stack, BOB delivers Ethereum-level security to Bitcoin-based DeFi, a unique advantage not offered by traditional rollups.

-

Cost-Efficient Transaction Processing: Hybrid rollups maintain the low fees of optimistic rollups while using ZK proofs only when necessary, optimizing both cost and performance for users and developers.

-

On-Demand Instant Finality: Users can request immediate validity proofs for transactions, achieving instant finality when needed—something not possible with legacy optimistic or ZK rollups alone.

-

Inclusive and Accessible Fraud Proofs: With OP Kailua and Boundless network integration, fraud proofs require minimal collateral and have low generation costs, making the process accessible to a broader range of participants.

-

Enhanced Scalability for DeFi: By merging optimistic and ZK rollup strengths, hybrid models like BOB set new standards for scalability and efficiency in decentralized finance applications.

The Strategic Impact on Bitcoin DeFi and Cross-Chain Applications

The implications for Bitcoin DeFi are profound. By enabling Ethereum-like privacy and scalability tools atop Bitcoin’s base layer, hybrid zk rollup technology could catalyze an entirely new wave of financial innovation on the world’s most secure blockchain. Projects leveraging this model can offer near-instant withdrawals, high-throughput trading venues, and composable smart contracts, all backed by both Bitcoin’s proven security and Ethereum’s flexible execution environment.

This isn’t just incremental progress, it is a structural shift that could redefine what’s possible in decentralized finance across both ecosystems. As more Layer 2 projects race to integrate hybrid models that combine optimistic performance with zk-level security guarantees, competition will likely drive further breakthroughs in usability, cost reduction, and interoperability.

Hybrid zk rollups are not just a technical curiosity, they’re rapidly becoming the connective tissue between Bitcoin’s unmatched security and Ethereum’s flourishing zk scaling solutions. The emergence of BOB as the first production-grade hybrid zk rollup demonstrates how this model can reshape both user experience and developer tooling. By offering on-demand ZK proofs, BOB slashes withdrawal times from days to hours, while keeping operational costs competitive thanks to its optimistic-first architecture. This approach is already delivering tangible benefits for DeFi protocols seeking to bridge liquidity and applications across chains without introducing new trust assumptions.

The integration with OP Kailua and the Boundless network means that generating fraud proofs is both accessible and affordable, lowering the barrier for participation in dispute resolution. This is especially significant for smaller participants who were previously priced out of acting as honest challengers in optimistic rollup systems. Now, anyone can help secure the network with minimal collateral, an important step toward true permissionless security.

What Comes Next: Ecosystem Growth and New Use Cases

The hybrid zk rollup model unlocks a spectrum of new use cases that go far beyond simple asset transfers. For Bitcoin DeFi, it means composable lending markets, decentralized exchanges, and derivatives platforms can all operate on a layer that inherits both Bitcoin’s base-layer resilience and Ethereum’s programmability. Interoperability becomes more than a buzzword; it becomes a reality as users move assets between blockchains with confidence in both speed and security.

This progress is not limited to financial applications. Privacy-preserving voting systems, confidential identity frameworks, and even cross-chain DAOs are now within reach thanks to advances in zero-knowledge technology applied through these hybrid models. As more projects follow BOB’s lead, expect rapid experimentation at the intersection of privacy, scalability, and composability.

5 Groundbreaking DeFi & Cross-Chain Uses of Hybrid ZK Rollups

-

Bitcoin DeFi Lending Platforms: Hybrid ZK rollups like BOB enable trust-minimized, Ethereum-grade security for lending and borrowing Bitcoin directly on-chain, with rapid withdrawal times and lower collateral requirements.

-

Cross-Chain Stablecoin Transfers: By leveraging both Bitcoin and Ethereum security models, hybrid ZK rollups facilitate fast, low-cost, and secure stablecoin transfers between chains, reducing settlement risk and enabling seamless DeFi interoperability.

-

Decentralized Exchanges (DEXs) with Instant Finality: Projects like BOB are pioneering DEXs where users can swap assets across Bitcoin and Ethereum ecosystems with ZK-backed instant settlement, minimizing front-running and transaction delays.

-

Programmable Bitcoin Smart Contracts: Hybrid ZK rollups allow developers to deploy Ethereum-style smart contracts that interact with Bitcoin, unlocking new DeFi primitives such as automated market makers and yield protocols secured by both networks.

-

On-Chain Proof-of-Reserves for Bitcoin-Backed Assets: With ZK proofs integrated into optimistic rollups, platforms can provide transparent, cryptographically verifiable proof-of-reserves for wrapped Bitcoin assets, enhancing trust and compliance in cross-chain DeFi.

Risks, Trade-Offs, and Open Questions

No technology is without its trade-offs. Hybrid zk rollups introduce additional complexity at both the protocol and implementation level, careful auditing of ZK circuits and dispute resolution logic is critical. There are also open questions about decentralization: while proof generation costs have dropped dramatically with solutions like Boundless, ongoing research will determine how these networks scale under real-world loads.

Community governance will play a decisive role as these protocols evolve. How should upgrades be coordinated across two distinct security domains? What incentives best align honest actors across Bitcoin-anchored chains and Ethereum-based smart contracts? These are pragmatic challenges that will define the next phase of blockchain scaling innovation.

Looking Ahead: The Roadmap for Hybrid ZK Rollups

The launch of BOB signals only the beginning for hybrid zk rollup technology. As other teams experiment with integrating zero-knowledge proofs into optimistic frameworks, and as tooling around OP Stack extensions matures, the ecosystem will likely see new entrants focused on niche verticals such as gaming, social applications, or enterprise privacy solutions.

For investors and builders alike, tracking adoption metrics (such as TVL growth in Bitcoin DeFi) alongside improvements in proof efficiency will be key indicators of mainstream viability. The race is now on to see which projects can best balance user experience with robust security guarantees, and whether this model will ultimately become the standard for cross-chain interoperability in Web3.